Long Synthetic

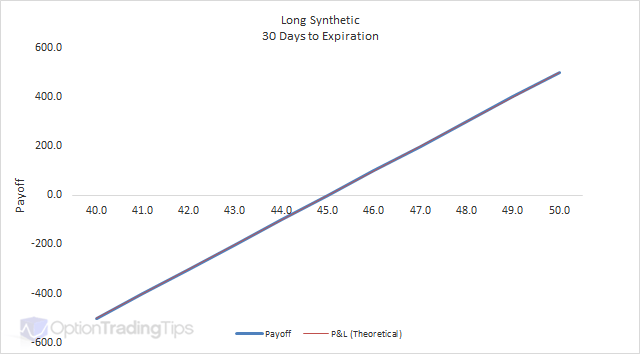

A long synthetic is buying a call and selling a put with the same strike price in the same expiration month. It is called a synthetic as the profile replicates a long position in the underlying. As a result;

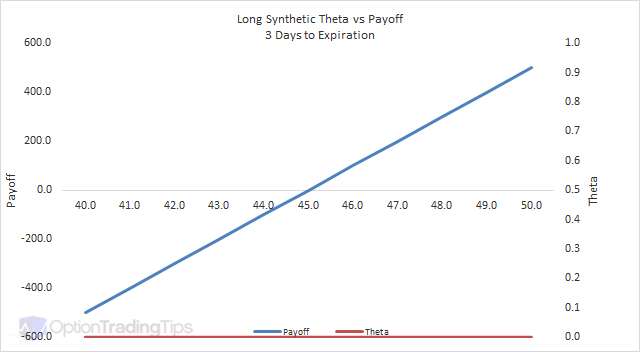

The Max Loss increases as the market falls but like a long stock position is ultmately limited to the total investment of the position. In this case it is limited to the value of the position at the strike price. I.e in this example it would be -$4,500.

The Max Gain is uncapped as the market rises.

PeterJune 24th, 2018 at 10:30pm

Hi hhcool1,

If you have the capital and want to own the shares, then you could consider closing both and buying the stock outright. Given the expiration is 18 months away, you're missing out on any dividends from the stock by buying the synthetic instead of the shares.

hhcool1June 20th, 2018 at 12:10pm

I'm sitting on a synthetic long position with TTD.

sold a short put Jan 2020 $45

bought a long call Jan2020 $45

TTD today is close to $93

I would like to own and keep the shares.

When does it make sense to exercise? The put is secured with cash that I could use elsewhere, however there is still a lot of time value left in it , so it would cost about $330 to but it back.

Is the right thing to do just leave it alone until Jan 2020?

PeterApril 15th, 2012 at 10:10pm

Hi Hel,

Apologies for the delayed response. Thanks for the feedback too :-)

You're right about the cash flows - you will receive $500 credit for this synthetic. You're also right about the P&L;

When APPL is at 628;

- The call is worthless and you lose the 3,600 paid.

- The put is ITM and will be exercised. You will need to deliver the stock at 630 and buy it back at 628 for a loss of 200. But you have already received 4,100 credit for selling the put so the gain for the put is 3,900.

- Total gain for the trade at 628 is 300.

When AAPL is at 632;- The call is ITM and will be exercised. You will be long the stock at 630 and given a market price of 632 you will be ahead 200 on the stock. However, you need to take away the 3,600 spent for the option. Net is a loss of 3,400.

- The put is worthless. You will keep the premium received, which is 4,100.

- Total gain of 700.

The breakeven point is the strike +/- premium. So in your case it is 630 - 5 = 625.You can choose whatever strike you like so if you don't want ITM puts just choose a lower strike so the calls are ITM.

HelApril 12th, 2012 at 3:52pm

Hi Peter, your site is by far the best site that explains Options concepts! I have been promoting it among my friends and they all love it.THANK YOU

Here's a number questions for this strategy. For ex, if I:

Long AAPL call @strike price 630 - price is 36

Short AAPL put @strike price 630 - price is 41

(both expires on June 12)

Today's Cash flow would be

(3600)+ 4100 = 500

If AAPL trades@628 on June 12,cash flow will be:

(63,000)+62,800 = (200)

If AAPL trades@632 on June 12, cash flow will be:

(63,000)+63,200 = 200

Here's my questions: it looks like if make money regardless?! just a matter of different return

500+(200)=300 or 500+200=700

- How do i calculate my breakeven point?

- Do I HAVE to always to short a ITM put? what if people exercises it??

I might have confused myself through the process and made some non-sense, please bear with me.

thanks a million

Dr. JohnFebruary 20th, 2012 at 6:58pm

You are correct about the downward slope. But it's not unlimited; it's bounded. The lowest the stock can fall is to zero. The reason the upside on long calls is unlimited is because there is no cap on a stock's price. In theory, a stock's price can go to infinity -- that's why we say unlimited or unbounded.

