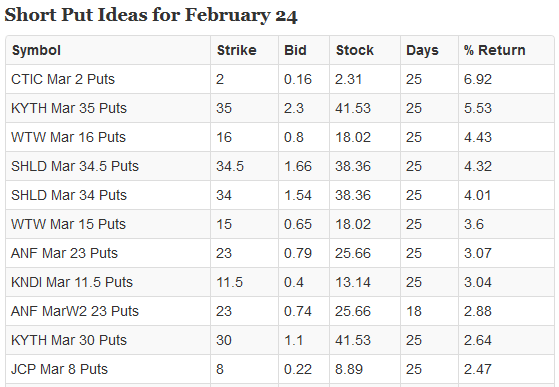

Double Calendar (JCP)

25th February, 2015

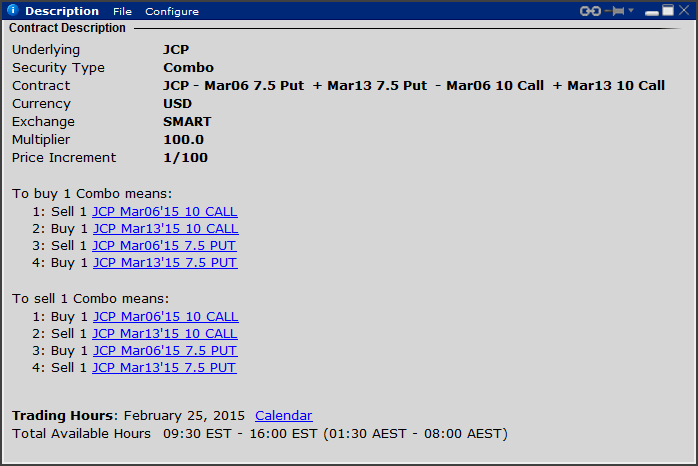

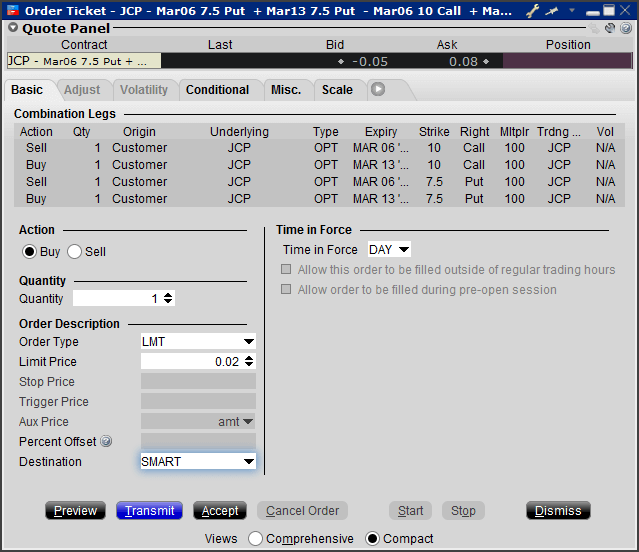

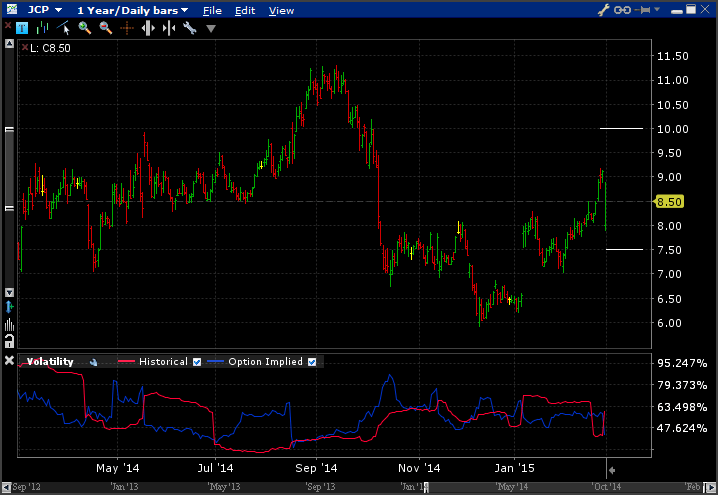

Earnings for JCP are out at 4pm tomorrow so the stock has seen a jump in implied volatilies. I thought about shorting the puts to go long at $8 but checked out the price on a double calendar. The midpoints for the calls and puts for March 6th to March 13th were flat - meaning I could sell the front month options for the same price as buying the back months.

Seems a good trade to me - if the front month options expire worthless the back month straddle will surely have some value. And if the market goes hard in either direction my max loss would be flat it seems.

I was thinking I might be able to do a few of these if I could get set at square, however, when I checked my order confirmation screen I remembered - brokerage! Depending on where my orders get filled I could be paying $8 per spread. So, I thought I'd not go crazy and place it small and just see how it plays out to give me some experience with some more small trades.

