My Current Open Positions

Market Close April 28

| Symbol | Strategy | Direction | P&L |

|---|

| BIDU | Iron Condor | Non Directional | 115 |

| SNAP | Iron Condor | Non Directional | 38.4 |

| SLV | Iron Butterfly | Non Directional | 45.6 |

| QQQ | Iron Condor | Non Directional | 27.9 |

| X | Double Calendar | Non Directional | -0.9 |

| MARA | Iron Condor | Non Directional | 99.5 |

| PINS | Iron Condor | Non Directional | 70.1 |

| AMD | Iron Condor | Non Directional | -10.3 |

| Grand Total | | | 385.3 |

April 28th, 2021

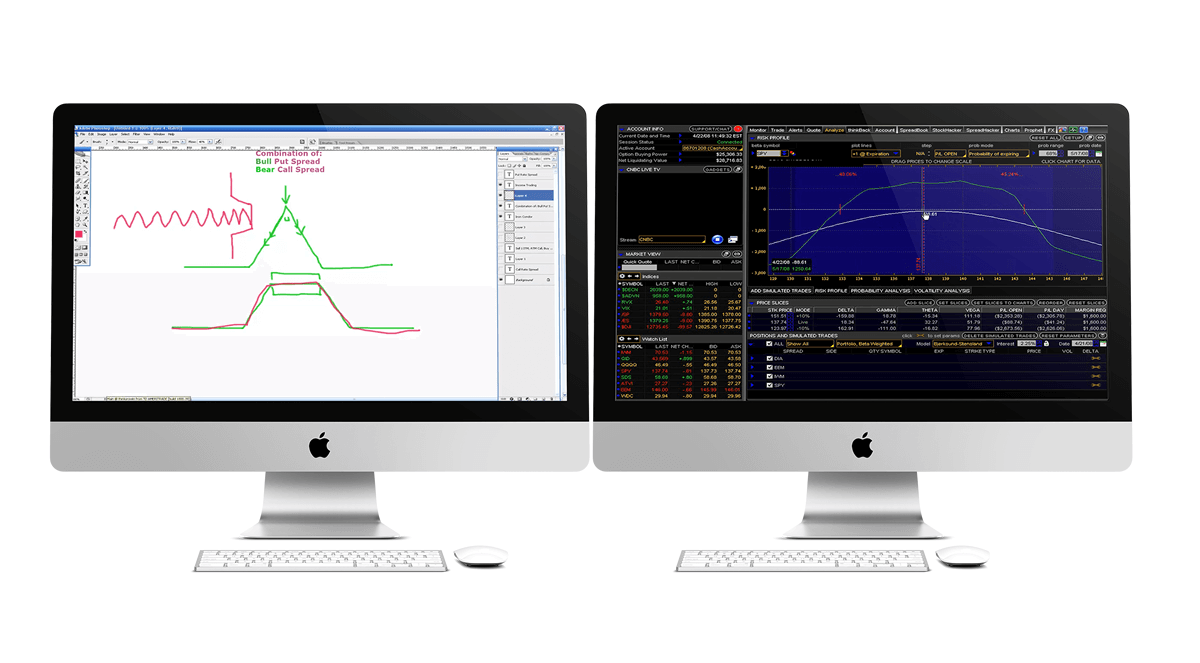

I've changed my approach slightly the last two months as I try and make back some losses. I've decided to be more conservative and stick mainly to non-directional trades with low deltas, wide strikes and longer expirations.

I'll still do some earnings plays, but not as many and I'll be more selective about them.

I'm also not going for the put spread rolls, straddle rolls and naked puts as I got burned easily on those.

I've been happy with the progress so far with the change. I made +7.62% during March and +1.32% so far in April, which means I am 0.77% away from where I started the year.

I've struggled to get filled on a lot of my orders though, but I suppose that is the consequence of playing it safe; less liquidity with those opportunities.

