Characteristics

When to use: When you are bullish on market direction and also bullish on market volatility.

A long call option is the simplest way to benefit if you believe that the market will make an upward move and is the most common choice among first time investors.

Being long a call option means that you will benefit if the stock/future rallies, however, your risk is limited on the downside if the market makes a correction.

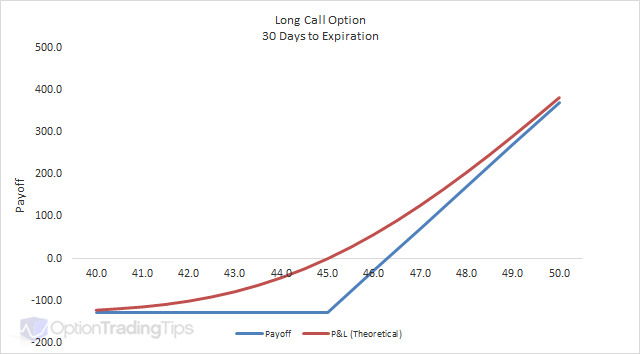

From the above graph you can see that if the stock/future is below the strike price at expiration, your only loss will be the premium paid for the option. Even if the stock goes into liquidation, you will never lose more than the option premium that you paid initially at the trade date.

Not only will your losses be limited on the downside, you will still benefit infinitely if the market stages a strong rally. A long call has unlimited profit potential on the upside.

Long Call Greeks

Delta

Gamma

Vega

Theta

TimataoMay 18th, 2015 at 7:52am

Hello Peter

More info. The large block traded at .65 ( I believe the stock price was around 51 at the time). The option did expire barely in the money. I believe the actual close was 52.55. The aftermarket was the interesting point when 999k traded at 52.61. So the market maker who sold the calls did owe the stock at expiration. Normally aftermarket trades 3-4k shares so the big block was unusual.

PeterMay 17th, 2015 at 10:17pm

Hi Timatao,

The seller of the calls would have been a market maker(s) for sure (being on the ask when the trade occurred) and with such a large trade would have been hedged with stock at the time of trade. But regardless of that, the call was out of the money on the expiration date so there wouldn't have been anything to cover as the option expired worthless meaning the seller keeps the premium. As the option's delta approached zero the market maker would be selling stock to keep delta neutral so perhaps the last block was what they had left to offload? Hard to say, but seems a reasonable guess.

On the buy side though...I see that earnings were out on the 23rd April. Seems the buyer had some good info prio to the announcement? The options were looking good for a while after the release - the stock went from 47.72 on the 22nd April to 51.51 (+8%) after the announcement on the 23rd and then 54.03 on the 24th. Hard to say how much they would have made on the premium though as I don't know where they bought it - maybe they paid 0.20, 0.30? At 54.03 it's intrinsic value alone makes the option worth at least 0.53 though.

Another reason to buy the calls so aggressively around that time (in addition to the expected price rise) might be to receive the dividends. The previous ex-date for DNKN was on the 5th March (div of 0.265) with a payment date of 18th March. Perhaps they bought the calls before the ex-date to qualify for the dividend, exercised the options to take delivery of the stock before the ex-date, waited for the stock to jump and sold the stock and still received the dividend on the payment date?

DNKN Dividend History

DNKN Earnings Information

TimataoMay 16th, 2015 at 3:51pm

Peter

Wanted to get your insight on May expiration on DNKN 53.5 call options. A big player purchased 16k contracts and paid the ask price a couple months back. I think the stock is undervalued so I purchased some of the same contracts and sold some 55 against.

The expiration was interesting as there was still 13k open interest on the last day. The stock traded up to 52.5 at the very close and then in the after hours a 999k block traded at 52.61. Did the seller of the calls not have the ability to cover and somebody covered his position at 52.61? This was such a large block I was wondering why somebody would do that if they wanted the stock? and what is your opinion of what this could mean for price action going forward?

Timatao

DennisApril 24th, 2015 at 2:56am

Hi Peter,

The reason why you should not exercise ITM calls early (except in some cases prior to dividend) is you give up the interest value included in the price (I know, not very much nowadays with rates close to zero).

Also, if you want to maintain your bullish/long position, by exercising you create more risk because you basically swap your 100%-delta call with stock... and because the stock will have a higher price than the call, you potentially lose more.

If you do want to exercise your calls early, please check any residual time value/premium left... if there is any, it's better to sell.

D

PeterNovember 3rd, 2014 at 5:28pm

Hi SG,

I'm not sure why someone would say that premature exercise is not a good idea. If the stock is approaching its' ex-dividend date and you want to receive the dividend, then you would definitely exercise early to ensure you're holding the stock through the ex-date to be eligible to receive the dividend.

But if your call option is making a profit and currently ITM then I see nothing wrong with squaring it off by selling the same amount of contracts back to the market to realize the profit.

If you were instead to exercise the option first, you would be utilizing more capital to take delivery of the stock position before selling the stock back to make the profit.

SGNovember 1st, 2014 at 6:35pm

Why is it said that premature exercise is not usually good? If I am ITM, and current premium is 100% ( or a higher multiple of 100%), would I not make money by selling the call? Is that what one means by squaring off the position?

PeterOctober 29th, 2014 at 5:50pm

Hi Warren,

Why sell it? If you're only going to receive one cent for it you may as well hold onto it - you have another 3 months for the position to fatten in value. Plus, your brokerage costs for selling at one cent may actually be more than the value received by selling.

If I were you I'd just hold onto them; it's too small value for selling considering the time there is left in the option.

AVP have their earnings out before market open tomorrow too - let's see what happens after that.

WarrenOctober 29th, 2014 at 11:04am

I have AVP 20 Jan 2015 calls which are worthless. How do I take the loss in 2014 (nearly $20,000) as there is no market for them even for .01? I use ETrade and they told me to just try selling each day at market. Considering the stock is now only $11, no one will be buying!

PeterOctober 24th, 2014 at 4:18pm

Hi Rony,

It's a difficult question to answer as it depends on just how bullish you are and what the delta of the option is (i.e. how much the price of the option will change relative to changes in the underlying price).

If the option is very close to expiration then an ATM option will be more attractive than an OTM option.

However, if there is decent time to go then an OTM option will most likely provide the highest return on investment (premium paid) provided the underlying makes a decent move upwards.

The best way to understand though is by simulating moves in the underlying and checking the theoretical imapact it has on the prices of the options. You can use my option pricing spreadsheet for this.

Give it a go and let me know how you go and if you have any questions.

ronyOctober 22nd, 2014 at 6:06am

Let's say, for instance, I want to maximize my profit with a call option of a stock I'm pretty sure will go up tomorrow. Let's say I don't mind the risk. Which call option should I buy? One that is exactly ATM? One that is slightly OTM?

Thanks!

PeterSeptember 29th, 2014 at 7:24pm

Hi Timitao,

Yes, I think selling ATM/OTM is preferable to selling another ITM call; there would be little difference in selling a slightly higher/ITM call to simply exiting your existing ITM position.

A long deep ITM call is like being long the stock. So you have to have a view on the direction on the stock; if you are no longer bullish and think the stock might turn, then best exit your option position. If you are neutral to bullish, then the most appropriate strategy is to sell ATM/OTM calls on the back of your existing position for premium and profit limit.

timitaoSeptember 29th, 2014 at 9:55am

My thinking is with a decent long position and no intentions on taking delivery of shares due to capital constraints (basically a weak long position), selling some upside calls would help reduce risk while collecting additional premium. And while the goal would be to just flatten the position, if I wanted to take the position to the last day the volatility and wide Bid/Ask could be dangerous.

I just wanted to make sure these would offset on settle as If the upside calls end up being in the money, trying to by back the higher priced calls while selling the deep in the money calls on the last day could be problematic. If the upside calls dont end up being in the money, I would just collect the premium.

I would be interested in your view, as I think selling out of the money calls (that could end up in the money) on up days, against the deep in the money long position could be gradual way to reduce exposure to a sharp downfall.

Timitao

PeterSeptember 24th, 2014 at 8:15pm

Hi Timitao,

Yep, you can do this. A long deep in the money call option will have a delta close to (if not equal) to 1. That means that the option behaves just like the underlying stock in terms of value change. So selling another call option with a higher strike price will be like a covered call on a long stock position.

