0 Wins, 3 Losses, -$246

November 18th, 2016 Option Expiration

I was very quiet this month too; I only put on 3 trades for the November expiration. It wasn't due to lack of opportunities, I just wasn't on the look out for them. I really should have put some trades on during the election but just didn't get around to it. So the ones I had I just let ride out.

| Trade | Open | Close | Days | P&L | Total |

|---|---|---|---|---|---|

| DDD Long Put | 20-Sep-16 | 27-Oct-16 | 37 | -49 | 1987.8 |

| JCP Long Call Spread | 23-Sep-16 | 27-Oct-16 | 34 | -47 | 1940.8 |

| CNP Long Call | 26-Sep-16 | 27-Oct-16 | 31 | -150 | 1790.8 |

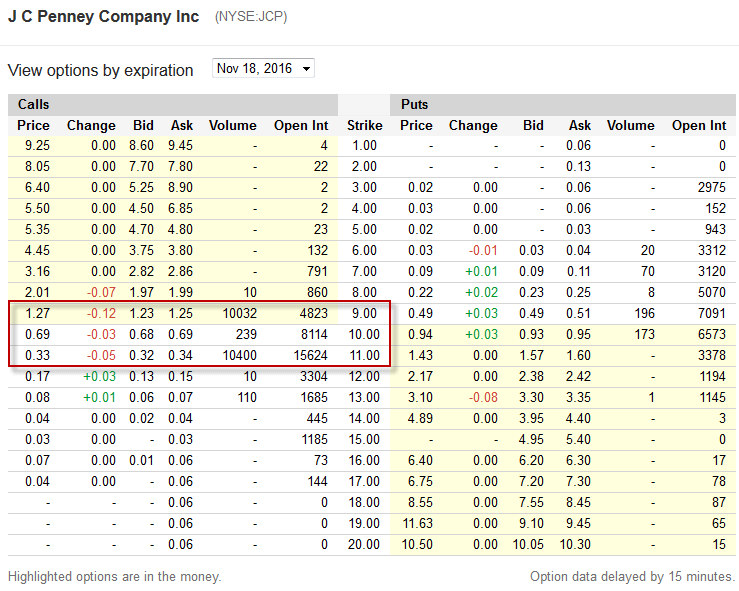

$JCP: Long $9 & $11 Call Spread

| Stock | JCP |

|---|---|

| Position | Long Call Spread |

| Trade Length | 34 Days |

| Capital | $91.00 |

| P&L | -$47.00 |

Start: 23rd September

Strong action in the $9 and $11 call options for the November expiration. Earnings out November 11th.

Now that I look at the chart since putting on the trade, the breakeven point of $25.50 looks a long way for the stock to move. I do have 6 weeks though.

