Long Butterfly - BBRY

24th March, 2015

I've been having a pretty bad run of trades - especially that short put trade on WTW that cost me $500! The short option strategies on high vol stocks before earnings have not played out that well lately. So this trade I'm going for a long strategy on a stock that I think is a bit controversial a few days out of earnings annoucement.

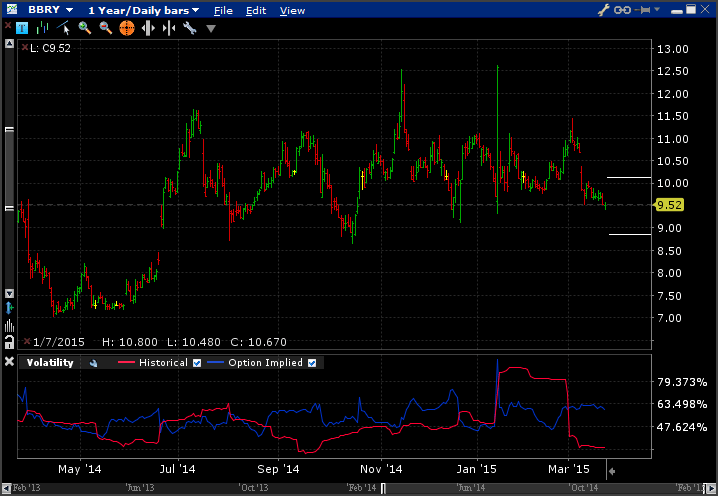

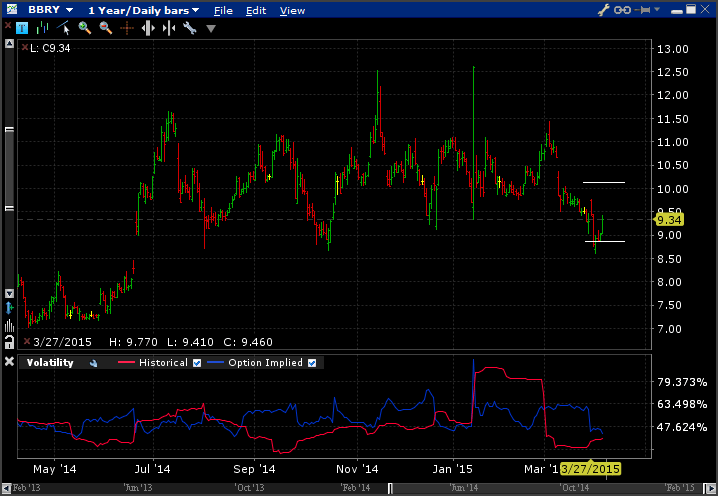

BBRY's implied volatility is relatively low (relative to recent historical levels)and lower than IV's for other stocks that I've shorted lately. Plus, historical vol is much lower than the IV. Of course, IV represents the markets view of expected movements so another way of looking at the low vol is to presume that the market has already priced in fairly low move post earnings. But I will take a chance on a substantial move regardless.

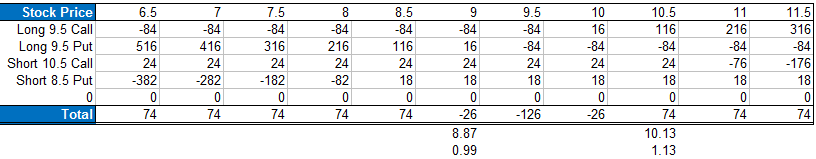

I have priced up a long butterfly by buying the $9.50 straddle and selling the $10.50/$8.50 strangle. Total premium paid was $63. The payoff looks like this;

Breakeven points for this are $8.87 on the downside and $10.13 on the upside. Here's the chart with those levels;

Earnings are out this Friday at 8am. Looking at the sentiment indicators and recent reports from analysts there seems to be viewpoints on either direction, although I'd say the majority of the mood indicates a downward trend.

There's only 3 days left in this trade though - so I'd need the move to be substantial.

Market Close March 24

This is how the trade looks at the close of business after being filled.

| Symbol | Position | Price | Close | P&L |

|---|---|---|---|---|

| BBRY Long Butterfly | ||||

| BBRY Mar27 $8.5 Put | -2 | 0.074 | 0.085 | -2.2 |

| BBRY Mar27 $9.5 Put | 2 | 0.418 | 0.395 | -4.6 |

| BBRY Mar27 $9.5 Call | 2 | 0.438 | 0.415 | -4.6 |

| BBRY Mar27 $10.5 Call | -2 | 0.122 | 0.11 | 2.4 |

| Total | 1.32 | 1.23 | -9 |

Currently down $9.

