Short Call Options aka Naked Call

A short call is simply the sale of one call option. Many refer to short positions as being "naked" the option. Selling options is also known as "writing" an option.

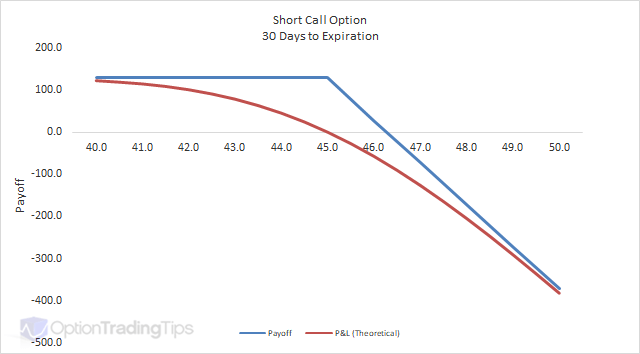

The Max Loss is unlimited as the market rises.

The Max Gain is limited to the premium received for selling the option.

PeterSeptember 28th, 2016 at 6:39pm

Hi DG,

What is your view of the stock? If you are neutral to bearish on the stock and now have a short stock position you could consider selling put options against it. This would also depend on the volatility and therefore the premium to be received if selling the puts.

You also mention "spread"...was there another leg to this trade? I.e. are you still long some options?

DGSeptember 28th, 2016 at 1:55pm

My option spread was assigned. I am now short, what is the next best move? I know I need to buy to call but at what price? Higher or lower than the price I was assigned? What will be my loss?

PeterApril 24th, 2016 at 6:50pm

Nice one! Let us know how it goes.

Just curious...is it a shorter term expiry that you're selling? And if it expires worthless, will you roll it again etc?

PekyApril 24th, 2016 at 12:34pm

Hi Peter,

Thanks for your reply.

Yes, that's correct. I have a long term option in the money and want to squeeze some extra cash. :-)

Thanks

PeterApril 23rd, 2016 at 10:17pm

Hi Peky,

Yep, you can do that. I take it your long position is making a profit and instead of selling back your existing call you are going to collect some premium from the short sold strike?

PekyApril 23rd, 2016 at 12:33pm

Hi,

I have a long call open trade and I'm wondering should I be able to sell a call option on a higher strike price and same expiry so that I turn my long call option into a long call spread?

To clarify, I have level 4 for trading options in my trading account, which allows me to write naked options within my margin limit.

Thanks

PeterMarch 29th, 2016 at 9:18pm

Hi Omkar,

You can hold any position of an option, long or short, until the expiration. If you are short, however, and the option is in-the-money then you will have the position exercised.

If the option is held over a deliverable asset, such as a stock, then you will be assigned a short position in the stock contract.

If the contract is held on an index, such as the NIFTY, it is likely that the contract is cash settled and you will be traded out of the position for a cash profit/loss.

Does this answer your question?

omkarMarch 29th, 2016 at 1:13pm

Hi, can anyone tell me, am I able to keep a short sell call till the expiry of contract? I seen in NSE open price is high at the start of day of contract. And price is low at the time of expiry of contract.

PeterFebruary 12th, 2015 at 6:04pm

Hi FM,

A synthetic short call can be constructed by a short stock and short put option.

You can work out other synthetic relationships using the Put Call Parity theorem.

FMFebruary 12th, 2015 at 2:10pm

how can you get a short call from 2 options, e.g synthetically made ?

PeterNovember 11th, 2014 at 6:44pm

Hi Pavan,

When you sell an option, you receive the premium straight away. In your case, you will receive INR 10 on the day you entered the position. Your P&L will be still be based on your sold price of 10 but your cash flows in your account will be the different to what you would experience if you bought the option.

I.e. if the market for the option drops to 8 then you have made a profit for the day of 2. However, you don't "receive" any more funds in your account as the maximum you can profit from your sold position is 10.

But, if the market in the option increased to 12 then 2 would be taken out of your account as a daily market-to-market loss.

