How to use Option Scanner Pro

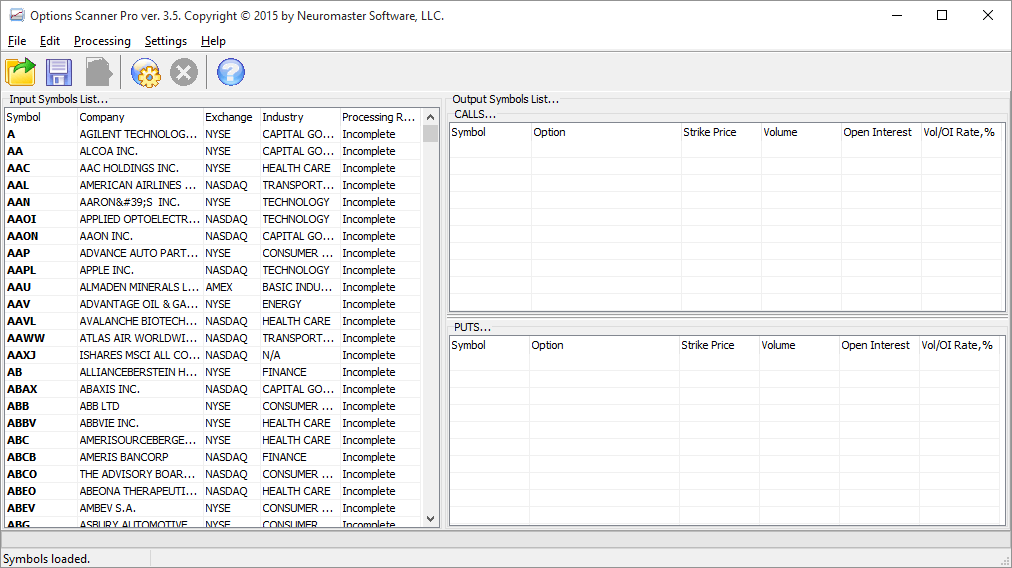

When you first launch the Option Scanner you will be presented with a screen like this:

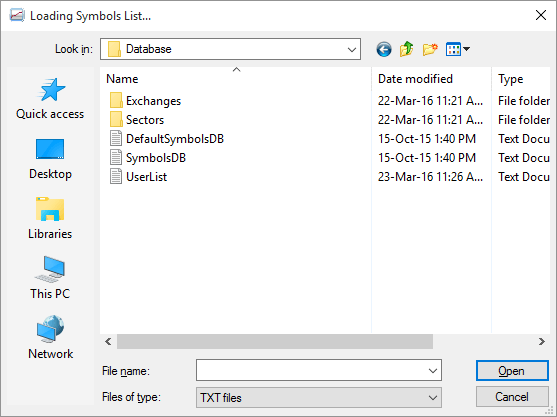

The left hand side lists the symbols that will be searched during the scan. This is the default list and is made up of over 3,000 US stocks and ETFs. However, if you want to run scans over a smaller, more focused list you can click the open button and choose one of the other pre-built symbol lists:

From here you can drill down further into specific exchanges and sectors and choose your desired list.

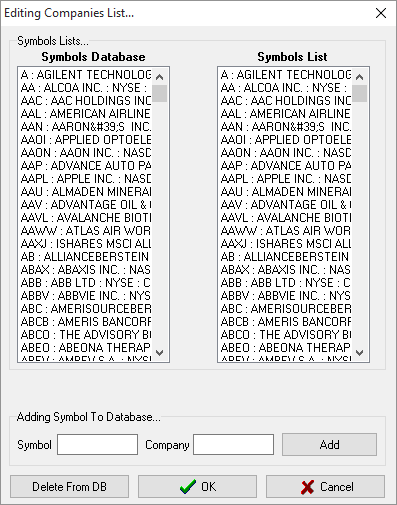

You're not restricted to these lists though; you can make your own custom list by adding/removing symbols from an existing list. Go to File -> Open Database and you will see this screen:

You can now enter both the symbol code and company name to add a new ticker to the database or select one of the existing symbols and remove it from the list.

Adjusting Scanning Criteria

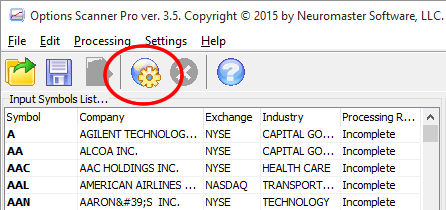

Before you start scanning, you will need to press the cog icon on the toolbar:

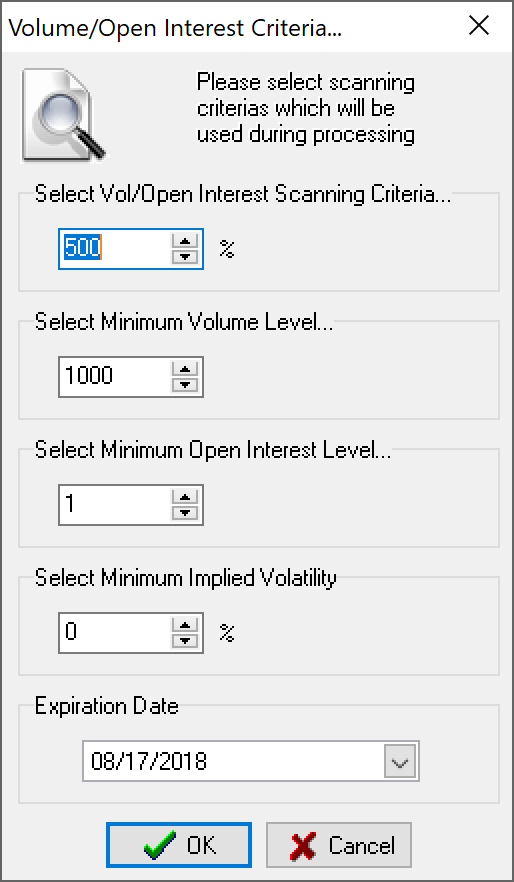

which opens the criteria panel where you decide what levels and expiration to scan:

The first item to set is the percentage level of volume compared to open interest. You want this, of course, to be at least 100%, maybe more. I'm using 100% as my default setting now. When the scans are finished you will be able to simply sort the list to show the highest scoring options at the top.

Next is the minimum volume level. I use 500, but again, you can set it higher to filter down the list some more. The most interesting opportunities will have volumes in the '000's, which will most likely show up the top once you've sorted the list.

Then you will set the minimum level of open interest. Again, I use 500 here but up to you what you select.

Last, is the expiration month.

Now, when you select "Nearest Expiration" the scanner will simply find the options closest to expiry and go with that. A small problem with that is that there are a lot of stocks and ETFs now supporting Weekly Options. So, early on in a given week you are likely to see many options showing up in the list for big name stocks like AAPL, FB, AMZN etc. As the options have only just listed, they will all have zero open interest and begin to accrue as they progress during the week.

This doesn't mean that "Nearest Expiration" should not be looked at, but just be aware that many of the Weeklys will naturally show large spikes for the big stocks so keep an eye out for the single entries for lesser known stocks.

Once you've set all those values, press "OK" to begin the scan.

Results

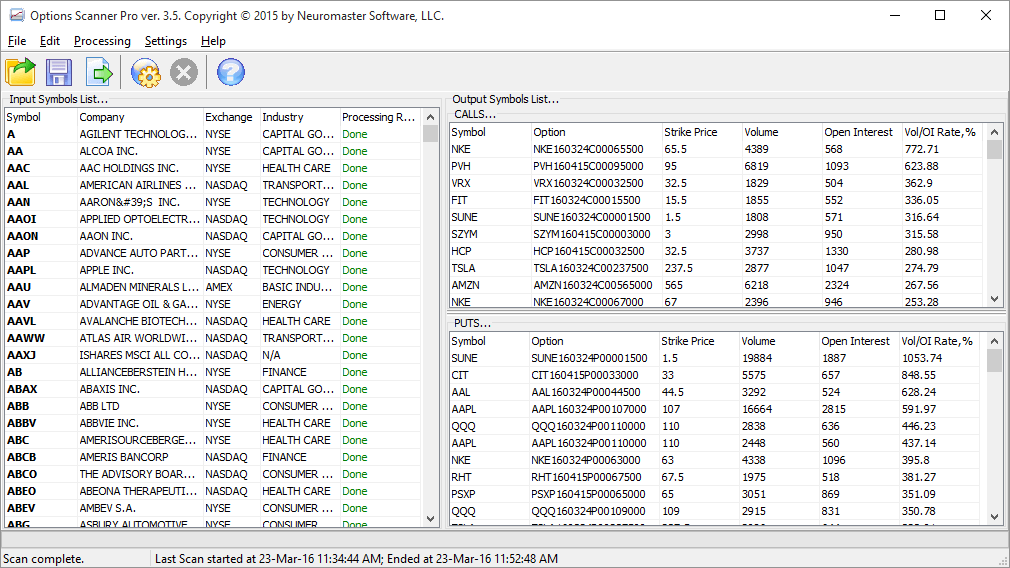

The scan only takes seconds to complete the full set of symbols for each expiry - approximately 3,000 symbols in total. When it's done the two panels to the right for the calls and puts is populated with the results:

In the results pane you can click to sort each column, so you can have the highest rated percentage difference at the top. Or, if you're look for a particular stock, you can then sort by the Symbol column.

Let me know if you have any questions by leaving a comment below!

PeterFebruary 18th, 2019 at 4:52am

Hi Mike,

Not sure what has happened with my comment script but I only received the email notification yesterday!

It does scan for high IV and you choose the expiry date you want to scan. However, it is only for single series i.e. no credit spreads with premium at a third of the width of the strikes.

MikeFebruary 8th, 2019 at 4:26am

Hi. Is the scanner able to do a scan for high IV Percentile, days to expiry & credit spreads with premium at a third of the width of the strikes ?

PeterMarch 18th, 2018 at 7:31pm

Hi Donny,

Unfortunately not; it only scans per-expiration date for all of the stocks that you include in your symbol list.

DonnyMarch 18th, 2018 at 8:42am

Hi Peter,

If I wanted to do only a certain stock to scan can I and also if I wanted the scanner to scan all the 12 months in a year will it reason for this If I get a hot signal on a stock and I want to scan with your option scanner I would want to see what EXP date has the best Vol Thanks.

PeterNovember 29th, 2017 at 3:58pm

It's only for the American market at this stage.

Dennis MurphyNovember 29th, 2017 at 6:44am

Is the Option Scanner Pro suitable for other Foreign Exchanges (Australian Exchange ASX) or only for American market

Add a Comment