Feb 22nd

The Feb 19 expiry closed out on Friday. I was looking good to finish it positive $300 but FSLY tanked.

I had a note to get out of it prior to their earnings release Thursday but changed my mind on the day. I was up $10 and held on to realize a $276 loss.

I closed out a few others early (TWTR, DIS, DIA, UBER, TSM, MRK and PYPL) as they hit the short strike with anger. Good that I did that too...apart from DIS they all would have reached their max loss. I held onto ADBE as it was only grinding away towards the short side..and it came back, so all good there.

Building a few more positions and will take a few more directional bets this week with vertical spreads.

February 5th

I left CSCO to run out on expiry as the day before it just crossed the short strike. Unfortunately, it continued and I realised the max loss on the trade. The other positions for that expiration, however, all closed out at a profit; EWZ, KO, MU, NIO, PFE and QQQ.

I also closed early my PYPL and UBER trades, which I'm happy about. Very small losses there, which is good as there was still two weeks to go and they are both looking at continuing to breakout.

My other positions for the 19th expiration are looking positive so far. I still have some way to go to claw back January's losses. But there's still a few weeks left to build on the portfolio.

February 1st

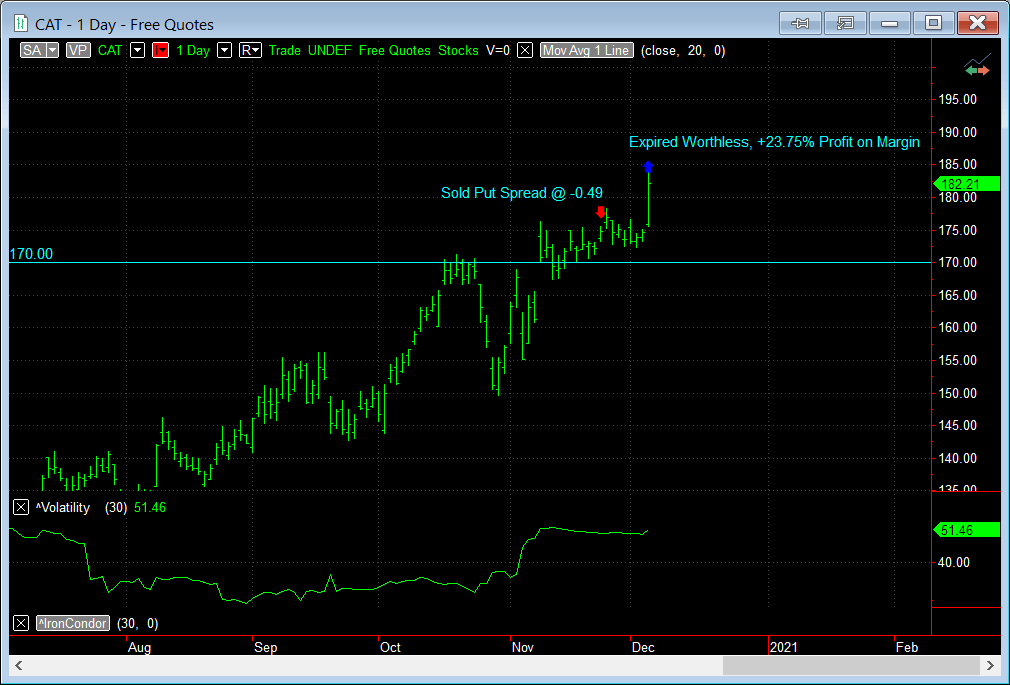

Despite CAT generating better than expected Q4 results, the stock still dropped and I let that expire at its' max loss. Same with FCX.

It was a disappointing January, especially with those two losses to close it out.

But things are looking good with the start of Feb. Almost all positions showing unrealized gains although the instra day swings have been strong; between $200 and $600 each close of day.

I heard the Reddit Army have been getting on board Silver. The ETF opened strong with a lot of volatility so I sold a condor around that for the 19th Feb expiration.

