The Ultimate Option Scanner to Improve Your Trading

Discover How To Find The Best Option Trading Opportunities & Become A Successful Options Trader Today

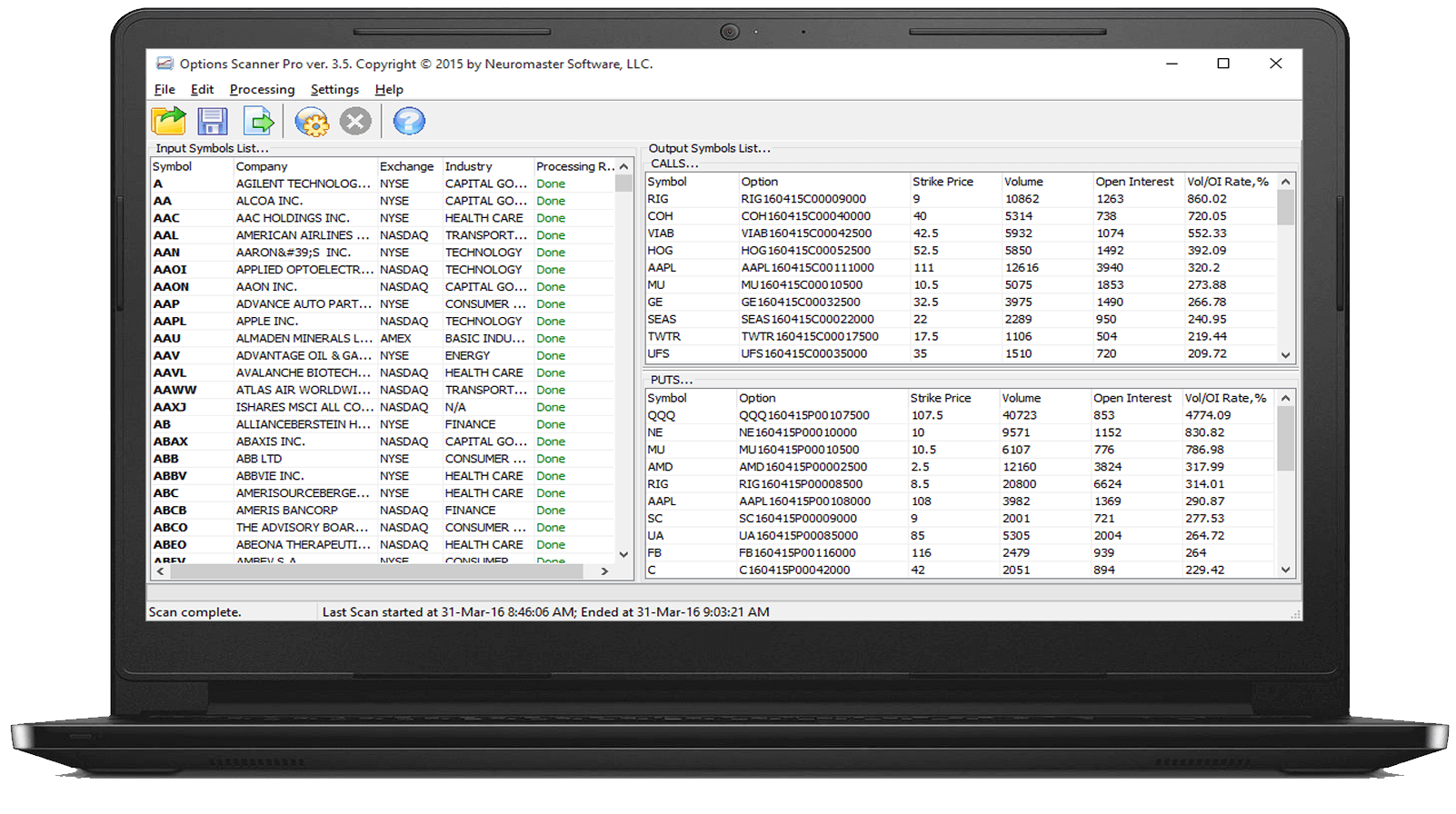

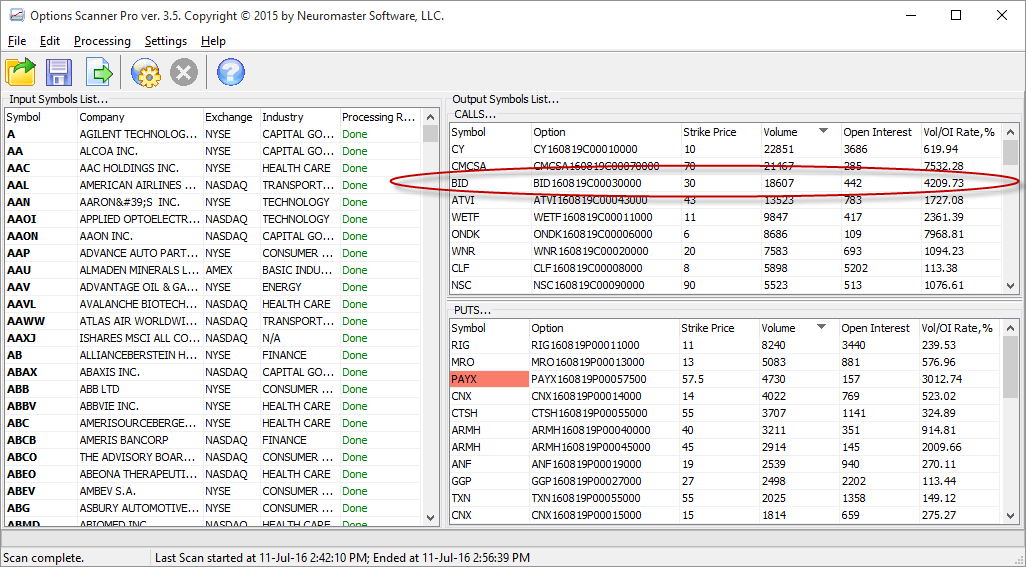

Scans in seconds

Supports thousands of stocks and ETFs

Customizable filter criteria

Volume, open interest and implied volatility

Custom ticker lists

30 Day money back guarantee

PeterDecember 13th, 2020 at 7:19pm

Hi Terry,

No, this only works for options; not technical analysis.

TerryDecember 13th, 2020 at 6:01pm

Does the platform have a built in Ichimoku cloud strategy?

PeterSeptember 15th, 2020 at 5:50pm

It's end of day data.

Jason VrimiSeptember 15th, 2020 at 5:40pm

Hello,

Just wondering that if this scanner is work in real time or update by EOD?

Thank you

PeterMarch 17th, 2019 at 11:02pm

Hi Arshtit, it won't work for the Indian market at this time...only for US markets. I will ask the developer if there are plans to add Indian data.

The Open Interest field is total, not change.

ARSHTITMarch 17th, 2019 at 4:41am

Is open interest is mentioned, it's total OI or change in OI?

ARSHIITMarch 17th, 2019 at 12:15am

How do I can use it for indian stock market?

PeterFebruary 18th, 2019 at 4:56am

@PRP - It is a Windows based application.

@Neal - it doesn't time series data, so no timestamp. Sorry, no closed captions on the video!

The fee has remained as is for about two years and is subject to the developer's own pricing.

The data used currently is EOD, however, this may also change. Previously it was 15 minute delayed but didn't have the coverage of assets and expiry dates. While the EOD data is less frequent there are more instruments covered.

PRPFebruary 14th, 2019 at 10:02am

Is this a web based tool or something that requires an application to be downloaded on a PC?

NealFebruary 14th, 2019 at 2:06am

Hello,

Does your option scanner pro give us the option to see the timestamp or the time and date when the market makers bought the stock? Also, does your video have the closed caption or subtitle for tutorial? I saw that the fee is being upgraded for free for the first year, what is the cost of upgrade in the second year? How much of delay is the data feed? Thank you for your time.