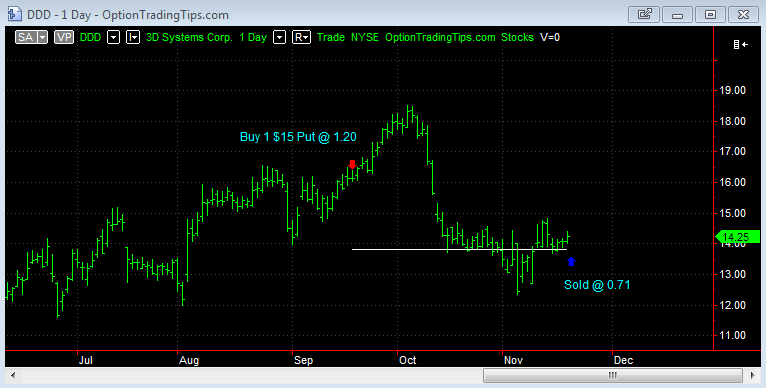

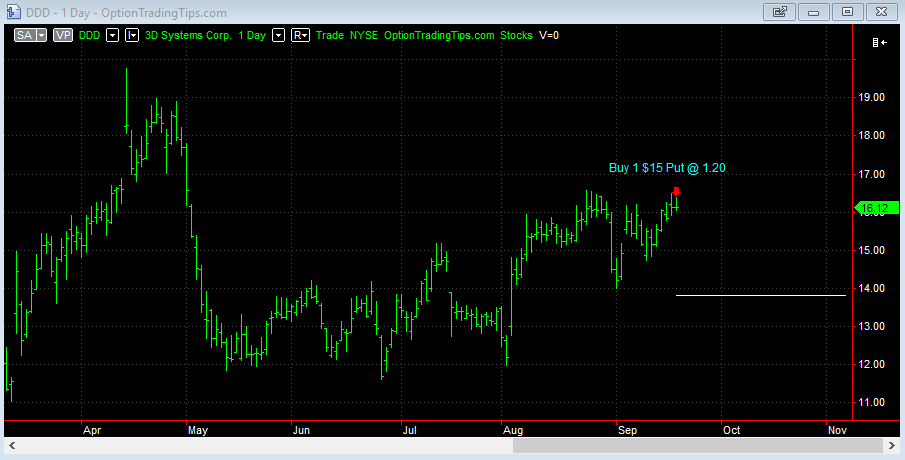

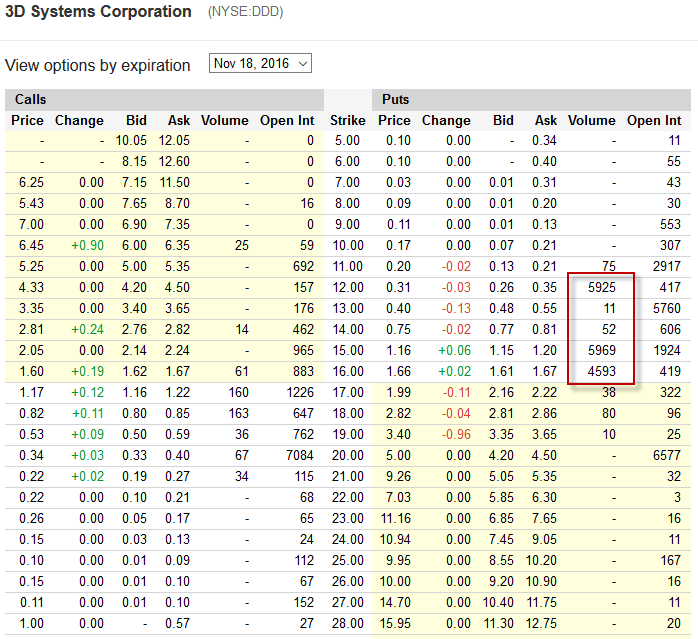

$DDD Long $15 Put

| Stock | DDD |

|---|---|

| Position | Long Put |

| Trade Length | 37 Days |

| Capital | $120.00 |

| P&L | -$49.00 |

Trade Start: 20th September

$DDD release earnings 2nd November. The puts for the 18th Nov expiration are showing increasing volumes. Volatility is reasonably high at around 50%, however, it is on the low side of its' average. The puts were therefore expensive for options 2 months out so I only bought 1 contract.

