Short Strangle

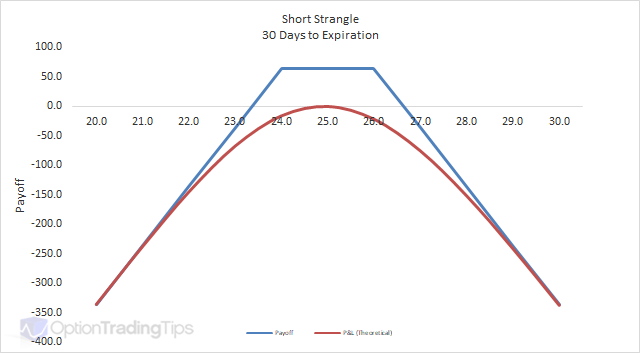

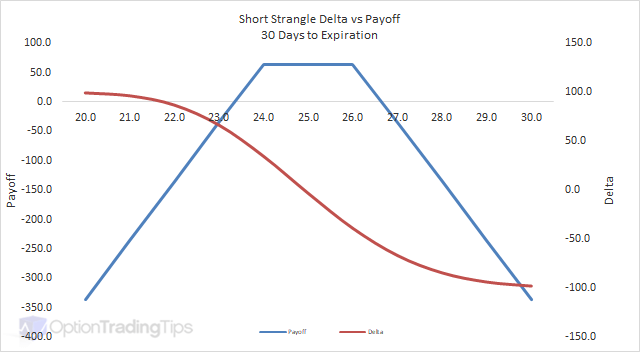

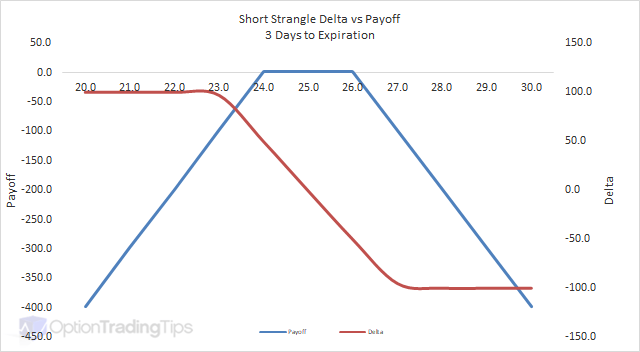

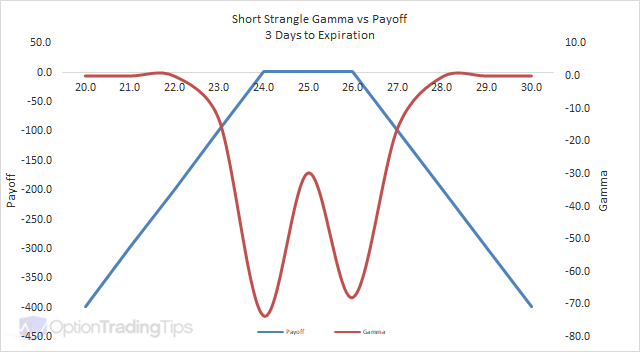

A Short Strangle is where you are short one put option with a lower strike price for every one short call option at a higher strike price. Both options have the same expiration date.

The Max Loss is uncapped as the market moves in either direction.

The Max Gain is limited to the total premium received for the call and put options.

PeterApril 4th, 2012 at 5:36pm

Hi Helena,

Sure, take a look at this screen shot;

[click to enlarge]

This was taken just now on MSFT. An example of a strangle here would be;

Sell 33 call @ 0.09

Sell 29 put @ 0.07

Net premium received would be $16 per contract. The breakeven points would be 33.16 on the upside and 28.84 on the downside.

HelenaApril 4th, 2012 at 3:17pm

Hi Peter,

Is it possible to give an example with numbers using this strategy? I just want to confirm some concepts you have explained here. thanks so much.

PeterNovember 17th, 2011 at 4:17pm

It depends how far out of the money the options are and how close to expiration. If the strikes are 10% either side of the stock price you will likely not have any problems finding a buyer.

RoshanNovember 17th, 2011 at 8:41am

Peter Thanks once you have been very helpful.

just one more question.

I would be using OTM options for short strangle. So what is the probability or even a possibility that I will find a buyer when I get into short strangle.

PeterNovember 17th, 2011 at 4:20am

Hi Roshan,

Yes, for any short positions your broker will require capital for the trade, which is called a margin. The margin is to protect the broker/clearer (and hence the trading counterparty) from large losses as a result of unfavourable moves in the underlying.

RoshanNovember 17th, 2011 at 12:24am

Hi Peter,

I would like to know if i should be having any capital in my account while getting into a short strangle position in any individual stock.

will the premium be credited to my account immediately on entering into the short strangle position.

Add a Comment