2 Wins, 3 Losses, +$1,084

September 16th, 2016 Option Expiration

I closed out 5 positions on Friday; only 2 winners from this batch. However, total P&L was up $1,084. A nice gain in LOW; turned $150 into $1,500!

| Trade | Open | Days | P&L |

|---|---|---|---|

| DB Long Put | 11-Aug-16 | 36 | -150 |

| LOW Long Put | 11-Aug-16 | 36 | 1050 |

| FIT Long Call | 11-Aug-16 | 36 | -126 |

| GT Long Call | 18-Aug-16 | 29 | 450 |

| NUAN Long Put | 18-Aug-16 | 29 | -140 |

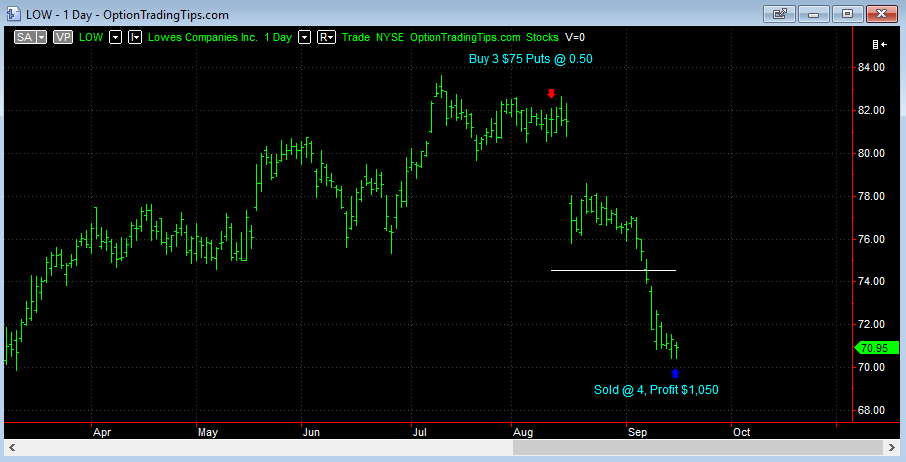

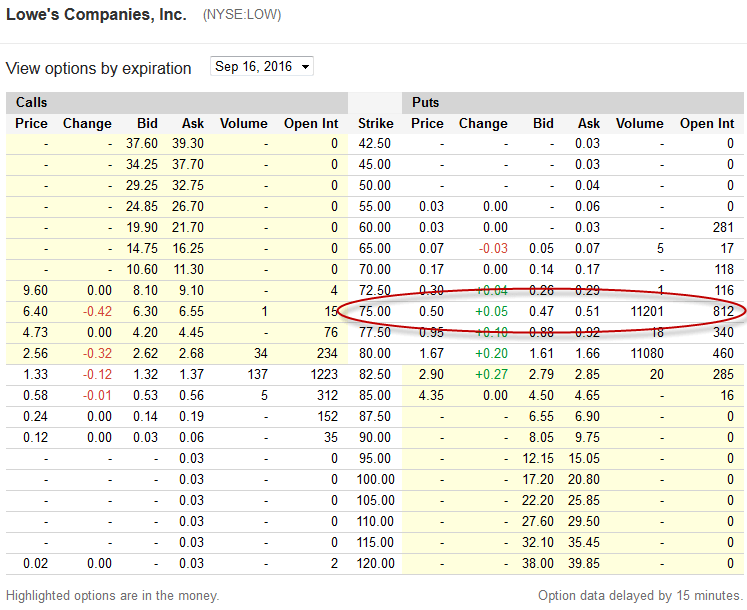

LOW Long 3 Sep16 $75 Puts

| Stock | LOW |

