Long Guts

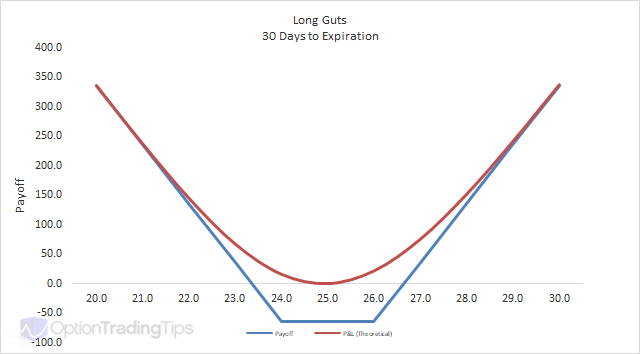

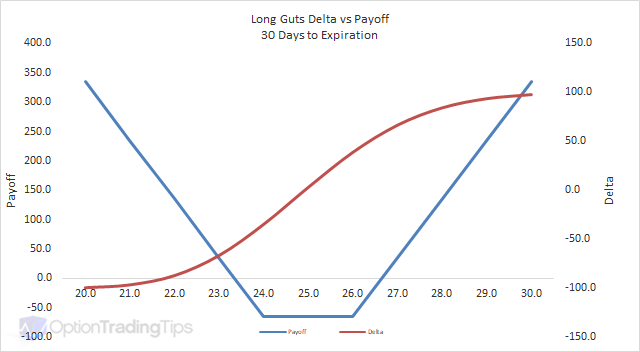

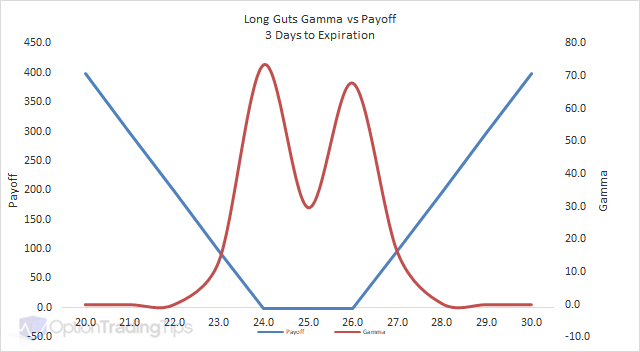

A Long Guts is buying one call option and buying a put option with a higher strike price in the same expiration month.

The Max Loss is limited to the total premium received for the call and put options.

The Max Gain is uncapped as the market moves in either direction.

martyMay 18th, 2011 at 12:14am

Does anybody have any experience using these Long Guts. Seems like we just need to find volitile stocks (or what ever) with liquid options. Any body there?

PeterNovember 16th, 2010 at 9:31pm

Ah yes, correct. I've clarified this in the description now.

IvoNovember 16th, 2010 at 5:52pm

The maximum loss is actually less than the sum of the premiums. At least one of the options will always expire in the money, and give you a "discount" over the sum of the premiums. This explains why the profile does look like a long straddle.

PeterSeptember 13th, 2010 at 8:37pm

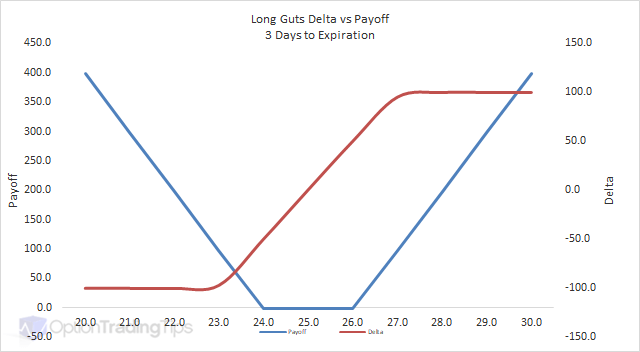

Yep, I would agree. I would always go with a strangle over a guts. The OTM options will gain value quicker and lead to greater % returns over ITM alternatives.

gaurav tandonSeptember 13th, 2010 at 1:54pm

if there's a downward bias (considering your example), then buying an ATM put may be a better choice than an ITM put...

dont you think so...

PeterSeptember 12th, 2010 at 9:54pm

I guess it depends on where the stock is trading and what your view of the stock is. Suppose with the above graph the stock is trading at $27 and has been in a $23 to $27 range for quite some time. You might have a view that the stock will break out of that range and also have a bias to the downside. So you will want that extra kick as the market falls but still want some protection if the market does rally. Whatever way the market goes you may be convinced of it breaking the range of the strikes and hence that's the strategy you will need to establish.

gaurav tandonSeptember 12th, 2010 at 2:08am

A long strangle cheaper will be cheaper than a long gut.

then why would anyone prefer this over a long strangle

PeterAugust 1st, 2010 at 9:02pm

As long as the underlying asset is above (below) the higher (lower) strike at the expiration date - plus premium paid - you will make money.

anjanappa chintamaniAugust 1st, 2010 at 1:21am

suppose market either moves one side gain another side loss but how to earn money

sanjayJune 24th, 2010 at 4:22pm

sir , please give an example with every strategies .this is easier to me understand quickly

SteveSeptember 29th, 2009 at 3:55am

You are such an option gun

GauravAugust 28th, 2009 at 5:53am

Hi there,

Sir can you explain this strategy GUTS with an example because i not getting it completely..

NiteshAugust 25th, 2008 at 6:10am

Thanks for the explanation. Appreciated.

AdminAugust 25th, 2008 at 5:34am

Hi Nitesh,

I see what you're saying and it would be true if the call were purchased at a higher strike price. However, I say that the put is purchased with a higher strike price, not the call.

So, the definition is for the put to have a higher strike price AND for both options to be ITM.

Know what I mean?

NiteshAugust 25th, 2008 at 3:20am

Under components you say, that Buy one call option and buy one put option at a higher strike price. However, if you that in Guts (as mentioned under Characteristics) that you buy in the ITM options it doesn't hold true with the call option at a higher strike price. If you buy a call option at a higher strike price it will be OTM call option instead of ITM call option.

Let me know if I am correct else please give me a explanation.

Thank you

Add a Comment