Now, if you hold the option until the expiration date and the option isn't exercised early (i.e. a European option) then you will keep the entire INR 10 provided the underlying settles below the strike price.

However, if the underlying settles above the strike then your loss will be the difference between the underlying price and the strike price less the INR 10 premium already received.

I assume you're talking about the NIFTY index? I believe the options are cash settled, so no delivery once exercised?

pavan kumarNovember 10th, 2014 at 9:00pm

Hi everyone,

Am short selling the "call" option on Monday of the last week of expiry at 10 as premium. On Tuesday "call" option will go down to 8 then my profit is 2. But my question what if I hold till the expiry ?

What if I do not cover that 'short call' even after the expiry ?

Will I earn that 10 after expiry???

PS : Currency is in INR. And Thursday is the last day of expiry in indian market.

PeterOctober 6th, 2014 at 5:34pm

Hi Clara,

No. An option's "moneyness" isn't dependent on the position each trader has in it.

A call option is always in-the-money when the spot price is higher than the strike price and a put option is always in-the-money when the spot price is lower than the strike price.

ClaraOctober 6th, 2014 at 12:57pm

In a short call, if spot price higher than the strike price, then the option is out of the money? And, if spot price lower than the strike price, then the option is in the money? Thanks.

PeterJune 2nd, 2014 at 12:16am

Hi Mariel,

Yep, you can indeed close out the option position by entering a buy order on the same contract for the same volume as you are short. Another participant will now either be short the option or be closing out a prior long position.

MarielMay 31st, 2014 at 4:43pm

Peter, thank you for all your hard work on this site. It has helped me learn so much!

Can you answer a question that seems like it should be simple but I am afraid to try it without understanding?

If I sell a covered option at say $5 and two weeks later the option price is $3, can I simply buy the same option at $3 to from someone else to close my original contract?

I see patterns in the market because of volitility where I can pretty well pedict (I think) that the options price will drop.... In fact, the option price tends to drop as the expiry date approaches anyway. Since I don't really care about holding the stock, if it does go up great, I'll keep the $5 sale and hand over the stock. If the options price drops though, I would like to know how to close the contract I sold so I can sell the stock too and use the money somewhere else.

Any help would be amazing!

Thank you!

Mariel

PeterAugust 2nd, 2012 at 6:08am

Hi Nick,

Sorry for the delay in responding...seems I missed your comment!

If you're short a naked call option and making losses - that means that either the market has rallied or implied volatility has exploded.

Naked calls are tricky - if it were me and I were taking a substantial loss on a naked call option I would seriously evaluate my view on the stock.

If I had a strong view on the stock making a bearish run I would buy put options to hedge your position.

Or you could simply close out your naked call option by buying the same amount of call options.

Whatever you do - don't go and sell more calls ;-)

PeterAugust 2nd, 2012 at 5:55am

And many thanks Lee for the compliments on the site ;-)

PeterJuly 30th, 2012 at 5:21am

Hi Scott, I would buy back the calls - if you long the future then you will have downside risk. Although I suppose it depends how strong your view is.

ScottJuly 29th, 2012 at 6:52pm

Peter, if you currently have short calls and feel there is risk to the upside which is a better tactic? Buying back your short calls or buying long futures?

PeterJuly 26th, 2012 at 5:31am

Sell puts and collect the premium. If you get exercised you close out your short position.

wayneJuly 25th, 2012 at 9:11pm

how would you repair a losing short stock position?

LeeJuly 12th, 2012 at 1:49pm

Still half-lost, but had to stop and thank you for providing obviously sharp insight. Please remember that, for every one who actually writes, as many as a hundred appreciate what you do.

Warmest wishes for your success. Excellent site among soo00OOO000ooooo many visited.

NickJuly 11th, 2012 at 4:44am

Hi Peter,

Could you please guide me any simple strategy, how to hedge positions, incase you are making losses due to a short call?

PeterJuly 4th, 2012 at 1:10am

Hi Tpbuilder,

RUT is an index and RUT options are based on the RUT index. Because of this the options are European and holders of options cannot exercise prior to the expiration date so you don't have anything to worry about.