-Neal

PeterAugust 14th, 2018 at 10:11pm

Hi Frederik,

1. How often is your data updated?

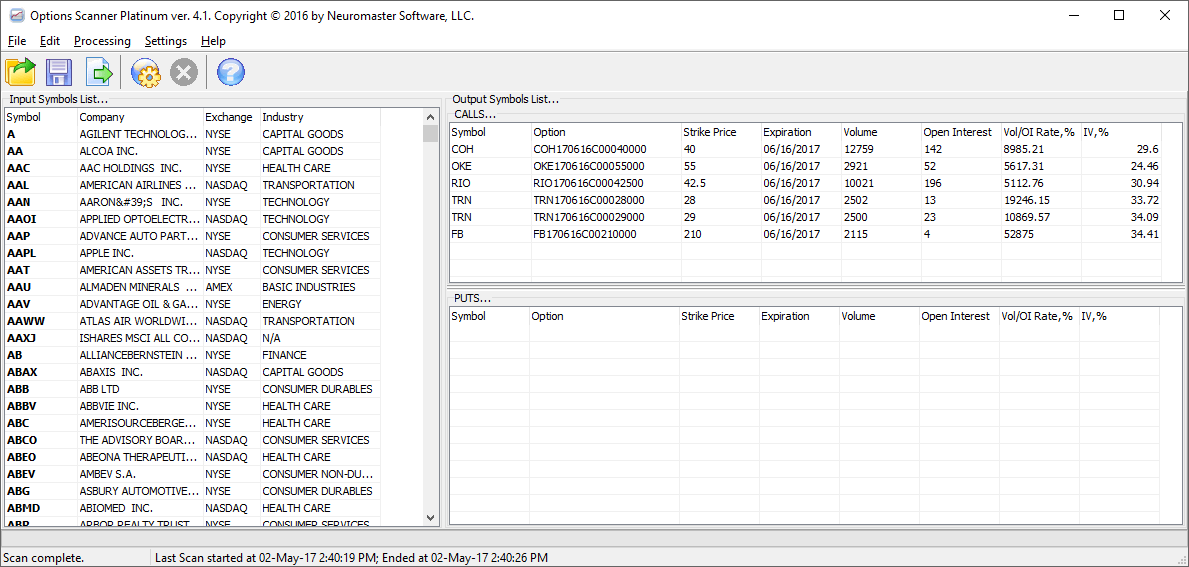

In the Platinum Version 4.1 the data is now end-of-day. Previously, the data was 15 minute delayed but the data was coming from web API's Yahoo! and Google Finance. The scanning was slow and cumbersome.

Now the data is supplied by a 3rd party vendor. However, the scans are instant.

2. Where does the market data come from.

3rd party vendor who obtains the data from the OCC.

3. Is it possible to scan for (bid) price relative to the strike price? As to find the highest premiums (in % relative to the stock price).

Unfortunately no, it doesn't use bid/ask price as available filters.

4. Does the scanner show upcoming events like earning publications?

No.

5. What filters can be set?

Volume/Open Interest %, Minimum Volume, Minimum Open Interest, Minimum Implied Volatility and Expiration Data. You can see more of the interface here:

Scanner Tutorial

Frederik S.August 14th, 2018 at 1:49pm

Hi Peter,

I have a few questions about the application.

1. How often is your data updated?

2. Where does the market data come from.

3. Is it possible to scan for (bid) price relative to the strike price? As to find the highest premiums (in % relative to the stock price).

4. Does the scanner show upcoming events like earning publications?

5. What filters can be set?

Thank you in advance for your answer. The app looks promising.

PeterApril 25th, 2018 at 8:44pm

Hi Mk,

The data is 15 minute delayed up until the end of the trading day. I.e. it won't look back 30 days.

mkApril 23rd, 2018 at 5:27am

hello

what is the data feed? (real time)? - if you collect the data, what is the lag? how many minutes of delay we are talking?

can i scan for e.g. all russel index and any expiry date, e.g. any option volume above 100% average last 30 days?

thank you

mk

PeterMarch 18th, 2018 at 7:32pm

Hi Donny,

Unfortunately not; this scanner will scan per-expiration date for all of the stocks that you include in your symbol list. It won't perform analysis on a per-stock basis.