|---|---|

| Position | Long Puts |

| Trade Length | 36 Days |

| Capital | $150.00 |

| P&L | $1050.00 |

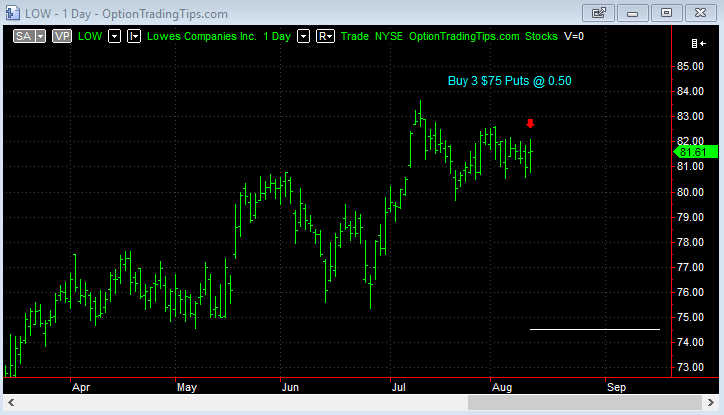

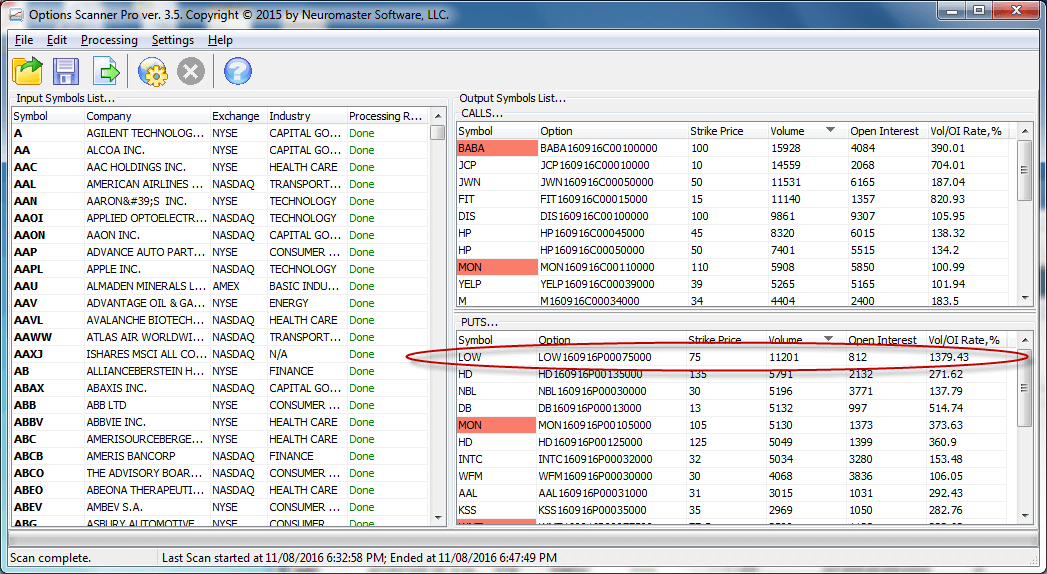

Trade Open: 11th August

LOW was top of the volume list from the Option Scanner with 11,201 going through the $75 put options. Existing option interest of only 812. If you take a look at the screen grab of the options below you'll see that the $80 put also showed significant interest; trading 11,080 over 460. Not much else trading in the other strikes and they have an earnings announcement out on the 17th August.

