Short Butterfly (KYTH)

25th February, 2015

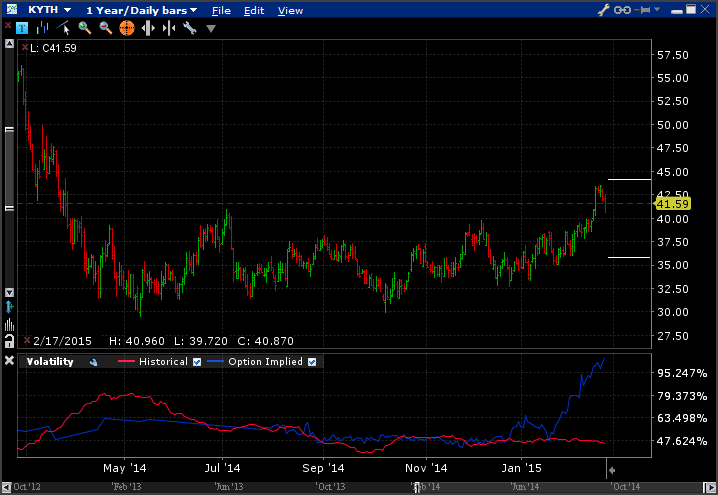

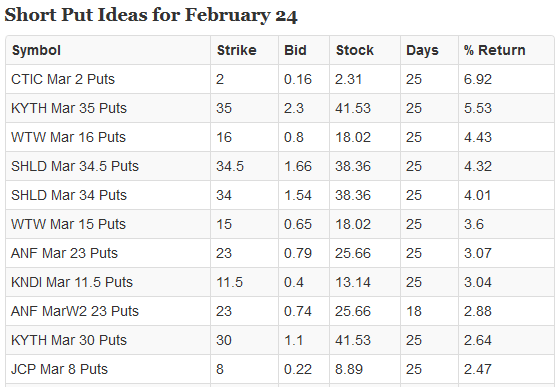

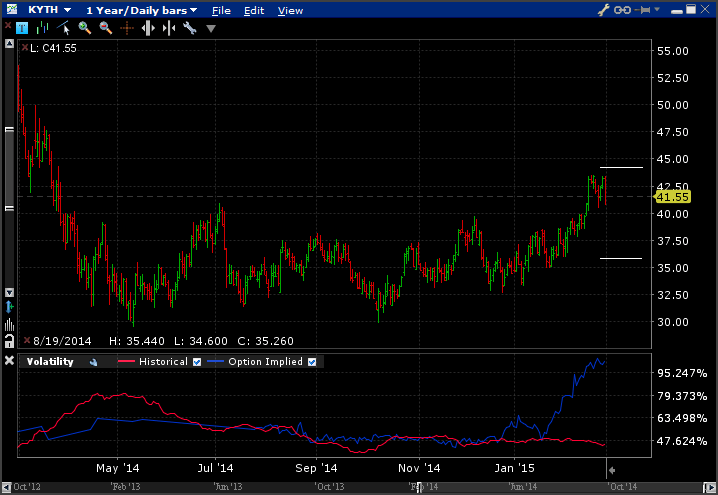

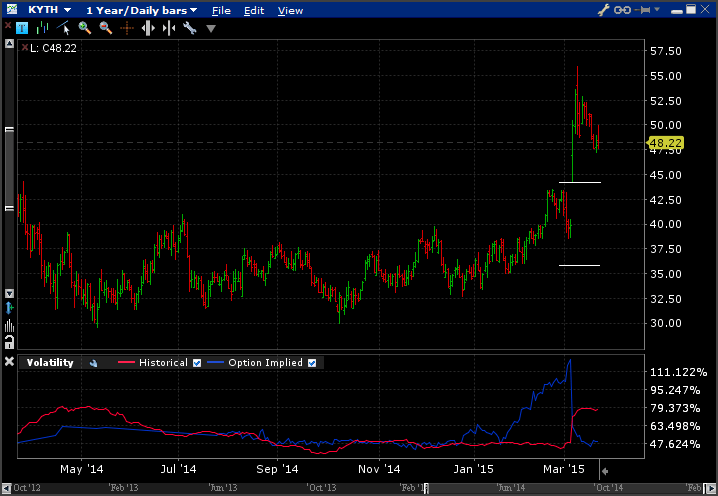

Volatility has been creeping up towards 100% for KYTH as their March 2 earnings date approaches. They've come to my attention via the short put option opportunities;

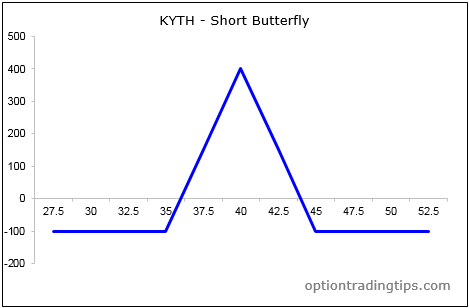

Going long the $35 puts looks reasonable - but then I started playing around with a few scenarios and came up with this payoff profile;

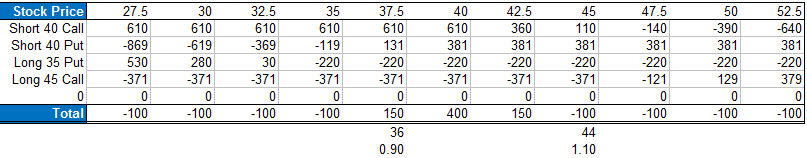

And check out the numbers from the grid;

Click to enlarge that last one.