Sometimes, however, index options might actually be based on an index future (e.g. the SPI options in Australia). In these cases the options can be American style and allow for early exercise. You just have to check the contract specifications to be sure.

TpbuilderJuly 3rd, 2012 at 6:25pm

I have a vertical short call spread on RUT with July 12 expry. Both my short call and my long call are in the money as of today. I am worried about exercise and assignment. What would be the best action to take to manage the risk in this scenario. Inside short call is at 805. Outside long call is at 815. Market is at 818 as of today.

PeterApril 12th, 2012 at 10:28pm

Hi Shafiqa,

Not sure what you mean, sorry. Basically long = buy and short = sell.

You can send me an email through the contact form.

ShafiqaApril 12th, 2012 at 5:40am

can anyone explain in simple language whats differnce amonge

long call

short call

long put

short put

ps: how they transact actually, means long call buys short call?? is that

Peter i hope u will ans me. n plz give me ur email address if u can.

Regards

PeterApril 3rd, 2012 at 12:58am

Hi Ricky, what stock is this?

rickyApril 2nd, 2012 at 7:51pm

I sold a back April 5 put (in the money strike 10) but now I'm not sure what my options are. any suggestions would be greatly appreciated. thnx in advance.

PeterMarch 26th, 2012 at 8:00pm

Hi Ding,

Yep, long call and short put both need a bullish underlying to be profitable.

DingMarch 20th, 2012 at 11:35pm

Hi Peter,

Can I say, long call and short put are affected by the same direction of the market?

If not, what are the differences?

Thanks.

RustyMarch 1st, 2012 at 5:24pm

Great site, and Peter you are so responsive. I've got a question for you as I am learning more about option trading, particulary spread option strategies. When it comes to writing call and put options - how close is too close to the money at expiration?

Meaning, lets say I got an Iron Condor set up on the SPY with my short call option strike at 138, and the short put position at 135. I get that if I let the short options expire in the money, that could be a BIG problem and I could get assigned. BUT I've seen some people say that no matter what, close out of your short positions - even if the option is OTM - do you suggest this? That would eat into my credit that I got on the front end.

Say the SPY closes 2 cents from my short call at 138? Would that be too close to the money for your comfort? What if I'm 25 cents away, 50, a dollar - is that far enough to assure no assignment upon expiration?

Just curious to get your thoughts. People talk about how easy these strategies are IF the stock price stays away from your short position - but is there still REAL risk it could get assigned if you don't close your short position before expiration?

PeterFebruary 23rd, 2012 at 5:23pm

Hi Scott, if you mean "early exercise" (exercised before the expiration date) then no, not always. A call option holder may exercise early if there is a dividend due to be paid, that way s/he will take delivery of the stock, which mean s/he is entitled to receive the dividend. Holding a call option only doesn't entitle you to receive dividends.

If you mean at expiration (and the options are physically settled) then yes. Upon expiration, all physically settled call options are automatically assigned into stock positions by the option clearer (usually your broker).

ScottFebruary 23rd, 2012 at 12:09pm

If I write a covered call, and the position is in-the-money, will it always be exercised?

PeterJanuary 15th, 2012 at 5:38pm

The bid/ask prices seen in the market are usually the result of market makers who will quote options based off a theoretical pricing model such as the black scholes model or the binomial model.

When you can place orders depends on the exchange: some exchanges have a pre-market where you can enter orders before matching begins. However, I prefer to only place orders during market hours.

SKBJanuary 14th, 2012 at 9:04am

First Question: How the price of an option (call or put) fixed? Is there any calculation?

Second Question: We should buy or sell an option in market hours only or after or before market time?

PeterJanuary 12th, 2012 at 4:28pm

Hi Al Moura, yep, you can just buy the same amount of options that you are short from the market to square off your position.

Al MouraJanuary 12th, 2012 at 12:25pm

Is it possible to use an option call to offset a short stock position? The short call of my option spread was exercised and I became short stock.

I do not have the shares and I am wondering if I can purchase an option call to cover that short.

