Characteristics

When to use: When you are bearish on volatility and neutral to bearish on market price.

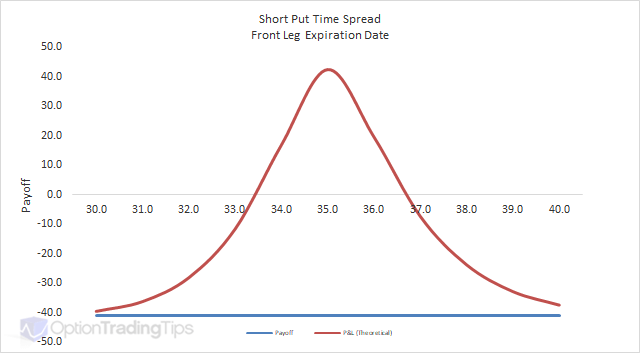

Note that with the payoff graph above I have shown the net theoretical result only at the first expiration date when with the underlying trading at 70, which is the best result: the near month call will expire worthless and you will still have a long AT put position.

A put time spread is similar to Call Time Spread except that you want the market to decrease rather than increase. So, a put time spread is used to take advantage of time decay. However, due to the risk involved in selling naked options, a time spread protects the position buy buying an option in the next month.

It is best to implement a time spread when there is < 30 days to expiration in the front month. Also, look to sell options that are out-of-the-money.

Put Time Spread Greeks

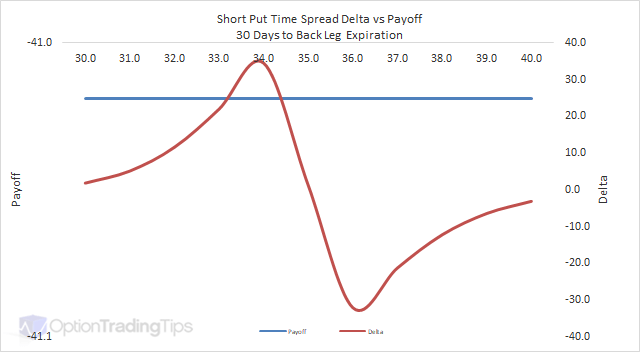

Delta

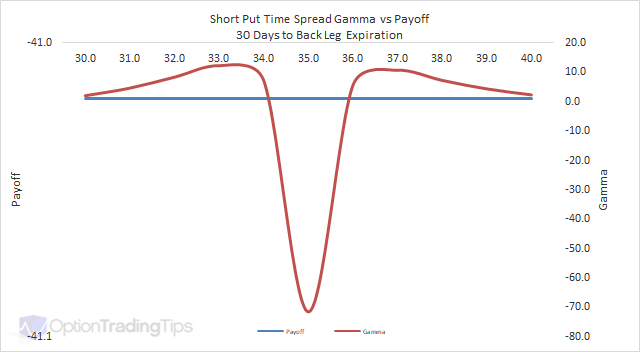

Gamma

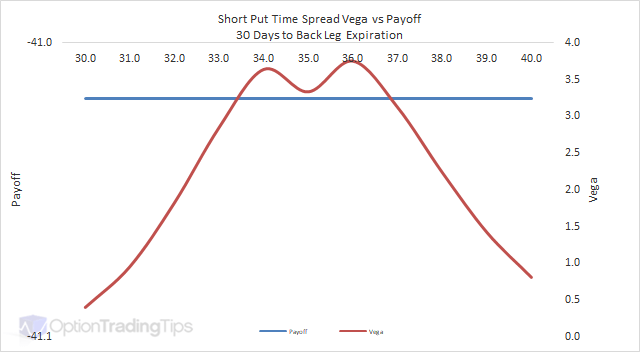

Vega

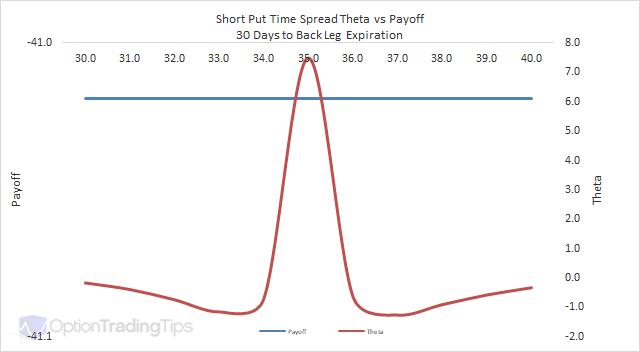

Theta

There are zero comments

Add a Comment