Also got in on a TSM condor but regretted it straight away. Sold approximately 30 delta short strikes for $49 credit. Not a very good price compared to the delta levels but it looked good on the chart and I was eager to get it done prior to the close. If it shows a good short term gain I'll close it out.

January 29

Put on some more high vol condors on what I see as being directionless stocks. I had a $600 P&L swing since opening them from Wednesday to today given the sell off and recovery. Happy with the positions so far though.

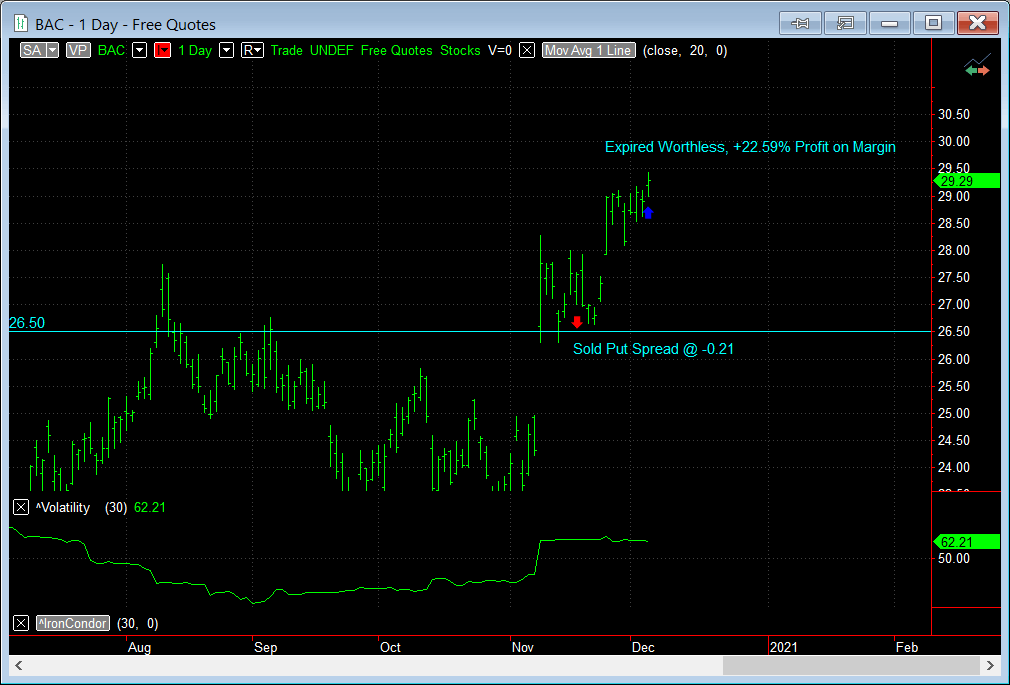

Rolled down and out X put spread for breakeven. Happy with that adjustment as I'm still bullish at this level. Closed out BAC for full profit. GM also looking at collecting full premium too. I will look at more small naked shorts for next week.

CAT release earnings before open, which is my biggest unrealised loss so far. It's trading just below the long strike now so need it to pop a few more points to be in the clear before close tomorrow.

FCX is done and will likely expire a full loss. I should have kept a closer eye on this one during the holiday period and adjusted as it touched the short strike.

Most of the other positions are in early stages and building towards Feb 19th expiration.

January 21

2021 off to a shaky start. A very small gain on closed trades and currently running a small $36 loss on open positions. My initial margin used for the above 14 positions is only $2,600 so I really need to either take on more underlyings or increase trade size.

Most of the loss on open positions is INTC's Iron Condor. After the announcement regarding the CEO stepping down, the stock popped and is now trading outside the call spread leg of the trade. I could have exited for only double the premium as my loss but I decided to wing it and see how the stock performs after their earnings are released in a few days, taking the chance that it drops back below the short call strike.