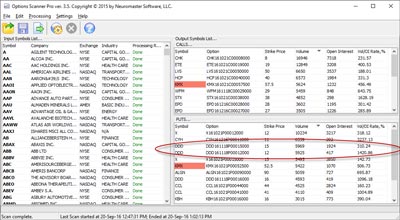

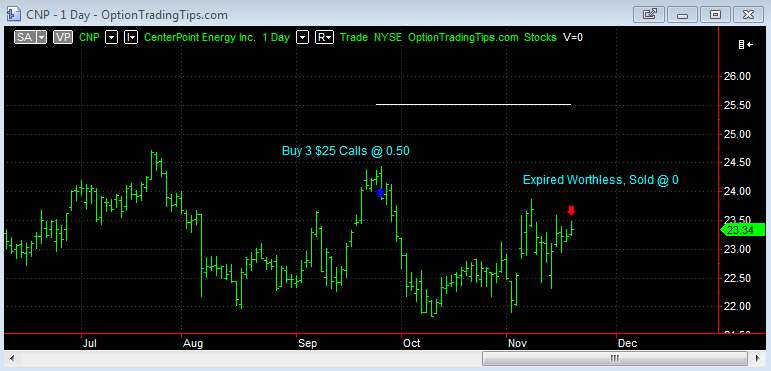

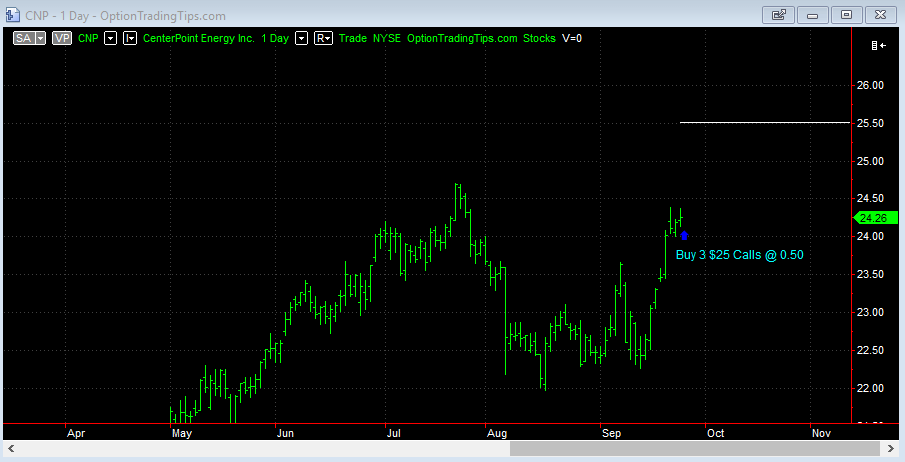

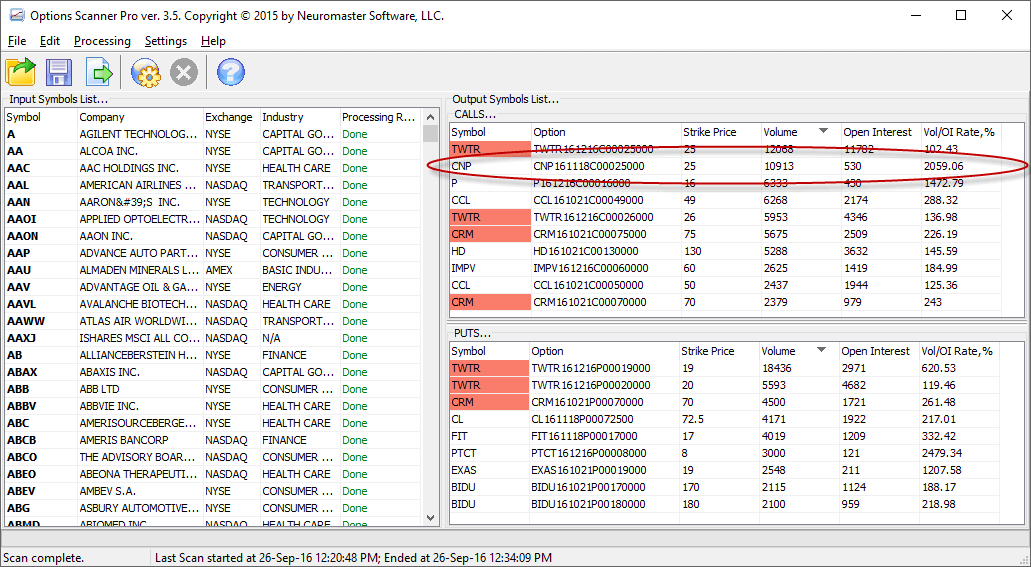

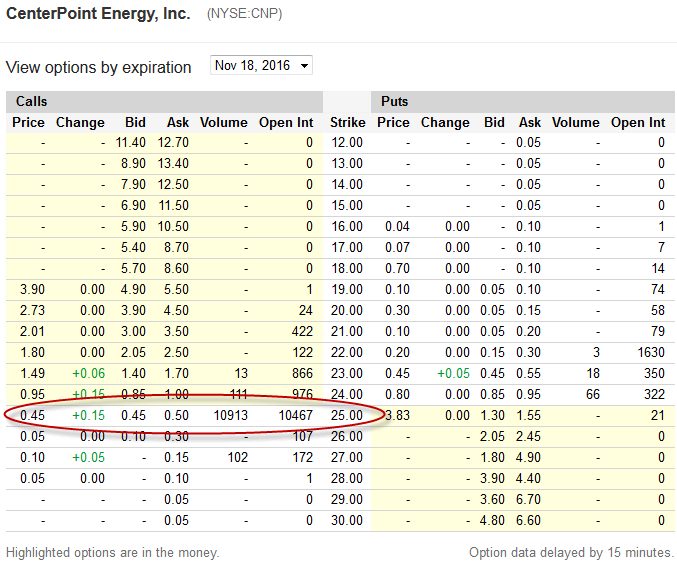

$CNP: Long $25 Calls

| Stock | CNP |

|---|---|

| Position | Long Call |

| Trade Length | 31 Days |

| Capital | $150.00 |

| P&L | -$150.00 |

Trade Start: 26th September

Very significant volume and open interest for the $25 calls ahead of CNP's earnings on November 3rd.

There are zero comments

Add a Comment