What are Currency Options?

A Currency option (also FX, or FOREX option) is a financial product called a derivative where the value is based off an underlying instrument, which in this case is a foreign currency. FX options are call or put options that give the buyer the right (not the obligation) to buy (call) or sell (put) a currency pair at the agreed strike price on the stated expiration date.

FOREX option trading was initially conducted only by large institutions where fund managers, portfolio managers and corporate treasurers would offload risk by hedging their currency exposure in the FX option market. However, currency options are now very popular amounst retail investors as electronic trading and market access is now so widely available.

$ Real money, real results $ The Option Scanner that delivers -> Read More...

I thought all FX Options were traded Over the Counter (OTC)?

When currency options first came on the scene, they were indeed traded OTC - where institutions and broker/dealers trade with each other over the phone to hedge their foreign currency exposure. With institutions dealing with transactions in the billions, this makes sense, especially since, unlike stocks/futures/options, there is no central trading location for foreign exchange.

However, many retail online brokerage firms as well as larger institutions provide electronic access to FOREX liquidity pools that also include the trading of currency options online. Many of the options traded via these firms are still considered OTC as the trader (customer) transacts directly with the broker, rather than matching the order with another trader. In this case the broker becomes the counter party to the currency option and hence has to wear the risk.

This also means that currency options can be catered to the individual trader. Without a standardized set of rules dictated by an exchange, a trader can choose the strike/expiry and in rare case the expiration style of the contract that is traded with the broker.

Not all electronic trading destinations for currency options are OTC though. There are firms that provide liquidity pools for institutions to transact with one another often called Dark Pools. For example, HotSpot, FXAll and CurrenX are all liquidity destinations for the FOREX market.

In addition to FOREX liquidity pools and OTC with your broker, currency options are also traded on exchanges. For example, the PHLX (NASDAQ) and the CME both offer currency options on currency futures. These products will also be accessible by most retail online FX option brokers.

What Brokers offer online FX option trading?

Take a look at the list below of brokers who offer online access to the currency option market.

Interactive Brokers

GCI Trading

Saxobank

CMC FOREX

FXCM

Refcospot

MAN Direct

OptionsXpress

Are currency options riskier than stock options?

I would say that there are two types of risk present when trading foreign exchange options: counter party risk and market risk.

For currency options that are OTC with your broker/dealer, you have what's known as counterpart risk. That is, the risk that the firm that holds the other side of the transaction goes bust, along with any financial obligation to deliver foreign currency. Any option agreements that you as a trader/client hold with such a company become worthless. Counterparty risk is more present in currency options than stock or futures options because there is no central clearing house to protect option traders when the dealer is unable to meet the exercise obligations.

In terms of market risk, FX options are more sensitive to macroeconomic factors than stock or futures options. Political and/or economic factors play a large role on the view of currencies. Stock options on the other hand, while still affected by macro economic conditions, are also influenced by company specific variables such as earnings reports, downgrades, sector sentiment etc.

Currency Option Valuation

FX options are generally European and hence can use a standard B&S model. Like an equity option, currency options can be priced using a standard black and scholes option model with a dividend yield. With a currency option, the dividend yield represents the foreign currency's continually compounded risk-free interest rate. In the same way, FOREX option pricing will need to consider:

Underlying Price (the Spot FOREX rate)

Interest Rate = Local Currency Interest Rate

Dividend Yield = Foreign Currency Interest Rate

Strike Price = The cross rate at which the currency will be exchanged

Expiration Date = The expiry date of the option

Volatility = The expected future volatility of the exchange rate over the life of the option

The forward price used for the currency option is a combination of both interest rates in each country.

More recent than the Black and Scholes is the Garman and Kohlhagen currency option pricing model. I've read that it is exactly the same as the B&S formula for options on dividend paying stocks, though I've not seen the exact formula. Check out the following books for more information on currency option pricing.

Suggested Books

The Complete Guide to Option Pricing Formulas

Mastering Foreign Exchange and Currency Options

FOREX Volatility Might Surprise You

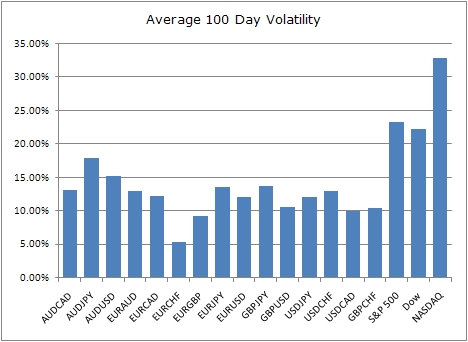

As I was writing this article I was thinking of the reasons that may help explain why currencies have higher volatility than equities. For some reason, I always assumed that FOREX pairs would have higher volatility than, say, index options. To gauge the magnitude of volatility difference, I began to compare a series of FOREX pairs and a few indices.