PeterFebruary 19th, 2012 at 5:04pm

Hi Dr. John,

That's not correct - the downside for a short put is that you will be assigned the stock at the strike price so as the stock falls you lose $1 for every $1 the stock drops - hence the downward sloping graph above.

Dr. JohnFebruary 19th, 2012 at 9:43am

The upside is unlimited. The downside is limited. Thus, the risk/reward profile given by this site is not correct. The most you can lose when you write a put is the strike price minus the premium.

PeterJuly 30th, 2011 at 6:50am

Sounds about right...depends on the strikes that you buy/sell, how close to expiration the options are etc but you're on the right track.

MattJuly 29th, 2011 at 7:37pm

It seems to me that the synthetic long will resemble the underlying long, except both gains and losses are magnified by (almost) the same factor. So, considering a net debit of $50 for a 100 strike price long synthetic: A $5 (5%) increase will result in a $450 profit; a $5 decrease will result in a loss of $550. In other words the synthetic long's results would be a 900% gain/1100% loss, whereas a long position in the asset would result in just a 5% change.

Am I on the right track?

PeterJuly 11th, 2011 at 7:27pm

The loss is said to be unlimited as there is no floor to the payoff as there is with a long call or long put. Your losses will continue to increase as the market price of the underlying decreases.

vkongJuly 11th, 2011 at 10:41am

I don't understand how there is an unlimited loss to this strategy unless unlimited means to the max loss of the writer in the amount of the sell put minus his premium.

dd008April 20th, 2011 at 4:17am

It's best used when you are bullish on the market plus it tends to be cheaper.

PeterMarch 2nd, 2011 at 5:42pm

Wouldn't that just be a long bond plus a short call option? That gives the same payoff profile as a short put.

GEH4March 2nd, 2011 at 4:35pm

Can you structure a synthetic put on long bond that replicates an interest rate cap?

PeterJanuary 17th, 2011 at 5:29am

Yes, short options are riskier that long options as you give away the right to exercise, however, short calls are often used in conjunction with a long position in the underlying stock for an income generation strategy.

rohitJanuary 16th, 2011 at 12:04pm

why should one go for shorting the call if he could have a unlimited profit by taking long position in put

PeterJanuary 13th, 2011 at 4:18pm

Hi Bkrish, a short put with a long call is a long synthetic and hence has unlimited downside risk. Two long calls, however, will have a limited risk on the downside totalling the amount of premium paid for the two options.

BkrishJanuary 7th, 2011 at 4:43pm

what is the advantage in going for one short put with one long call over two long calls?

PeterDecember 4th, 2010 at 3:49am

Right - a short put doesn't have any downside protection. However, not sure what you mean when you say that you lost your call premium?

GulshanDecember 4th, 2010 at 2:57am

When i will short put then i have to give margin to the broker and in downside i will lost my call premium as well as the amount of put (which can be unlimited) This strategy does not give any downside protection.

PeterDecember 3rd, 2010 at 8:12pm

Not the same as a long call - the same as a long stock.

varathaDecember 3rd, 2010 at 1:25pm

this one is for long call stratergy

PeterAugust 8th, 2010 at 3:10am

It's no more risky than having a long position in the underlying asset.

deepakAugust 8th, 2010 at 1:25am

this is very risky.if market goes upside den its ok but wat about downside...

PeterAugust 4th, 2010 at 2:51am

Hi Narender, this strategy doesn't provide downside protection. It would be used to replicate a long position in an underlying potentially without the capital outlay required.

narenderAugust 4th, 2010 at 12:50am

sir

if market fall dawn then how this stretgi save us

PeterSeptember 12th, 2009 at 7:33am

Sorry...I don't understand your question. Are you saying that selling one put option is that same as buying 2 call options (which it's not)?

Trader09September 12th, 2009 at 12:00am

Being new into this had little confusion over this strategy.Wats the need to sell one put option when 2 call options wud have meant same thing, as selling an option i suppose entitles u to unlimited risk, whereas buying does not...

WardoFebruary 9th, 2009 at 2:56pm

I executed a successful synthetic long at the March $22.50 strike for Peabody Energy, symbol BTU. My question is now what? I want to lock in some profit and stay long. With the underlying at $29-30, my $22.50 call has little premium left in it. Whereas say the March $30 calls are $2.50 ask. Any creative thoughts/ideas?

AdminFebruary 8th, 2009 at 3:36am

Hi Chaser,

If you were to buy the underlying stock you would have to outlay the entire cash to hold the stock. I.e. if the stock was trading at $25, then 100 shares would require you to spend $2,500. However, say you looked at the $25 synthetic with 30days to expiration and 5% interest rates, a call may be trading at 0.76 and the put at 0.63.

So, a long call ($76 debit) minus short put ($63 credit) means the same position only costs $13.

pchaser87February 7th, 2009 at 10:00am

*what do you mean by cheaper?

pchaser87February 7th, 2009 at 10:00am

what do you mean cheaper? lower comission?

do you have any suggestions for any good books/websites on options market making?

Add a Comment