Short Condor Trade - Coach (COH)

15th January, 2015

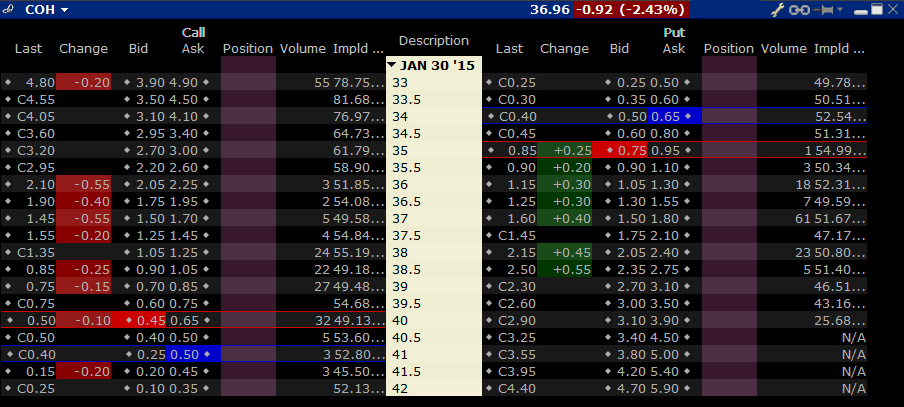

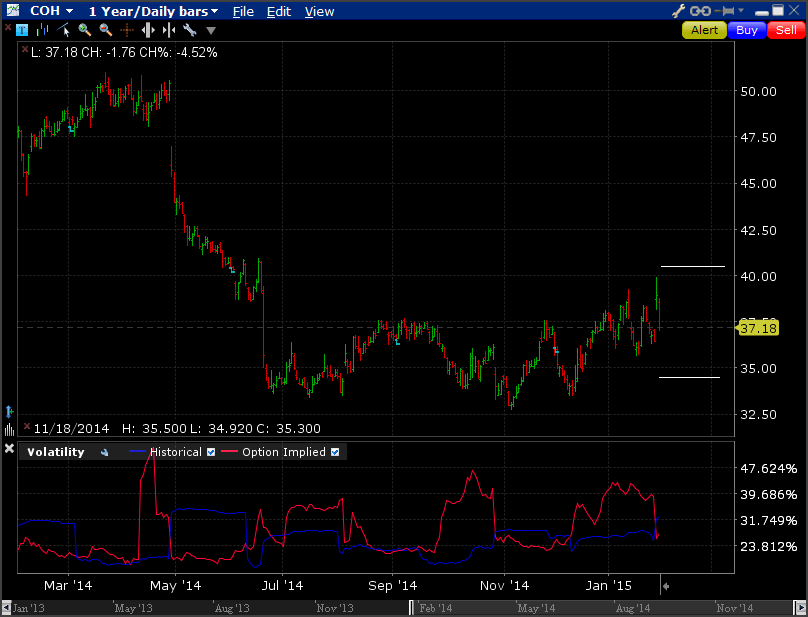

The Short Call option candidates for the close of trading 14th Jan showed COH at the bottom of the list with the Feb $41.50 calls, bid at 0.25 for a 24 day return of 0.67%. Not all that exciting, but fact that COH is on the short call list means that the options are showing reasonably high implied volatility. So, I took a look at the stock anyway to see what else I might be able to put on.

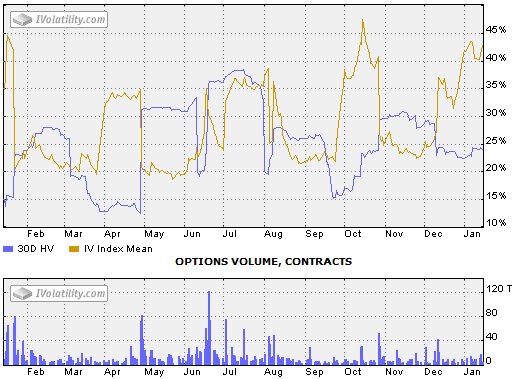

Looking at the implied volatility, I see that it is currently at 41% vs 37% a month ago and rising. Historical volatility, however, is fairly low at 24% and stable at 24% a month ago.

