Put Bear Spread

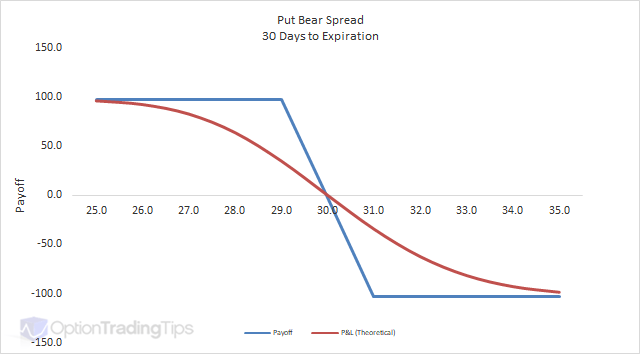

A Put Bear Spread is buying a put option while selling a put option with a lower strike price. Both options are in the same expiration month.

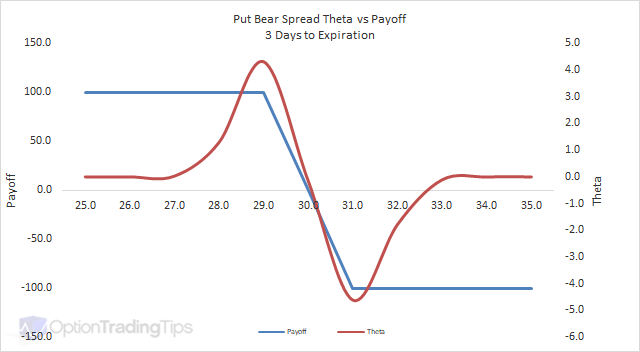

The Max Loss is limited to the net amount paid for the spread. I.e. the premium paid for the long put less the premium received for the short put.

The Max Gain is limited to the difference between the two strike prices minus the net premium paid for the position.

There are zero comments

Add a Comment