Characteristics

When to use: When you are long stock and want to protect yourself against a market correction.

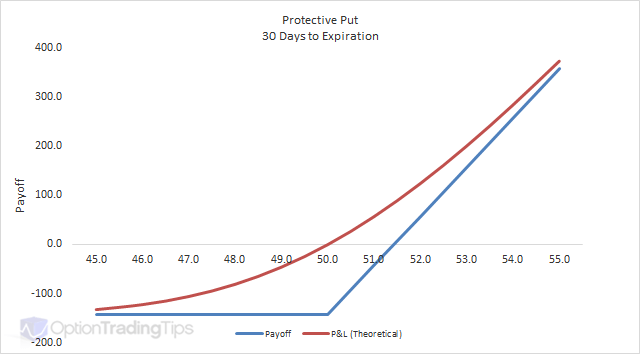

A Protective Put strategy has a very similar pay off profile to the Long Call. You maximum loss is limited to the premium paid for the option and you have an unlimited profit potential.

Protective Puts are ideal for investors whom are very risk averse, i.e. they hold stock and are concerned about a stock market correction. So, if the market does sell off rapidly, the value of the put options that the trader holds will increase while the value of the stock will decrease. If the combined position is hedged then the profits of the put options will offset the losses of the stock and all the investor will loose will be the premium paid.

However, if the market rises substantially past the exercise price of the put options, then the puts will expire worthless while the stock position increases. But, the loss of the put position is limited, while the profits gained from the increase in the stock position are unlimited. So, in this case the losses of the put option and the gains form the stock do not offset each other: the profits gained from the increase in the underlying out weight the loss sustained from the put option premium.

