Short Straddle

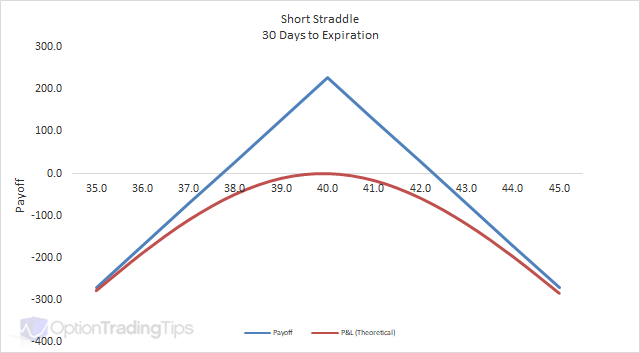

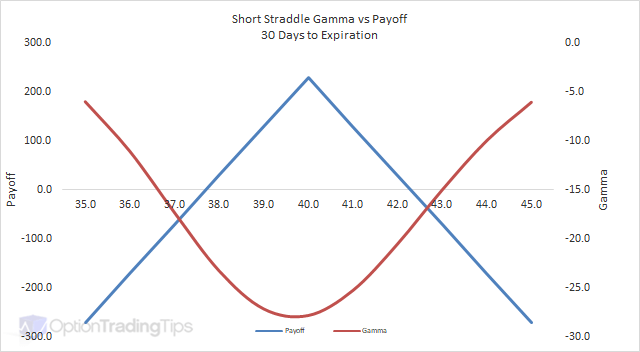

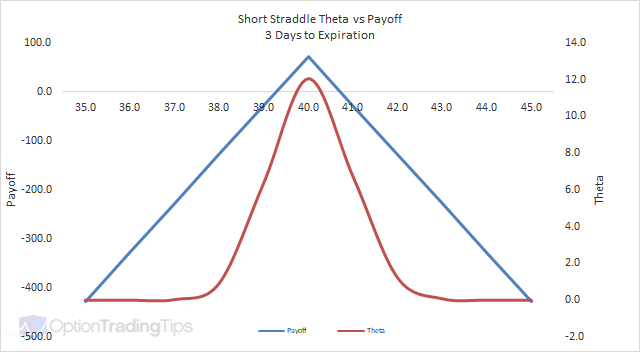

A short straddle is where you sell both a calls and puts at the same strike price in the same expiration month.

The Max Loss is uncapped as the market moves in either direction.

The Max Gain is limited to the total premium received when selling the spread.

PeterNovember 19th, 2010 at 12:29am

Yep, that's called a Short Strangle and is exactly what they're designed for.

kumarNovember 18th, 2010 at 11:42pm

can i sell 6200 call one lot and sell 5700 put one lot both expiry nov with a view to take advance of time decay. I fell both the options would expire worthless since there is only 5 more trading days. Kindly advise.

PeterMay 23rd, 2010 at 11:17pm

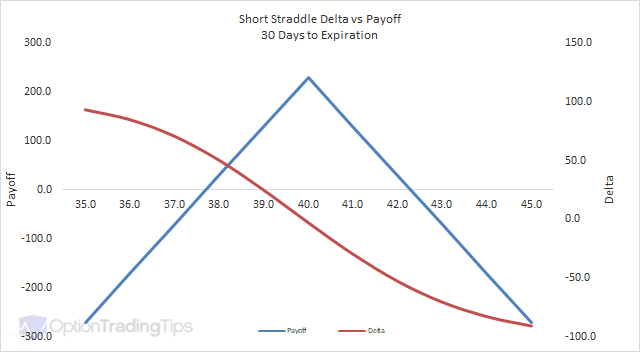

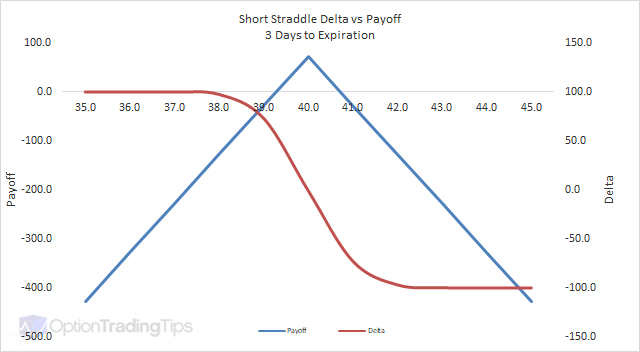

A short call has a negative delta, which means you will need to "buy" deltas to hedge. Normally this is done with the underlying asset i.e the stock or future, but can be any strategy that produces a positive delta.

PAYALMay 23rd, 2010 at 1:05pm

Which Strategy is used to hedge Short Call Option Strategy and Why?

AdminMarch 23rd, 2009 at 4:23am

That's right Rudy, so it depends on your view of the underlying as to what strategy you decide.

RudyMarch 23rd, 2009 at 3:38am

Which is a better strategy? short straddle or short strangle? While short straddle offers more premium, short strangle has better odds for success.

AdminJanuary 13th, 2009 at 6:16pm

Typically you would short the ATM strikes as you would be neutral on market direction.

ShibaprasadJanuary 13th, 2009 at 10:08am

Shoul I short the puts and longs as otm or atm?

Add a Comment