Thanks,

Al

PeterJanuary 9th, 2012 at 3:53pm

Not sure exactly what you mean by "net a zero change" but, yes, the stock will drop by the amount of the announced dividend after the stock goes ex-div.

If you exercise a call option after that date you will not receive the dividend but you will still be assigned a position in the stock at the strike.

SamJanuary 9th, 2012 at 8:10am

Hi Peter. Thanks for the response.

I would assume that once the Div has been announced, it would be reflected in the price, the price dropping by Div amount on ex-Div day. Buying and selling after ex-Div date would net a zero change.

Correct?

PeterJanuary 8th, 2012 at 10:25pm

Hi Sam,

I would say that as a "rule of thumb" that you should expect an in-the-money call option to be exercised right before the ex-dividend date of the stock. This will occur as the holder of option will exercise to take position of the stock so s/he will collect the dividend payment.

SamJanuary 7th, 2012 at 7:52pm

Hi. Any rule of thumb for when a short call will be exercised? e.g. I buy stock at 100 and sell a call 3 months out at 110. Two months later stock is at 120. Will the option be called? The call buyer's profit is 100%. ROI on add'l capital required is ~10%

Thanks.

PeterNovember 16th, 2011 at 7:47pm

Hi Mark, I've moved our recent conversation to the Short Put page.

PeterNovember 13th, 2011 at 6:43pm

No, you don't have to do anything...just allow the options to expire.

SamNovember 11th, 2011 at 7:30pm

I have under written covered call options that expire on Nov 18, 2011. I have gotten the premium for the sale. Since I did a 'sell open' to sell the options, do I do a 'buy close' to close this position or can I just let the options expire and keep the premium? Do I have to do something to keep the premium I have received?

PeterOctober 9th, 2011 at 9:18pm

It's because the stock has been experiencing a lot of volatility lately (currently around 70%), which has inflated the option premiums.

But yes, it's a great return for that time frame! The stock would have to trade down to $42 before you start losing on this trade.

TomOctober 9th, 2011 at 8:48am

Hello covered call investors. Why do you think that Prudential's (PRU) 11/19/11covered call option premium at the money yields nearly 8% for roughly a 1 1/2 month investment? The stock carries a baa2 Moody's rating and has a less than 5% outstanding shares short. Seems too good to be true. Thanks!

MikeSeptember 9th, 2011 at 11:28am

Thanks!!! Not going to be selling calls today though :~(

PeterSeptember 9th, 2011 at 8:24am

Yes, I would consider doing that. I own 200 MSFT right now and am considering doing the same. The problem I face though is that if the stock does rally hard I will get exercised and only make the profit at the strike, which is fine if that's all I think the stock is worth...problem is that I always kind of want the stock to keep going higher.

I don't think I will end up selling the calls though...I will probably hold onto the stock and let it ride a bit.

But sure, if you sell 2 calls you will lock in some profits and capture some premium too. Up to you though ;-)

MikeSeptember 9th, 2011 at 8:15am

If I own 200 shares of a stock and it is trading below $4.00 @ $3.50 and my exit point is @ $4.00 . Would it make sense to sell $4.00 calls to generate income?

Thanks,

Mike

PeterAugust 17th, 2011 at 6:51am

Mmmm...maybe. Your short call will offset the long stock so you've bought another call at a different strike to benefit if the stock rallies. If the stock falls, you can buy back the short call but you'll still have the gains in the long stock that you'll forgoe plus the premium lost with the call you've just purchased.

Maybe just closed them all out and start again with another stock ;-)

AnnieAugust 16th, 2011 at 8:41am

"What are the details of the trades? I.e. What was the price you paid for the stock and price you sold the call and what strike?"

Stock price paid: $145.11

Short call is presently a Jan12 145 as I rolled it up and out recently.

Two premiums were received: $9.05 the first time and $1.27 when I rolled it.

Since there is time to play with this option -- and if I BTO a long Jan12 call -- I've been a-thinkin' that the trade could win by (1) selling the stock at (or near) its peak and (2) BTC the short call when (if) the premium drops reasonably, and then (3) STC the long call when it drops to $.05 (or let it expire -- possibly rolling it back in if that would provide another credit.