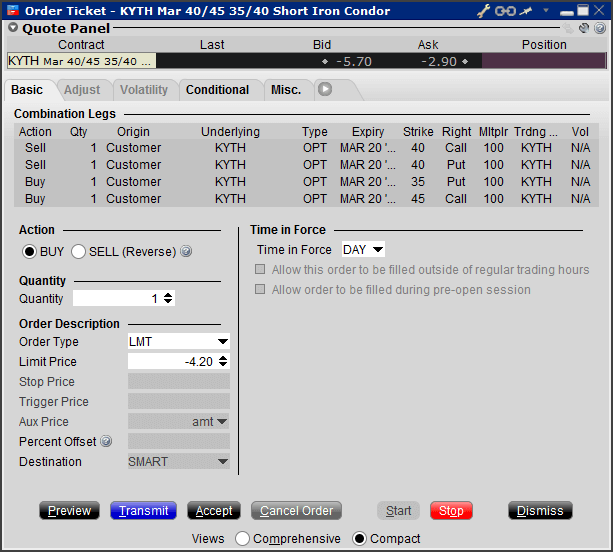

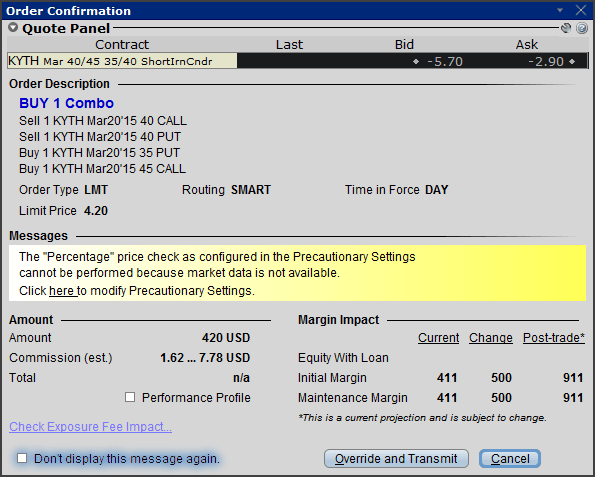

I originally had the order to buy sell this butterfly for $4.20 credit - but as I checked my screen before the market closed it was still working so I lowered my credit to $4 was was filled immediately. Here are the original screens of the orders anyway;

Max loss of $100 to max gain of $400 - but needs to stay pretty tight to make the $400. Unlikely, but I'll give it a go anyway.

The strategy has a 20% buffer to breakeven so see how I go on this one.

Update, Market Close Feb 27th

KYTH down slightly in preperation for earnings release Monday afternoon.

After my hit on WTW, I am now very nervous about the result of the announcement Monday.

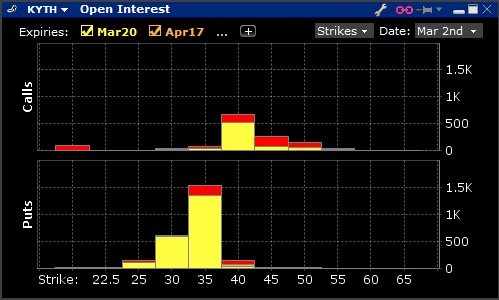

Now, take a look at the open interest standings as of Friday's close;

There's a lot of interest around the $30 and $35 puts! At this level the price will end up under my lower breakeven point. So, do I exit my butterfly for a $10 loss and then go long some $35 puts currently trading at $1.25? My max loss for the butterfly is currently set to $100 - so I could avoid this and go for a max loss of $125 (plus whatever it costs to exit my butterfly) and go with the oprn interest trend?

Update, March 2nd

Earnings released after market were right on with market estimates as showing a net loss of 1.07 per share.

In after hours trading the stock didn't move much at all and was still trading around $40.35.

Update, March 5th

KYTH up over 25% after the U.S. Food and Drug Administration (FDA) announced that they will review KYTHERA's New Drug Application (NDA) for ATX-101 (deoxycholic acid) for improvement in the appearance of moderate to severe submental fullness.

Kythera Biophrarma (KYTH) Gains Following Release of Adcom DocsKythera (KYTH) AdCom Docs are Positive for Neothetic (NEOT) - Guggenheim

Position Closed, March 20th

KYTH didn't manage to pull back enough after the March 5 bounce and the stock ended up closing the option expiration above the upper breakeven point.

The position ended up at the maximim loss point of -$100 before brokerage.

Both puts expired worthless. I lost $220 on the bought $35 put and kept the $381 premium on the $40 put.

The $40 call closed $8.22. Sold it for $6.1 so a loss of $212. While the $45 call closed $3.22. Bought for $3.71 so a loss of $49.

Here are the trades;

| Symbol | Position | Price | Close | P&L |

|---|---|---|---|---|

| KYTH Short Butterfly | ||||

| KYTH Mar20 $35 Put | 1 | 2.2 | 0 | -220 |

| KYTH Mar20 $40 Put | -1 | 3.81 | 0 | 381 |

| KYTH Mar20 $40 Call | -1 | 6.1 | 8.22 | -212 |

| KYTH Mar20 $45 Call | 1 | 3.71 | 3.22 | -49 |

| Total | -4 | -5 | -100 |

There are zero comments

Add a Comment