Long Put Spread (MU)

Closed: Profit $71.40

Market Close July 3

| Symbol | Position | Price | Close | P&L |

|---|---|---|---|---|

| MU Long Put Spread | ||||

| MU Jul02 22.50 Put | -1 | 0.222 | 3.43 | -320.8 |

| MU Jul02 23.50 Put | 1 | 0.508 | 4.43 | 392.2 |

| Total | 0.286 | 1 | 71.4 |

17th June, 2015

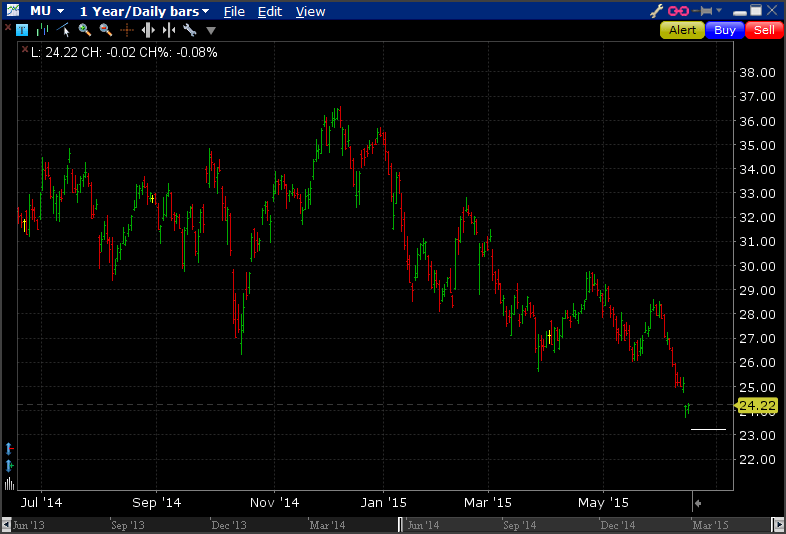

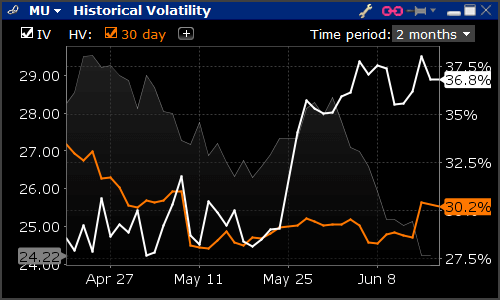

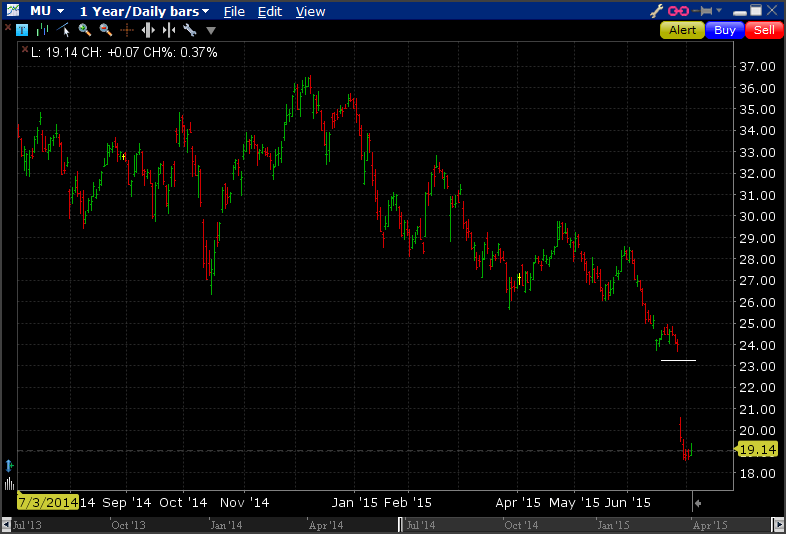

Micron Technology (MU) showing some high vols with a decent downtrend. Stock has been pretty choppy but the overall trend for the past year is negative. The shares have just slightly bounced off recent lows, so I probably should have waited a little longer to establish this position but the payoff profile looked pretty good as it was.