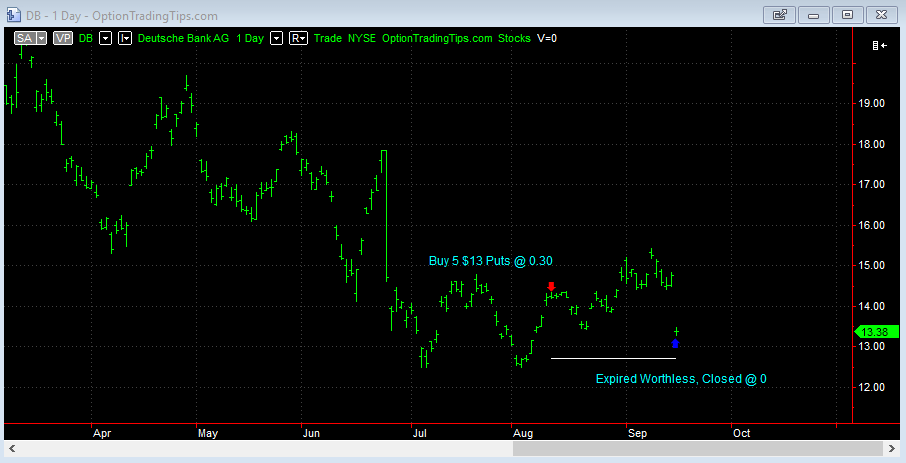

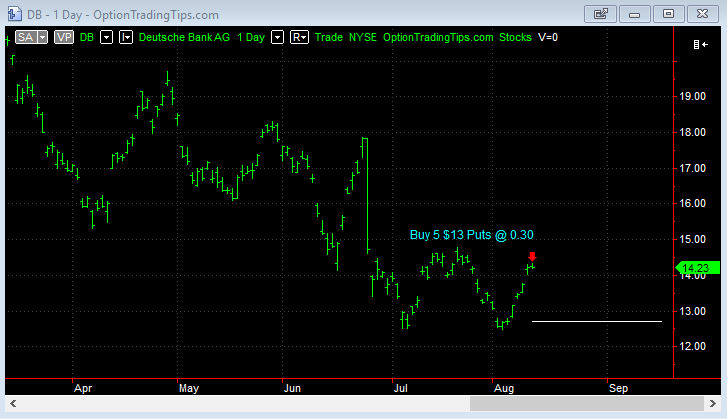

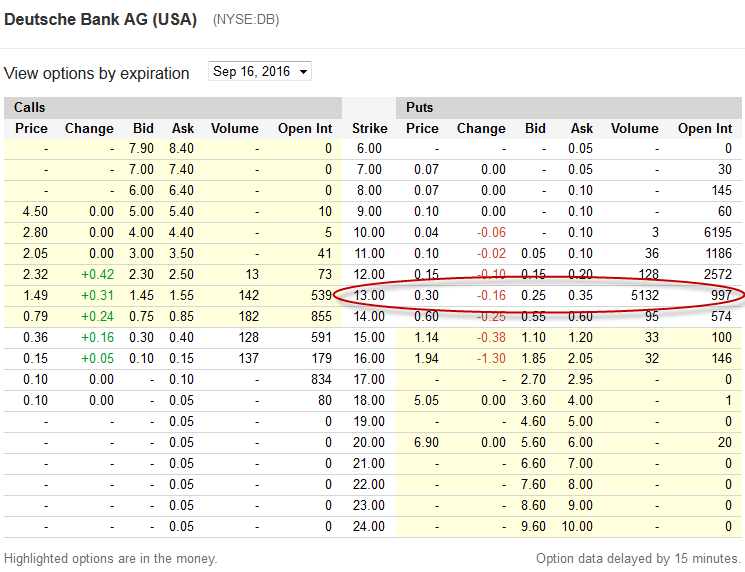

DB Long 5 $13 Sep19 Puts

| Stock | DB |

|---|---|

| Position | Long Puts |

| Trade Length | 36 Days |

| Capital | $150.00 |

| P&L | -$150.00 |

Trade Open: 11th August

Not that convinced about this one but I took it anyway. 5k in $13 puts traded over 900 in open interest. Not all that convincing in terms of volume but there is some decent interest in the puts generally. Plus, I like the look of the chart in terms of the stock making a retracement to the downside.