The other open losses aren't a concern right now. CAT is still trading above the short strike level, however, has dropped a bit since establishing the trade. This is a fade on a bullish play so I'm expecting the stock to keep above the short put strike.

IWM, again, is killing me on the Condors. Pretty sure I'm net loss on all my 2020 IWM Condors too. Typically a favoured stock to sell Condors on but since bottoming out after COVID the mid-caps have been rallying hard. So, I think I will look to move my index Condors over to the SPY instead.

Closed Positions 2021

| Symbol | Strategy | Direction | P&L |

|---|

| T | Put Spread | Bullish | 21.73 |

| IWM | Iron Condor | Non Directional | -28.82 |

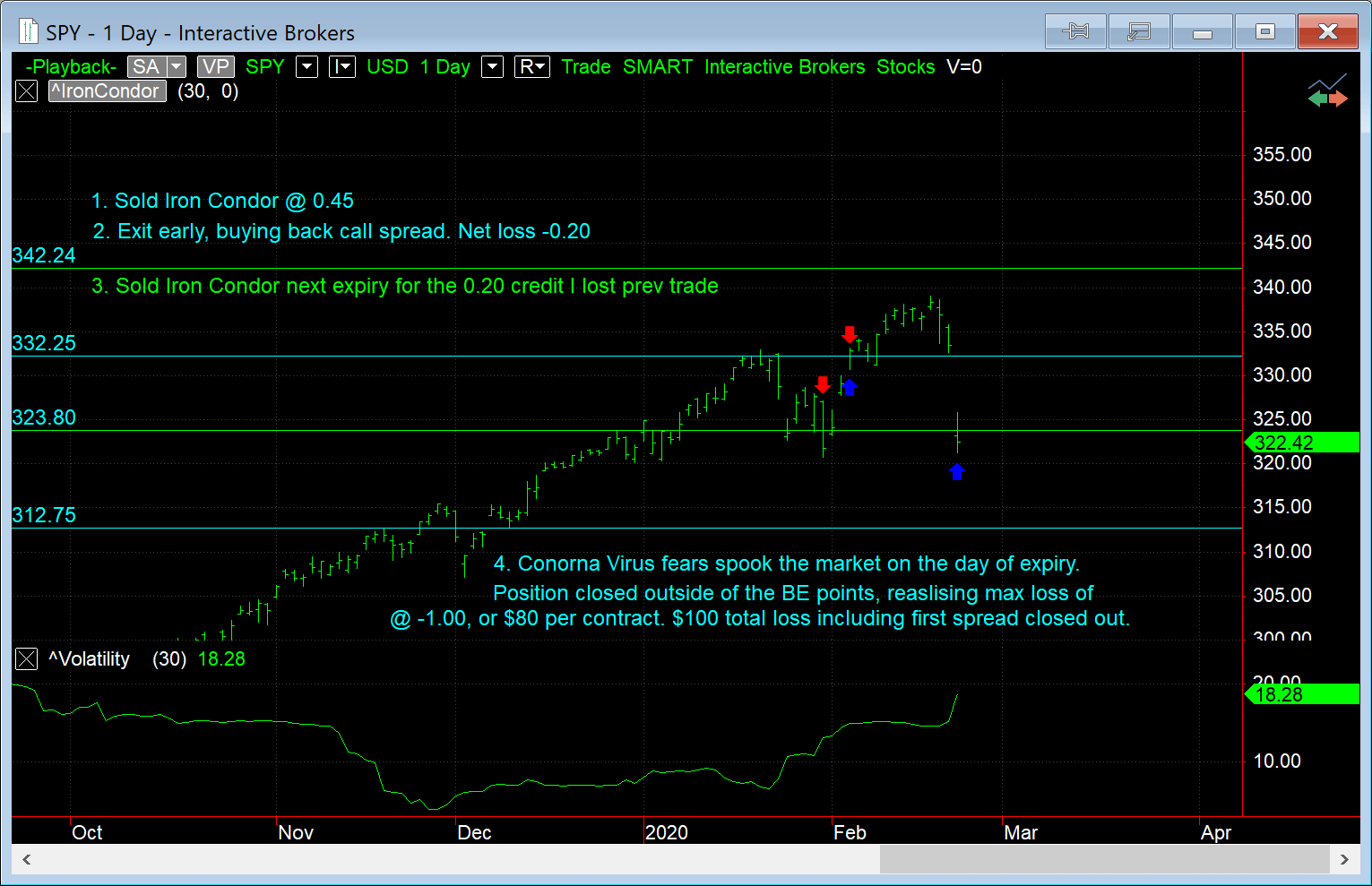

| SPY | Iron Condor | Non Directional | -44.47 |

| INTC | Iron Condor | Non Directional | -61.82 |

| MU | Put Spread | Bullish | 36.73 |

| IWM | Iron Condor | Non Directional | -22.53 |

| WMT | Call Spread | Bullish | -42.44 |

| SPY | Iron Condor | Non Directional | 25.7 |

| SPY | Adjustment | Non Directional | 22.85 |

| BAC | Short Put | Bullish | 31.43 |