Am I dreaming?

PeterAugust 16th, 2011 at 1:12am

Hi Annie,

You can buy a call at a different strike price but this won't really help your situation. If you want an option with a low premium then it is going to be out-of-the-money and therefore have a low delta. This means that as the market moves up the option value won't change as much as the value will change for your in-the-money option. So, net you are still going to lose more because of the short call.

The thing is, by selling a call on a stock that you already own you're effectively locking in to sell the stock at the strike price. Now that the stock has rallied there's not much you can do but bank the premium received to offset the loss made by the call price increase.

What are the details of the trades? I.e. What was the price you paid for the stock and price you sold the call and what strike?

AnnieAugust 15th, 2011 at 10:30pm

Hello. I just discovered this site and am hopeful that my concerns can be resolved by your thoughtful response(s). I have a long position on a stock that has risen $20 recently. Just before this rally, it was headed south, so I sold a call at a strike lower than my purchase price to gain some income. I'd like to sell the stock at this new high, but the short call is impeding that sale. The short call has risen to an astronomical figure, so I cannot buy it back but must await the stock price to cycle back down. If I wait for that to happen, I will have missed this opportunity to sell the stock at this high pricing. Question: Can I BTO a long call as a replacement for the stock? Does it matter how high a strike price I choose? I'd like to keep the premium I will pay for it low. Thank you! ! !

PeterAugust 13th, 2011 at 11:24pm

Hi OB,

The delta of an option is determined by using an option pricing model. You can see an example in my option spreadsheet. Some brokers include greek calculations in the platform that they provide their clients. If not provided then the traders themselves will need to source software if they want to see the greeks.

The section on option greeks will answer this question.

The greeks aren't factored into the option calculations: it is the other way around. The greeks are the output when using an option valuation model.

OBAugust 13th, 2011 at 10:31am

Hi,

I have a few questions which I'm confused by and need some detailed explanations on. Thx for your assistance

First question: How is the Delta of an option determined and who determines it. That is, how is a trader informed that the Delta of an option is say, 0.47.

Secondly: How do the 1st derivatives greeks affect/impact the valuation of the risk exposure from an options trade (call or put)

Thirdly: How are all the 1st derivatives greeks factored into an options valuations such that one gets an indication of what is needed to Hedge the options exposure (call or put)

PeterAugust 10th, 2011 at 5:30pm

Yes, you can buy the option back at a lower price to close out your short position. The difference between the price you bought and the price you sold the option is your profit/loss.

VIshalAugust 10th, 2011 at 11:16am

If I sell an OTM option at the start of new series and when the expiry is near, the value of option will automatically lowered due to time constraints (suppose call is now ITM). Now If I close my position by buying the ITM option, would I still get benefited?

PeterJuly 16th, 2011 at 7:32am

You will be short the stock at a price of $300 and then be showing an unrealized loss of $20 if the stock is trading at $320. You will, however, have the initial premium that you received when you sold the option to offset the loss on the stock.

ronnieJuly 15th, 2011 at 12:31pm

If I don't close my naked call and at expiration the stock closes $20 above the $300 strike price, when it gets assigned to me will I be short the shares at strike price after paying the $20 loss or will my account be debited $320 per contract share?

PeterJune 14th, 2011 at 11:13pm

Hi Eric, yep, short calls are very risky - especially on single stock options or commodity options where the potential for a large upside swings exist (takeovers etc).

Index options, however, are not prone to the same kind of upside price deviation so a short call strategy might be more appropriate for a speculator on index options.

Even though the payoff describes an unlimited loss profile, remember that you have the option to exit/adjust your position throughout the life of the trade. If you're short a call option and the market begins trading higher towards your short strike you can always exit the position with a small loss - you don't have to wait until the options' expiration and suffer a potential account breaker.

