Call Options vs Put Options

Rights vs Obligations

| Buyer | Seller | |

|---|---|---|

| Call Option | Right to Buy the Underlying | Obligation to Sell the Underlying |

| Put Option | Right to Sell the Underlying | Obligation to Buy the Underlying |

Buying vs Selling Options

| Graph | Outlook | Risk | Reward | Premium | Exercise | |

|---|---|---|---|---|---|---|

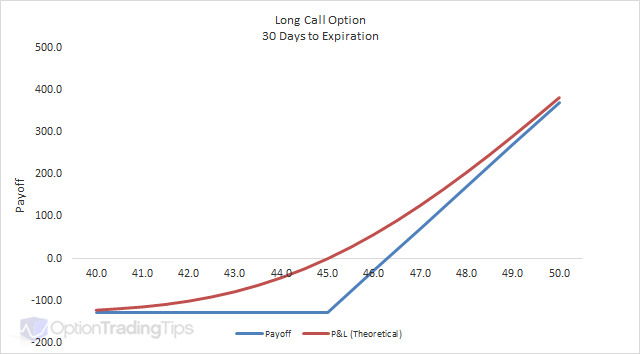

| Buy Call Option |  | Bullish | Limited | Uncapped | Pays | Right |

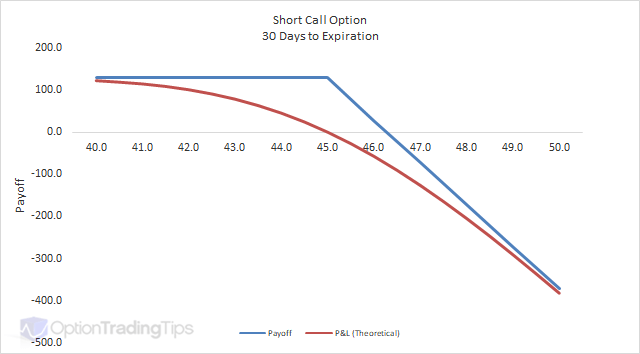

| Sell Call Option |  | Bearish | Uncapped | Limited | Receives | Obligation |

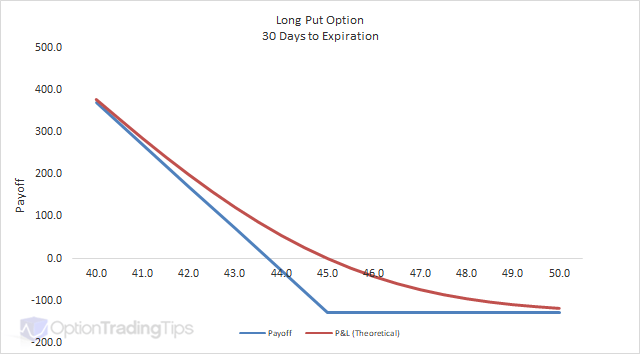

| Buy Put Option |  | Bearish | Limited | Uncapped | Pays | Right |

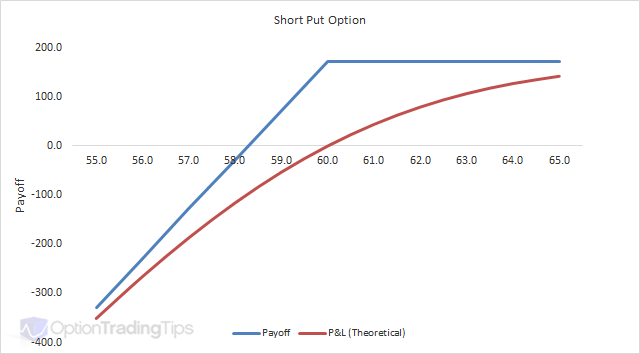

| Sell Put Option |  | Bullish | Uncapped | Limited | Receives | Obligation |

Buy Call Option

A Call Option gives the buyer the right to buy the underlying at the strike price at or before 1 the expiration date. A buyer of a call option wants the market price to go up and pays a premium to the seller of the option in order to have this right.

If the stock price (underlying asset) is higher than the strike price then it is the buyer of the option that can choose to exercise the option. The seller of the option is then obligated to deliver 100 shares to the option buyer at the value of the strike price. The buyer of the call option will then be long (have purchased) the shares at the strike price.

Buy Put Option

A Put Option gives the buyer the right to sell the underlying at the strike price at or before 1 the expiration date. A buyer of a put option wants the market price to go down.

