Expiration Summary 19th August, 2016

Total P&L was up $1,470. I took positions in 7 stocks.

| Trade | Open | Days | P&L |

|---|---|---|---|

| BID Long Call | 11-Jul-16 | 29 | 1950 |

| NLY Long Put | 8-Jul-16 | 42 | -90 |

| LGF Long Put | 8-Jul-16 | 42 | -145 |

| CMCSA Long Call | 11-Jul-16 | 39 | -100 |

| D Long Put | 26-Jul-16 | 24 | -135 |

| PEG Long Put | 27-Jul-16 | 23 | 140 |

| KR Long Call | 27-Jul-16 | 23 | -150 |

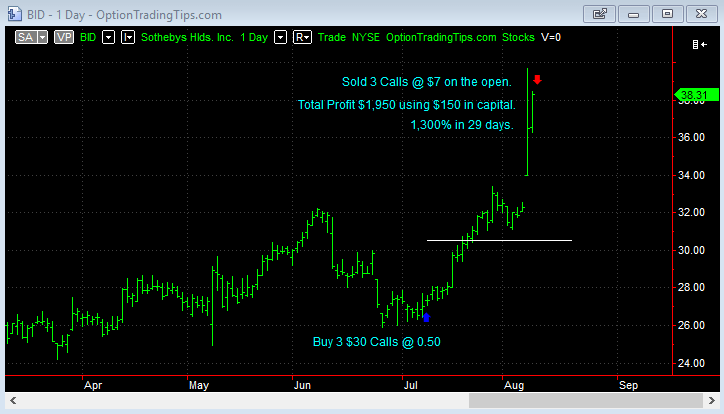

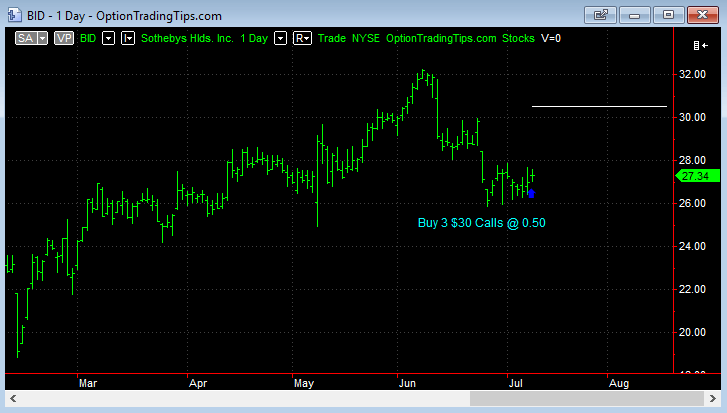

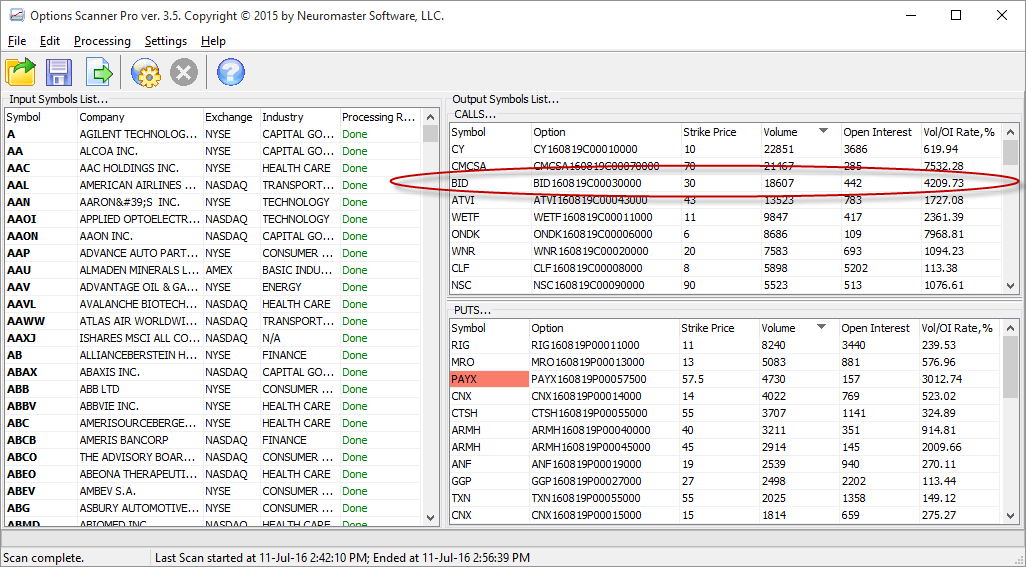

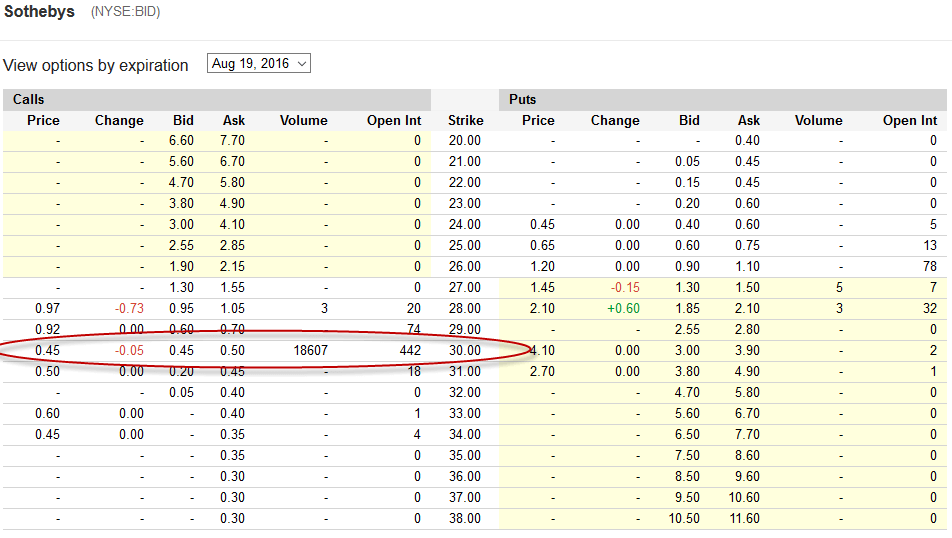

BID Long $30 Calls

By far my biggest winning trade to date! I was so excited post BID's surprise earnings announcement I couldn't risk holding onto the trade until expiration. Given the huge upswing, I wouldn't be surprised if the stock sees some profit taking over the next week or so.

My $150 investment made $1,950 in profit, which is a 1,300 percent return in 29 days. Hard to believe. My P&L for the year is now up.

Here is the trade result plotted on a chart:

| Stock | BID |

|---|---|

| Position | Long Call |

| Trade Length | 29 Days |

| Capital | $150 |

| P&L | $1,950 |

Here are some links of the news post earnings announcement:

Sothebys Shares Continue to Climb on Surprisingly Strong Q2 Profithttps://www.investors.com/news/sothebys-shares-continue-to-climb-on-surprisingly-strong-q2-profit

Sothebys Stock Breaks our After Earnings Pophttps://www.investors.com/news/sothebys-stock-breaks-out-after-q2-earnings-pop-45-on-commissions/

Trade Open: July 11th

Bought 3 BID $30 Call options @ 0.50 each. Total premium spent $150.