| X | Short Put | Bullish | -38.72 |

| GM | Short Put | Bullish | 29.91 |

| CAT | Put Spread | Bullish | -180.27 |

| FCX | Put Spread | Bullish | -75.27 |

| EWZ | Iron Condor | Non Directional | 21.7 |

| CSCO | Iron Condor | Non Directional | -78.34 |

| NIO | Iron Condor | Non Directional | 28.46 |

| PFE | Call Ratio Spread | Non Directional | 18.19 |

| MU | Put Spread | Bullish | 23.73 |

| KO | Iron Condor | Non Directional | 30.46 |

| X | Short Put | Bullish | -59.42 |

| QQQ | Ratio Spread | Non Directional | 56.32 |

| FSLY | Iron Condor | Non Directional | -276.04 |

| NKE | Iron Condor | Non Directional | 56.66 |

| PYPL | Iron Condor | Non Directional | -0.64 |

| DIS | Iron Condor | Non Directional | -34.62 |

| LUMN | Call Spread | Bearish | 55.67 |

| ADBE | Iron Condor | Non Directional | 155.64 |

| MRK | Iron Condor | Non Directional | -41.98 |

| SLV | Iron Condor | Non Directional | 27.66 |

| TSM | Iron Condor | Non Directional | -16.81 |

| UBER | Iron Condor | Non Directional | -1.62 |

| DIA | Iron Condor | Non Directional | -0.81 |