EricJune 14th, 2011 at 9:43pm

I was wondering why traders would ever short call when bearish rather than long put - it doesn't make sense to me conceptually about why a trader would put himself at unlimited market risk and limit his upside potential. Could you offer some insight on why speculators, not those who sell to hedge, would ever do that? Thanks.

kenFebruary 28th, 2011 at 4:31pm

I have a trader who has 2 accounts and he because of different strategies in the different accounts he wants to long a spy call in one account and short the same in another. i understand that you cant do it in one account because then you would be flat. I think the example would be acct#1- long 3 spy 50 calls acct#2 long 3 spy 40 calls and short 3 spy 50 calls. I feel as if its something that cannot be done but i am not 100% sure

PeterFebruary 12th, 2011 at 9:08pm

Mmm...hard to say. I read on the TradeKing site that it's approximately 17%, which was taken from the OCC annual report back in 2006. Not sure what today's figures are but I would guess somewhere in that vicinity. I'll email the OCC and let you know what I find out.

MIkeFebruary 11th, 2011 at 11:23am

How often would you say that in the money calls are exercised? In other words, If am short a call (but covered by a long call) and the underlying stock is trading moderately above the strike + any remaining premium, am I better off directly closing the spread by buying the short and selling the long or is it better to just wait for owner to exercise it. If I just close the spread, I am leaving money on the table but if I wait to late I may have trouble selling out of the long call at the last minute. What do you think?

PeterFebruary 4th, 2011 at 12:01am

If you buy the same call back then there is no risk as you have closed out the position.

TroyFebruary 3rd, 2011 at 10:12pm

If I short a call and then buy a call to cover is this position closed like stock would be or do I still have risk?

PeterJanuary 31st, 2011 at 10:47pm

Hi Paul,

1. No. The expiration day is the last day that an option buyer may choose to exercise his/her options into stock.

2. When you buy an option, money is deducted from your account immediately to pay for it. If you allow the option to expire ITM then the profits from the increase in value will be debited into your account.

3. If you sell options so that you have an open short position, yes, your broker will ensure you sufficient funds are in your account for the position. This is what's called margin. It won't be the full exposure of the resulting position if you're exercised against - it will be an amount based on the risk of underlying asset. Most brokers will adopt the SPAN Margin method or the like for this.

PaulJanuary 28th, 2011 at 7:51am

Thanks Peter.

A few more questions:

1. If I sell the option on the last day before it expires, can the option be exercised against me by the new buyer after the expiration date?

2. If an option is ITM and I let it expire, will the broker lodge the value of the option to my account? Will he include the profit it has made?

3. If I want to buy then sell options and not exercise them, will the broker insist that I have sufficient funds in my account to cover the potential exposure from a buyer exercising his rights? Is it possible to buy insurance rather than have the collateral in my account to protect myself against same?

PeterJanuary 24th, 2011 at 3:45pm

Hi Paul, yes, you can sell the option before the expiration date. Your profit/loss will be the difference between the purchase/sale price of the option. There is no risk of an early exercise as you are the option buyer.

PaulJanuary 24th, 2011 at 1:54pm

Question: If I buy an option and it reaches the strike price, can I sell it before the expiry date and if so would I be exposed to risk if the buyer used the option to exercise his rights.

PeterDecember 20th, 2010 at 3:45am

Hi Amanda, no, if you sell (go short) an option then you are the seller - i.e. you can't buy and go short at the same time, it's either one or the other.

AmandaDecember 20th, 2010 at 2:09am

Hi,

If a call option gives the buyer the right but not the obligation to BUY so can the buyer short (sell) a call?

PeterDecember 13th, 2010 at 5:31pm

Hi Nomadine, no, there aren't any option strategies that will automatically "recover" a loss - that would be like instant profit. Depending on your view, however, there is probably a strategy that you could implement to provide a more suitable way to play your view while providing a better risk/reward profile than just shorting the stock.

NomadineDecember 13th, 2010 at 11:10am

I have shorted a stock at 120 and it has now risen to 180 giving me a paper loss of 60 per share. Is there an options strategy to recover my loss?