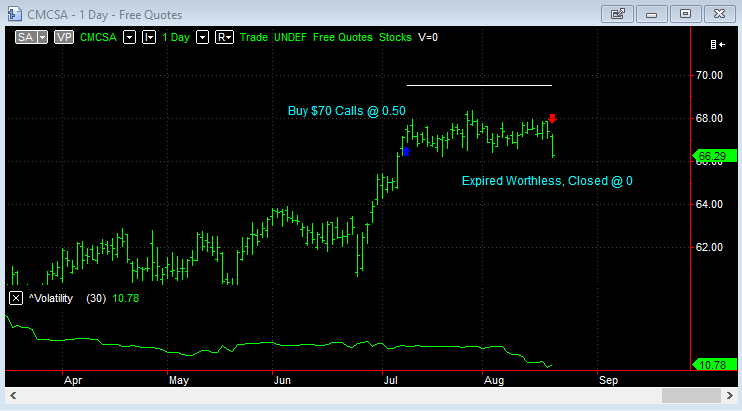

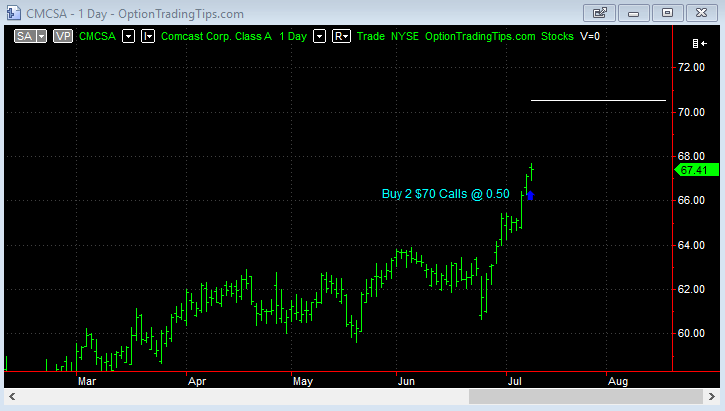

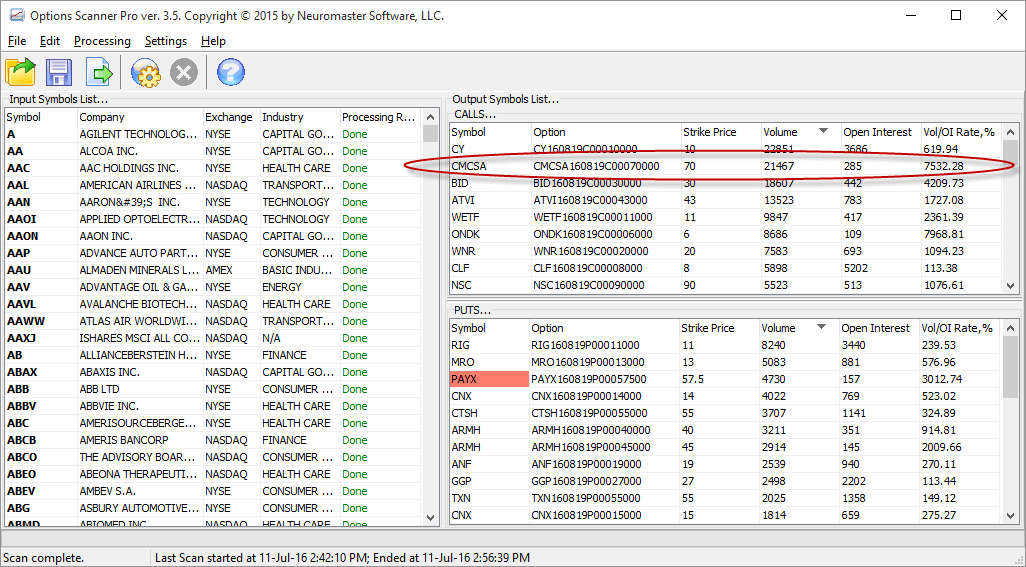

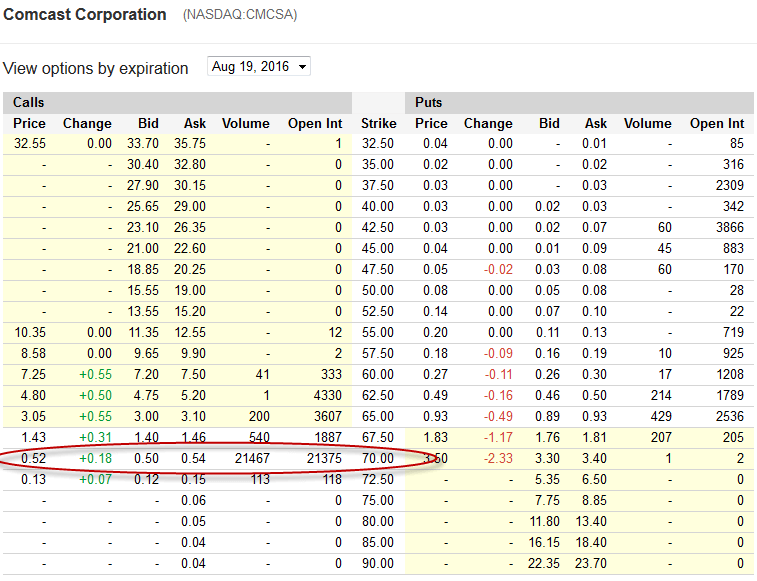

CMCSA Long $70 Calls

| Stock | CMCSA |

|---|---|

| Position | Long Calls |

| Trade Length | 39 Days |

| Capital | $100.00 |

| P&L | -$100.00 |

Trade Open: July 11th

Bought 2 CMCSA $70 Call options @ 0.50 each. Total premium spent $100.