Just a question - why sell another in the money call? If you want to lock in profits on your existing call option then you can just sell the same option back and close it out. If you sell an out of the money or in the money call you will still receive some premium and lock in a higher exit price if the market rallies.

TimitaoSeptember 24th, 2014 at 11:40am

Hello

If I own a long in deep in the money option can I sell a similary expiration dated call option at a higher price (still in the money) and let them both go to expiry?

ie in an example like Priceline where I wouldn't have the capital to cover 1000 shares, would selling the other call offset on expiry?

Thank you

PeterAugust 1st, 2014 at 10:00pm

Hi Eresh,

The blue graph shows the payoff at the expiration date of the option while the pink line shows the theoretical P&L of the position 60 days prior to the expiration date. As the time to expiration approaches the pink line moves closer to the blue line.

EreshAugust 1st, 2014 at 6:27pm

Hi Peter, I don't understand how to intuitively predict the P&L + 60 days curve. Could you explain please?

PeterJune 22nd, 2014 at 9:50pm

Hi K.N, it's a good question and I'm not too sure either - let me investigate and come back on that one.

K. N.June 19th, 2014 at 12:48am

Hi Peter,

I have a quick question on the long duration of a call (or put) option.

Assuming I buy a call for APPL, with strike price, say 200, expiration 7/2016, for 50c a contract.

Then in July of year 2016, APPL price is 500 (hypothetically) and the option chain table only shows strike range from 400 to 600 with 10 dollars increment; it doesn't even show a strike price of 200..

Are you still able to sell your call (or put) if it's not shown on the option chain table?? How can you tell what is the asking/bidding price for your contract for that strike price?

I'm sorry for the amateur question, I just don't know where to turn to to ask.. :)

Thank you. :)

PeterApril 23rd, 2014 at 7:06am

Hi Steve,

Sounds like your second order was taken out by a market maker - that is, their electronic trading system must have had an automatic sell level at around the price of your second buy order, so as soon as your price reached the market it was immediately and automatically taken out.

PeterApril 23rd, 2014 at 7:05am

Hi Joey,

It depends on the bid/ask spread. If the options are liquid and the bid/ask spreads are tight, then yeah, I'd just be buying at the offer price to get set straight away rather than risk losing out on getting in on the position. Also depends on your trade too - if you expect to hold the trade for a few days at least then this margin of paying up probably isn't going to mean much in the long run.

steveApril 21st, 2014 at 9:05pm

hello peter,

my question is similar to joey's..i have excercized two calls on a stock which is trading at 4.20..i bought june calls @ 3.00 w an ask price of 1.40..i bought 5 contracts each..i do not understand it asking for my limit price..originally i placed it at the 4.20 stock price but it stated that it had to be in .1 increments so i then used the ask price n it completed..on the second order i used a number .05 cheaper than the ask price n it cleared? later i practiced w that limit number n it accepted right down to .10? i did notice that the price of the transaction was very small but declaring the limit price has me confused n want to understand it before i make anymore options trades..

thanks, steve

JoeyApril 21st, 2014 at 11:28am

Hello Peter,

I have question concerning two long call positions I'm attempting to open.

I normally Buy to Open, slightly in-the-money, at the Bid price.

I am noticing that it takes time for my orders to leave the Open status and become active.

Does this mean that my limit price set at Bid is too low? What would you reccommend in this scenario? Increase my limit closer to or at the ask price?

I missed the opportunity of gaining a few points because of my order not activating, I also run the risk of the order getting processed too late (before a reversal).

Much appreciated,

Joey

JoeyApril 12th, 2014 at 12:21pm

Thanks a bunch Peter you explained it perfectly.

I seem to have a fairly succesful strategy in the making. I'm operating out of a virtual account at the time and plan to go live by July.

I don't see there being too many differences between the virtual and actual, but any advice you have will be welcomed. :)

Take care,

Joey

PeterApril 11th, 2014 at 5:20am

Hi Joey,

Thanks for posting - although not sure I agree with genius though ;-)

The amount you're seeing, which I assume is $4,400, is the total proceeds you will receive as a result of selling the options i.e. 5 x 8.80 x 100 (100 = multiplier).

The difference between this and your purchase proceeds will be your profit of $900.

Also, this transaction is a closing trade - where you are reversing an existing position. This is different to "exercising" the option. An exercise in your case (long puts) would be to deliver stock (sell shares) to the seller of the put option at the exercise price.

Let me know if you need anything else.

JoeyApril 10th, 2014 at 12:42pm

Hello Peter,

Thanks for sharing your genius.

I have a question on a PUT position that I am attempting to exercise. I Bought to Open 5 OEX PUTS and I am now in the money. When Selling to Close my preview screen shows that the transaction will cost me over $4,000. Thats more than my original opening transaction and way more then the $900 profit I'm trying to realize.

Could you explain what exactly is taking place?

Here is a copy/paste of that line item:

Action Qty Symbol Desc Contract Size Price Duration All or None

SellToClose 5 OEX AprWk4 820 Put S&P100INDEX 100 Limit 8.80 DayOrder Off

Thanks again,

Joey

PeterMarch 4th, 2014 at 4:43am

Hi Greg,

If your position in the option is profitable you can simple unwind the position by selling back in the market; you don't have to exercise the option and sell the stock to profit.

If it's moments before expiration then the volatility component will be so small it would be negligible; the option will be trading very close to its' intrinsic value.

Let me know if anything is not clear.

GregMarch 1st, 2014 at 11:05am

Peter,

Amazing site...Thank You! A newbie question-

If I buy a long call and the stock price goes up above the strike price is it true that I maximize my profit by simply letting the option expire assuming I have enough margin to buy the underlying stock?

Alternatively, I could sell the option moments before expiration. Would I then make a similar profit, minus a premium for not having to buy the stock?

If so, how big is that primium (controlling for volatility)? Even if the price were guaranteed to remain the same between my sale of the option and its expiration, I must be paying for the luxury of not tieing up my capital in the stock, but how much?

Thanks!

Greg

PeterFebruary 11th, 2014 at 3:35am

Hi Fred,

You should look at Interactive Brokers. You can sell options naked provided your have enough capital to cover if exercised.

FredFebruary 9th, 2014 at 11:24am

Hi Peter,

I've learned so much from this site! Thank you.

Question: I was told by CITI, that they would only sell me "covered" call/put options. Can you recommend some brokers that will sell me "uncovered" options?

Also, I like a broker that will "assist" me at expiry with my "uncovered" positions

Thanks again

PeterJuly 16th, 2013 at 6:12am

Hi Phil,

Yep, most likely. However, most brokers also provide leverage with your account - so even though your cash balance is not enough you'll be loaned the excess to cover your position. It does depend on the broker though so best to check with your broker or ask this before openning your account.

PhilJuly 14th, 2013 at 2:36pm

Peter,

If I buy a call at strike price below current stock price (deep in the money), since I am very bullish.

What if at the expiry day the price of stock is much higher that the strike price but not enough cash balance to exercise and then sell for profit. Will the broker automatically execute and deposit the profit in my account (since I do not have a margin account enough to support the purchase).

Thank you,

Phil

PeterJune 23rd, 2013 at 7:25pm

Hi Nick,

That's right - your max loss with a long (purchased) option is limited to the premium paid. This is the same for both calls and puts.

nickJune 22nd, 2013 at 8:27am

Peter,

If you long (purchase) a call or put and let them expire is that how you limit your loss and just lose the premium?

I.E.- You buy a call or put option and before the expiration you are at a loss greater than your premium. I have the choice to let the option expire and I will only lose the priemium and not greater than premium?

Furthermore, if I am correct. Does this only apply to long call and puts as oppose to shorts?

PeterMay 16th, 2013 at 7:51am

Hi Chad,

Your position will be updated to reflect the change i.e. your number of contracts will be multiplied by 5 but the strike price will be divided by 5. So your effective position after the split has the same exposure as before the split.

ChadMay 15th, 2013 at 7:36pm

What if I buy a call option for ABC 425 june 13 but the stock splits 5 for 1?