Protective Put Greeks

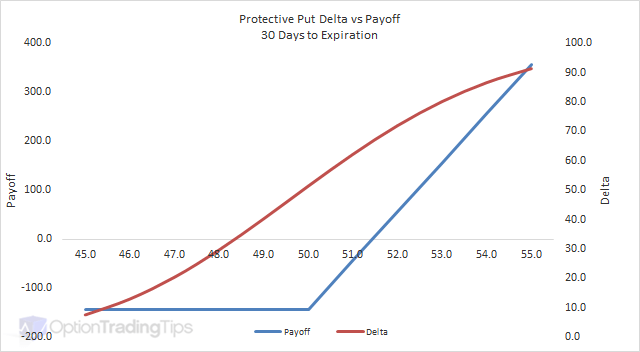

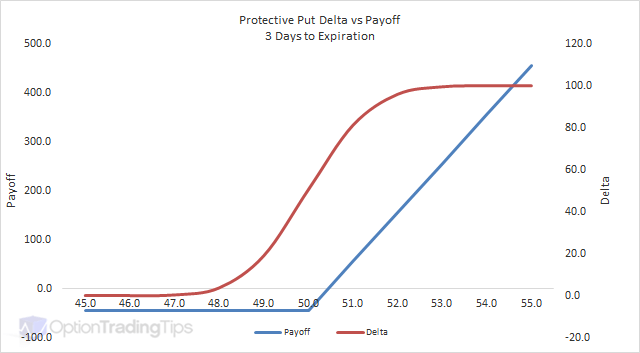

Delta

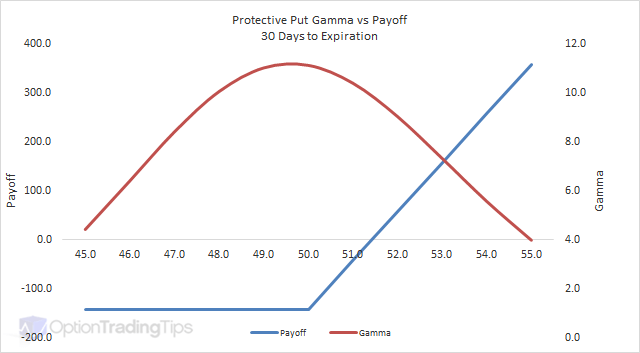

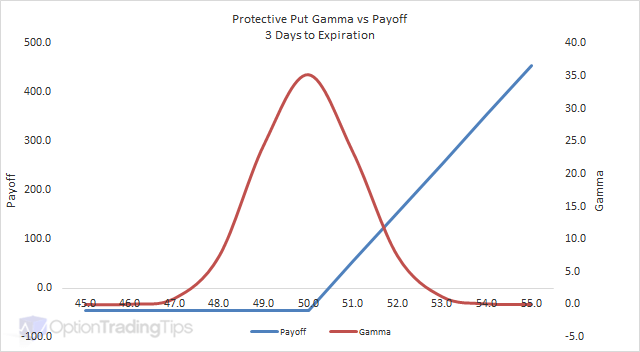

Gamma

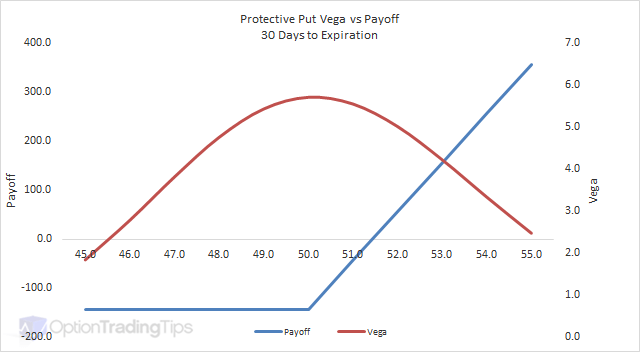

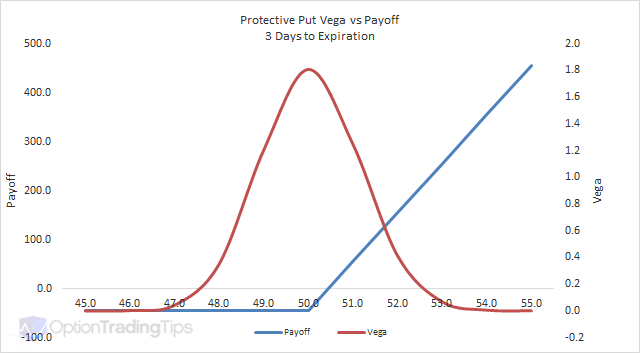

Vega

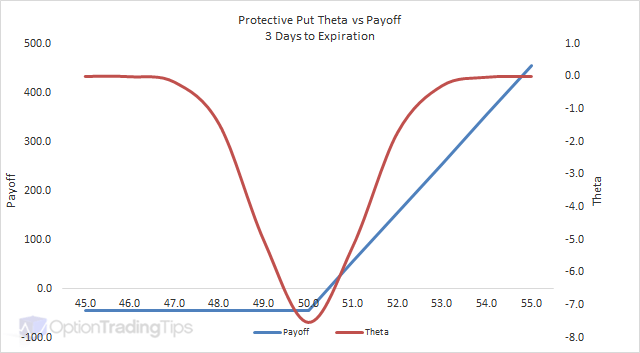

Theta

PeterFebruary 27th, 2012 at 5:27pm

I wouldn't say it is short term bearish - why would you want the stock to drop at all? Sure, your losses have a floor with the purchase of the put but you are net a loss because of the purchase price of the put.

You are bullish short and long term. You want the stock to trade as high as possible - at a minimum past the put strike + premium level. You only buy the put for downside protection "just in case" you are wrong about the upward move.

MichaelFebruary 27th, 2012 at 9:33am

The combination of a owning the stock and buying a put is bullish and bearish. It is long term bullish and short term bearish. If you were only bullish, you would not buy the put. If you were only bearish, you would just sell the stock

mikeMarch 9th, 2010 at 10:51pm

Ok nevermind> after reading a little more i realize thats a long strangle. I actually did a long strangle and a long straddle today and didnt even know i was doing it. It just made sense. thanks for all the great info!

mikeMarch 9th, 2010 at 5:32pm

i use this strategy on almost all of my trades. i buy out of the money calls and puts at the same time. when i buy i set the limit on my put where it pays for the call. the only thing that can hurt me is if it dosent move either direction. would you agree with this strategy?

AdminMarch 16th, 2009 at 5:39am

Hi Matt,

Yes, you're right it is a protective strategy, however, it is still considered bullish because as the stock price rises the delta of the put approaches zero and becomes worthless. At this point (with a worthless put option) your position only consists of a long underlying.

As the stock price declines the delta of the put option approaches -1 and starts to behave like a short stock position and is hence a "hedge".

But the strategy itself wouldn't be called a "hedge" - i.e. just buying the stock and buying a put doesn't just make a hedge as the position is constantly changing as the stock price moves around. It is a protection strategy.

MattMarch 15th, 2009 at 5:36pm

Quick question about this one. This is effectively a hedge right? You are long the underlying and you want to protect yourself in case the price falls You will be able to sell at a certain strike price, protecting yourself from a large loss. Why would this be considered a"bullish" play? Is it just called bullish because you are long underlying? It seems a little confusing because you are protecting yourself, so it doesn't seem "bullish".

Add a Comment