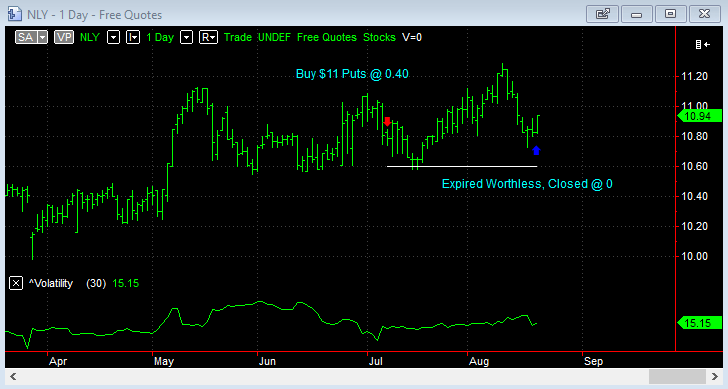

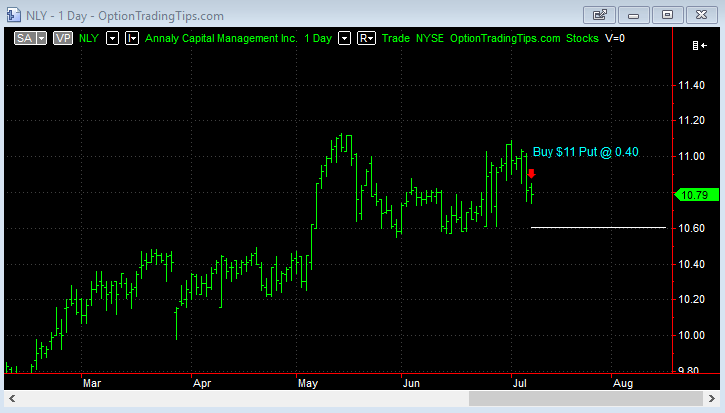

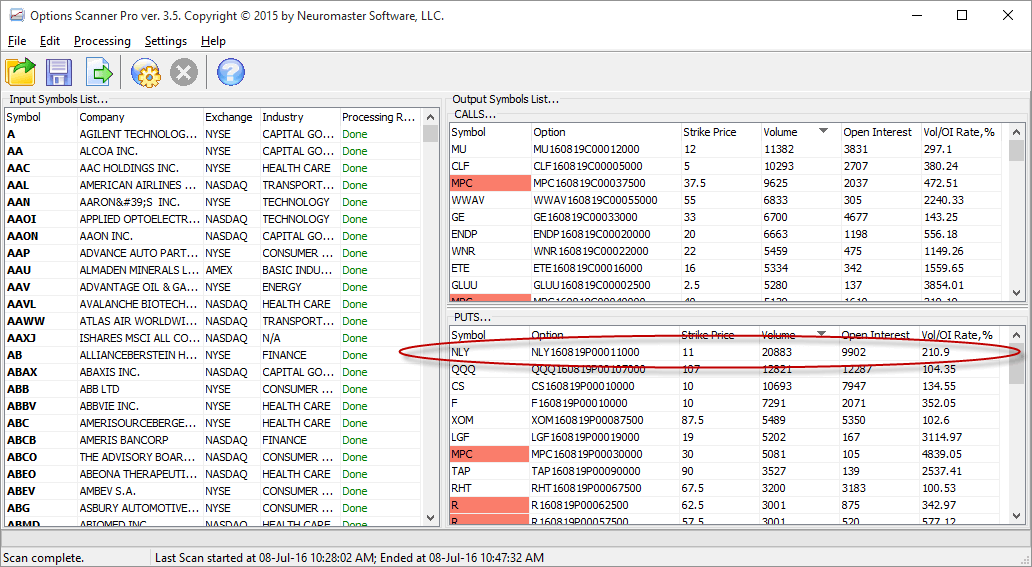

NLY Long 4 $11 Puts

| Stock | NLY |

|---|---|

| Position | Long Puts |

| Trade Length | 42 Days |

| Capital | $120.00 |

| P&L | -$90.00 |

Trade Open: July 8th

Bought 3 NLY $11 Put options @ 0.40 each. Total premium spent $120.

