Characteristics

When to use: When you own the underlying stock (or futures contract) and wish to lock in profits.

This strategy is used by many investors who hold stock. It is also used by many large funds as a method of generating consistent income from the sold options.

The idea behind a Covered Call (also called Covered Write) is to hold stock over a long period of time and every month or so sell out-of-the-money call options.

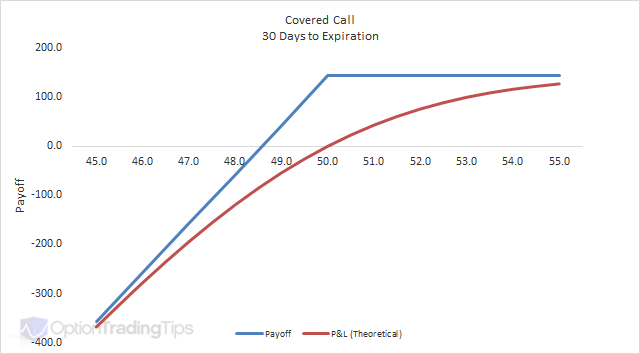

Even though the payoff diagram shows an unlimited loss potential, you must remember that many investors implementing this type of strategy have bought the stock long ago and hence the call option's strike price may be a long way from the purchase price of the stock.

For example, say you bought IBM last year at $25 and today it is trading at $40. You might decide write a $45 call option. Even if the market sells off temporarily it will have a long way to go before you start seeing losses on the underlying. Meanwhile, the call option expires worthless and you pocket the premium received from the spread.

Protected Covered Call

A "protected" covered call involves buying a downside (out-of-the-money) put together with the covered call i.e:

Buy Stock, Sell Call Option and Buy Put Option.

The profile of a protected covered call looks like call spread and has the benefit of limiting your downside risk in the event of a large sell off in the underlying stock/future.

Call Writer promotes this strategy as a Super Put.

promotes this strategy as a Super Put.

Monthly Income

Covered and protected covered calls are usually the strategies used by advisory services that promote option strategies for "generating monthly income" while "protecting capital". Services like Call Writer will provide you with real time lists and a trade management calculator where you will learn how to select, plan and manage covered call trades for consistent monthly cash flow.

will provide you with real time lists and a trade management calculator where you will learn how to select, plan and manage covered call trades for consistent monthly cash flow.

Their method shows you how to limit your risk to a small percentage of your total account.

Visit Call Writer

Covered Call Video Example

In the video below, Suze Orman explains the covered call strategy in very slow, easy to understand options market segment.