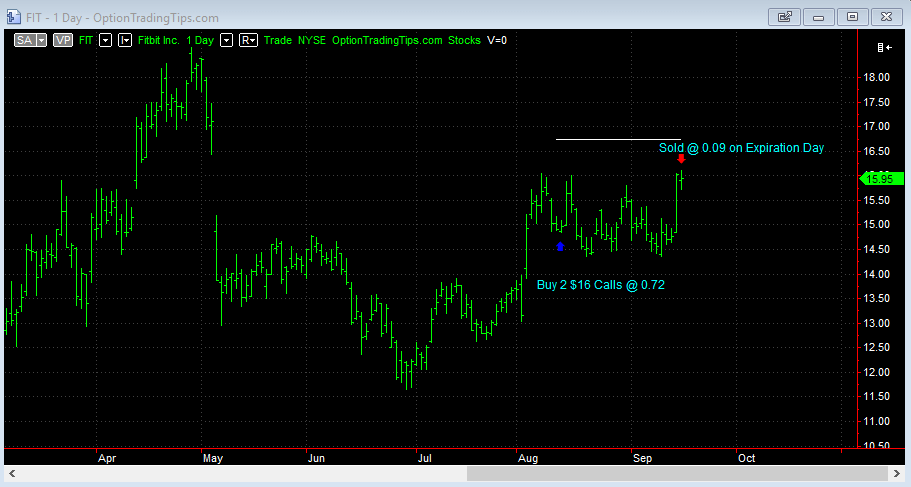

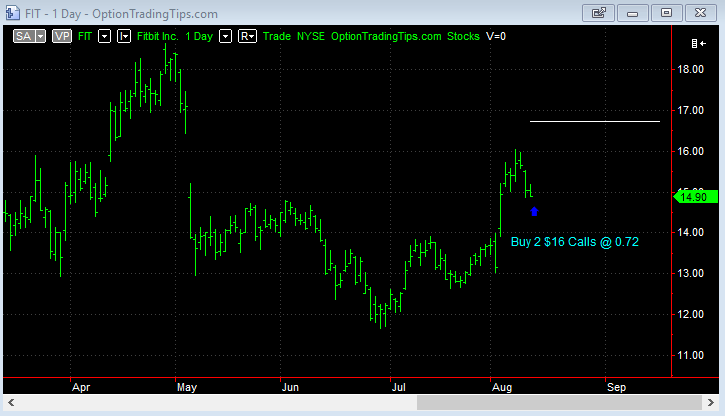

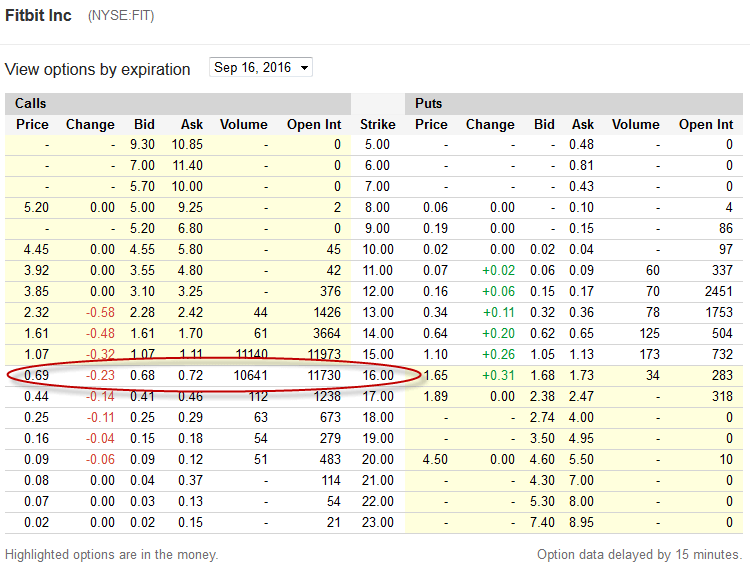

FIT Long 2 Sep19 $16 Calls

| Stock | FIT |

|---|---|

| Position | Long Calls |

| Trade Length | 36 Days |

| Capital | $144.00 |