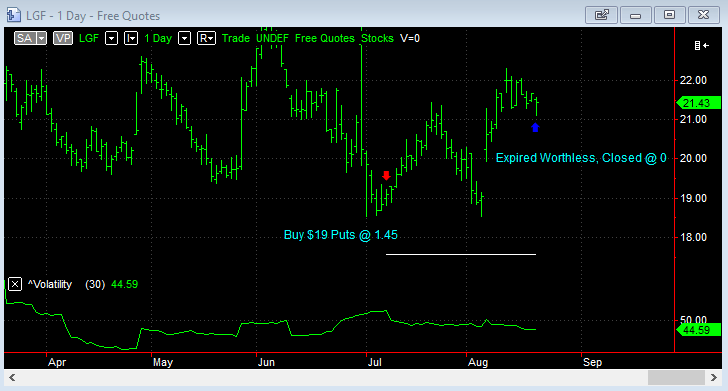

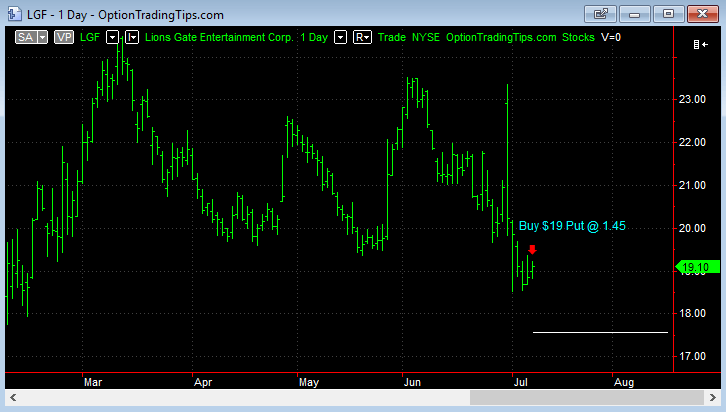

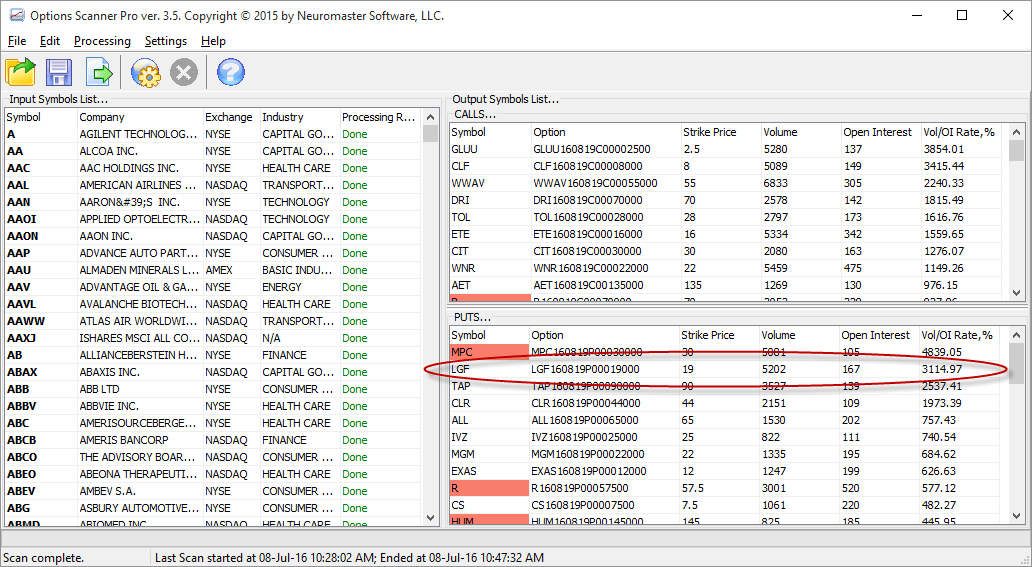

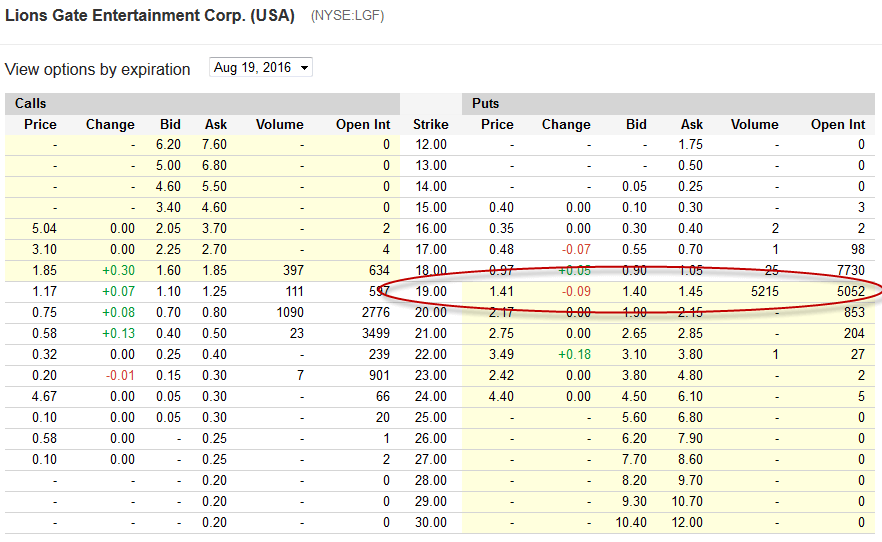

LGF Long $19 Put

| Stock | LGF |

|---|---|

| Position | Long Put |

| Trade Length | 42 Days |

| Capital | $145.00 |

| P&L | -$145.00 |

Trade Open: July 8th

Bought 1 LGF $19 Put @ 1.45

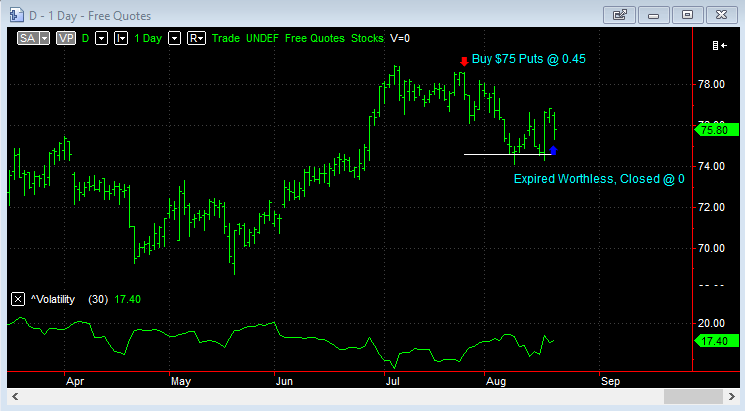

