Call Backspread

A Backspread can also be called a Ratio Spread. Backspreads are usually referred to this compilation when the strategy results in a net credit.

A Call Backspread is made up of a short ITM call and long two OTM call options.

The Max Loss is limited to the difference between the two strikes plus the net premium (which should be a credit).

The Max Gain is unlimited on the upside and limited on the downside.

PeterAugust 25th, 2016 at 6:07pm

Hi Jim,

Yes, you're right, a mistakenly typed short instead of long in the first sentence. I think it's fair to remove that sentence.

Good point on the breakeven levels for the backspread vs straddle. I'll do a comparison and add it to the page.

JimAugust 25th, 2016 at 2:00pm

In the Characteristics section, you say that it is similar to a Short Straddle with limited loss on the downside – and then later you say it is like a Long Straddle with payoff flattening out on the downside.

The entire first sentence should be stricken: it's wrong, and you say it more correctly a moment later. It is in fact exactly a long straddle with a flat end, and you can do an identical trade by buying a straddle and selling a put a few bucks down (OTM).

You also should mention that what's nice about this trade is that – because of the credit – it's a less expensive way to put on a Long Straddle, and thus, its breakeven points are closer to your strike, giving you a higher probability of profit on each end.

PeterJune 14th, 2013 at 2:05am

If the options are American style with a delivery settlement, then yes, you can be called and have to sell the stock at the strike price.

If you aren't holding the stock at the time of exercise then you will go short the stock, which means your broker will borrow the stock for you to deliver to the buyer and charge you a stock borrow fee.

ClaudeJune 13th, 2013 at 3:07pm

Hi,

As you short an ITM call, could you be assigned?

What would you do at that moment?

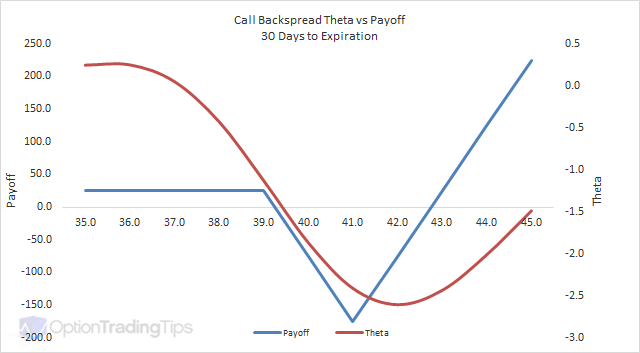

PeterNovember 26th, 2010 at 8:21pm

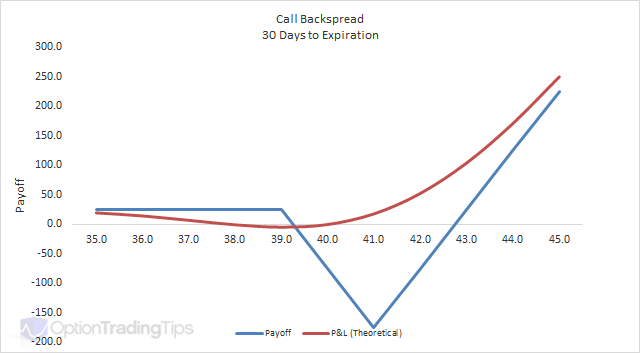

Hi MD, the blue line represents the payoff of the option strategy at the expiration date and the pink link shows you your theoretical profit/loss when the options have 60 days left to expiration.

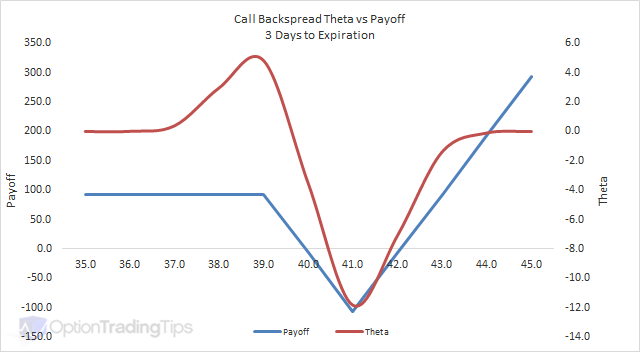

MDNovember 26th, 2010 at 3:10am

Can you please explain the graph? I can't understand how to read it.

PeterNovember 10th, 2010 at 3:56am

Hi Kartik, try this page for an example of a call backspread.

kartikNovember 10th, 2010 at 12:13am

Hi

Can you please provide one example in order to explain this strategies.

PeterMay 21st, 2009 at 6:12am

Hi Brett,

Yes, it is more than the net premium...the max loss is the difference between the two strikes less the net premium. Or technically plus the net premium...but as the premium is a credit (-ve) you will subtract it.

I have clarified it above too. Thanks!

BrettMay 20th, 2009 at 6:18am

I'm new to options, but couldn't the loss on a call backspread be much greater than just the net premium? If the market moved above the short ITM call you would have to pay and if the rally did not reach the long OTM calls those would expire worthless and you would be on the hook for the difference in the market and the short call, which could be substantial depending on the strike prices and commodity/stock involved. Do I have this right?

Add a Comment