Iron Condor (SPY)

Start: March 2nd,2016

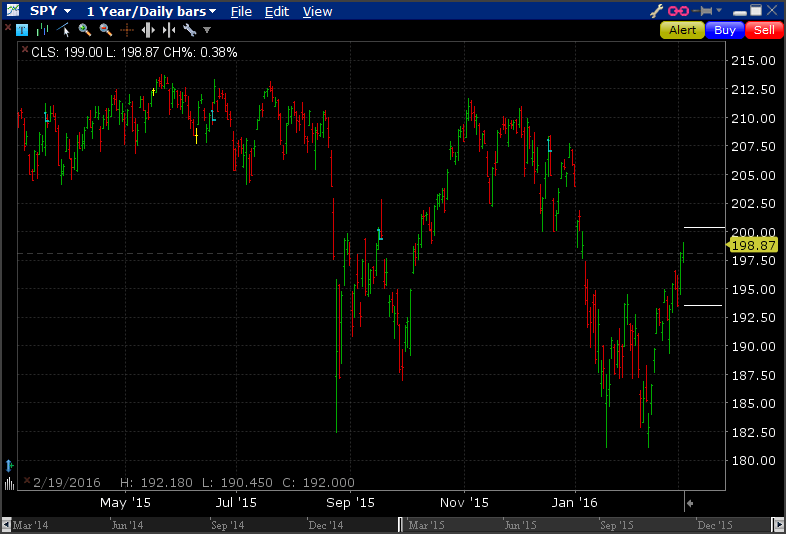

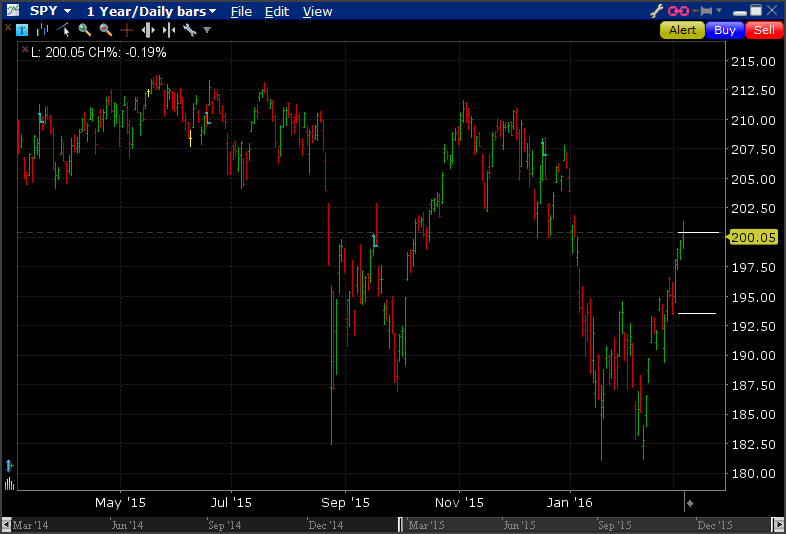

I placed an Iron Condor on the SPY ETF on the close today, betting that the market will be slightly bearish and trade in a narrow range until expiration. Expiry is this Friday, so two days of trading activity.

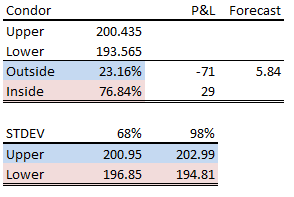

Using my probability estimator, I have a 76.85% chance of a win:

Closed Position: March 4th

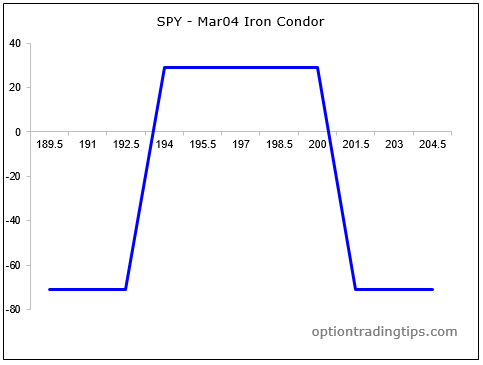

Just missed out on this one. I ended up closing out the SPY position an hour before market close at a small loss of $22. The max loss was $71 and max profit $29. However, the ETF was looking like closing between the two call strikes. If allowed to expire, then I would have ended up being assigned short stock on the short call with the long call expiring worthless. I didn't want to take on a short position so needed to exit prior ro expiry. Too bad it was so close, just missed out there. Here is the final chart:

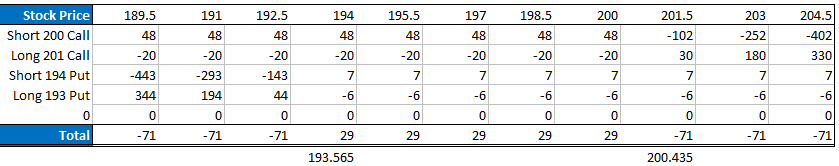

| SPY Mar04 Iron Condor (comms $4.32) | ||||

| SPY Mar04 200 Call | -1 | 0.48 | 0.58 | -10 |

| SPY Mar04 201 Call | 1 | 0.2 | 0.07 | -13 |

| SPY Mar04 193 Put | 1 | 0.06 | 0 | -6 |

| SPY Mar04 194 Put | -1 | 0.07 | 0 | 7 |

| Total | -0.29 | -0.51 | -22 |

PeterMarch 20th, 2017 at 6:04pm

Hi Xi, not this trade - this one I have closed out as a loss. I haven't taken any new trades in a few months now, but will do soon and update. Are you trading options - what are your favorite strategies?

Xi HongMarch 19th, 2017 at 10:39pm

Hi, are you still using iron condor?

Add a Comment