| P&L | -$126.00 |

Trade Open: 11th August

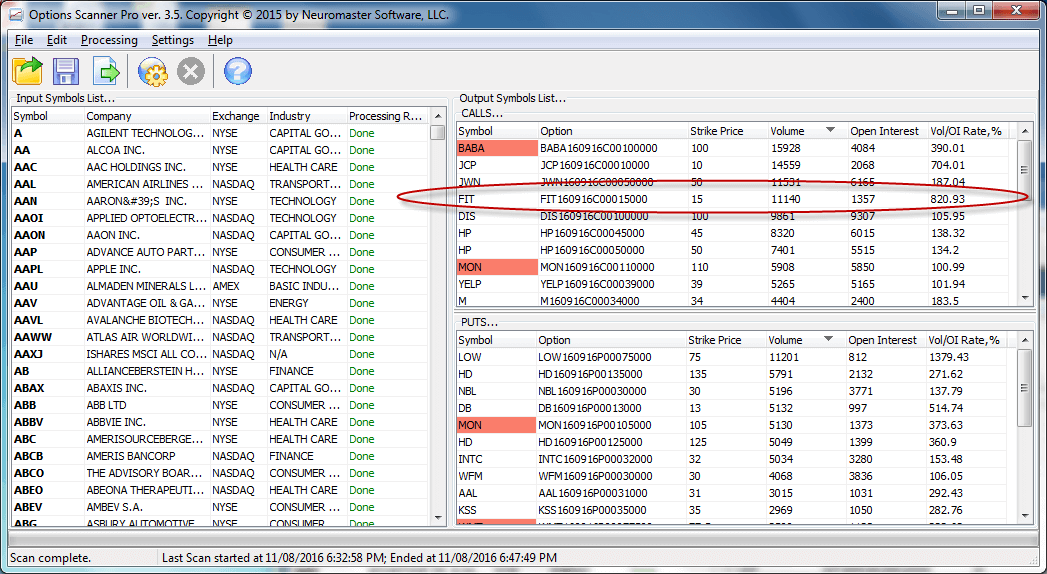

Heavy volumes going through both the $15 and $16 call options. Almost double the existing open interest on those strikes and thin volumes on the put side.