If the price of the underlying stock is lower than the strike price, the buyer of the put option can choose to exercise the option. The seller of the put option is obligated to sell 100 shares to the put option buyer at the strike price. The put option buyer is now short 100 shares at the strike price of the option.

Sell Call Option

A seller of a call option waives any rights over the exercise of the option. S/he is obligated to deliver (or sell) 100 shares to the option buyer if the option is exercised.

When the transaction initially takes place, the buyer of the option pays to the seller an option premium up front, which the seller keeps regardless of the outcome of the option. This premium serves as a kind of insurance for the seller.

Option sellers take on more risk but are paid up front for the trade.

Sell Put Option

A seller of a put option also waives any rights over the exercise of the option. S/he is obligated to buy 100 shares for each option contract to the buyer of the put option if exercised.

Just like selling a call option, a put option sale means the seller receives the premium up front at the time of trade and keeps this amount no matter what the outcome of the option.

You might think that selling put options is very risky when looking at the payoff graph as the downside seems uncapped as the market price falls. However, shorting put options is a popular strategy for those who wish to buy stock but at a price that is lower than where it is currently trading. Think of a short put as below market limit order. But, instead of simply placing a limit order into the market, a put option means you receive money up front by way of premium, which you keep if the stock keeps rallying.

If the stock falls below the strike price, then you will be exercised by the put option buyer and have to take delivery of the stock at the price you wanted to buy it for anyway. Plus you keep the premium.

If the stock keeps dropping then yes, your losses will mount as you are now long the stock at a higher price than it is currently trading. But you would have bought it there anyway.

[1] At or before depends on the style of option.

AnthonyJune 6th, 2015 at 1:31am

Hey brozos,

All you need to understand options is the graphs.

Wohooooo

PeterJanuary 2nd, 2014 at 10:49pm

Hi Manojg,

The seller of the put option is short the option, not the stock. If the option is then exercised by the buyer the seller of the option now becomes the holder of the stock - or long stock. After the exercise there is no position in the option. Not sure if that answers your question - let me know if it is still unclear.

PeterJanuary 2nd, 2014 at 10:46pm

Hi Sam,

No, the payoff is the P&L at the expiration of the option.

ManojgDecember 28th, 2013 at 9:59am

I have some confusion about call/put options and long/short positions, and I want clarify it. Here it is:

Let us say there is a put option. The buyer of the put option gets right to sell the stock and he holds short position. (Am I right?)

Similarly, the seller of the option (i.e. writer of the option) is obligate to buy the stock if the option is exercised. So, he holds long position (right?). However in Hull's book says the seller holds short position. Now what is right?

samDecember 10th, 2013 at 3:20pm

what you called the payoff you would receive if you chose to exercise an option today ?

PeterJuly 4th, 2012 at 1:16am

Hi Jake,

1. Yes, when you are long a put and you exercise you will sell the underlying asset at the strike price. If you don't hold the asset and short positions are allowed (i.e. futures) then you will simply go short the asset. Otherwise your broker may borrow the stock on your behalf to sell to the buyer.

2. Only if the option is American style. Options can either be American (can exercise prior to expiration date) or European (can only exercise on the expiration date). Typically stock options are American style but it is of course best to check the specifications before you trade.

JakeJuly 3rd, 2012 at 9:50am

Hi Peter,

1.I have a question regarding PUT option, Please explain this scenario when the stock price is $20, and what happens when holder PUT an Option ? Means that holder sells the stock at $25 and that means holder should have these stocks with him before to sell at $25?

2.Can we excersise Call or Put option before expiry date, say suppose if the expiry date is 25 th July and on 15 July stock price is $50, can we Call an option on 15th July or we will have to wait till 25th July ?

PeterMay 8th, 2012 at 1:39am

Sort of. An easier way to think of it is that a call option increase in value with the market goes up and a put option increases in value when the market goes down.

You can trade in and out of these contracts just like stocks/shares as the values rise and fall prior to expiration without having to take delivery of or deliver the underlying instrument.

just guestMay 8th, 2012 at 1:25am

Hi, Peter,

I just want to know if I properly understood the terms and principle of call and put options.

So, the holder of the option can play with the put or call options. When the price is down, then the holder can oblige the buyer (on the basis of the option contract)to buy the stocks for a value specified in the above option contract? But the transaction can be closed only during the period of contractual time. But if the price goes up the holder has the right not to sell (but it means that the holder will not earn anything if the option contract is expired)?

Regards,

anjanMay 2nd, 2012 at 1:28pm

It's good, I understand it.