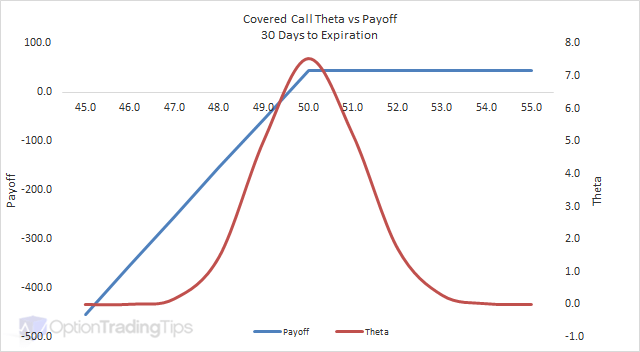

Covered Call Greeks

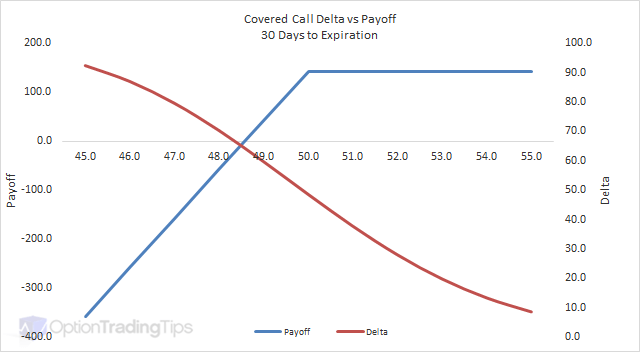

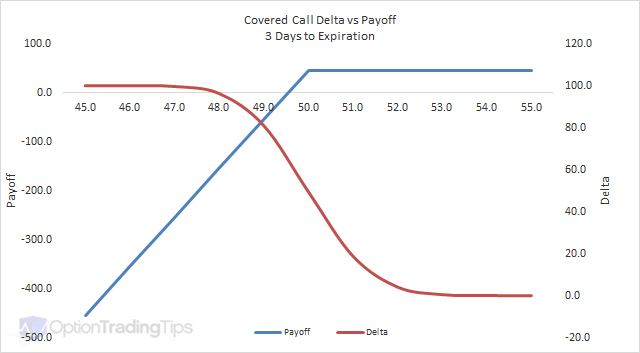

Delta

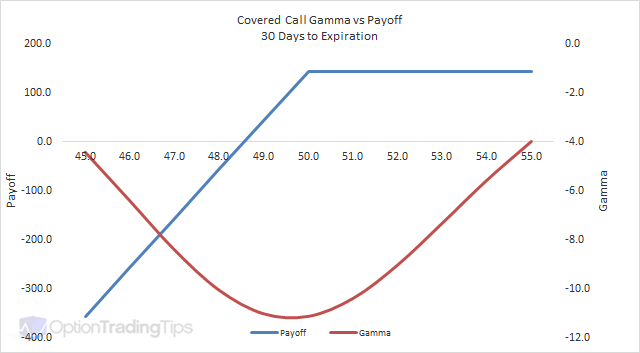

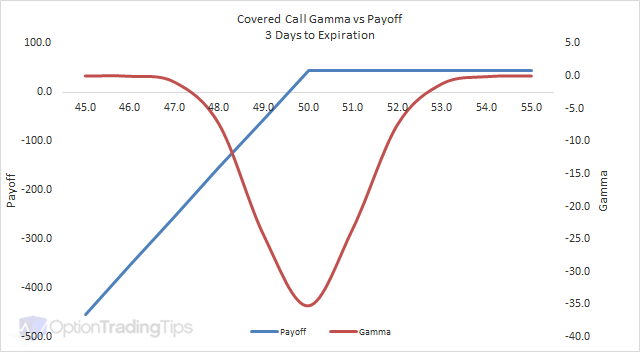

Gamma

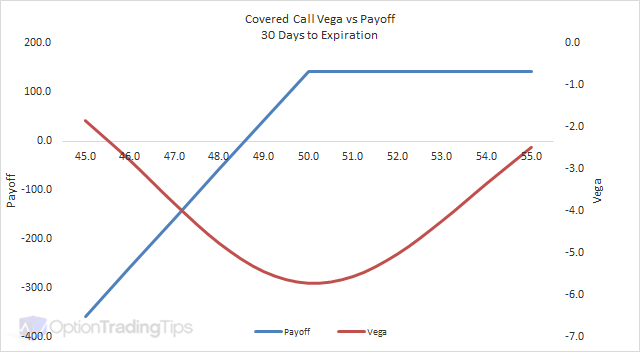

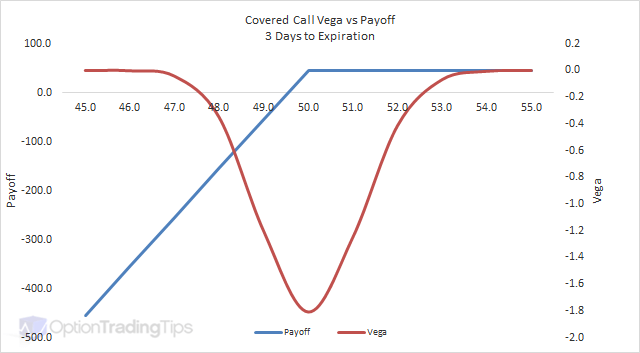

Vega

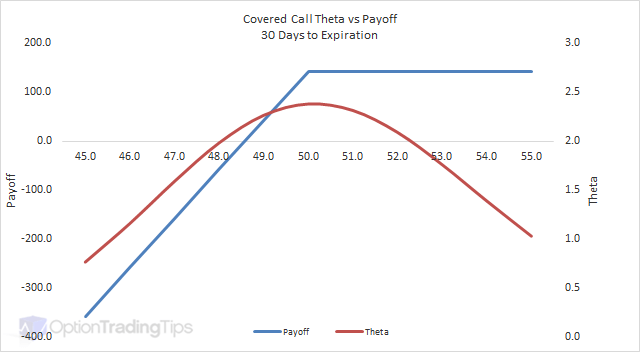

Theta

PeterApril 22nd, 2013 at 4:37am

Hi Sarah,

Apologies for this but the bottom part of your message was cut off. Could you please repeat it?

