Short Call Butterfly

A Short Call Butterfly is long two ATM call options, short one ITM call option and short one OTM call option.

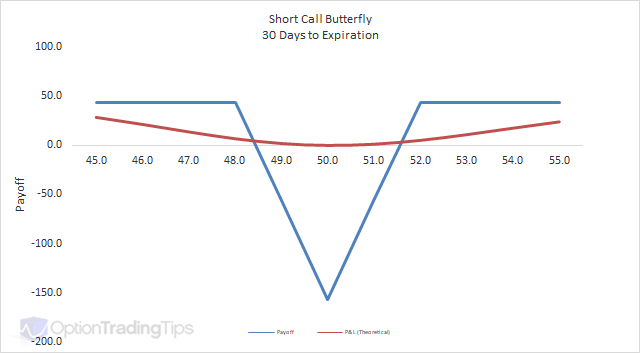

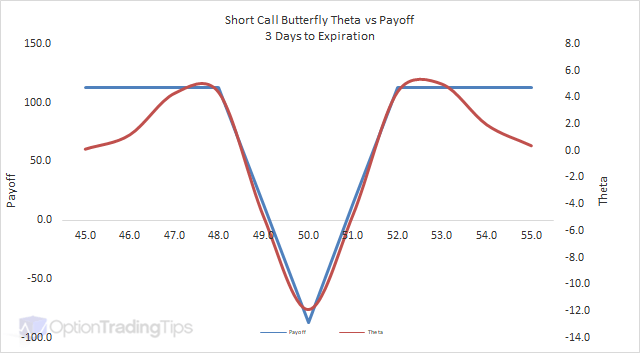

The Max Loss is limited to the net difference between the ATM strike less the ITM strike less the premium received for the position.

The Max Gain is limited to the net premium received for the option spread.

PeterFebruary 14th, 2012 at 4:49pm

Hi Azad,

Not with a short butterfly. If you are bearish and want some upside protection then I suggest you take a look at a Put Backspread.

AzadFebruary 14th, 2012 at 10:27am

Hi Peter,

Is their any unlimited potential of profit in this strategy. I am bearish on Indian market which is the best strategy I used with protection.

PeterJuly 28th, 2011 at 6:23pm

For American options on stocks yes, especially as the stock approaches its ex-dividend date. Long call option holders may exercise for stock so they can receive the dividend.

shaivalJuly 28th, 2011 at 4:20pm

Is there any risk of getting option assigned?

Add a Comment