PeterAugust 13th, 2012 at 7:51pm

Hi Akin,

Sure, you can find the sheet here.

AKINAugust 13th, 2012 at 8:31am

Please, can you provide excel sheet of the detail graph and how you arrived at the figures of the computation

JasonMay 1st, 2012 at 12:40pm

Peter,

Is it better to buy a long call at a lower strike price to benefit off the exercise or selling the call option or better to buy a long call with a higher price with a lower call option? I know the risk is much less at a higher price but if you chose the lower strike and the stock doesn't move much you could exercise and hold the stock to sell on the market.

PeterApril 23rd, 2012 at 5:54pm

Hi Mike,

Nice work on the puts!

Yes, sounds like you have closed the position by selling back the puts that you owned. Your brokerage statement should show a zero position for this contract now.

Your calls are quite out of the money - so time decay will definitely start hurting your position with only a few weeks to go. AAPL's earnings report is due tomorrow though, so you'd be hoping for a bullish number ;-)

MikeApril 23rd, 2012 at 5:09pm

Hi Peter,

I bought option contracts a few weeks ago on APPL, $695 May '12 Calls and $545 May '12 Puts. I don't own the stock.

I sold (Sold to Close) the same Put contract this morning for a profit since the premium went from $9.60 to $18.00. Did I essentially close this position? I think you answered it earlier in another person's question, but I want to make sure that I don't have any more risk there. I decided to take the profit b/c I wasn't sure if it would get this low again. I don't have a risk if it actually gets in the money ($545) since I closed the contract position by selling it, right?

I still own the $695 May '12 call, hoping that it takes off after earnings and I can make a profit. Obviously, time is not on my side, so I should prob look to get out at a certain price and time. I was thinking if it trades sideways up/down with not much change in two weeks, I might be better off just taking a loss and not risk losing the whole premium?

Thanks for the great site!

Mike

PeterApril 22nd, 2012 at 7:39pm

Hi Lorenzo,

Yes, the implied volatility is a lot higher than where it was a month ago - over 50% higher for the puts. The calls are also higher so the market is indicating that this week will be a volatile one. I'm not sure about tanking though - if the puts were significantly higher than the calls then that I might be inclined to say that but they're both showing signs of strength.

LorenzoApril 20th, 2012 at 12:23pm

Hi Peter,

Noticing something a little unusual. I have come to like to "sell to open" AMZN put options usually the weekly on the Friday before. I usually pick a strike price around $5 to $10 under what the underlying stock (AMZN) is trading at. This week (today Friday 4/20/12) I'm noticing that the price for 4/27 puts (for $180 thru $190 strikes) is quite pricey/high as compared to what I'm used to seeing for "like" historical comps. Should I see this as a sign that Amazon is going to tank at some point prior to 4/27 expiration. Especially in light of the fact that Amazon is reporting earnings between now and then? (on April 26)...and is this "tanking" theory of mine usual for any stock (regardless whether it's reporting earnings or not) when the put prices are so inflated as compared to the prior comparable weeks?

Thanks!

PeterApril 9th, 2012 at 6:02pm

Hi Curtis,

The reason that there are often two strikes listed in the same expiration month is because of Weekly Options. Weekly Options are options that are listed on the Monday and expire on the Friday of the same week.

You can tell by date, which is part of the ticker you pasted;

AAPL120413 - the first part of the ticker is the stock code followed by the expiration date, which is 13th April 2012 (120413 - YYMMDD).

PeterApril 9th, 2012 at 5:52pm

Nice trade DoSSlar$! Congrats!

CurtisApril 9th, 2012 at 10:11am

Hi Peter, Great advice on this site. I have a question about the following identifications. Both of these are for a buy to open call $650 strike price. The first one was selling for $3.29 and the second for $7.55. Why the price difference for contracts that are for the same strike price?

AAPL120413C00650000

AAPL120421C00650000

Thanks

DoSSlar$April 4th, 2012 at 9:43pm

Peter,

I cannot thank-you for the basic confidence you have provided me with simplistic approach to a common person on the option, let me share the good news on my first 3 long bullish single option calls, i made on AAPL all three of them after closing gave me a net profit of average 250%, i could have held it a little longer and closed it on the March/April calls, looking at the recent increase in the volatility I decided to let it go i.e "Closed out my positions". I still feel my other options would be ok.

PeterMarch 26th, 2012 at 9:04pm

Hi SS,

Great trade, congrats! Yeah, it's really hard to advise as the decision to exit or continue is really up to you. Sure, there will be some time decay especially if the option is out-of-the-money and close to the expiration date. So, if you are happy with the profit so far then it might be a good idea to exit and then either buy another call further out or look for another opportunity.

PeterMarch 26th, 2012 at 7:35pm

Hi Edna,

If the option is physical settled, which American stock options generally are then when the call option expires and it is in-the-money, the position will be automatically exercised and converted into a stock position. That means that you will see a long stock position with a price equal to the strike price of the option.

PeterMarch 26th, 2012 at 6:56pm

Hi Chris,

Apologies for the late response - I was traveling with work.

Seems like a great trade there! When to get out is entirely a risk/reward decision best left up to the trader, which will be determined by your view of the market. If you think the stock still has legs then sure, hang onto them. But remember also that the more in-the-money a call option is the closer its' delta is to +1 and therefore it will move in price in the same proportion as a stock.

So, holding an in-the-money option is just like holding the stock outright.

I'd be pretty happy with a profit like that though!

SSMarch 21st, 2012 at 9:46pm

I am new to options but am finding it to be very interesting. My question : On 3/15 GMCR was trading at 51 and I bought Apr 55 calls at $1.80. Today the stock went steeply up and so did the call option - at one point went up as high as 5.22 and now ended the day at 3.55. I believe GMCR has more upside until Apr 21 and could well be close to 60 with the big move today. Should I simply continue to hold onto the calls or would it have been better for me to have simply sold today in the high 4s. I am mainly concerned that the time decay may erode the value of the option faster than the appreciation in stock price and am unsure how to factor this in a simple manner. Thanks again for your wonderful opinions.

ednaMarch 14th, 2012 at 4:09pm

Hi,

I'm in the money on call options which are coming toward expiration. The stock is still moving up and I'm not sure if I should get out "sell to close" or just let the contract expire. Could you please explain what happens with an in the money call option when you let it expire. Thanks!

ChrisMarch 14th, 2012 at 3:12pm

Hi Peter,

I bought my first call option in January. I sold my Apple shares at $510 and purchased the equivalent May 15 $550 calls at $13. These are now worth $54 but I still have two months left and I don't want to take possession of the shares. How do I know when to sell? I assume if I wait to just a few days before May 15, I will lose some premium. My thinking is to let it run till about 3 weeks before expiry, then sell to close. What do you think?

PeterMarch 11th, 2012 at 7:24pm

Hi HK,

If you own the call option you don't have any exercise risk. The call buyer has the right to exercise the option so it is the seller of the call option that carries the risk of being "called" or assigned.

If you bought the call option for $0.10 then your risk is limited to the amount paid, which is $10 (0.10 x 100).

HKMarch 6th, 2012 at 12:55pm

OK, so this may sound stupid but I want to know the risk of owning a call option. Assuming I buy a call option at $.10, and 2 months later that call option is trading at $.25 and I want to sell my call option. Then, would I be obligated to sell the underlying stock if the purchaser of the $.25 decides to exercise?

PeterMarch 5th, 2012 at 5:56am

The market maker doesn't "have" to buy it back, but it's their business to make money providing two way markets. They have a theoretical edge in buying the option and hedging it with the stock.

If you don't have enough money in your account to cover an exercise your broker will probably borrow the stock for you and then sell it back immediately at the current market price.

MarcMarch 2nd, 2012 at 3:33am

Does the market maker have to buy the options back before or on the strike date?

Say I buy an $11 call option in the money for 3.60 on a march 17 option when its march 2nd. The stock is trading at $14.90 when I buy it. The stock now rallies and goes to 15.50. is my option now worth 4.50 and who' gonna pay me for it if I try to close it? Let's say I dont even have the money to buy the stock in my account. Do I risk a house call of $1100 per option or be forced to sell some shares out of my portfolio to cover and then forced to buy the stock at $11 a share on March 17 if no one buys my option? It's a good deal but what if I can't cover that amount? What if I have 10 contracts. Will I have to buy $11000 worth of shares if I cant find a buyer for the option to keep from just watching the options expire and losing my $3600.? (10 contract at 3.60 ea.) How does that part work.