PeterApril 29th, 2012 at 6:20pm

Hi Anita,

When a holder buys a call option s/he has the right to "buy" the stock if s/he decides to. A put option gives the holder the right to "sell" the stock if decided.

So, when buying an option, the holder of a call option wants the market to rise and when holding a put option wants the market to fall.

anitaApril 28th, 2012 at 1:25am

Sir,

please clarify my doubt. when a holder buys a call option, automatically he gets right to sell it if he wishes, why then put option. what are the features of both call and put option.

anita.

PeterApril 16th, 2012 at 7:01pm

Hi Charles,

No, they are very different. Even though your bias is bullish, your payoff and risks are almost opposite.

First, buying a call gives you the power to decide to exercise the option or not - so your risk is limited to the premium that you paid for the position. If it is not profitable to exercise you just walk away and your only loss is the premium. However, when you sell an option that power sits with the buyer and you then have the risk of being exercised. You do receive the premium but your losses are not limited like they are when you buy an option.

Second, if the market does rally your profit potential varies between a long call and short put: a long call has potentially unlimited upside profit while a short put's profit is limited to the premium you received when you sold the option.

You can see the payoff graphs of the two in the below links;

Buying a Call Option

Selling a Put Option

CharlesApril 16th, 2012 at 12:38pm

Hi,

Is short selling a put option equivalent to buying a call option, since in both situations you are bullish on the market directions.

Thanks!

PeterMarch 30th, 2012 at 9:05pm

Hi Tony,

Sort of - when you exercise you will need to sell the underlying. If you don't already own the underlying then you will have a short position in the underlying. If the underlying that you are trading doesn't allow for short positions (some stocks in certain countries) then your broker/clearer will borrow the stock on your behalf to cover the trade.

TonyMarch 30th, 2012 at 3:51am

Hi Peter.

Great site.

Let's suppose I have not purchased the underlying.

If I buy a Put option, and I decide to exercise it, then it means that I have to buy the unerlying at the market price and then sell it at the strike price?

Thanks in advance.

PeterMarch 27th, 2012 at 5:03pm

There isn't any better choice between the two types as they both have different characteristics. Retail traders may buy calls if they think the market will rise and buy puts if they think that the market will fall.

AlmasMarch 27th, 2012 at 4:42am

which option is better for investor generally?

PeterMarch 26th, 2012 at 8:05pm

Hi Achu,

A double option is an option combination of a call and a put with an "or" condition. That is, the buyer (holder) of the double option decides if s/he will buy the underlying or sell the underlying when the decision to exercise is made. Obviously s/he cannot do both, so when one exercise choice is made the other side is automatically cancelled.

Achu AnilMarch 21st, 2012 at 2:22am

What is double option?

ArickMarch 15th, 2012 at 12:51am

put option and call option are the two face of a coin there is no individual exercise, that is when in the share market there is a sell of underlying asset(put option) there has to be a call option. the profit is depend upon the rise and fall of the value of share,premium etc.

PeterFebruary 14th, 2012 at 4:52pm

Hi Amarendra,

A call option provides the buyer the right to buy an underlying asset (such as a stock) at fixed price and date in the future. For this right the buyer pays a price for the option (called premium) to the option seller.

Amarendra nath RoyFebruary 14th, 2012 at 4:16am

What is call option? Please explain .

PeterDecember 20th, 2011 at 4:58pm

Hi Daniel,

It depends where you are trading and what broker you use. I use Interactive Brokers and they don't charge any exercise/assignment fees/commissions anywhere except in Australia.

DanielDecember 20th, 2011 at 4:19am

Mr Peter,

when do the exercise, who among call writer, put holder, put writer and call holder will pay for the exercise?

PeterDecember 12th, 2011 at 11:25pm

Hi Ravi,

A long position is where you have paid money and own "rights" to the asset - in the case of options, you have the right to exercise the option.

A short position is where you have sold something that you don't actually own. When you short options you receive money upfront as a result of the transaction but the right to exercise sits with the buyer (holder) of the option.

RaviDecember 12th, 2011 at 3:00am

Dear Sir,

1. what is the difference between short and long position?

I wonder whether what situation short sale is allowed?

PeterDecember 8th, 2011 at 3:24am

Hi Daniel,

Option buyers (holders) pay the premium to the option sellers (writers). So, sellers receive the money up front when the trade takes place.

DanielDecember 8th, 2011 at 3:14am

Hi Peter, could you please help me?