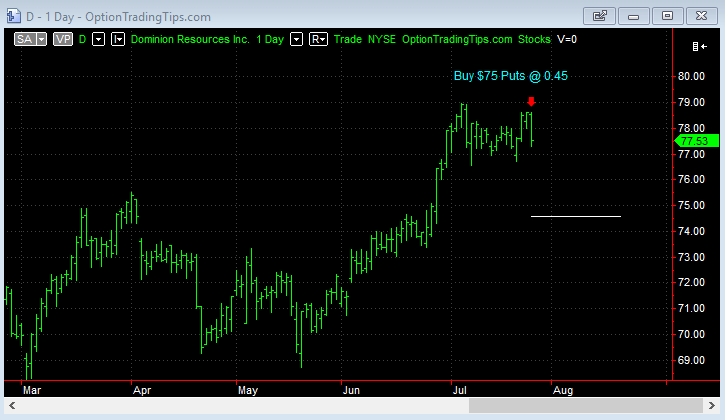

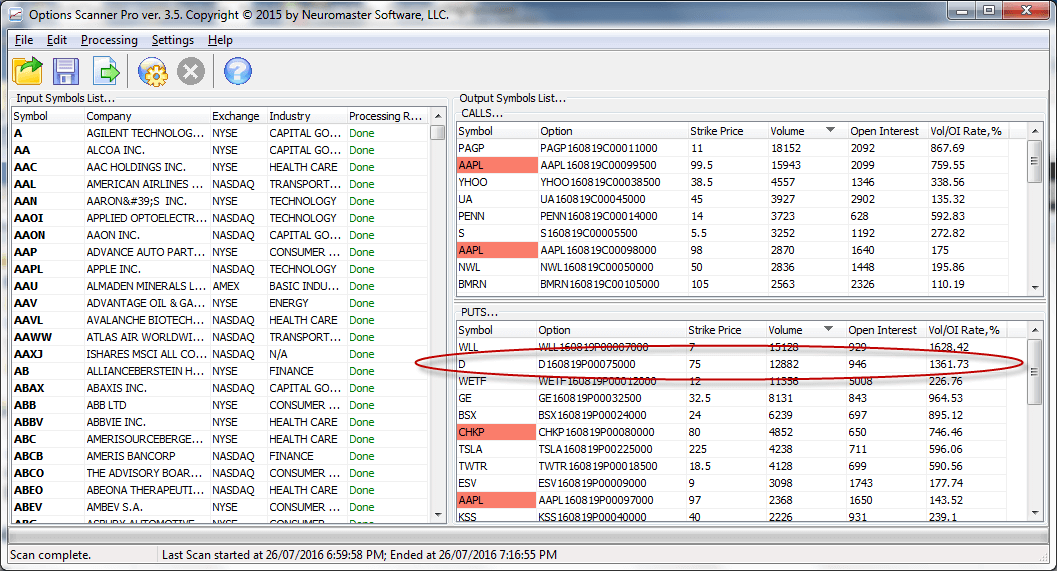

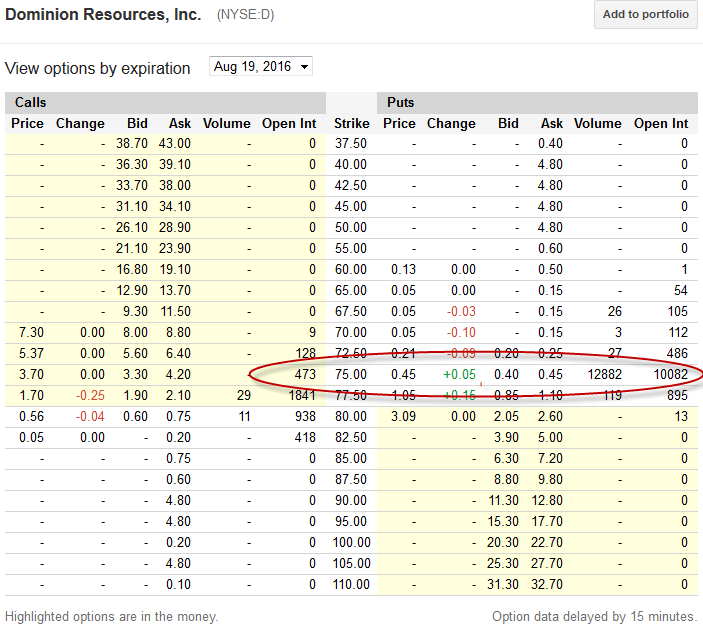

D Long 3 $75 Calls

| Stock | D |

|---|---|

| Position | Long Puts |

| Trade Length | 24 Days |

| Capital | $135.00 |

| P&L | -$135.00 |

Trade Open: July 26th

Bought 3 lots of D $75 Call options @ 0.45 each. Total premium spent $135.