All these training videos talk about what a call & put is but no one says who is gonna buy it if I try to close it. Can the market maker just ignore it and let it expire if stock volume doesn't merit using all the calls and puts he has sold on the strike date?

PeterMarch 1st, 2012 at 4:40pm

Hi Zach, yes, you're example is correct!

PeterMarch 1st, 2012 at 4:39pm

I appreciate the feedback D0SSlar$!

ZachMarch 1st, 2012 at 4:01pm

I know you probably answer this many times and reading things I seem to have an understanding but option trading seems really profitable and that usually means to good to be true for me. Lets say I want to buy 5 contracts of XYZ at 1.10 option price. I would pay a premium of $550. Now lets say that the option price increases to $2 the next day. I could then sell my options and make a profit of $450 over the premium? $2 x 5 contracts= $1000-$550 for premium correct?

D0SSlar$March 1st, 2012 at 1:09am

Peter,

MY sincere thankyou for the excellent explanation for newbie in option trading. The most important learning i got from you that is the difference between "Closing" and "Excercising" the option, coming from a trading "real underlying stocks" , a new option trader need to understand that "Buy" a Call/Put option is a just a "Right/Obligation" between a seller and buyer, to make a "deal" a "fixed price" (Strike price) for the stock.

A "Seller" or "Buyer" depending on which side of the the deal he/she is standing can "let go" and "walkaway" i.e ("Closing") and walk away with a "Premium profit" or "Premium Loss" or "Excercise" (i.e "Take the delivery of the actual stocks -long)...what a great concept, the t of the Greeks andother stuff is basically a "barometer gauge the pulse of the underlying stock option price.

Bottomline once the trader buys the option contract, the "contract" behaves exactly like a "Stock or equity" from a technical perspective.

Thank you

NewbzFebruary 29th, 2012 at 8:10pm

Thanks for the help, Peter.

Options trading looks like a good fit for someone like me who has a small amount of risk capital but still wants to invest. I want to get as much info about options as possible.

PeterFebruary 29th, 2012 at 6:39pm

Correct, the new buyer of the option will exercise his/her contract against another participant who is short the option.

Yes, the long/short terminology applies to both call and put options.

NewbzFebruary 29th, 2012 at 5:54pm

Peter,

If I understand you correctly is this what you're basically saying:

1) I buy an Options Contract for $100

2) The value of the contract goes up to $110

3) I sell the contract and make a $10 profit.

4) The new owner of the contract exercises the position and I'm not the one covering it.

Does this scenario apply to both Call and Put options I "long" (if I'm using that term properly, I mean "buy")?

PeterFebruary 29th, 2012 at 4:06pm

Hi Newbz, if you buy and then sell the same option then you no longer have a "position" and hence cannot have your option exercised.

You can only be exercised when you have a short position in an option i.e. you've sold the option without first holding the contract.

NewbzFebruary 29th, 2012 at 3:23pm

This is going to sound like a dumb question, but I can't get a clear answer on it:

If I buy an option then sell the option, does that mean I have to cover the option if the new owner exercises it or does the one who originally wrote the contract cover it?

PeterFebruary 28th, 2012 at 6:48pm

Congrats on your first trade Brian! How did it go...did you make some money?

PeterFebruary 28th, 2012 at 6:46pm

Hi Sam,

The options that are deeper in the money will have higher premiums than the options closer to the current trading price, so I would be inclined to sell those first. Unless you have expectations that the stock will trade higher, then you might want to consider holding and selling later.

BrianFebruary 28th, 2012 at 1:59pm

Hi again,

Sorry for the confused question earlier, I figured it out. A bit of jitters as this was my first Options trade. Thanks!

SamFebruary 28th, 2012 at 11:19am

Peter,

If I have two call options under my employee stock option plan each with same expiration date but different strike prices, which one of these do I sell first (assuming I want to sell before expiration). All of these are in the money. Do I sell the one deeper in the money with lower premiums or the one closer to the trading price with higher premiums?

Note that this is company stock option grants and there is no up front capital. My guess would be the one closer to the current trading price of the stock as those have higher premiums.

Just wanted to confirm.

Thanks,

Sam.

BrianFebruary 28th, 2012 at 8:51am

Peter,

Your site and comments are some of the most useful I have found online, so thanks for that.

I have a question regarding a call option position I would like to close. It appears that I could sell with the stock under the strike price, but make $3 per share on the premium. Would it not be better to sell for the premium versus hoping that it surpasses the strike by enough to match that gain?

Thanks!

PeterFebruary 26th, 2012 at 4:26pm

Hi RJay,

1) Don't worry about the volume - if the price is right, there will always be a buyer. If you must get out of the position, at worst you can enter an order to sell at below intrinsic value where you will for sure find buyers.

2) The market price of the call is dependent on two main values: intrinsic value and extrinsic value. I.e. the price of the stock now and the expected volatility of the stock until the expiration date.

RJayFebruary 25th, 2012 at 10:16am

Great site!

Question: I bought 2 calls @ $2.80. The call is for a 31$ strike price in July (its at $32 right now), I see there are only 13 contracts under volume (2 of them are mine).

1) With such low volume, is it guaranteed I'll be able to sell my calls?

2) With such low volume, whats driving the price of the call? I am speculating the stock will rise at least to $35-$37 by July.

PeterFebruary 22nd, 2012 at 5:48pm

Hi Curtis,

First answer:

If you sell the option (i.e. close the option position) then your profit will be the difference between the price (premium) you sold the option minus the price you paid for the option. Let's say that when the stock was trading at $530 like you describe that the option is trading at $55. If you sell back the option then your profit will be $55 - $37.65.

You are confusing "exercising" the option and closing out the position prior to expiration.

If you were to exercise the option (i.e. convert the option to stock), then yes your profit will be $530 (market price of stock now) - $515 (price that you took delivery of the stock for) - $37.65 (premium initially paid for the option).

Second answer:

Same as above - if you sell the option back instead of exercising it for stock you make/lose only on the transaction of the option - not the stock.

I would say that if you are very bullish on a stock then you are better placed to buy deep out-of-the-money call options as the % gains are greater if the stock does reach the levels anticipated.

Let me know if anything is unclear.

CurtisFebruary 22nd, 2012 at 11:54am

Hi Pete, First thanks for offering some great advice on here. I have recently become interested in buying call options but I am still a little unsure about several things.

First example: ABC trading at $510. I can buy a $515 strike price call option for $37.65/share for july 21, 2012. Say by july 1st stock is trading at $530. Now when I sell my option before the expiration date I will make money on the $515 and $530 difference ($15 per share). But I assume the strike price will be less due to time decay, so I would lose money on this. Correct me if I m wrong.

Second example: ABC trading at $510. I can buy a $500 call option for $47.05/share for july 21, 2012. Say by july 1st stock is trading at $530. Now when I sell my option before the expiration date I will make money on the $500 and $530 difference ($30 per share). Plus any increase in the call option price.

It seems to me that if you are very bullish that a stock will climb you would be better to buy a stock where the strike price is below the current trading price. Any thought would be appreciated. Thanks

PeterFebruary 5th, 2012 at 11:45pm

I think it depends on your broker and if you can buy the stock on margin. But you can surely sell to close prior to exit the position and still profit from the increase in the options' price.

PeterFebruary 5th, 2012 at 11:43pm

Yep, you'll have to sell to close on the 17th during trading hours as the 18th is a Saturday ;-)

MikeFebruary 5th, 2012 at 11:43pm

Peter ,

If I don't have sufficient funds for buying the stock on expiration date(say,to buy 100 GOOG) for call option , does the only option I have is to sell to close or i can exercise the call and gain profit without actually buying it on the expiration date

MikeFebruary 5th, 2012 at 11:39pm

Hi Peter,

I have a call option which expires on 18th Feb.Can i sell to close this option on 18th (since i am hoping the stock to go up on 18th itself) or i have to sell(to close) before 17th end of day.