wallstreettradingroom.comMarch 17th, 2018 at 7:32am

Hi,

I have used Option-Alert very expensive but data is within seconds I love trading UOA Unusual Option Activity and have now for about 5 years. My question and I have used Optionsonar etc so many of them not to my liking your scanner scan only underline stock that I want it to and how could I scan for only real unusual option activity like stocks that are trading 3x and more then normal also is there a delay on your data thank you

PeterJanuary 7th, 2018 at 9:53pm

The data used is for the current trading day, which has a refresh rate every 15 minutes.

miguel angel dortaJanuary 4th, 2018 at 12:35pm

Hello,

Is it in real time for what happens on a specific day or does it look for historical data?

If it is realtime, the screen and the data refresh?

PeterDecember 28th, 2017 at 5:40pm

Once you buy a license for that version, you have the product for life. If a new version is released that has a feature you’d like to upgrade to, you can choose to upgrade for a small fee, which will depend on the significance of the new version’s features. Upgrade fees can be expected to be about $97.

CarlosDecember 28th, 2017 at 1:50pm

How much does it cost from the second year?

PeterNovember 21st, 2017 at 6:00pm

Hi Pierre,

No, there isn't any strategy functions. It will show you strikes that have had significant volume spikes across an expiration - so if a huge call spread goes through, you will see both strikes with approximately the same volumes in each.

There isn't a free trial but there is a money back guarantee.

Is there something else you need to know about the functionality that I can help answer?

PierreNovember 21st, 2017 at 11:13am

Does it have bull call spread functions?

PierreNovember 21st, 2017 at 11:08am

Can I try it for free for a few days

PeterNovember 15th, 2017 at 5:14pm

Unfortunately not; it's a Windows only program.

DanNovember 15th, 2017 at 4:20am

Do you have this software on Mac platform?

PeterOctober 19th, 2017 at 10:47pm

Hi Paul, it's just the scanning function; no broker connections.

PaulOctober 17th, 2017 at 1:07pm

Does it connect to the execution broker? or just provide the scanner function?

PeterJuly 17th, 2017 at 6:08am

Hi Serge,

Unfortunately, it is a Windows only program!

SergeJuly 17th, 2017 at 3:31am

Hi dear

Excuse my English, I write with google translator.

My computer Mac OS Siera.

Does option scanner work with MAC based system?

Is it pure Windows App, or Excel Accsse App?

Thank you in advance.

greeting

serge

PeterJune 23rd, 2017 at 7:16am

Hi Jared,

No, the Option Scanner here doesn't provide text alerts.

It does, however, allow you to scan all expiration weeks for stocks, ETFs and indices. By the looks of option sonar it only looks at "this week" and "LEAPS" when you click Browse By Expiry. And I think it only looks at equities.

Also, it does't look like option sonar allows users to customise the criteria that determines how unusual the volume spikes are. For example, you can configure the Option Scanner mentioned here to only show you options that have traded more than 2,000 lots while having at least 1,000 in open interest. Without these filters, a scan returns too many contracts to look at.