SarahApril 19th, 2013 at 9:21pm

Hi Peter,

I have to say this is a great site that I learned lot related to my study. Thank you.

Here I have a question about the Covered Call:

Stock current trading price: 80

Strike price: 80

Call price: 3.39

Call Delta: 0.54

Strategy:100 units of stock, short 100 units of the 80-strike call.

PeterFebruary 10th, 2013 at 5:09pm

Hi CD,

The components you mentioned don't fit the description of a Covered Call strategy.

A Covered Call is;

Buy Stock

Sell Call

Perhaps the middle line of your example is "Buy Stock" instead of "Buy Put"? If so, this is called a Collar.

To answer your questions, however;

A) Correct.

B) If the call is exercised, the stock must be trading above $44, which means the put is worthless i.e. you cannot exercise it.

C) Depends on where the stock is at expiration. If it is below $44 you will keep the premium of 2.31 as the profit on the call option and perhaps lose the put premium. If the stock is below $29 then you could exercise the put and buy back the stock for a profit there.

CDFebruary 8th, 2013 at 7:22am

Great Site. Would examine the following scenario and see if my understanding of the outcome is correct?

Covered call

Sell 44 NUE Call $2.31

Buy put

Buy 29 NUE Put $0.04

Possible outcomes

A) Call exercised (sell NUE at $44/shr) and put expired (lose $4 premium)

B) Call exercised (sell NUE at $44/shr) and exercise put (buy NUE at $29/shr)

C) Call and Put expired (do nothing)

It would seem I could use B) to make $1300 + $231 -$4 and still retain my position in NUE?

PeterSeptember 26th, 2011 at 10:41pm

Hi Abraham, thanks for the positive feedback, always good to hear!

You're absolutely right with the clarification. You would be exercised on the stock and have to deliver it (sell it) at the strike price of $7 while also keeping the premium received when you first sold the call. Your profits will be capped at the strike price.

abraham September 26th, 2011 at 9:03pm

Wanted to say I have learned more from this site than any other site i have seen. Good Job. I do have a question concerning writing calls. So if I own a stock let call it ABC. and I paid $5. comming out to $500 for 100 shares. and I write a call on it with a strike price of $7. and a primum of lets say $1. would that mean I will get $100 dollars for who ever buys the premium and if the stock goes up to lets say $7.50 by the experation date. So would that mean i would make $200 for selling the stock plus 100 for the premium making a total profit of $300 dollars?

MattMarch 15th, 2009 at 3:59pm

Yeah there is no risk if the price soars. The counterparty is obviously going to exercise his option and buy the underlying from you at $45 (assuming the stock is currently trading above $45). Thats the whole reason that the person bought the call option from you, they think that the price of the stock was going to go up. Then they could buy the underlying from you at $45 and sell it on the market lets say at $50, making a $5 a share revenue (profit is limited to how expensive the premium he paid to buy the call option). Since you (the covered caller) originally bought this stock and $25 and sold it at $45, you have made $20 profit and have also been paid a premium for the whole deal.

AdminJanuary 9th, 2009 at 6:22pm

By selling a call on your existing position you are saying the stock will stay stable or sell off slightly and you will keep any premium received by selling the call.

"Start seeing losses on the underlying" - you are long the stock at $25. You sell a $45 call option. The stock has to sell off by 44% before you start losing on the underlying. But you still keep the option premium.

What exactly are the risks if the stock soared? You've sold a call option and have locked in the profit of strike - underlying (plus premium).

PsychocarpDecember 30th, 2008 at 7:29pm

Your last paragraph is clear as mud to me. You made $15/shr in a year and now you want to write a covered call at $45. Are you assuming that the market is going down? I hope so, but you didn't say that. What does "start seeing losses on the underlying" mean? The underlying $15 profit, what? From what spread?

How come you didn't mention the risks if the stock price soared instead of dropped?

Add a Comment