PeterFebruary 5th, 2012 at 4:36pm

Hi Mark,

You don't have to sell option back before the expiration date, however, if the call option is in-the-money (stock > strike) at the expiration date and you don't do anything you will automatically be assigned the stock by your broker during the clearing process. So, the next day you will have a long position in the stock in your statement.

MarkFebruary 4th, 2012 at 12:36am

Hi Peter. Fantastic site! I commend your great advice.

Question: buying 50 contracts @ .08 for a Feb 18 expiration long call on a stock trading @ 8.25. The strike price is 9.00. I am very bullish on this stock, but brand new to option trading. Do I have to sell the option, (or exercise) before the expiration date even if the stock is trading above the strike price on the exp day??

Hope this isn't too dumb of a question

Thank You!

Mark

PeterFebruary 2nd, 2012 at 5:34pm

Thanks IA!

IAFebruary 2nd, 2012 at 4:47am

3 years worth of authentic and valuable Q&A. Fantastic work Peter. We can always do with more active market participants in the Options space. Very impressed.

PeterJanuary 31st, 2012 at 4:33pm

Yes, you can sell the option back in the market. The profit depends on the multiplier, however, if it is call option on a US stock then the multiplier will be 100. So your profit will be 1,000 per contract ((30 - 20) * 100).

RosyJanuary 31st, 2012 at 12:57pm

Hi,

I have bought a call option for feb'13 for a price of 20 on 10th feb. After few days i.e, on 17th the value of that option has increased from 20 to 30. Can I sell my call option at price 30 ?

How much profit I will earn if we exclude the brokrage.

PeterJanuary 20th, 2012 at 10:07pm

Hi Joules, it depends what your objectives are and your view of the stock. If you think the stock has a lot of potential and can rally, say, 20% in the next 60 days then you would be more inclined to look at a strike 10 to 20% out of the money as the price increase on the out of the money calls will be more percentage wise than the in the money options.

JoulesJanuary 19th, 2012 at 11:44pm

Peter:

When determining what strike price you want to buy on a call, in your opinion is it best to buy a strike say 50-60 days out that is already in the money...or....should you buy a strike out of the money and hope for the stock to move up to the strike before expiration? Is there a way analyze the best strike for the money?

Joules

PeterJanuary 19th, 2012 at 3:48pm

Hi Tim, yes, you can close out your long position by simply selling back the same amount of option contracts to the market. Then your position will be flat and therefore there won't be anything to exercise or be exercised against.

TimJanuary 19th, 2012 at 2:37pm

Good afternoon. I recently purchased out of the money purchased put options with an expiration in 30 days. Say the value of the stock is not trading below the strike price (but it's close) within a few days of expiration. Assume the bid-ask premium is higher than when I purchased. Can I close the position without exercising and profit from the spread between initial premium and current premium? If so, would I be liable as a written put if the stock falls below the strike price?

PeterJanuary 8th, 2012 at 10:23pm

Hi Chintan, please have a look at the page on option types.

Chintan DoshiJanuary 6th, 2012 at 5:07am

Please explain me once again the Full Infomation Of Call And PUT Option

PeterDecember 29th, 2011 at 10:14pm

Hi Tyler,

It looks like you're trying to enter a covered call strategy, which is buying the stock and at the same time selling a $11 strike call option?

So, you're currently long the stock and want to buy a call option on top of this?

TylerDecember 29th, 2011 at 8:42pm

Peter,

I am on td ameritrade trying to do a call option and I am not sure I have it right. I am long on MTW and feel it will rise above the 11.0 strike price. It is currently trading at around 9

Trying to buy MTW Jan 21 2012 11.0 call

On the website it has two orders in place after I put in the order:

1.). Buy 100 MTW

2.). sell to open 1 MTW Jan 21 2012 11.0 call

Am I positioned the way I would like to be? The premium is .1. Thanks,,

DenisDecember 27th, 2011 at 11:35pm

I have a position in long calls that is worthless right now. There are no bids for it and I cannot sell it even though I have a pending order for $0.01. Market depth is clearly showing no bids.

Is this a good proof that the option is worthless so I can claim loss for tax purposes in the current year? The options only expire next year.

PeterDecember 27th, 2011 at 6:40pm

Hi Jayne B,

With such a large stock increase the option will likely be deep in the money and have a large delta (approaching +1). This means that the options' value will change almost exactly in line with the stock. So, whether to sell now or not depends on your view of the market. At this point the position in the option will just be like having the position in the stock.

If it were me, I would probably sell and capture the gains so far and move onto the next opportunity. Up to you though ;-)

jayne bDecember 27th, 2011 at 4:42pm

Hi Peter,

I'm new to trading in options and am unclear about the best time to sell my call option. Here's the deal:

For Jan 12 expiration:

Bought 500 shares of XYZ for $11 a share. The option price is now $25 a share. Clearly I'm in the money and the stock price seems to be steadily going up. Would it be better to sell the option now or wait until we're closer to the expiration date? (Again, I'm assuming the stock price continues to rise. I understand that's only one possible scenario.)

Thanks so much for your advice.

PeterDecember 21st, 2011 at 10:34pm

Hi Rebecca,

Then best to just allow them to expire as you'll incur additional transaction costs if you sell.

PeterDecember 21st, 2011 at 10:33pm

Hi Srikanth,

You will have to buy the stock at the strike price, which is 20, so you'd be up for an additional $2,000.

RebeccaDecember 21st, 2011 at 10:09pm

Hi Peter,

I currently hold January 2012 call options that are worth pretty much nothing (I bought them for much more and unfortunately lost money on them). My question is whether it is better to sell the options now or to let them expire? Is there a difference? There's no way they'll go up in value between now and January.

Cheers,

Rebecca

SrikanthDecember 21st, 2011 at 8:03pm

Peter,

Could you Please clarify me one thing...

I am going for Long call on XYZ stock

JAN 2013 contract @20.0 ( BID:11.15 ASK:12:50)

For that I have to pay 12.50*100=1250$ (This is the amount i am paying now) to enter into option contract

During expiry time...i.e JAN 2013 ..If i want to buy the shares .

As I already paid 1250$,Then How much I have to pay for buying the 100 shares?

Is it 20*100=2000$

or 2000-1250=750$

2000$ or 750$ ??

PeterDecember 11th, 2011 at 5:38pm

Hi Stuart, thanks for the comments about the site, much appreciated!

Your decision will depend on your confidence with the stock and what your investment objectives are. If you like trading options and enjoy the leverage on your investment then you might want to sell the options, take the profit and move onto another trade. However, you might really like the stock and consider holding it as part of a longer term plan for your portfolio. If this is the case, then you could exercise and take delivery. But, remember that you will need to invest a lot more money if you exercise the options and take delivery - $49,500 (45 x 100 x $11).

If you don't exercise you will have $50k to use with other option trading opportunities - or to spread out and buy more stock with.

StuartDecember 11th, 2011 at 10:23am

Hello Peter, Let me first say you are the first person on this topic who like a great teacher can take complex subject matter and break it down so the plebes can grasp it. Then with a sound base camp you help provide, climb the complex mountain of options trading on our own. My question is: I bought 45 contracts long calls with 11 strike price six weeks ago out of the money and with lady luck by my side the co. declared to renew its dividend. So, I'm in the money and am very bullish on this stock. Is it prudent to roll over the contract, ( and at what strike price, I feel 13 is in the cross hairs ) or allow the contract to expire, take on the shares, and ride it, hopefully up?

PeterNovember 9th, 2011 at 7:05pm

Hi David,

1) As you said, your broker may provide the margin for you to buy the stock or you can borrow more money. You cannot transfer your position though.

The better choice would be to simply close out your option position by selling the option back on the expiration date.

2) The premium is the amount that you paid when you first put on the trade. You don't get this money back as this is paid to the seller of the option. If you exercise the option you will buy the stock with the price paid being the strike price.

DavidNovember 7th, 2011 at 6:51pm

QUESTION

1) If I want to exercise a call option and I don't have the money to buy the stock, can I get a loan from a securities lending company, or can I assign the option to someone who can exercise the option and cut me a check for my share? - For example, my broker gives me 2:1 ratio on my money; but I needed to get the 50% of the initial funds.