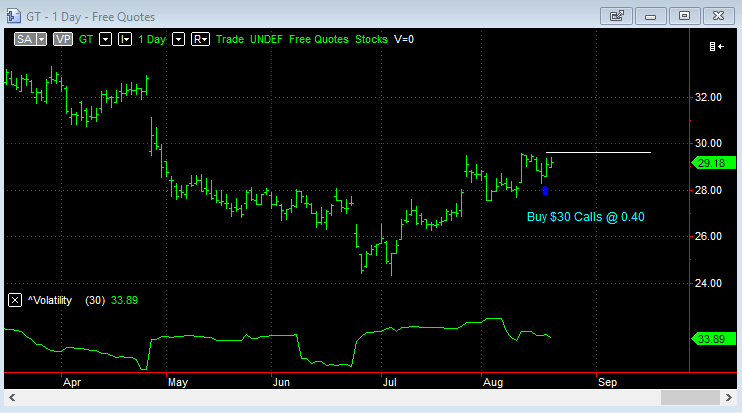

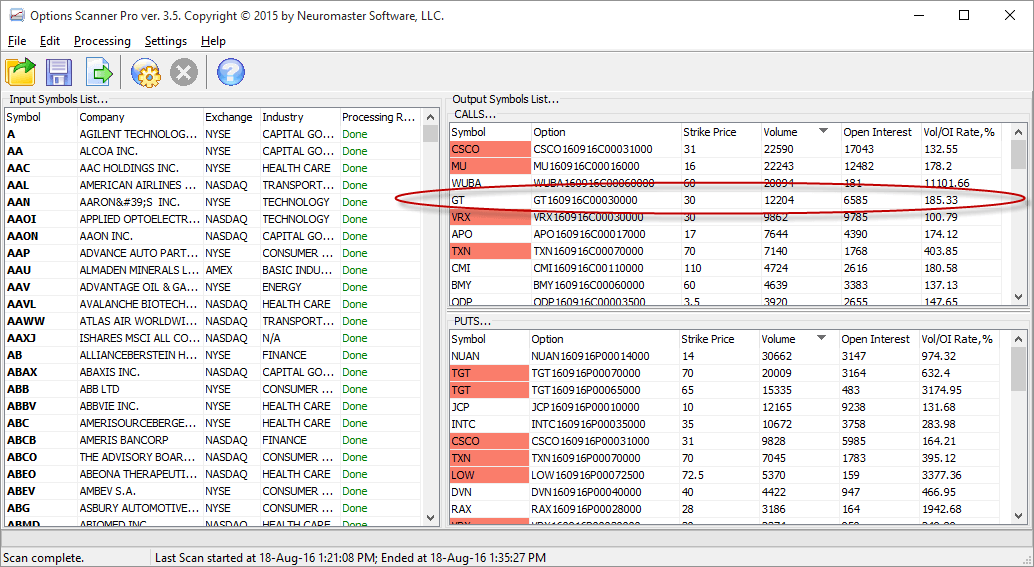

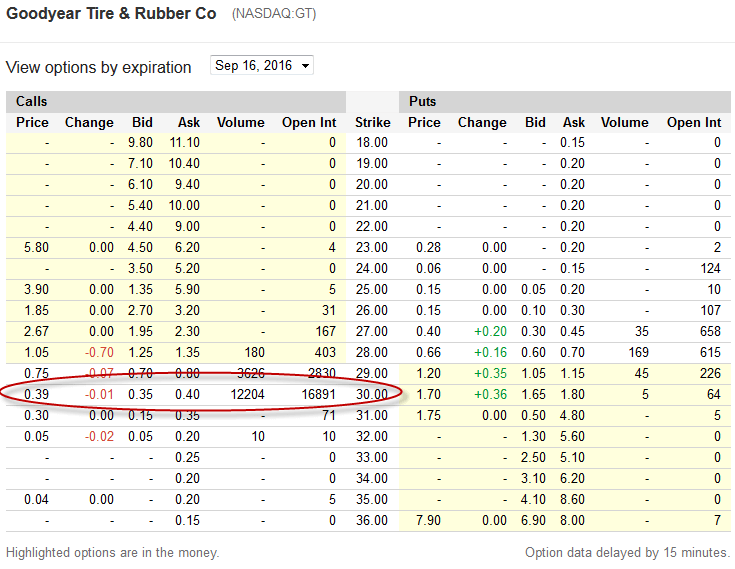

GT Long 3 $30 Calls

| Stock | GT |

|---|---|

| Position | Long Calls |

| Trade Length | 29 Days |

| Capital | $120.00 |

| P&L | $450.00 |

Trade Open: 18th August

12k over 17k for the $30 calls on Goodyear Tire and Rubber stock. Almost no action at all in the puts. Volatility is moderate and short term trend is up. Happy to be long this stock with some calls.

