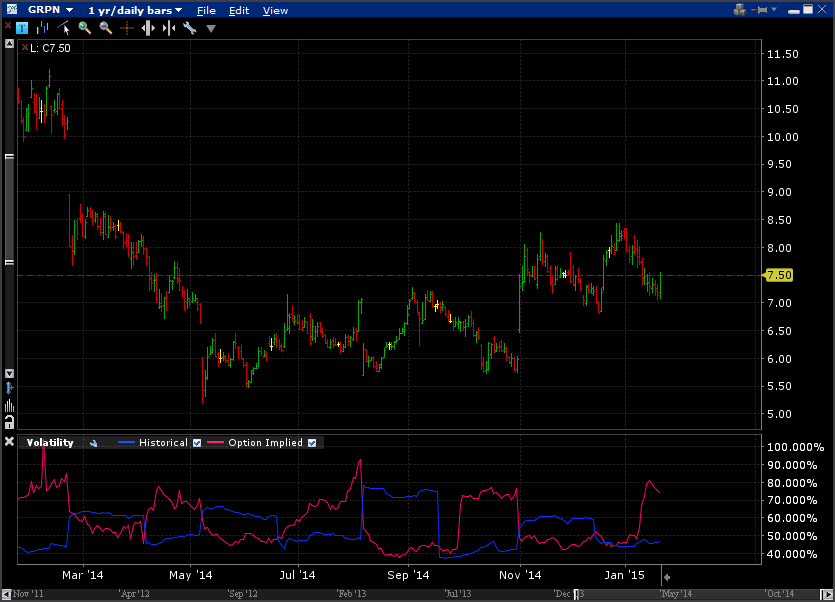

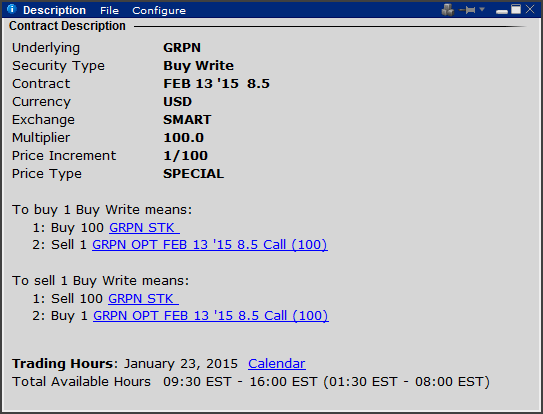

Buy-Write Trade - Groupon (GRPN)

23rd January, 2015

Top of the Short Call Ideas list;

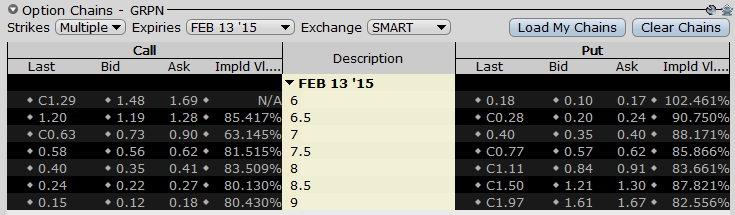

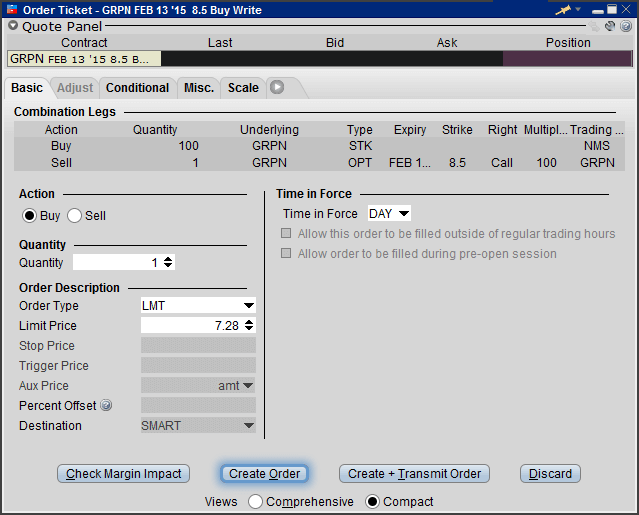

GRPN $8.50 calls with 23 days left to go showing a 2.93% return. Earnings out on Feb 12th.

26th January

Already don't like this trade! After selling the call and buying the stock, the stock has dropped a little...the stock leg is down $17 while the option market value remains flat.

28th January

After 3 consecutive down days in the stock, I'm not feeling good about this trade, so I placed a sell stop order at $6.94, which was filled during today's trading. Now, I only have the short call option position.

13th February

Well, seems I should have sold the stock early as the market recovered from that dip to finish the period off at $7.97.

The $8.50 call expired worthless so I keep 100% of the $16 premium there, however, realized a loss of $52 on the stock leg by selling early. Total loss for the trade being $36.

If I had held onto the stock and exited on expiration day I would have made $67 instead ($51 on the stock leg and $16 on the short call).

There are zero comments

Add a Comment