PeterOctober 10th, 2010 at 12:24am

Hi Sonia, that combination is called a Long Strangle.

soniaOctober 9th, 2010 at 9:48pm

Hi I was just wondering why is that for a bull spread strategy you can only have a bull spread using Puts OR Calls. If you are bullish about a stock but are realistic. Why cant you buy a call when the stock is at $30.00 (long call) and buy put (long Put) at 50.00. Assuming you are only bullish enough to think that a stock is only going to go up $20.00.

P.S I am only a student therefore this question mind sound weird.

PeterSeptember 27th, 2010 at 10:21pm

It all comes down to your appetite for risk - how much money to make/lose. There is no optimum point to buy back the stock/option.

JJSeptember 27th, 2010 at 3:46am

Confused about duration. If I want to short a stock, a short call, at what point do you have to repurchase the stock? Are there choices?

DineshSeptember 22nd, 2010 at 8:17am

This is an excellent site. I never seen a site like this which provides indepth financial data about options. My humble Thanks to the creaters of this site.

PeterFebruary 14th, 2010 at 5:59am

Hi Ade, short calls are bearish strategies so you use them when you expect stock prices to fall. A short put is the opposite - you would sell a put if you expect the market to rise.

adeFebruary 10th, 2010 at 1:22am

When do you use Short put and Short call?

why do ppl use it when it is not profitable?

can you show me if this is profitable?

sorry if you have mentioned but I overlooked.

ramanJanuary 31st, 2010 at 10:25am

Best stratergy to cover your stock.

PeterJanuary 15th, 2010 at 2:43am

Nope, they're the complete opposite. A naked call option loses value as the market rises and a naked put loses value as the market falls. Both have a limited profit potential of the premium received when selling the option though. See this graph for a naked put

https://www.optiontradingtips.com/strategies/short-put-option.html

AndyJanuary 14th, 2010 at 8:32pm

Peter, is a naked call the same as a naked put?

PeterJuly 10th, 2009 at 6:24am

Hi JD, you could buy the underlying stock as a hedge, which would make your position a "covered call".

JDJuly 9th, 2009 at 9:23am

If I have a naked call OTM...how can I hedge my risk of loss, or is the unlimited risk just that...unlimited

PeterMay 6th, 2009 at 6:15pm

Hi George,

Yes, the amount of shares remains constant, however, as the price continues to rise your losses magnify. If you are exercised, you will have to sell the shares to the option buyer at the strike price, not the current market price. So the further away from the strike price the stock is trading at, the greater your losses become.

GeorgeMay 6th, 2009 at 1:46pm

Hi, I can see how in a short call you are limited in profit because the buyer will not exercise and your profits are the premium. But if the market rises aren't you as a selling just limited to the amount of stock you must sell to the buyer as your loss? For example if I initially own 100 shares @ 10 that I purchased, and if i sell an option and they exercise the option on me dont I just loose 1000?

AdminMarch 24th, 2009 at 3:57am

That's either a Short Straddle or a Short Strangle:

https://www.optiontradingtips.com/strategies/short-straddle.html

https://www.optiontradingtips.com/strategies/short-strangle.html

MavisMarch 24th, 2009 at 1:58am

Can anyone give an example for 'short call' and short put'?

JerryMarch 16th, 2009 at 5:29am

Short call you want the market to go down and short put you want the market to go up. Both have limited profit and unlimited losses.

ADELMarch 10th, 2009 at 9:10am

Hi, may I know what's the difference between SHORT CALL and SHORT PUT?

PaulJanuary 26th, 2009 at 4:38am

Yes.

DAMODARJanuary 24th, 2009 at 8:40am

CAN THE OPTIONS (CALLS OR PUTS) SHORT AND COVER AFTER ANY TIME BEFORE EXPIRY DATE AS FUTERS SHORTSELLING AND SHORT COVERING?

AdminDecember 13th, 2008 at 11:57pm

Yes, correct. The writer is committed to selling the stock at the Strike Price if the buy decides to exercise. The premium received is the current traded price of the call option when traded.

HHDecember 12th, 2008 at 11:30am

In other words, does this mean that the 'writer' is selling a contract (at a price) where the writer will commit to selling a stock at an exercised price? is the 'premium' that the writer receives considered the price of the call?

Add a Comment