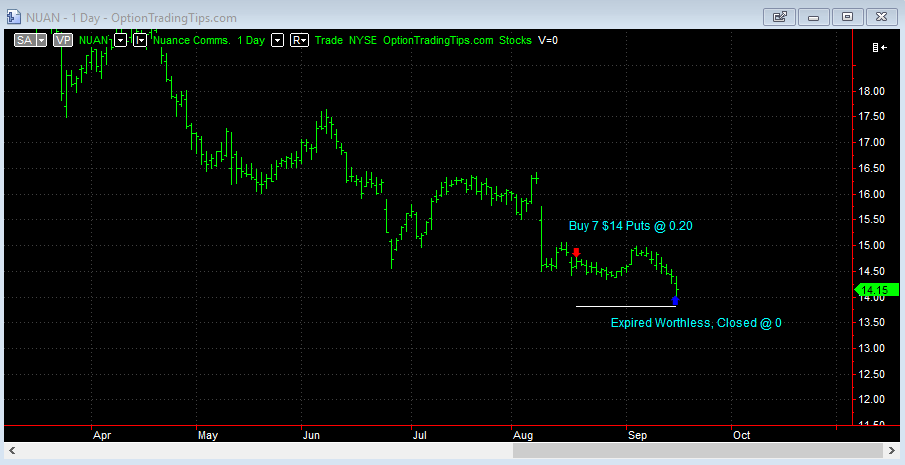

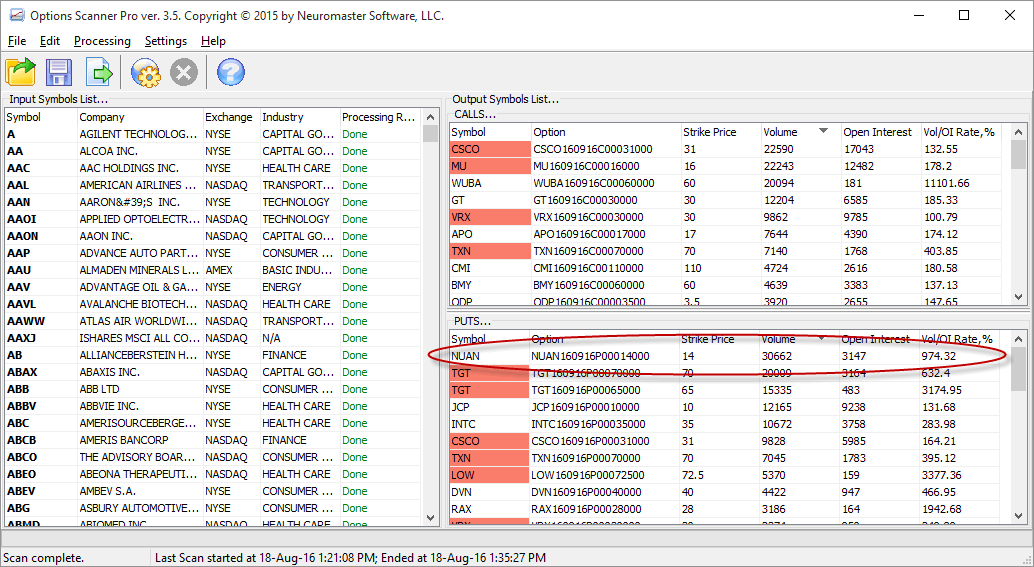

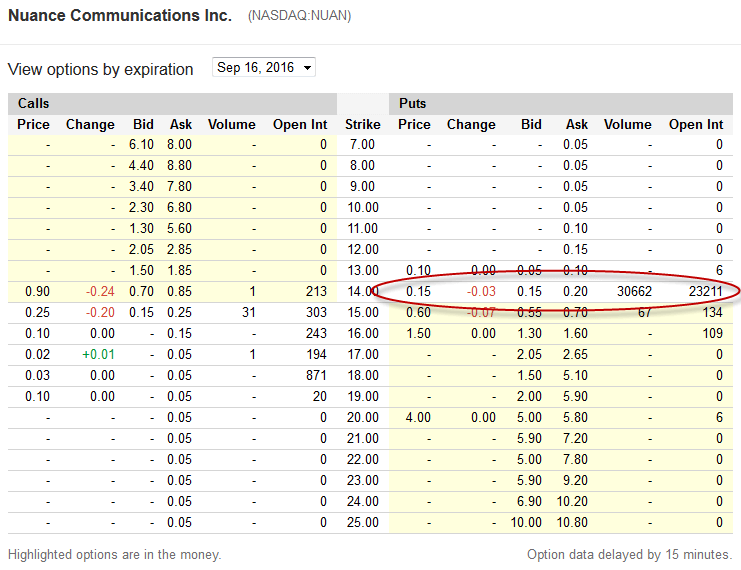

NUAN Long 7 $14 Puts

| Stock | NUAN |

|---|---|

| Position | Long Puts |

| Trade Length | 29 Days |

| Capital | $140.00 |

| P&L | -$140.00 |

Trade Open: 18th August

Strong downtrend with NUAN with 30k in $14 puts trading over 23k in open interest. On the call side for the September option series there is currently only 1.6k in open interest. Happy to be short this one.

There are zero comments

Add a Comment