Earnings are out on August 3rd.

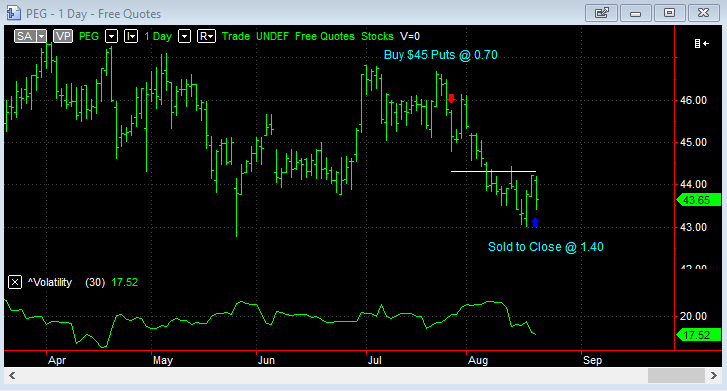

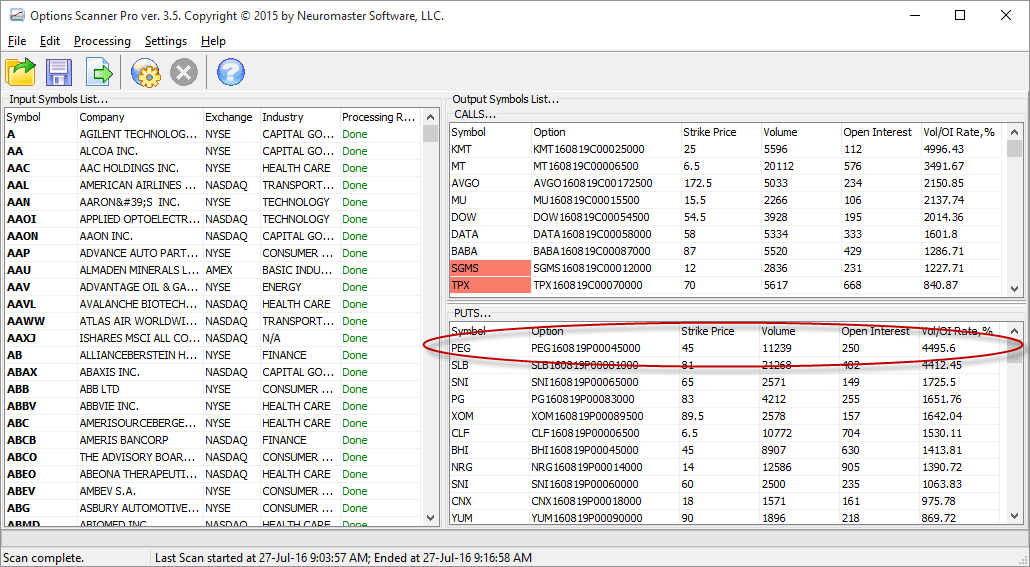

PEG Long 2 $45 Puts

| Stock | PEG |

|---|---|

| Position | Long Puts |

| Trade Length | 23 Days |

| Capital | $140.00 |

| P&L | $140.00 |

Trade Open: July 27th

Bought 2 lots of PEG $45 Put options @ 0.70 each. Total premium spent $140.

Earnings are out on July 29th before market open.