2) If I exercise the option, what happens to the premium I paid? Is the premium part of the strike price or is it extra. Meaning, do I pay the premium + the strike price or do I just pay the strike price, which includes the premium I paid?

Thank you.

PeterNovember 2nd, 2011 at 4:58pm

What was the stock price before and what was the change in the option price?

The decision really depends on your view of the stock - if you think there is more upside potential, then you'd hold onto the position for more gains. Otherwise, if you're happy with the % profit achieved already then take it.

aaNovember 1st, 2011 at 9:49am

A call option contract (American option) from september 10 to october 10 with premium $5 per contract. the stock price goes up to $78 .what should u do? (for each american and european option) explain

PeterOctober 14th, 2011 at 6:39am

Yep - you can close out the long position by selling the option and take the profits of the higher sold price.

The downside to trading options this way if you are bullish on a stock is the time factor: that the stock must increase - and increase enough - before the expiration date for the option to be profitable. Otherwise you will lose your entire premium investment that you paid when you bought the option initially.

When you buy stocks outright you have time on your side that the price will rise "sometime" in the future to profit.

RoshanOctober 14th, 2011 at 5:00am

Thank you Peter

I wasn't aware of this alternative. So what I have come to understand is that 'exercising' and 'closing' the option are two ways for closing out my options position.

So I assume to close out of my option position I could enter an offsetting order to sell the call option at the "new" higher price and pocket the difference in premiums as a profit? Please correct me if I am wrong.

Also I wonder why do so many people waste time and money by buying stocks and holding onto them for months and years to realize profit, when they can make huge profit with options sometimes even 100% in a weeks time.

PeterOctober 14th, 2011 at 4:03am

Hi Roshan, you can profit by the increase in the option price by simply selling the back the option in the option market (closing out your option position).

If you exercise the option you will be assigned the stock, which means you will have to have enough capital to take delivery of the stock. And then you will have to sell the stock at the current price to take profits.

I.e. the better alternative is to just close out your long call position and make the 50% increase in premium.

RoshanOctober 14th, 2011 at 1:46am

Hi Peter,

1 quick question.

stock A market price 90

call option: A100 trading at a premium 5

now 10 days to expiry Stock A reaches 98(still not hit the strike price) but trading at a premium 7.5

can I exercise my option and profit from the 50% increase in the premium?

PeterOctober 10th, 2011 at 7:23pm

Hi Annu,

Yes, you can sell (close out) the long call option before the expiration date.

You will receive money by doing this, which will offset the cost you paid when buying the option.

So, you paid $5 to buy the option and then received $4 when you sold it back - resulting in a loss of $1.

AnnuOctober 10th, 2011 at 2:46pm

Hi Peter,

If I buy a call option at 5 and it is trading at 4 but before expiry date. If I sell the option at 4 so I would get premium back or not.

Annu

JonathanSeptember 29th, 2011 at 7:51pm

That's exactly the part I wasn't sure about, thank you very much for clearing it up.

PeterSeptember 29th, 2011 at 12:21am

Hi Jonathan,

I think the part that you are confused about is the selling of an option for which you already have a position in.

If you buy 1 option contract then you have a long position. If you sell the same contract then you have zero position i.e. nobody can exercise against you.

If you sell an option first, without previously having a position, then you will have a short position - or be short an option. It is only when you are short an option can you be exercised against.

In your example, you've had a long position but sold to close the position - therefore you cannot be exercised against as you no longer have a position.

Does that make sense? Or have I confused you ;-)

JonathanSeptember 28th, 2011 at 9:37pm

I was wondering if you could help me with the following question.

I know that options that expire in the money are automatically exercised at expiration. So if you hold a call option in the money, you have a choice: exercise before expiry, sell the option, or let it expire and it automatically gets exercised. I've read a bunch of stuff online saying that it is usually better to sell the option rather than let it expire because you get the added profit from the premium, unless you want to hold the stock longer. In that case you might as well let it expire and then you get the shares at expiry for the strike price. So here's my question: if you sell the option before expiry, isn't there a high risk that the person who buys it will exercise it against you, either by exercising it themselves or letting it expire? And wouldn't that end up costing you money?

Here's an example: I buy a 30 call on RIMM for say $1.50 and as expiry approaches the stock is trading at $36. At that point let's say the option is worth $5. If I let it expire, I automatically purchase RIMM at $30 - at which point I can sell it at $36 for a profit of $6/share. If I choose to sell the option, I profit $5-1.50 for $3.50/share. But if someone else buys my 30 call for $5 when the stock is trading at $36, there is a very good chance it will be exercised - which means I would have to buy the stock at $36 and sell it to that person for $30, for a loss of $6/share. So although I profited $3.50/share on the option sale, I come out behind when the option gets exercised against me. So why would I take that risk? Or am I missing something here?

PeterSeptember 9th, 2011 at 7:57am

Thanks Michael, I am affiliated with Option Sizzle and will let them know about the error, thanks for pointing it out! Peter.

Michael TSeptember 9th, 2011 at 3:48am

Just an FYI - When I went to the the home page of the site you (Peter) suggested for option ideas (optionsizzle.com) I got a message from my antivirus software that it blocked an exploit. Meaning the site was trying to do something it shouldn't be.

If you are affiliated with the site, you should let them know. If it's a legit site, then they should investigate the error.

BTW - I'm very impressed with your ability to answer all of these questions. Really enjoy the q&a.

PeterAugust 31st, 2011 at 7:03pm

No, you don't earn on both. But it's a good question.

If you are still holding the call option after the stock has been taken over then you can sell out of the option to close the position and your profit will be the difference between the sold price and the purchase price. With the prices you mentioned the call would be worth at least $7,800 per contract ( (150 - 72) * 100). If you paid .25 and sold it for 78, then your profit would be 1,555,000 ( (78 - .25) * 100 * 200).

Alternatively, you could choose to exercise the option, which means you would have to buy 20,000 shares at the strike price. If the strike price was $72 then you would need 1,440,000 in capital to cover the exercise. Then you would sell the shares at the market price to make your profit. Your existing option position would be sold at zero and the price paid initially has already been received by the option seller.

Hope this makes sense - let me know if anything is unclear.

RahAugust 31st, 2011 at 12:13pm

I I bought call options 200 contracts for $25 per contract or .25 per share 20,000 shares betting that the stock will be bought out. Strike price is $125 for sept calls. Current price is $72. If the company is bought out next week and the stock goes to $150 do I make the value of the call plus $30 for every share I am holding which would be $600K plus??

Thanks!

PeterAugust 29th, 2011 at 9:44pm

You'll be buying the stock at $13 - the strike price.

TomAugust 29th, 2011 at 8:09pm

Peter,

I had one more (probably silly) question.

If I buy a call option of stock XYZ (trading at 10) with a strike price of 13 (say expiring in 120 days), and this stock hits 14 before it expires, and I decide to execute, am I able to buy the stock at 10 (the price at which I bought the call contract) or at 13 (the strike price)??

Thanks for your help!!

Tom

PeterAugust 25th, 2011 at 7:33pm

Hi Tom,

Option premiums generally decrease the further they are out of the money. Hence, the cheaper they are to buy. So, your percentage returns are magnified upon a large move. However, the rate of change (i.e. option delta) is lower for out of the money options. If the market does move, out of the money options will not change as fast as in/at the money options.

The decision as to what call option to buy comes down to just how bullish you are on the stock. If your view is only slightly bullish then you would be best off buying an at the money option, however, if you expected the stock to stage a massive rally then you would be better off picking an option in line with the expected price of the stock post rally.

Call options the are in the money (strike price below the stock price) have higher deltas and therefore their prices move more in line with the stock that it is based on. This means that you can take advantage of an upward move in the stock at the same rate as if you owned the stock without making the full purchase.

In your example, buying a $4 strike call option on a stock that is trading at $7 would be worth at least $3 in premium, let's say $3.50. Buying 1 call option contract would cost you $350 (100 shares) and this option's price changes are likely to move in line with the stock. If you were to buy the stock outright this same position would cost you $700.

TomAugust 25th, 2011 at 2:39pm

Peter.

Can you please explain to me 2 things.