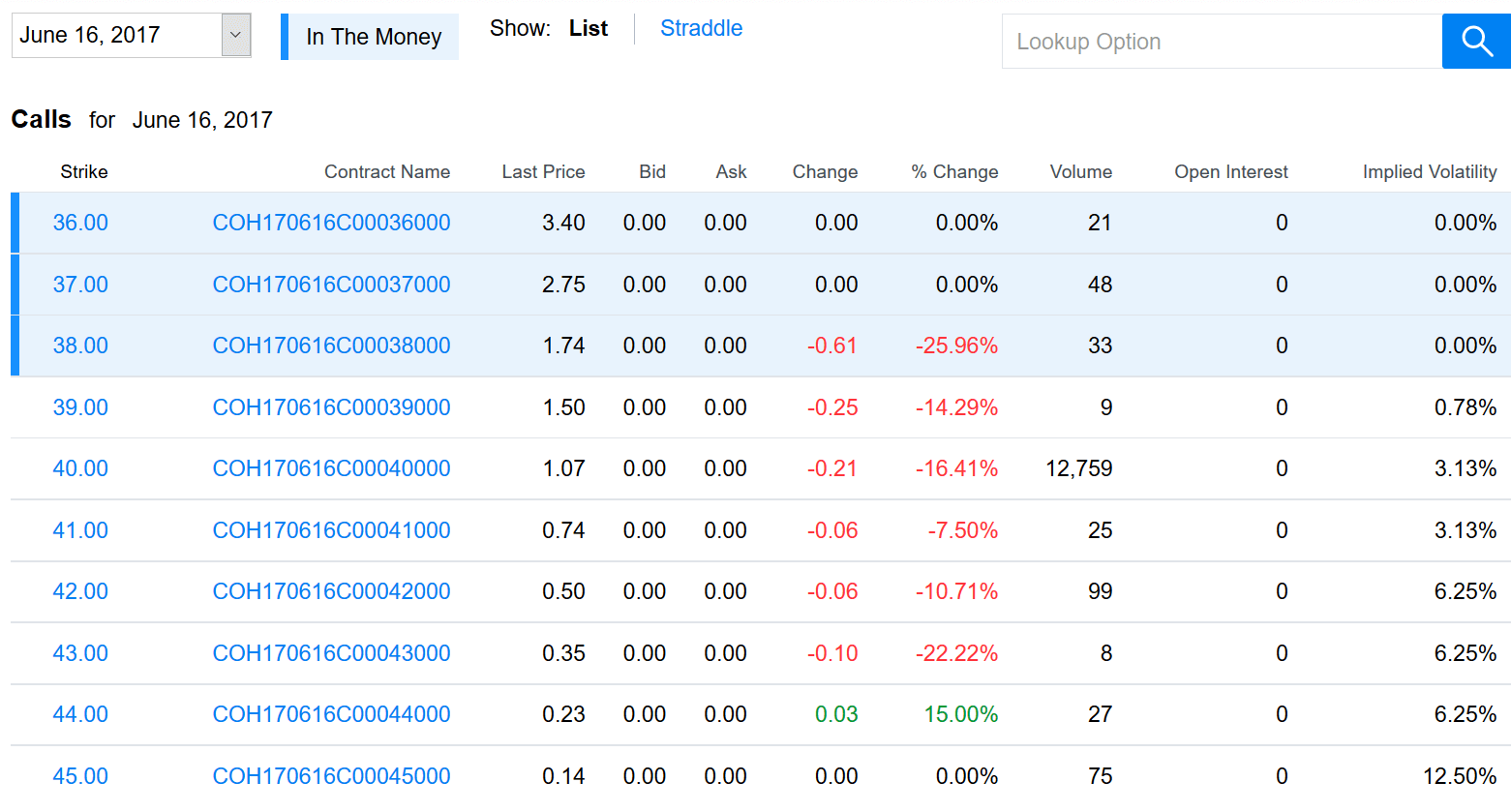

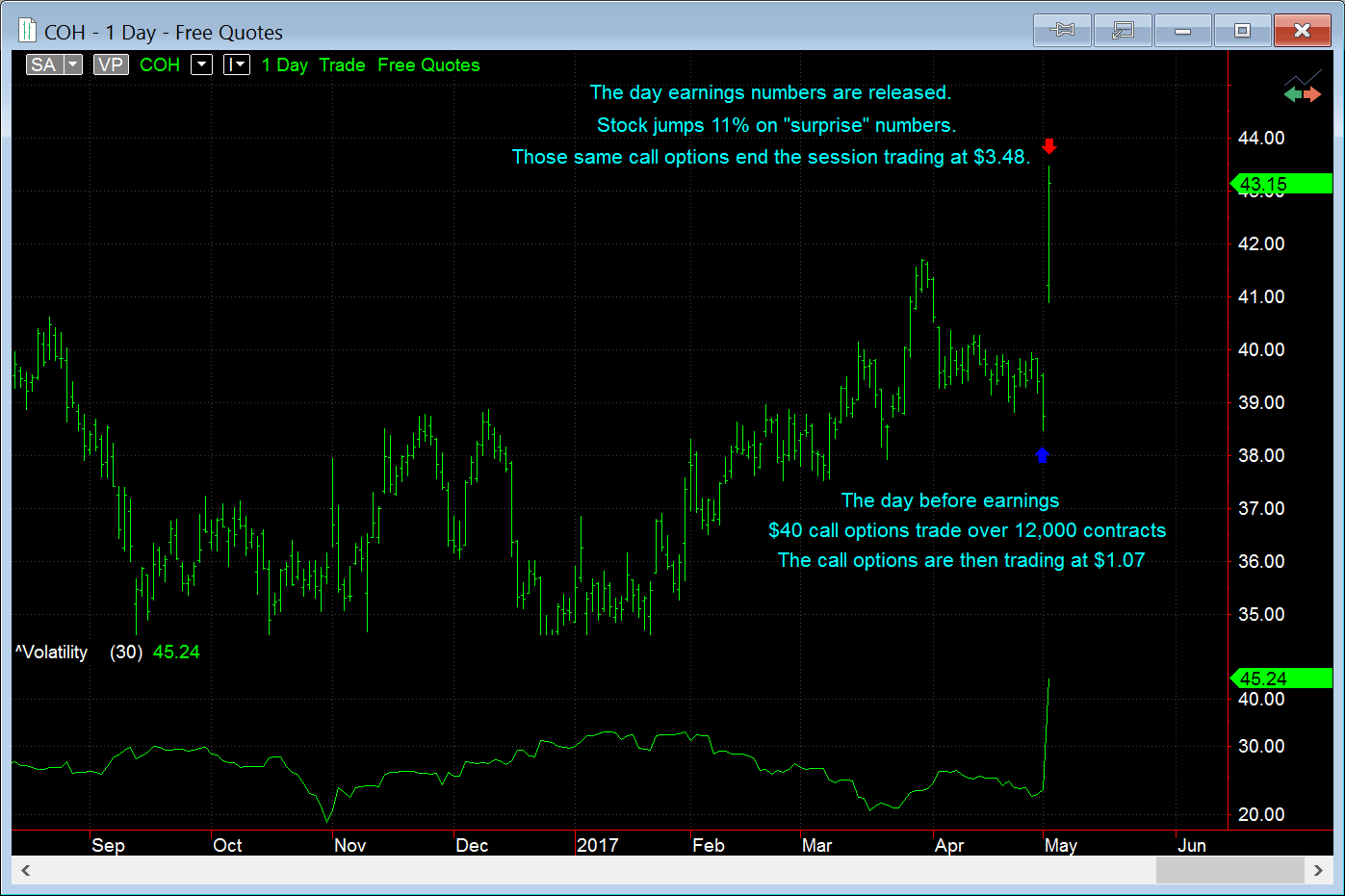

Also, the Option Scanner also allows you to filter and also sort by implied volatility. So, if a strike has a a lot of volume traded it can often pump up the price of the option, which increases the implied volatility. When buying options it is best to buy when implied volatility is low, so this scanner pulls out the high volume option trades while also letting you know if those also have low volatility.

Another thing is that the Option Scanner mentioned here allows you to build custom ticker lists so you can only scan those stocks that you're interested in. Or, more useful is actually removing those symbols that already trade a lot of options during any normal day, which makes identifying unusual volume trades more difficult; volume spikes are more interesting on obscure, or less well known stocks where perhaps there is an earnings announcement approaching.

JaredJune 23rd, 2017 at 12:02am

How do you guys compare to www.optionsonar.com? They seem to offer text message alerts for unusual option activity that matches your criteria. Does your scanner provide this?

PeterJuly 27th, 2016 at 3:22am

Hi Raja,

Yes, currently it is only supported for the USA market due to the ease of availability of option market data.

Raja ShuklaJuly 26th, 2016 at 8:06am

As i understand from the description that this is valid only for USA market!

If i want to use this for the indian market , what modification i have to do ?

Regards,

Karl van UdenJune 13th, 2016 at 5:49am

Trial

Add a Comment