I want to know who are can make payment and receive payment among of call option writer, put option writer, call option holder and put option holder.

PeterNovember 21st, 2011 at 7:43pm

The strike price is the price that you will have to buy or sell the underlying at if the option is exercised.

ciyeraNovember 21st, 2011 at 12:24pm

what is strike price? and how its related to both calll and buy options?

PeterNovember 19th, 2011 at 5:28am

Please see the page Why Trade Options.

SarahNovember 18th, 2011 at 4:35pm

When do we use options? And why do we use it?

PeterNovember 17th, 2011 at 4:09pm

If the call option is out of the money at the expiration date then the strike price will be higher than the current market price - so you would be better buying the stock directly via the exchange.

RajeshNovember 17th, 2011 at 8:33am

Hi Peter,

I have a question here. If we buy a call option and upon expiry the option is out of money, can we buy the underlying stock at the strike price(IN INDIA)? If yes, how much quantity we need to buy (Is it the lot size or for the money which we invested for the option)? Please help me.

EliOctober 7th, 2011 at 5:28am

It was an assignment question and my answer was the value of options are same when the underlying price is equal to the strike price I hope my answer is correct.

Again thank you so much for your quick reply.

PeterOctober 6th, 2011 at 5:20pm

Hi Eli,

The options will be approximately equal when the strike price is the same as the stock price (ATM).

Well, it's really when the "forward price" of the stock is the same as the strike price where the forward price takes into consideration the interest rates and dividends of the stock.

EliOctober 6th, 2011 at 3:56pm

Hi Peter,

Many thanks for your kind response. I learned many terms via your answers :)

My question is that in what condition the value of a call option and a put option of a stock with the same maturity date can be equal?

PeterAugust 13th, 2011 at 11:27pm

No, there is no obligation as the trader no longer has a short position.

kanchanAugust 13th, 2011 at 4:42am

if the seller sold a call option of X at a premium of $10 .. and before the expiry date the premium reduces to $4 .. he buys back the option and makes a profit of $6 ... is he still obliged to buy the shares if the buyer of the option exercises the option ?

kanchanAugust 13th, 2011 at 4:31am

@ rachel

so the seller will take the delivery of the shares ? wat if he does not have enough cash in his account to buy the shares ?

PeterAugust 7th, 2011 at 7:45am

Well put Rachel!

RachelAugust 6th, 2011 at 7:36pm

Kris

April 6th, 2010 at 11:00pm

Hi,

Quick question. What i don't understand about put options is using your example above, though you have the right to sell the put option for $25, and say at expiration the maket value for the shares is $20?. Who would want to buy the shares at $25 when it's already at $20?

---------------------------------------------------

You may like to understand what the two parties of the options contract are. There are two parties: the writer and the holder. The person who bought the put option is also called the holder. He has the right but not the obligation to sell the underling stock. However, the writer also known as the seller has the obligation to buy back the underlying stock if the holder choose to exercise the put option.

So the seller of the put option will buy back the stock if the buyer of the put option choose to exercise their right, even when the market price if much lower than the exercise price.

PeterMay 18th, 2011 at 5:44pm

Yep, you can have bonds and bills as underlying assets - you can also trade options on an index, forex, commodity futures, agricultural futures and even weather futures. Check out the CME for more.

toyinMay 18th, 2011 at 3:10am

to my understaning option to be exercised base on underlying asset.fine and the underlying asset mentioned is shares,can we used Treasury bills and bonds as underlying asset

PeterFebruary 23rd, 2011 at 3:52pm

If the options are ITM then you won't have any trouble selling them back - there will always be a buyer. The buyers will almost always be market makers who are obligated by the exchange to provide a two way market in option contracts. Market makers will place bids on these ITM options based on the fair value of the option in an attempt to hedge it back with the underlying stock.

PaulFebruary 23rd, 2011 at 9:40am

Thanks Peter. One last question.

If options depreciate as they near their expiry date are they difficult to sell even if they are well in-the-money? Why would the option value matter when the broker will pay the profit even after the option expires?

PeterFebruary 22nd, 2011 at 7:55pm

Hi Paul,

All options can be traded out (i.e. sold back) prior to expiration - regardless of the settlement type.

And yes to your second question - as settlement type is irrelevent you can sell the option back in market to realize a profit.

Physical delivery just means that if you do hold the option until the expiration date and decide to "exercise" the option, you will need to deliver (or be delivered) the underlying asset that the option is based on - as apposed to simply receiving a cash settlement.