1)If i am bullish on xyz trading at say 7. I can buy contracts at strike prices of 8, 9, 10, 11 etc. Obviously the lower strike prices carry less risk and should be closer to realization. But how does one choose which to pick - especially since I can trade an option w/o exercsing it, and hence it really doesn't have to hit the strike price. Is there more upside to a further out strike price?

Even more confusing for me is, why are there contracts for calls below the market price? Why can I purchase a strike price of 4 when a stock is at 7? (i mean this is no put contract)Does that mean I could exercise the option anytime (it already hit the strike price since its below the actual value) if for a example a stock got upgraded. Is this this supposed to be some hedge in case the stock looses value?

MiltonAugust 24th, 2011 at 10:37pm

Peter...great stuff...

Nat...get some flash cards

PeterAugust 7th, 2011 at 7:51pm

Yes - provided that the buyer has a "long" position.

NatAugust 7th, 2011 at 7:32pm

Hello Peter,

Thank you very much for your explanation. This means that if I sell my call option to someone to close the position and reap my profit or cut my loss, the person who bought it from me will be guaranteed to buy his share from my original seller, right? (if my original seller has not closed out his position)

PeterAugust 7th, 2011 at 6:42pm

It's no bother, you're welcome to ask questions.

Think of an option position the same way that you would a stock.

Say you buy 100 shares of stock and then you go and sell 100 shares of stock. After the sale of stock, you no longer have any shares left - your long position of 100 shares has been "offset" by the sale of 100 shares.

I think the confusion you have is that you are imagining a market where there are only a few players - you, a buyer and a seller, where each is trading around the same allotment of contracts.

But in practice the markets are full of buyers and sellers and the process (called novation) of allocating the contracts and positions of each participant is handled by the clearing houses.

NatAugust 7th, 2011 at 9:16am

Hello Peter,

I am pretty much clear on the second question. However, for the first one, then what would happen to the buyer of my call option? Who will be obliged to pay him the $10 at the end of the expiry date?

Thank you again and sorry bugging you. I am kind of new to all of this and the only part I don`t get it is offsetting the position.

If you would be so kind to provide a numerical example of how offsetting a position works, I would really appreciate it.

PeterAugust 7th, 2011 at 8:45am

With your first question I was thinking you were describing something like this;

Bought 1 $10 strike call option

then

Sold 1 $10 strike call option

Now, because you've sold out of the same contract you no longer have a position at all. However, if you did this;

Bought 1 $10 strike call option

and then

Sold 2 $10 strike call options

In this case, because you are now selling more contracts then you are holding you would net be short 1 $10 strike call option.

And yes, for your second question, if you had of sold the call option instead and the stock ended up at $11 then you would have made the $1 profit instead of the loss.

NatAugust 7th, 2011 at 8:00am

Hello Peter,

Thank you so much for your quick response. I just have a couple more questions if you could kindly clarify it for me.

According to my first question, I don`t understand why I will no longer have an option position if I sell my call option because I have turned into the seller of the call option. Won`t I have the obligation to sell the share to the person whom I sold the call option as the seller?

Secondly, in the second case where I would have made a loss of $1, would it have been better if I had sold my call option contract because it would have been worth a little more since the price of the share is higher to offset the position instead of exercising it?

PeterAugust 7th, 2011 at 7:42am

Hi Nat,

For your first question, if you offset the bought option by selling the same option in the same quantity then you no longer have an option position.

You would only have to worry about the option being exercised if you were "short" an option - i.e. selling an option without first buying an option.

And yes for your second question - you will make a $1 loss if the stock is only at $11 at the expiration date.

NatAugust 6th, 2011 at 8:27am

Hello Peter,

If I bought a call option contract at $2 for a strike price of $10 but the price of the underlying stock is rising to $20 and the premium increases to $4. I want to offset the position by selling it to obtain a $2 profit before the expiry date.

Then after that, as the seller of the call option, will I be obliged to sell the share for $10 before the expiry date of that contract to the person I sell the call option to? Do I have to place a margin in the broker`s account as a seller of the call option?

Another question is if I buy the call option contract at $2 for a strike price of $10. But the price of the underlying stock rises to $11 at the expiry date and I exercise it. I will actually have bought it for $12 (strike price+premium and not including commission paid to broker for buying the contract and exercising the option plus taxes) which means that although the price of the stock has risen, I have made a loss of at least $1?

Thank you for your time.

PeterJune 4th, 2011 at 6:43am

Hi Konstantin,

1 & 2 - Not all companies have listed options available to trade. You will need to check with the exchange website whether options are listed on the company you're interested in. Are you looking at US companies? If so, check the CME site.

3 - No, listed options are standardized by the exchange so once they expire you cannot change it. You can, however, roll your position from one month to the next if you want to maintain the option.

4 - If the option has expired out-of-the-money then nothing happens at expiry - you just lose the premium paid.

KonstantinJune 3rd, 2011 at 9:47pm

Hi Peter!

I have a couple question very simple.

1-Can I Buy/Sell options stocks of micro-company? (price around .3$/share)

2-Is only specific company trade option or all of them?

3-Can you extend your expiration date?

4-If the expiration date is not finished yet, but in reality I make a loss of 100% , my option will be sold automatically?

Bdw, great website, simple and very clear!

Thank You!

Konstantin

PeterMay 31st, 2011 at 8:04am

Hi RK, the P&L graph represents the time value of the option. It plots the theoretical profit and loss now with an option that expires in 60 days.

RKMay 31st, 2011 at 2:45am

What is P&L in graph?

Could you please explain the graph in detail?

PeterMay 11th, 2011 at 6:42pm

The option will never be de-listed before expiry - as it is likely other traders will have open positions in these contracts.

If the stock price has dropped significantly the call option will simply be considered worthless by the market. When this happens, you will probably notice that there will be no market bid for these contracts but there may be offers to sell the option at very low prices.

LMerMay 11th, 2011 at 6:19pm

I am curious. If I buy an out-of the-money long call for .80 that expires in Nov. or Dec. and it drops to N/A is it still a valid contract that will "re-appear" when the stock value rises? Can it be delisted and just dissapear?

MananMay 6th, 2011 at 3:02pm

Thanks Peter.

PeterApril 28th, 2011 at 11:41pm

Hi Manan, you won't have to do anything - the assignment of the stock due to the exercising of the short call option is handled automatically by your broker/clearer. You will just keep the premium and have zero position in the stock.

MananApril 28th, 2011 at 3:25pm

Peter, I have a question:

I own the ABC at 25.00 and I sold the in-the-money one call option for May 21, 2011 for 1.4 and earned a premium of 140. Assume it will be traidng at 28.00 by May 21, what will I have to do, apart from selling my stock at 25? Is there anything that I need to do? Reply will be appreciated. Thanks

PeterApril 17th, 2011 at 6:06pm

Almost - intrinsic and extrinsic value are terms that relate to the market price of the option when compared its strike and underlying price.

The graph above doesn't look at the market price of the option - the blue line simply represents your profit and loss of buying the option.

AshutoshApril 17th, 2011 at 10:40am

Thanks Peter,

Thanks for the prompt reply. Actually I was confused but a bit later when I went through the whole site I got it before your post here.

Actually you have posted everything in nice and short manner. I really appreciate your work on this.

In above scenario....long call,

when it's ITM then the (strike price)line below x axis would be...Intrinsic+Time value(premium paid)......m i right?

Please correct me if I am wrong.

Thanks in advance

PeterApril 17th, 2011 at 6:10am

Hi Ashutosh, the -1 line beneath indicates the loss of the option while the stock price remains below the strike price. For a long call option this value is the price you pay for the option - as this is the maximum you can lose with this position.

The -1 in the graph is just an example but would otherwise equal the price you have paid for the option.

AshutoshApril 16th, 2011 at 1:49pm

Peter, Nice, Elaborate info On Options.

One query,

I couldn't understand the graph.

As here in Long Call,

On Y-Axis ..... -2 to +5

On X-Axis ..... 20 to 30

I don understand why The Call has started from -1.

Please clarify.

