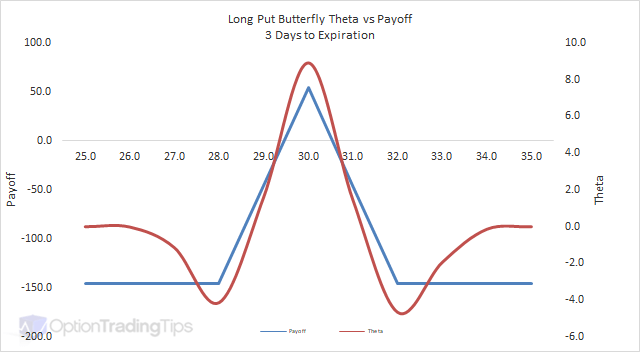

Long Put Butterfly

Sell two ATM put options, buy one ITM put option and buy one OTM put option.

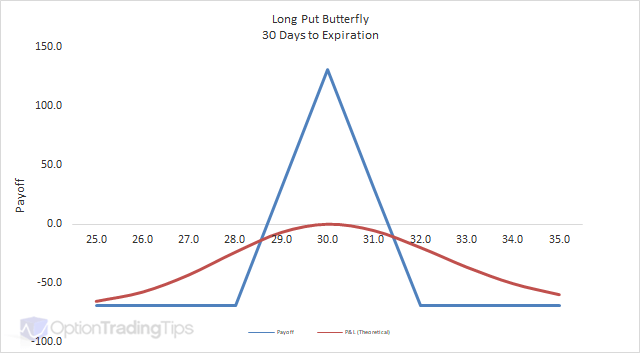

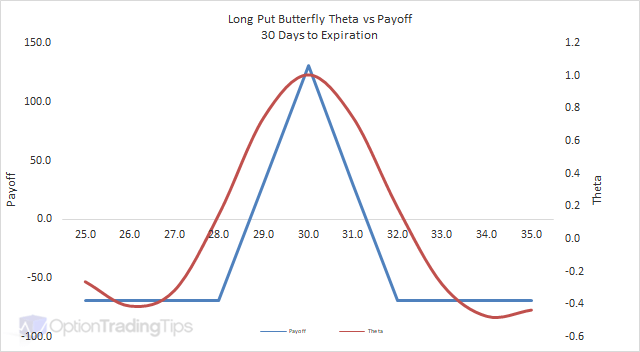

The Max Loss is limited to the net premium paid for the spread.

The Max Gain is limited to the ATM strike less the ITM strike less the net premium paid for the spread.

PeterAugust 10th, 2021 at 7:15am

Yes, it is, thanks for the correction!

Anonymous August 7th, 2021 at 7:37am

Should the max gain and max loss scenarios be swapped around?

Add a Comment