I was surprised. Using end-of-day data, equity indices exhibit about double the amount of volatility than the major currency pairs. Take a look at this:

Here is the spreadsheet with the data:

![]() Currency Vs Index Volatility XLS

Currency Vs Index Volatility XLS

9.5 years of data was used to compile the above - from the 3rd January, 2000 to 5th August 2009. I calculated both 30 day and 100 day historical volatility and then averaged this across all data sets. Here's the summary:

| Security | Volatility |

| AUDCAD | 13.10% |

| AUDJPY | 17.91% |

| AUDUSD | 15.27% |

| EURAUD | 13.05% |

| EURCAD | 12.23% |

| EURCHF | 5.31% |

| EURGBP | 9.24% |

| EURJPY | 13.59% |

| EURUSD | 12.14% |

| GBPJPY | 13.79% |

| GBPUSD | 10.69% |

| USDJPY | 12.05% |

| USDCHF | 13.08% |

| USDCAD | 10.09% |

| GBPCHF | 10.48% |

| S&P 500 | 23.40% |

| Dow | 22.24% |

| NASDAQ | 32.84% |

The 3 stock market indices averaged 26.26% while the 15 currency pairs averaged 12.14%.

Given that currency volatility is, on average, almost half that of an equity index, you could assume that option premiums are relatively half as cheap also.

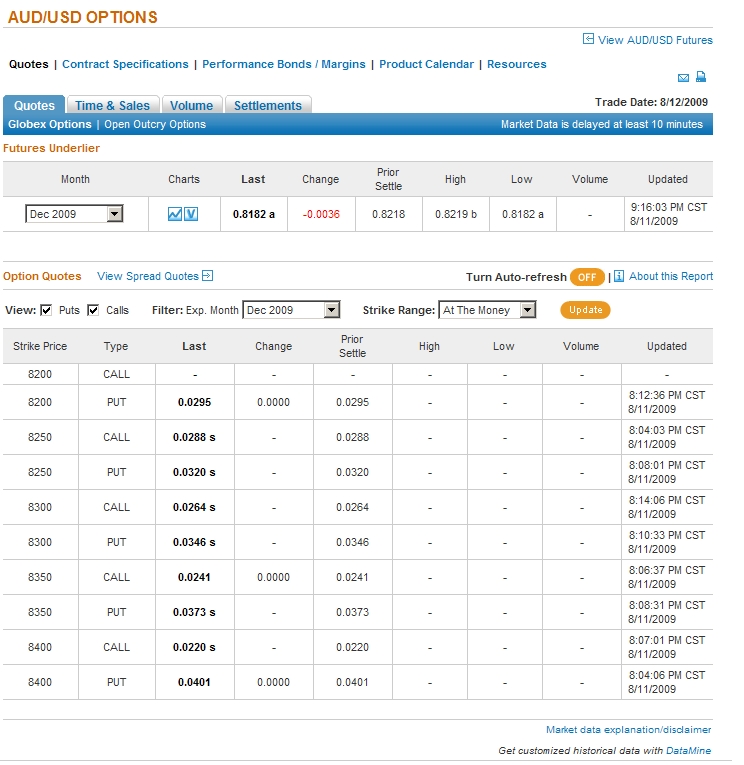

However, FOREX markets are known for their intra day price swings, so perhaps this volatility will drive up option premiums beyond their historical values. So, I thought I'd take a look at the implied volatilities for a sample of FOREX options.