PeterApril 13th, 2011 at 8:28pm

Hi Maria, you could try Option Sizzle they have a subscription service where they provide short term option trade ideas.

they have a subscription service where they provide short term option trade ideas.

mariaApril 13th, 2011 at 3:46pm

Peter-Is there any site you use that would list good value option bets i.e--where the options don't cost that much per contract and the call/ underlying stock has a good probability of increasing in value?

PeterApril 10th, 2011 at 8:35pm

The payoff for a long call option is max(0, Stock - Strike).

The cash flow when you short an option is simply the premium received when the trade is established.

WadeApril 10th, 2011 at 8:21pm

How do you get the cash flow of exercising the long call is St-X and the cash flow of exercising the short call is -(St- X)? Could u explain a bit more? Cheers

PeterFebruary 12th, 2011 at 9:05pm

Hi Alex,

It is only referred to as writing an option if your position is short. In your case, you already have a long position so to sell an option is just closing out that position.

AlexFebruary 12th, 2011 at 2:57pm

Hi Peter,

I have a question. So lets say I bought a call option for $1 with a strike price of $10. In a month the price of the stock went up to $12. which means that my call option right now cost $2.

So, right now I want to sell that option back. Does it mean that I am actually writing a call option? And if before the expatriation price of the stock will go further up I will lose money, and will have to buy back stock at the strike price?

Or it simply means that I am closing my position and will not have to fulfill any other obligations?

Thanks

PeterFebruary 10th, 2011 at 1:50pm

No worries, good luck!

JoannFebruary 10th, 2011 at 11:16am

Peter,

Great Advice! Simple and clear! Yes, I think it is a covered call. And from you, I know that I am a option holder of a short call.

Thank you very much. I am watching everyday now to catch the right 'price' as the market seems to cool down a bit. That is what I need. Sorry! It is just a timing issue.

Take care!

Regards,

Joann

PeterFebruary 9th, 2011 at 9:05pm

Hi Joann,

So, you own the stock as well as the short call option, right i.e. a covered call?

If so, then you've probably already capped out in terms of your upside gains? The short option will keep losing money as the stock rises but these losses will be offset by the gains on the stock.

If you are still bullish on the stock, then buy back the call option and continue to hold the stock.

JoannFebruary 8th, 2011 at 5:16pm

Hi, Peter,

I've been stuck for a little while and just found you!

I have been trading option in a very simple way with my existing ABC stocks and was doing fine since the stock does not go up and down a lot.

But in the last two weeks, it went up more than 20%, so I began to get nervous b/c I might loss those stocks which I do not intend to sell. (big captial gain)

I 'sell to open' an option (not sure if it is called short call) to SELL ABC at 150 by 1/2012 for 10 contract and got 8.00 premium/sh collected in late 2010.

Now ABC is worth 165 and the same option symbol is at 21.00 premium/sh.

Normally I knew I can 'buy to close' the option when the gap isn't big and can still make a profit.

But this time, the gap is quite large and negative.

21-8 = 13/shr

I am debating on doing one of the following:

1. should I spent 13000.0 to buy back my stocks and turn around to 'sell to open' at a higher strike price (like 190 w/ 19/shr) to offset my loss of 13000.0 or

2. should I sit on the current option and hope the market will cool down a bit before 1/2012 and take back with a <=8 premium/shr. to keep my small gain and still keep my ABC stocks or

3. should I just let my option being taken and then face the captical gain tax (I estimate the gain to be 60000 (60*1000).

Someone told me that since my expiration date is 10 month away, normally folks (option buyer) won't exercise my option as yet. How close to 1/2012 should I start to worry?

I have yet to digest/understand about all the bells and whistles about option, so my question might be not be stated very professional.

Hope you could understand my question and looking forward for your wise advices.

Joann

PeterFebruary 6th, 2011 at 9:36pm

Good stuff mate! How did your trades end up?

JoshuaFebruary 6th, 2011 at 6:19pm

This has been a great help Peter. I cant say thank you enough. I just made my first call buys last week. Keep up the good work.

PeterFebruary 3rd, 2011 at 9:44pm

You trade options on an exchange, which means (unless you're an exchange member) that you have to go through a broker.

kumarFebruary 3rd, 2011 at 8:46pm

How do you really enter in the options contract. if i want to trade in options, what should be my approach. do i have to deal with options only through a broker

PeterJanuary 15th, 2011 at 6:50am

Hi Wen,

Sure, the X-Axis represents the stock price and the Y-Axis is the Profit and Loss (P&L).

The blue line shows the actual profit/loss of the option at the expiration date of the option. And the pink line shows the theoretical profit/loss of the option with 60 days left to expiration.

So, with this example, if the stock price is below $26 at the expiration date of the option you will lose money, which is represented by the blue line. The profit you will make above $26 is shown as the line increases to the right.

WenJanuary 14th, 2011 at 9:53am

Hi Peter,

Thank you so much for the site. Great work.

I need your help understanding the graphs. I tried to grasp but I couldn't make out. Could you please explain what is on the X-axis, Y-axis, what is P&L, what is P&L at expiration, P&L +60 days. What are 20 21 22 ... 30 , -2,-1,...5.

I read your response to another question on graphs on this page, but could not get the point.It will be very helpful if you take an example to explain this.

Thanks in advance,

Wen

PeterJanuary 11th, 2011 at 3:42pm

No, nothing happens as you don't actually hold the stock - only a contract which provides the right to buy the stock.

SSJanuary 11th, 2011 at 11:43am

What happens if you buy a long call and the stock pays a dividend. does the holder of the long call have to pay a dividend to the write of the call option?

PeterDecember 30th, 2010 at 9:26pm

Hi Jerry, hard to say what the odds are, but yes, they are selected at random. The chances of early exercise are higher right before a stock goes ex-dividend.

JerryDecember 30th, 2010 at 12:14pm

Hi Peter please don't mind me asking this silly question. say if i write an option and sometime later the other party decides to exercise it but there might be many other people writing exactly the same option as i did in the market. What are the chances that the option i wrote being exercised? Are options being exercised selected randomly? Thank loads!

PeterDecember 14th, 2010 at 3:41am

Yes, you can sell the options that you purchased back at a profit. If the position is closed then no, you don't have any risk of being exercised.

If your position remained short, then yes, your options could be exercised.

You can also do it in reverse i.e. sell an option and then buy it back at a lower price for a profit.

bharathDecember 14th, 2010 at 1:13am

hello,

can you tell me if i can sell call and put options after buying them in the first place thereby gaining profits in increased premium values,now that i have sold these options do i run the risk of the buyer exercising it or have i passed on the risk to someone

NeelamNovember 21st, 2010 at 11:14am

Thanks, this site is so clear, that I understood those concepts just by going through it. So now I don't feel to ask those silly doubts. Thanks once again for your work on this site.

PeterNovember 15th, 2010 at 5:27pm

Hi Kaushik,

Yes, you can certainly roll it over - you would do this buy buying the Jan11/Apr11 Calendar Spread - selling the Jan call option and buying the April call option.

With this calendar spread, if the market drops off during January you will profit by keeping the premium received for selling the January call options while still being in the game for a bullish move with your long April call options. If the stock doesn't make the expected gain by April, then yes, you will lose your premium paid for the April options.

If you were very bullish on the stock, however, you might be better placed just buying the stock outright - then you don't have time working against you. It all depends on your appetite for risk and your view of the stock. And also what the prices are for the options, which comes down to the volatility. When volatility is low, which means option premiums are low, this is usually a better time to buy options.

kaushikNovember 15th, 2010 at 12:52pm

Peter

I have a better Q this time :p

I have a call option (out of the money) that expires in JAN 11, i am not sure if the stock will make it. But i am confident it do well by the APR 11.

So is there a way that I can rollover this Call to APR11 Expiry. If so how should i do it. I mean should i cancel JAN11 Call and buy APR 11 call.

And also What are the disadvantages. can you please help me in this

Kaushik

PeterNovember 12th, 2010 at 2:45pm

Sure, what is it exactly you don't understand?

NeelamNovember 12th, 2010 at 10:32am

Hi, I have many people about the meaning of long call and long put, similarly short call and short put i am not clear about it, can you help?

PeterNovember 7th, 2010 at 5:05am

Hi Ben,

When you trade options via an exchange you aren't buying the option from the company that the option is based on...you are buying the option from another trader or market making firm.