| X | Short Put | Bullish | 33.21 |

| VZ | Ratio Spread | Bearish | -160.11 |

| TWTR | Iron Condor | Non Directional | -139.62 |

| LVS | Iron Condor | Non Directional | 25.39 |

| PFE | Ratio Spread | Bullish | -71.77 |

| IWM | Iron Condor | Non Directional | 35.66 |

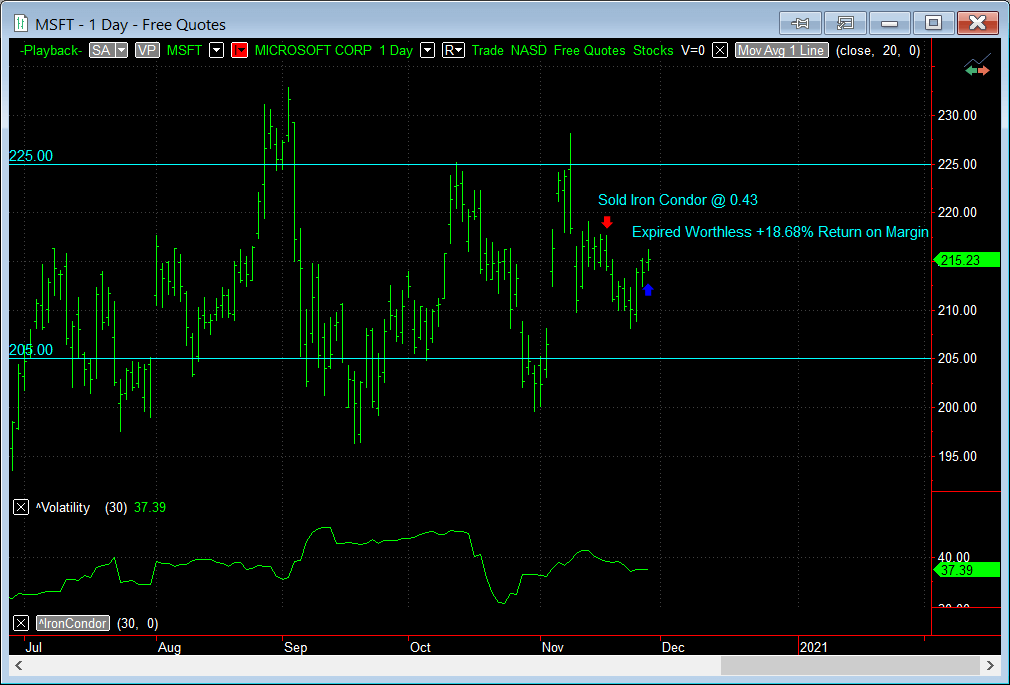

| MSFT | Iron Condor | Non Directional | 110.65 |

| AMD | Iron Condor | Non Directional | -34.62 |

| JNJ | Iron Condor | Non Directional | 4.37 |

| QCOM | Call Spread | Bullish | -52.18 |

| X | Naked Put | Bullish | 19.48 |

| BP | Iron Condor | Non Directional | -36.6 |

| T | Iron Condor | Non Directional | 25.7 |

| FCEL | Iron Condor | Non Directional | -30.81 |

| HD | Iron Condor | Non Directional | -146.83 |

| ORCL | Iron Condor | Non Directional | -53.61 |

| JD | Put Spread | Bullish | -32.54 |

| PYPL | Put Spread | Bullish | -198.27 |

| QQQ | Iron Condor | Non Directional | -40.63 |

| MU | Iron Condor | Non Directional | 65.67 |

| JD | Put Spread Roll | Bullish | -202.54 |

| HD | Adjustment | Non Directional | 192.72 |

| CAT | Iron Condor | Non Directional | 32.46 |