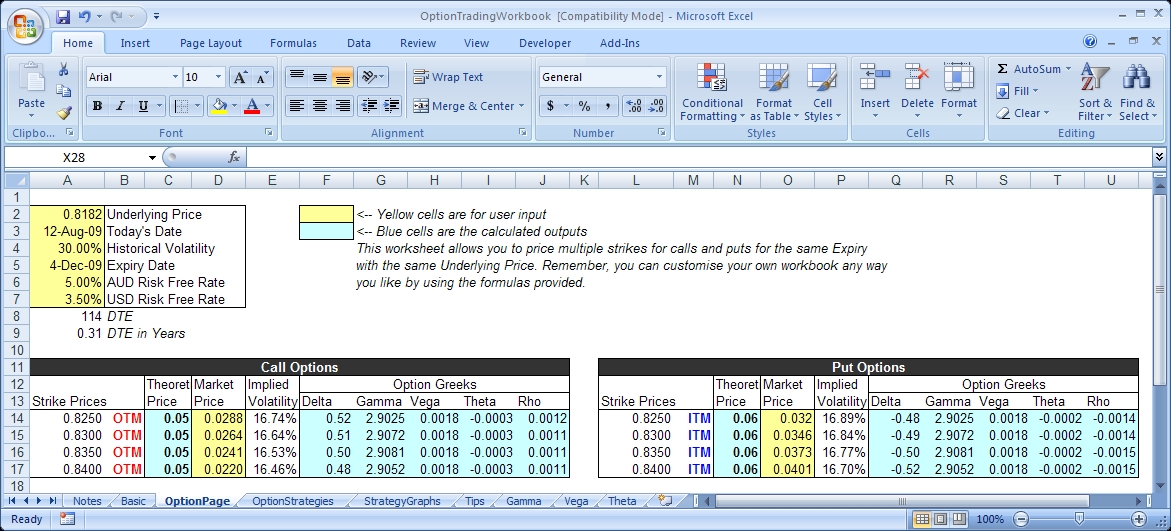

Implied volatility data for currencies is hard to find...so hard in fact I couldn't find any freely available. I decided to use the option prices on FOREX futures listed on the CME - CME AUD Contract Specs and Prices - and plug those into my spreadsheet option calculator.

Note: The spreadsheet uses the Black and Scholes method (for European options) whereas the currency options priced are American style exercise but I don't imagine a huge difference there. For this example I think it is fine.

The 16.80% implied vol for the AUDUSD FOREX options isn’t too far off the 15.27% 100 day historical volatility. Still much lower than the current 22.72% implied volatility for the S&P 500 index - S&P 500 Implied Volatility.

Lower Volatility = Lower Premiums

Does it matter that volatility is lower for currencies than other asset types? It all depends on your trading style.

Volatility is factored into the time value of the option. When the level of implied volatility increases this leads to fatter option premiums. If you're strategy is buying options for directional trades, then higher vols make this more expensive and your profit per trade less.

If you love selling naked options or taking on covered calls, then higher option premiums mean more credit to you when you establish the trade.

Lower Volatility = Lower Margins

As an option buyer, your only risk is the premium you pay for the option contract. However, when you short an option, your broker allocates a portion of your account as a margin for the position. This is called an "initial margin". If the underlying market moves against the trader, he/she may have to deposit additional funds in order to maintain the trade. This is called a "maintenance margin".

If the margin cannot be maintained due to insufficient funds, the broker will close out the position on behalf of the customer and return any remaining monies back to the client.

On top of the currency exposure, margins are also affected by the levels of volatility inherent in the underlying spot currency.

Interest Rates

Interest rate movements play a huge role in the movement of currency prices. If, for example, the savings rate of the United States increases while the rates in Australia remain unchanged then money will flow out of Australia and into the US as cash held in the US is now worth more relative to Australia given the current exchange rate. As the FOREX market moves in response to changing interest rates so does the option premiums whose underlying asset is foreign currency. When pricing foreign currency options the interest rates of both countries need to be considered and entered into an option pricing model - unlike other types of options, such as equity options, futures options etc that only take one input for interest rates to derive a theoretical price.

This interest rate differential between two currencies can be considered as the "cost of carry" for the particular currency spot.

See external links below for some additional resources on pricing currency options.

Options on Currency Futures

In addition to options that have their underlying as foreign currency, option traders may also trade options where the underlying is a currency future. That is, a futures contract where the underlying is based on the foreign currency.

Options on currency futures are far more accessible than straight out FOREX options. As mentioned earlier, most of the volume traded through currency options takes place in the over the counter market (OTC market), whereas options on currency futures are traded on exchanges that can be easily accessed by an online broker. The Chicago Mercantile Exchange has the most widely available currency futures and currency options in the world.

Currency Option Vs Currency Future

Like all options, when you buy an option your risk is limited to the premium paid for the derivative. Options also carry the "right" to take delivery (exercise) of the underlying asset if so desired.

When you buy a futures contract you are "obligated" to take delivery (or cash settle) the underlying asset upon expiration. With risk not being limited to a premium (as is the case with buying options), a futures contract's risk profile is more aggressive...having loss potential on both up and downside of the market.

Buying futures contracts also requires the deposit of an "initial margin" upfront that can be much larger than an option premium, which fluctuates on a variety of factors. The initial margin also earns interest whereas an option premium doesn't - the option premium is paid to the seller, who earns the interest on the amount paid.

Are Currency Options Ever Useful?

I'll let Giddy answer that in his Myths About Foreign Exchange Options

AnonymousOctober 2nd, 2013 at 3:48am

Very interesting! I was curious about why currency options are mainly defined on currency forwards instead of currency spots. Here I have found the clearest explanation in the whole World Wide Web. Thanks!

PeterOctober 29th, 2012 at 4:27am

Hi Mike,

Yes, you can download the spreadsheet here;

Option Trading Workbook.

MikeOctober 18th, 2012 at 2:43pm

In the screenshot above from the OptionsTradingWorkbook.xls it prices out FX options. Is this version of the xls workbook available for download?

brendanMay 12th, 2012 at 10:27am

a very good intro

Add a Comment