Market Close March 25

US markets sold off on weak economic data - the S&P 500 down -1.5%.

Position up slightly from yesterday -$4.

| Symbol | Position | Price | Close | P&L |

|---|---|---|---|---|

| BBRY Long Butterfly | ||||

| BBRY Mar27 $8.5 Put | -2 | 0.074 | 0.115 | -8.2 |

| BBRY Mar27 $9.5 Put | 2 | 0.418 | 0.535 | 23.4 |

| BBRY Mar27 $9.5 Call | 2 | 0.438 | 0.33 | -21.6 |

| BBRY Mar27 $10.5 Call | -2 | 0.122 | 0.11 | 2.4 |

| Total | 1.32 | 1.28 | -4 | |

| Grand Total | -4 |

26th March, 2015

After a soft openning, BBRY made some small gains during Thursday's session to end the day up slightly, closing out at $9.30 (+0.22). The butterfly has lost a little value from yesterday, showing an unrealised loss of -$6.

27th March, 2015

After some tame earnings numbers, BBRY closed out the week at $9.46. Dissapointing. I was obviously hoping for a huge surprise here.

Anyway, I was long the $9.50 put, which puts the option ITM. I was up watching before the close and entered an offsetting sell order to close out the option, which was bid at 0.06 but the order didn't go through as the market had just closed before it hit. So, I was auto-exercised on the put and I'm not short 200 shares at $9.50.

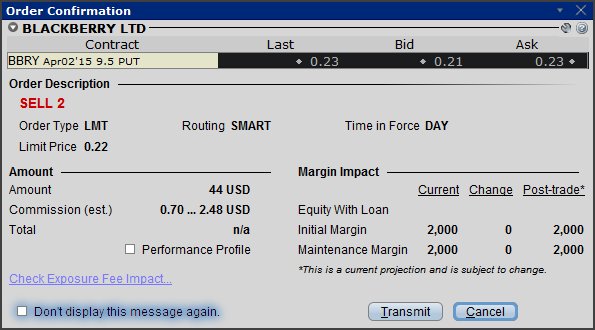

I decided to sell the $9.50 puts to offset the short stock.

However, I have to watch the upside here in case the stock rallies past $9.72 (strike + short put premium).

30th March, 2015

I was filled selling 2 puts at 0.22, net premium received $44.

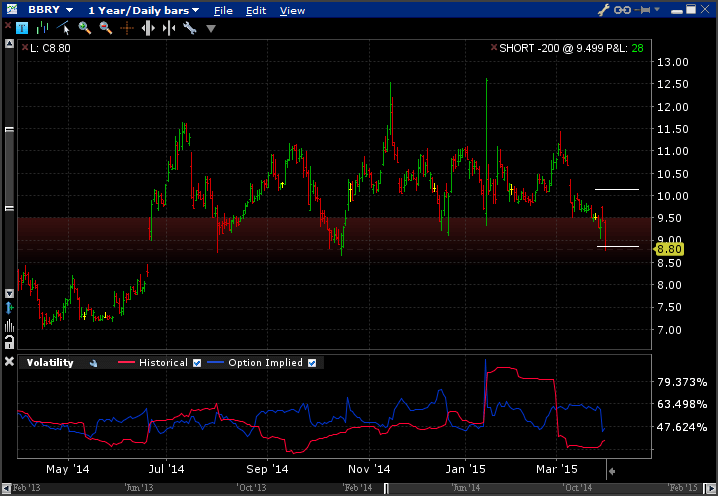

However, check out the stock now - down 6.98% to 8.80!

Below the breakeven point of the spread that expired Friday. Apparently an analyst wrote a bearish report on the BBRY.

So now I am short 200 shares at $9.50 but also short 2 $9.50 puts.

2nd April, 2015

BBRY ended the week at $9.34 so my short puts are ITM. I was auto-assigned the stock, which means buying the shares at $9.50. This trade closed out my short position so I am all done on this trade.

PeterJune 4th, 2015 at 8:55pm

Thanks David! No, I got distracted early April with work and lost my momentum with trading. I think I'll get back into some trades next week though even though the losses are putting a dent in my motivation ;-)

Regarding the Volatility spreadsheet - are you trying to zip file or the xls link? Try this raw link;

https://www.optiontradingtips.com/resources/historical-volatility.xls

DavidJune 4th, 2015 at 5:52pm

I like your trade commentary and TWS charting..do you have any recent trades?

I tried to download the Historical Volatility.xls file but doesn't seem to work?

Don't think it is needed with access to TWS.

Thx

Add a Comment