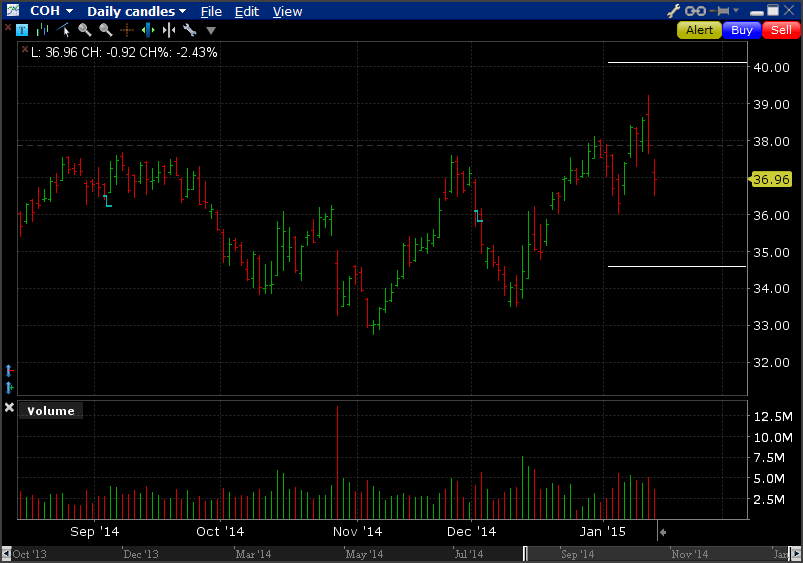

Coach has been range trading for the last 7 months between $33 and $38. Currently at $36.96.

Initially, I thought about a short butterfly $36.50/$37/$37.50 for a $10 credit but given the range trading and high IV I decided to switch to a credit condor spread.

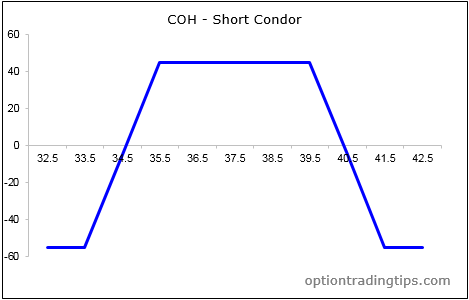

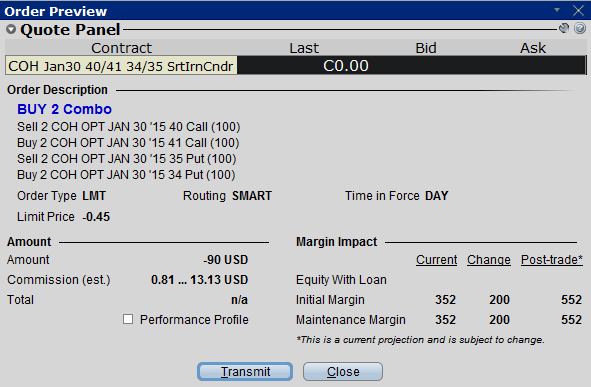

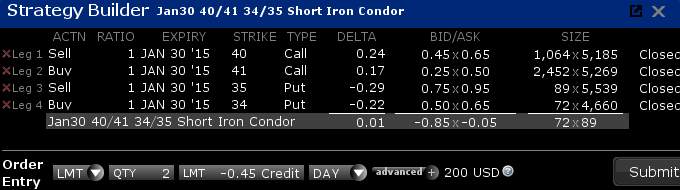

Jan 30th expiration;

- Sell $40 Call @ 0.55

- Buy $41 Call @ 0.37

- Sell $35 Put @ 0.85

- Buy $34 Put @ 0.58

Net credit of $45 per contract. Max loss either side if the market rallies or tanks is $55. Breakeven points are $34.60 (-8%) and $40.40 (+8%)

16% buffer for the market to trade in over the next two weeks.

I am worried about a possible spike, however, as I noticed from the Earnings Calendar that COH reports their numbers on January the 29th.

Update: Market Close Jan 15th

My order to sell the condor for a $45 credit wasn't filled during the day - so just before the market close I modified the order down to $40, which saw it filled. So, the breakeven points are now $34.69 and $40.31.

The component prices for each leg were;

- Sell $40 Call @ 0.40

- Buy $41 Call @ 0.285

- Sell $35 Put @ 0.95

- Buy $34 Put @ 0.66

Update: Position Closed Jan 30th

COH shares jumped after releasing better than expected earnings. The gains, however, were short lived and COH ended the week trading at $37.18.

The condor trade was sucessful and I kept the entire premium received for spread of $81.

| COH Condor | ||||

| COH Jan30 $41 Call | 2 | 0.285 | 0 | -57 |

| COH Jan30 $40 Call | -2 | 0.4 | 0 | 80 |

| COH Jan30 $34 Put | 2 | 0.66 | 0 | -132 |

| COH Jan30 $35 Put | -2 | 0.95 | 0 | 190 |

| Total | 81 |

There are zero comments

Add a Comment