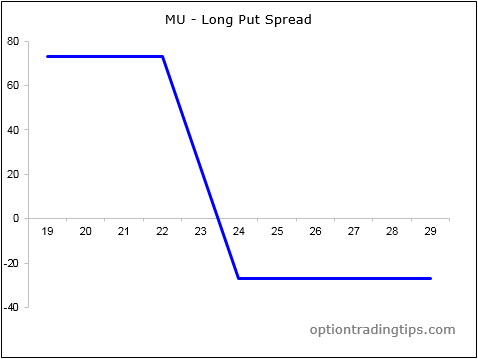

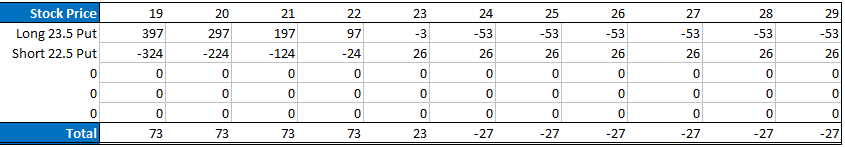

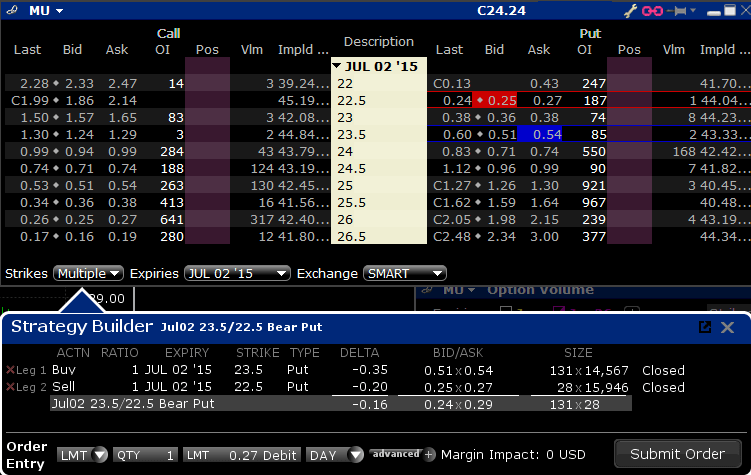

Breakeven on the downside is $23.46, which based on the current stock price of $24.22 and 37% vol gives only a 28.13% chance of trading below that. But the payoff if below is $73 compared to a max loss of $27 if the stock stays above that by expiration.

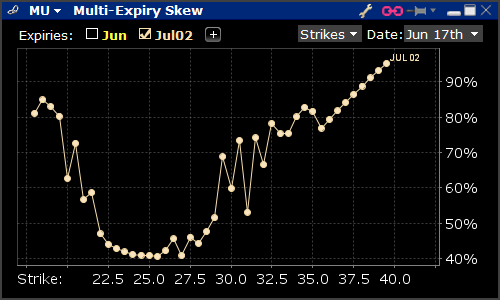

The vol skew paints suggests that the market expects the stock to rally as the call prices increase;

And here is the historical vs implied vol graph;

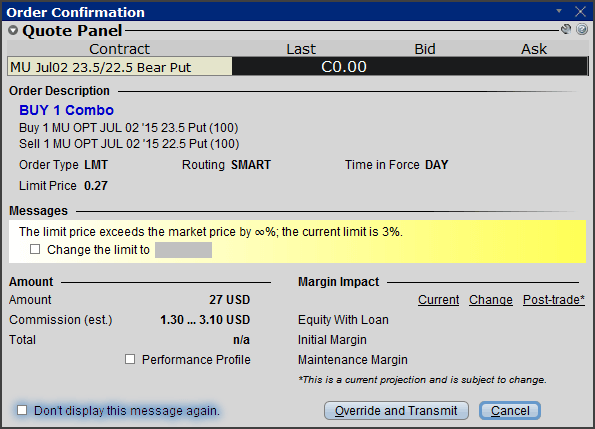

I placed my order to buy the $22.50 and $23.50 put spread for a debit of $27 and was filled on that order;

Update 3rd July

MU closed the week out at $19.07. The put spread expired at its' max value, less the premium paid leaves a profit of $71.40. Here's the chart after the close on Friday;

There are zero comments

Add a Comment