Call Ratio Vertical Spread

A Call Ratio Vertical Spread is long one ITM call option and short two OTM call options.

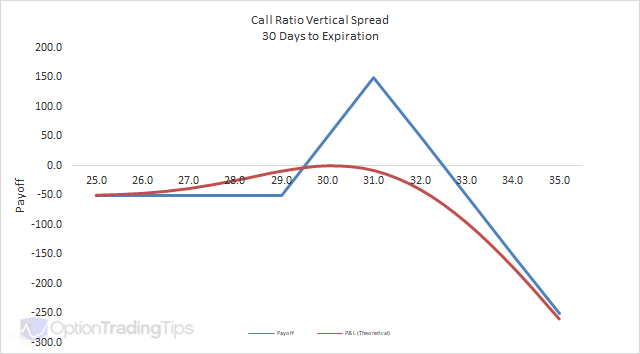

The Max Loss is uncapped on the upside and limited on the downside.

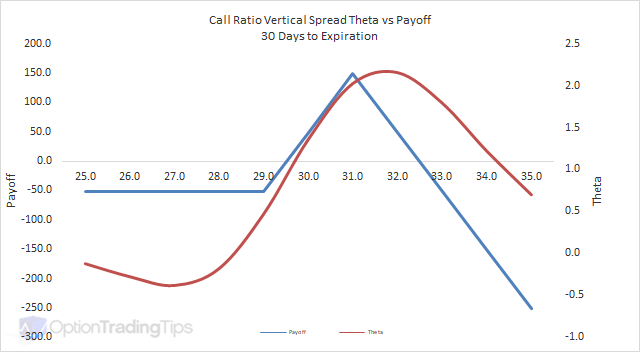

The Max Gain is limited to the difference between the two strikes less the net premium paid.

PeterAugust 25th, 2014 at 4:35am

Hi Adesh,

The description was corrected as Nitesh and I had discussed; the maximum gain being the difference between the two strikes minus the net premium paid. Maybe I've confused your request?

adeshAugust 24th, 2014 at 8:30pm

Nice article.. Yes..I guess Nitesh is right..if it's a debit ratio spread..then money paid is max loss not max gain.. Please correct the article..it's creating confusion..!!

MattMarch 31st, 2012 at 5:04pm

Happened to get into this site.

Netish,

when you executing this strategy, typically yes. Cuz this position commonly ratioed and delta neutural. The ratio does not need to be 1:2, as it is a vol spread.

if you can execute this with credits in your account, it would be a directional spread then. Cuz the delta would deviate from neutral position