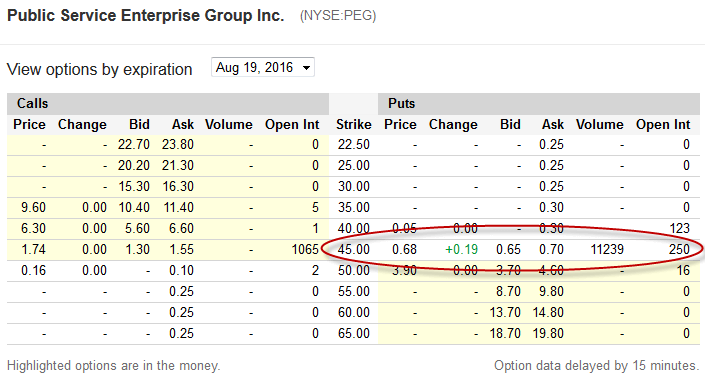

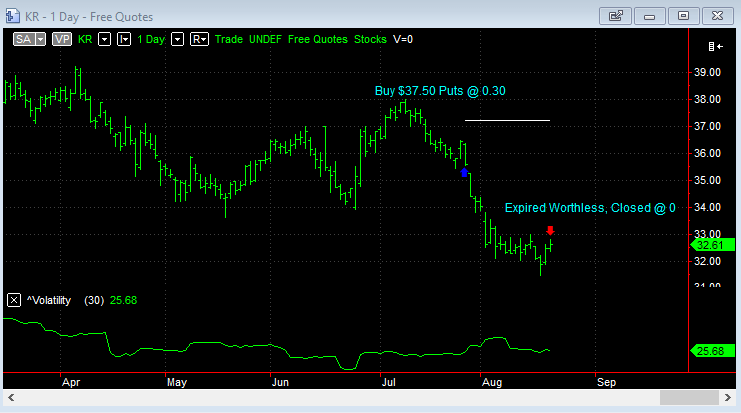

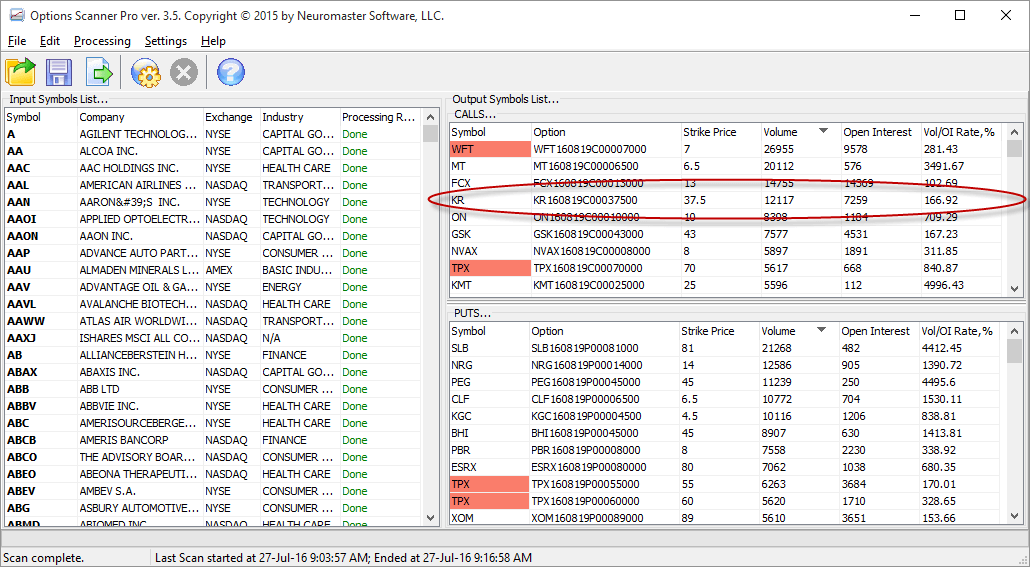

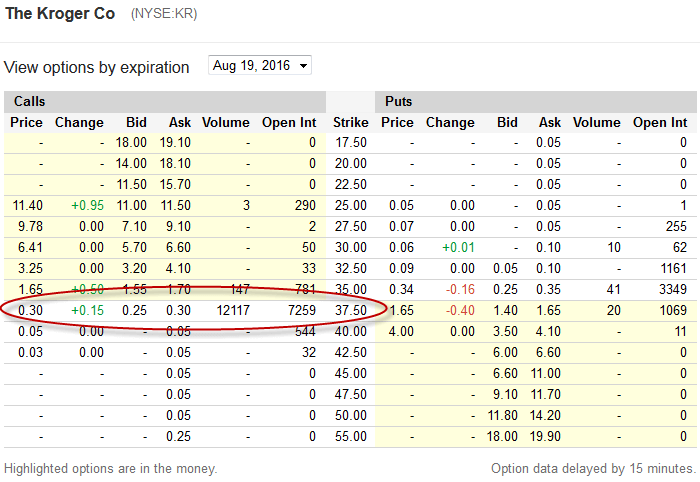

KR Long 5 $37.50 Calls

| Stock | KR |

|---|---|

| Position | Long Puts |

| Trade Length | 23 Days |

| Capital | $150.00 |

| P&L | -$150.00 |

Trade Open: July 27th

Bought 5 lots of KR $37.50 Call options @ 0.30 each. Total premium spent $150.

Earnings are out on September 9th, which is past the expiration date, so perhaps the options volume is indicative of a move prior to the actual announcement.

There are zero comments

Add a Comment