Double Calendar Spread on MX

13th February, 2015

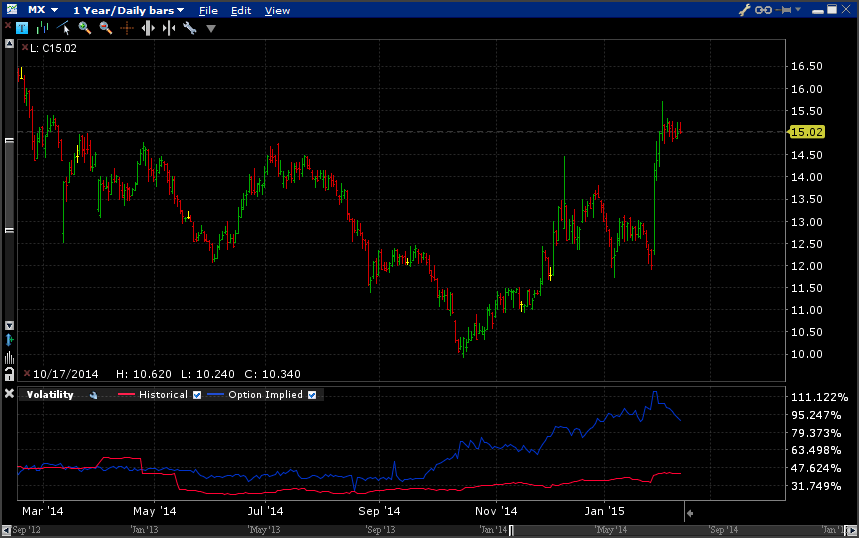

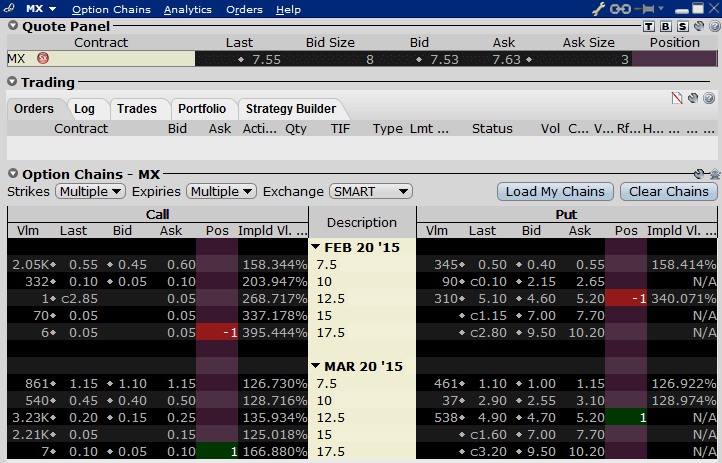

MX caught my eye after appearing on the short put list for February options. Implied vols for the front month (Feb 20) options were around 150%. Checking the earnings calendar I see that nothing is on the radar for MX until July!

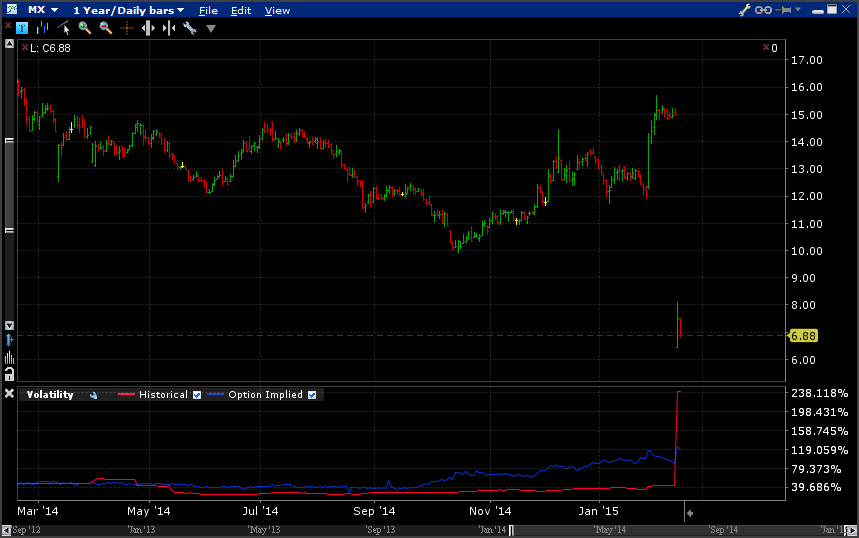

Nonetheless, IV is still around 100% points higher than historical vol and the stock has been in a tight range for the past week;