Best

PeterSeptember 12th, 2010 at 9:39pm

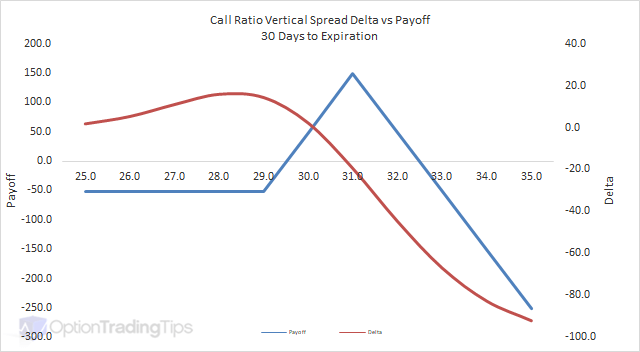

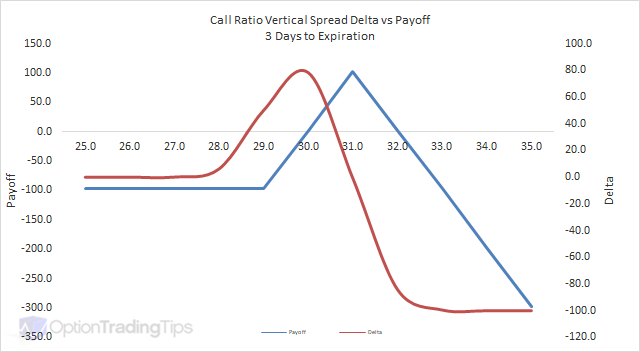

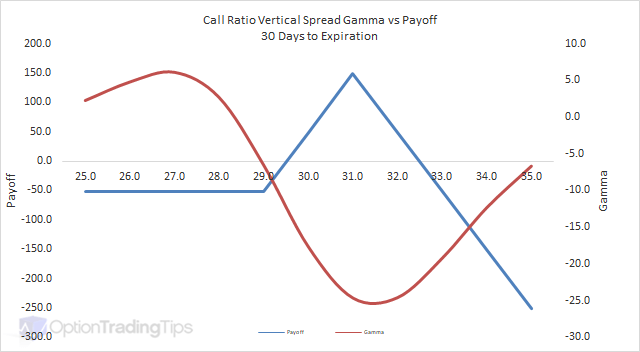

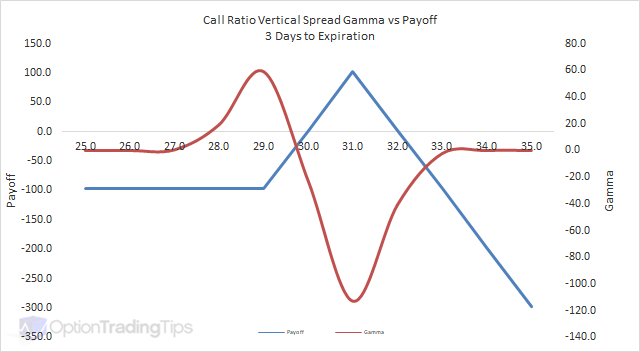

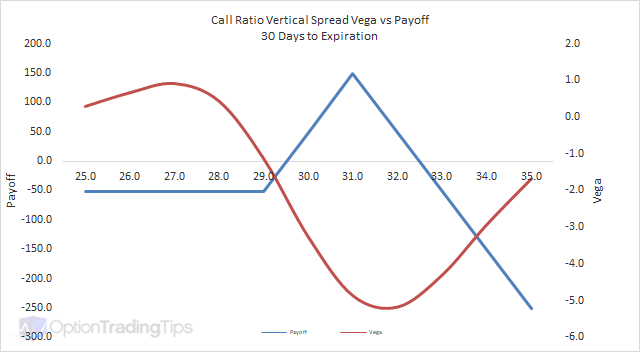

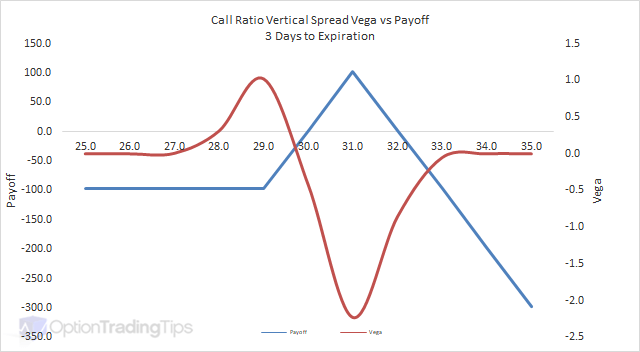

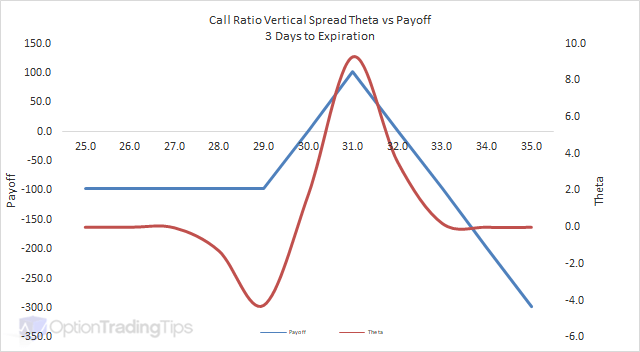

Normally yes, a "long" strategy benefits from increases in implied volatility. However, you'll notice from the payoff graph that this strategy requires the underlying market to remain within the bounds of the strike prices to be profitable post expiration - hence being bearish on volatility.

gaurav tandonSeptember 12th, 2010 at 3:56pm

should'nt a bullish volatility condition be more favourable for a trader going long on tis strategy?

please explain, if im incorrect..

thank you,

AdminAugust 28th, 2008 at 3:04am

Mmm, yep, that was careless. I've made the change as indicated.

I will now review the others for any errors.

Thanks.

NiteshAugust 25th, 2008 at 6:48am

Hi,

I agree. But under Maximum Gain it could not be "Limited to the premium Paid". Paying a premium is not a gain.

I guess Maximum Gain would be Difference between the two strike prices less the net premium paid

AdminAugust 25th, 2008 at 6:24am

Hi Nitesh,

That's right...it will depend how far apart the strikes are what prices you pay/receive for each option.

Having said that, for consistency I've changed the max gain to be limited to premium "paid". I think now it keeps it in line with the comparison to a Backspread.

What do you think?

NiteshAugust 25th, 2008 at 6:00am

Hi,

I am not very clear with this strategy. Under Maximum Gain: You say that the Gain is limited tp the premium received and under characteristics you say that Call Ratio spread requires up front payment ( I assume you mean that the premium received by selling two OTM call option is less then buying ITM Call option).

I am a little unclear about the up front payment. Please clarify?

Thank you

Add a Comment