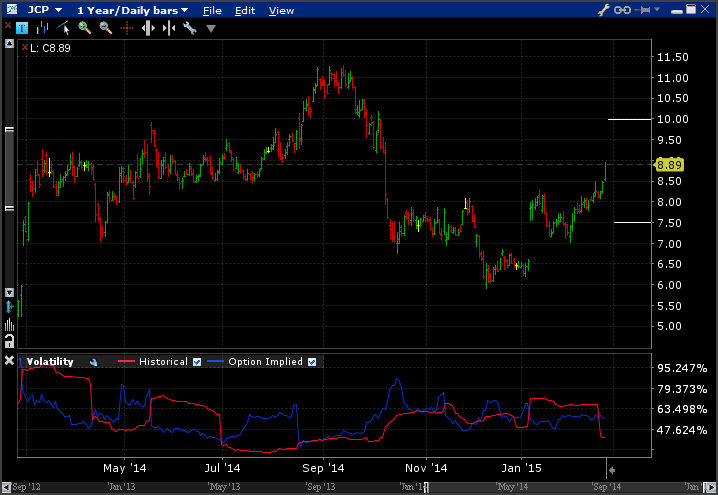

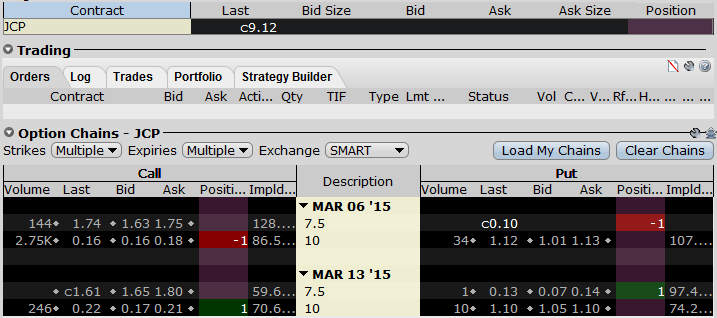

Here's the chart from the close of 24th;

Approximate breakeven points shown.

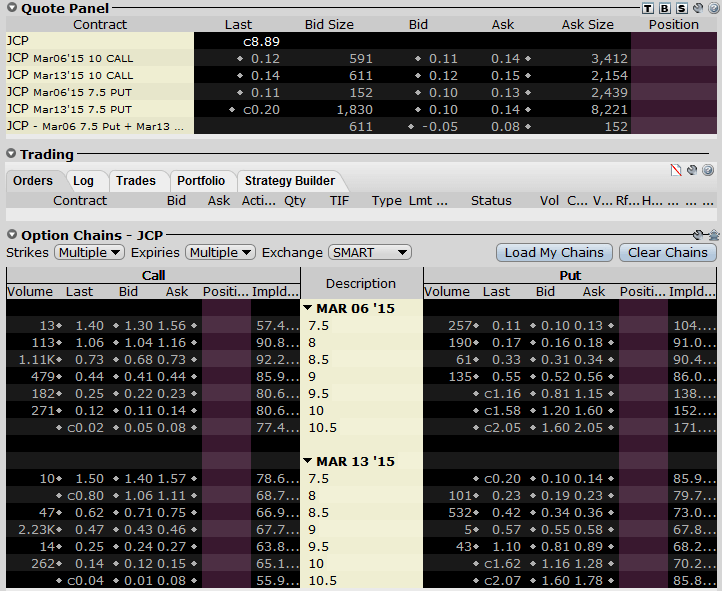

Here's the option chain with the legs and combo prices;

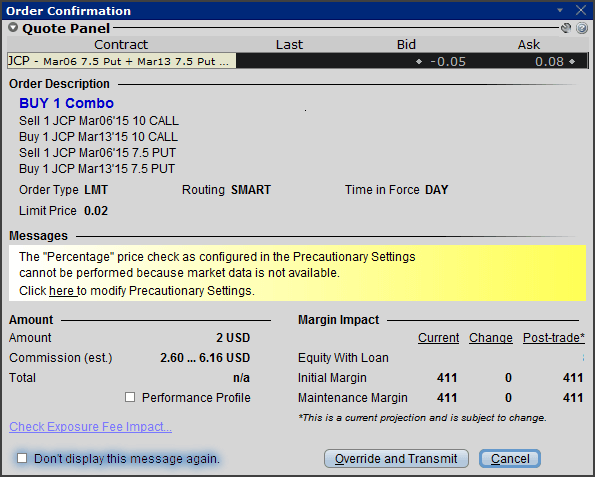

When I checked my order about an hour before the market closed, it wasn't filled and the combination was offered at 0.06, so I upped my order price to 0.03 and was immediately filled.

Update, Market Close 26th Feb

JCP's earnings were out after the market close - the day session had the shares up 1.45% at $9.12, however, shares are down 11.18% in after hours trading, currently at $8.10.

Sales are up but operating expenses also up so their report summary is they have broke even for the quarter. Here are the reports;

J.C. Penny Shares Tumble [Yahoo link removed]

Increased Sales Lower Expenses Pushes J.C. Penny

Even though the stock is trading at $8.10 in after hours trading, it is still above the lower strike for the spread - so I think this trade is still looking good.

Unrealized P&L is up $3.

Update, Market Close Feb 27th

After a soft opening due to the news on their earnings, the shares finished up from the open to close at $8.50.

The price is just off the middle of the breakeven points, which is good, however, I still have to exit the back month options as the front's expire. Expiration is this Friday so I'll wait a little bit and see how the week plays out.

There are zero comments

Add a Comment