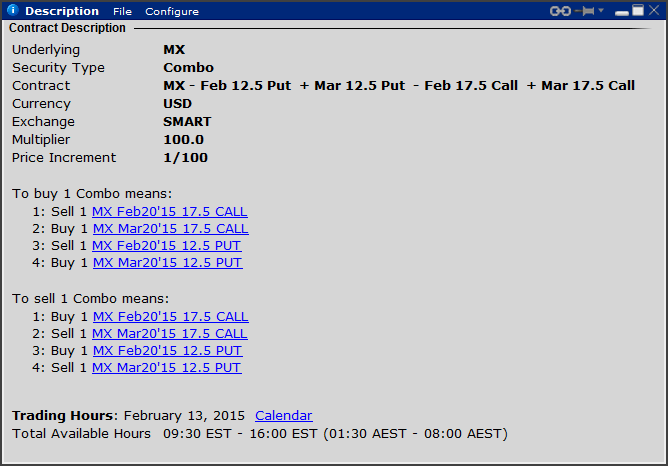

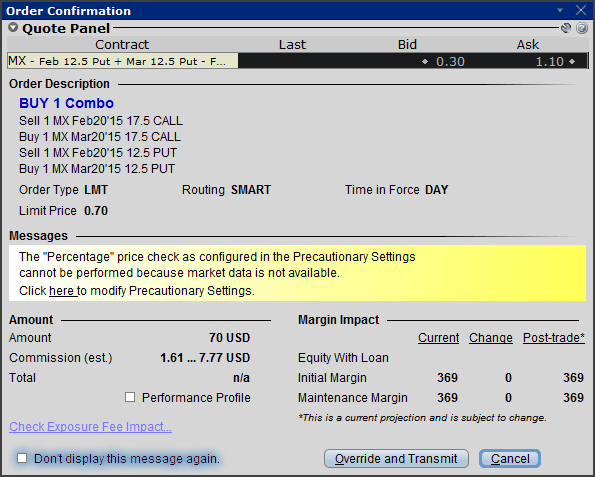

Given the recent spike in price from $12 to $15, I was weary of simply shorting puts. Thinking of some downside protection and also allowing for some upside opportunity, I went for a double calendar spread.

Market Close, February 13th

After checking my fills post the market close, I see MX has absolutely tanked, down 50%!

The stock closed $7.55 - well below my short $12.50 put option.

Fortunately I am long the $12.50 March put as protection!

Just goes to show how having protection can really save you in situations like these.

So, what happened to MX stock? Well, I read that MX had previously understated earnings during 2013 and the losses now reported are much larger than originally stated. An investigation may soon follow;

(MX) Stock Declined Today After Restating Financial Results

Bernstein Liebhard LLP Announces That It Is Investigating Claims Against MX

Results of Operations and Financial Condition, Regulation FD Disclos

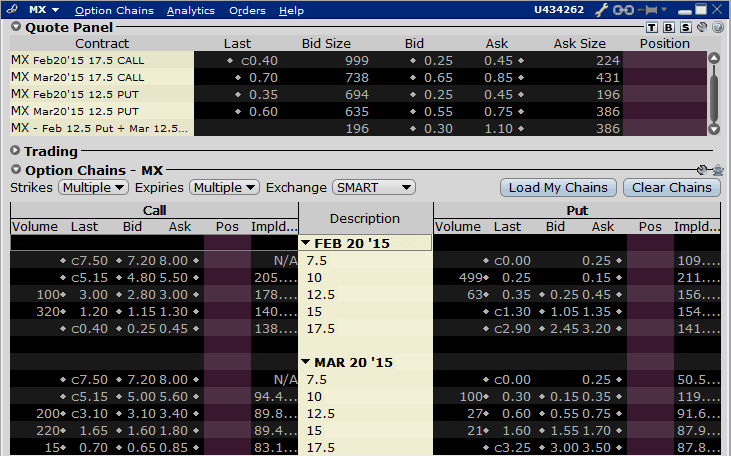

Here are the option chains before and after market for Friday the 13th February;

Really not sure what to do now - expiration for the front month strangle is this Friday - I need to decide if I should exit all legs this week or hold onto the back month strangle.

Thoughts?

Market Close, February 18th

Option assignment! I opened my broker terminal before Wednesday's trading session and see that I have been assigned on my $12.50 Feb put option. This means that I am now long 100 MX shares at a purchase price of $12.50 with the stock trading at $6.88 means an immediate loss of $562 on the stock leg.

However, I have kept the $715 in premium from the short sale of the $12.50 Feb put.

So, now I have a position in the stock and a long Mar $12.50 put (calls are pretty much done so ignoring them at this point) to deal with.

I could ride it out by holding the stock and put - but there is still a month to go on the put leg and not much time-value to benefit from.

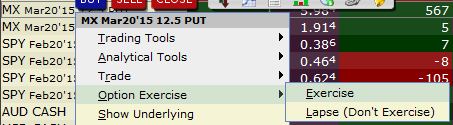

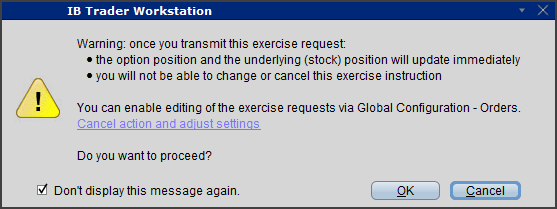

I decided the best thing to do was to just close out the trade and move on to the next opportunity. So, I exercised my march put, meaning I sold the stock at $12.50 while losing the entire premium for that option.

The stock leg is therefore a stratch trade; bought and sold at $12.50. The put side actually made $116.20 as the short put price was higher than the long price. But I lost $182.90 total on the call legs.

All in all my net loss on this was $66.70. Would have been nice to have been long some OTM puts in this situation but I'm not fussed about the result in the end - happy to walk away with a small loss given the smashing the stock experienced.

Here are the screens of exercising the put and the resulting trades if you're interested;

Position Closed, 20th March

I held onto the calls until final expiration...they were almost worthless so I kept them in case of a surprise bull run. They've now expired so the trade is done completely for a net loss of $71.60.

| Symbol | Position | Price | Close | P&L |

|---|---|---|---|---|

| MX Double Calendar | ||||

| MX Feb20 $12.50 Put | -1 | 7.146 | 0 | 714.6 |

| MX Feb20 $17.50 Call | -1 | 0.036 | 0 | 3.6 |

| MX Mar20 $12.50 Put | 1 | 5.984 | 0 | -598.4 |

| MX Mar20 $17.50 Call | 1 | 1.914 | 0 | -191.4 |

| Total | 0.716 | 0 | -71.6 |

There are zero comments

Add a Comment