Short Iron Condor (FSLR)

Start: February 23rd

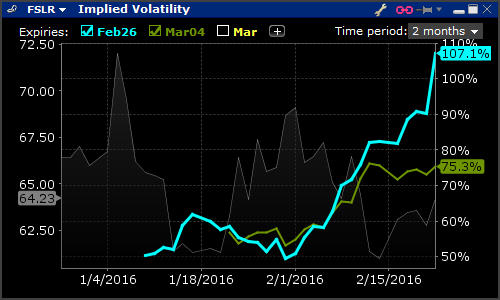

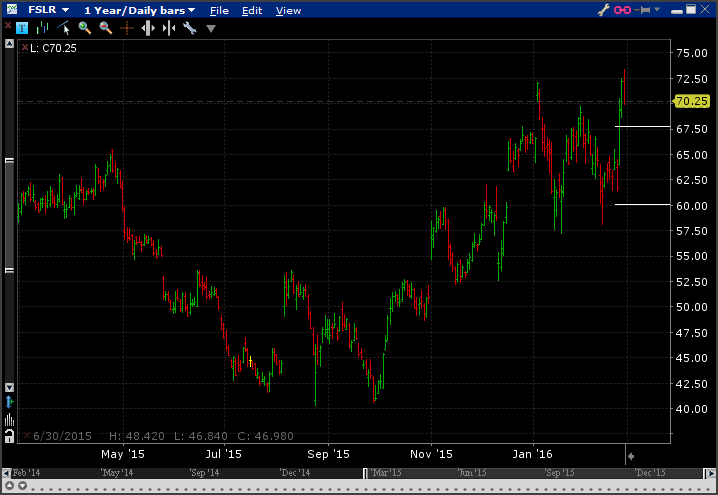

First Solar are releasing earnings after market close today. Recent price action over the past two months has been choppy and heading into a range bound pattern.

Implied volatility for this week's expiry (Feb 26) is very high at 107%.

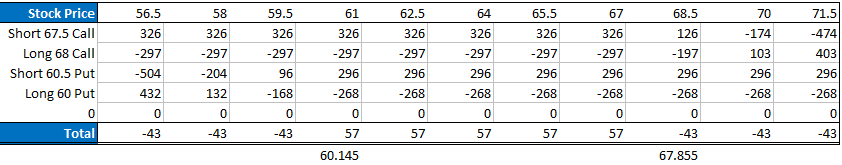

My bet is that the stock, even after earnings are released, will remain fairly range bound and I have executed a short Iron Condor using the $67.50/$68 call options and $60.50/$60 put options.

This is a credit spread done at $28 per contract and I did it for a huge 2 lots!

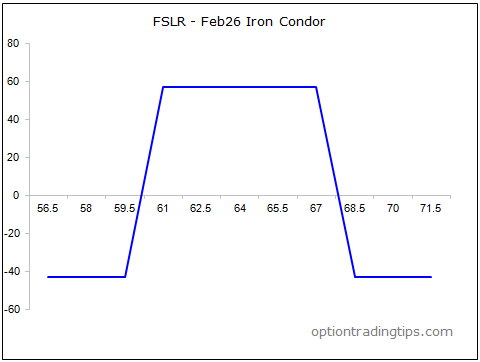

Max profit if the stock stays inside $67.855 and $60.145 will be $57 and max loss if outside this range will be $43.

Here is the payoff profile graph:

Here are the order details and options screen:

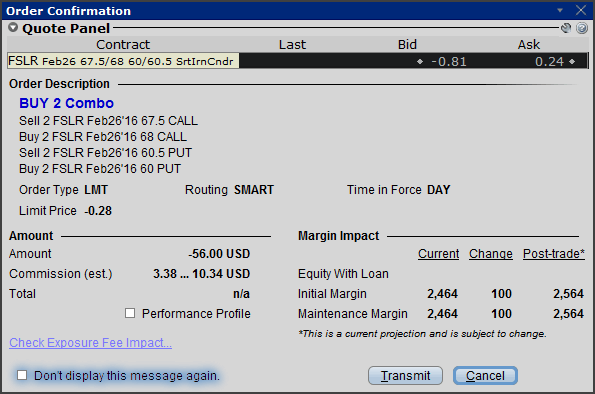

Update 24th February

Even though my order was for 2 lots I was only filled for 1, so my max loss can now only be $26 and max profit of $24.

Update 26th February

Check out the rally after FSLR reported stronger than expected earnings:

The above chart was taken after Friday's close, which was well above our upper break levels. This means I've reached the max loss on the trade of $26.20.

Here are the closing values:

| Symbol | Position | Price | Close | P&L |

|---|---|---|---|---|

| FSLR Iron Condor | ||||

| FSLR Feb26 $67.50 Call | -1 | 1.01 | 2.75 | -174 |

| FSLR Feb26 $68.00 Call | 1 | 0.921 | 2.25 | 132.9 |

| FSLR Feb26 $60.00 Put | 1 | 1.861 | 0 | -186.1 |

| FSLR Feb26 $60.50 Put | -1 | 2.01 | 0 | 201 |

| Total | -0.238 | -0.5 | -26.2 |

There are zero comments

Add a Comment