| EEM | Iron Condor | Non Directional | 84.42 |

| FCX | Iron Condor | Non Directional | 78.12 |

| UBER | Iron Condor | Non Directional | 35.66 |

| WMT | Iron Condor | Non Directional | 65.66 |

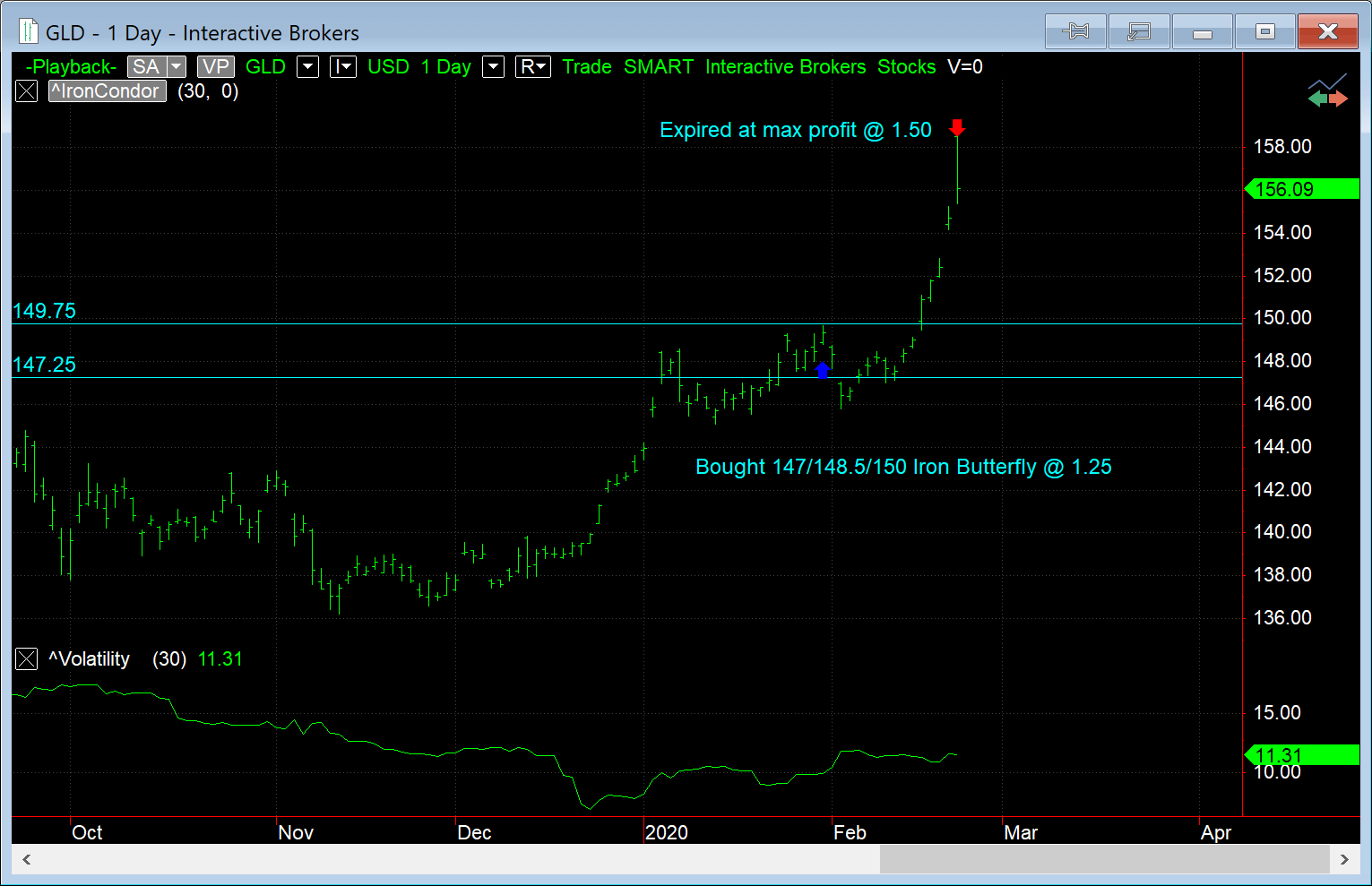

| GLD | Iron Condor | Non Directional | -31.2 |

| XLF | Iron Condor | Non Directional | 40.8 |

| SPY | Iron Condor | Non Directional | 1.1 |

| SLV | Iron Butterfly | Non Directional | -77.78 |

| ORCL | Adjustment | Non Directional | 31.73 |

| ORCL | Adjustment | Non Directional | 52.46 |

| LVS | Adjustment | Non Directional | 47.73 |

| AMD | Adjustment | Non Directional | 82.19 |

| BP | Adjustment | Non Directional | 31.46 |

| GLD | Adjustment | Non Directional | 66.12 |

| JNJ | Adjustment | Non Directional | 66.46 |

| IVV | Iron Condor | Non Directional | -102.74 |

| SPY | Adustment | Non Directional | 25.58 |

| NVDA | Iron Condor | Non Directional | -189.03 |

| TLSA | Iron Condor | Non Directional | 132.01 |

| MU | Iron Condor | Non Directional | 48.52 |

| IWM | Iron Condor | Non Directional | 82.06 |

| Grand Total | | | -445.27 |