PaulFebruary 22nd, 2011 at 3:57pm

Hi Peter,

Me again. I`ve pasted one of your earlier examples below. My question is: If the option in the example below were a physical settled option, could you still sell the option for $2? If so, why is it called a physical settled option? Thanks.

Say you bought a $25 call option for $1 while the underlying shares were trading at $26. If the market rallies to $27 the option must at least be worth $2 because you can exercise your right at $25. So, even though the shares only went up 3.8% you DOUBLED your money because you can now sell back the option for $2.

PaulFebruary 22nd, 2011 at 3:43pm

Hi Peter.

Thanks.

Another question: Would it be correct to say that a physical delivery option is an option which must be exercised and cannot be sold?

PeterFebruary 22nd, 2011 at 5:16am

Hi Paul, there isn't anything about the option that tells you the settlement type - you just have to check out the specifications with the exchange. If you search the exchange website for "contract specifications" you'll usually find it ok.

Generally speaking I would say that equity options (options based on a stock) are physically settled and index options are cash settled.

PaulFebruary 22nd, 2011 at 4:57am

Hi. Can you tell me how to distinguish between physical delivery options and cash settled options. In other words, if I only want to buy options which can be sold for cash - how can I distinguish these from physical delivery options. Thanks.

PeterJanuary 19th, 2011 at 9:46pm

Hi Sash,

Thanks for the positive feedback!

Now, about the option - it depends on how bullish you are on the stock. That is ti say how far you think the stock will move after the open. At-the-money options are most sensitive to stock price changes and hence will have large gains initially, however, the further the stock moves away from the strike price the less sensitive the changes become.

For this reason you may want to look at options that are slightly out-of-the-money. This way as the stock approaches the strike price it becomes more sensitive to the stock price movements and the option's percentage return will be far greater.

This concept of sensitivity has to do with the option's Delta (sensitivity to stock price movements) and Gamma (the option's delta sensitivity).

If you expect a very large move, then you would choose an option that is very far out-of-the-money, which would likey have a very low purchase price. And as the stock rallies hard towards the strike price the more value it gains - but more importantly the more percentage gain on the initial purchase price of the option.

SashJanuary 19th, 2011 at 8:31pm

Hello Mr.Peter,

First of let me THANK YOU for putting together this site. I am lucky to stumble across this site. You did a great job explaining a concept that is so difficult to understand (atleast for me).

My Question is: Lets say I determine (based on research) that a particular stock (eg:X) is going to go up today before the stock exchange open. Instead of buying X at $55, can I buy the corresponding call option for X? If so, how do I determine which call option to pick? Should I select a call option that has high open interest or should I go with an option that has high volume? Or neither?

Thank you so much again! Good bless your heart!

PeterSeptember 23rd, 2010 at 6:02am

Yes, the stock price can only go to zero, but the terminology for the profit on the option is still most commonly known as being "unlimited".

DaveSeptember 21st, 2010 at 6:55pm

There is an error in your text in paragraph 8. It says "buyer's of put options have unlimited profit potential" when in fact profit is limited at 0.

PeterApril 8th, 2010 at 10:51am

Hi Kris, nobody would but that is the risk you take when you "sell" an option as apposed to "buy" an option. The buyer has the "right" to exercise and the seller has the "obligation" to deliver if the buyer decides to exercise.

KrisApril 6th, 2010 at 11:00pm

Hi,

Quick question. What i don't understand about put options is using your example above, though you have the right to sell the put option for $25, and say at expiration the maket value for the shares is $20?. Who would want to buy the shares at $25 when it's already at $20?

PeterMay 12th, 2009 at 6:32am

Hi Glen,

Absolutely! This is how most people would trade options...for the short term gain in the value of the option contract itself based on the movements in the underlying asset.

I'm not sure about your second question though. Can you elaborate?

Glen O'RiordanMay 8th, 2009 at 10:44am

Can you buy an option, let's say a call option, with no intention of exercising it, but rather merely the expectation of trading out of it? Can you take advantage of the leveraging situation without risking needing to actually pay for the stock - that is, if the stock moves into a profitable range, sell the option (rather than exercise it), and if not simply pay the premium. Is it possible that you would decide to sell the option and not be able to?

AdminJanuary 9th, 2009 at 6:14pm

Try http://www.nseoptions.com/

Bankim MajumderJanuary 8th, 2009 at 8:27am

Want to know whether any put in Indian stock market may buy currently i.e. within 14-01-2009

Add a Comment