Put Ratio Vertical Spread

A Put Ratio Vertical Spread is short two OTM put options and long one ITM put option.

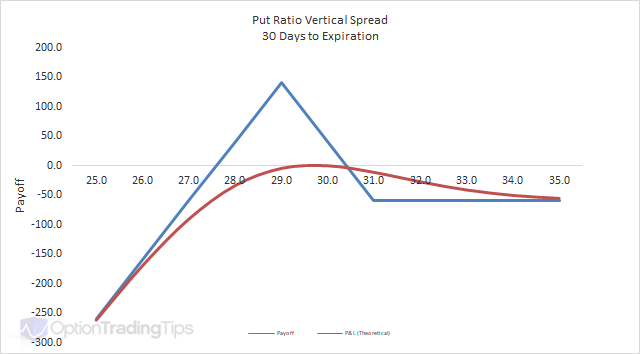

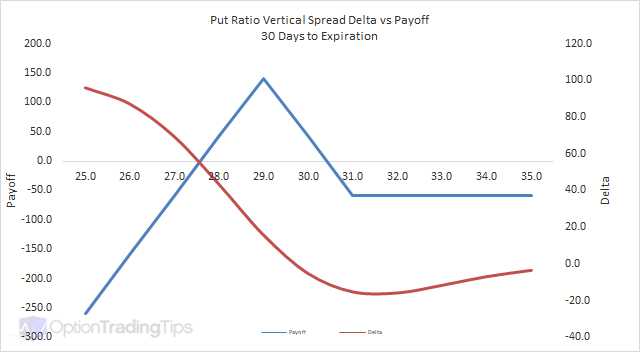

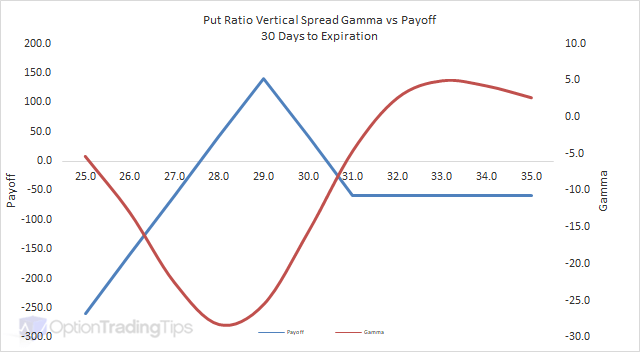

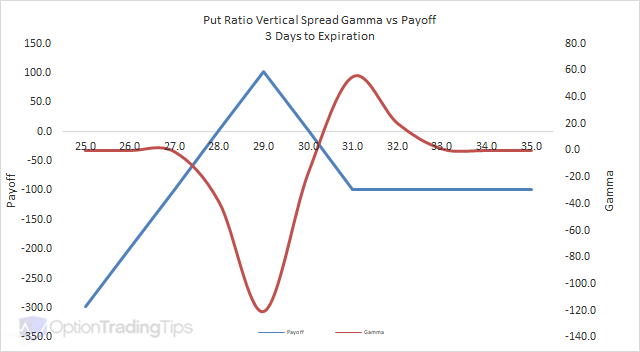

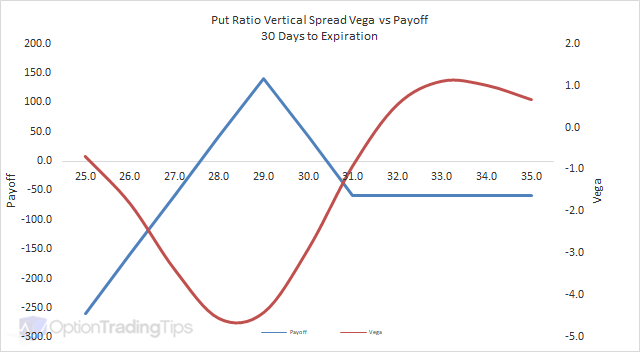

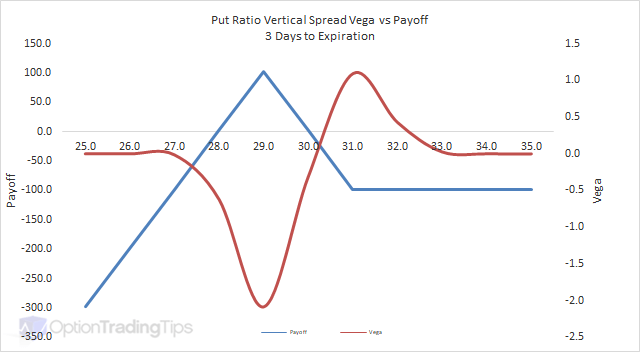

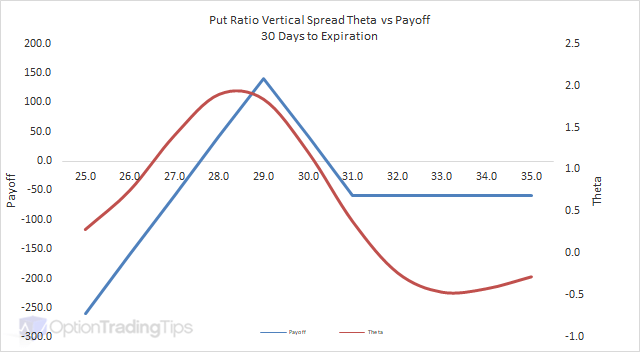

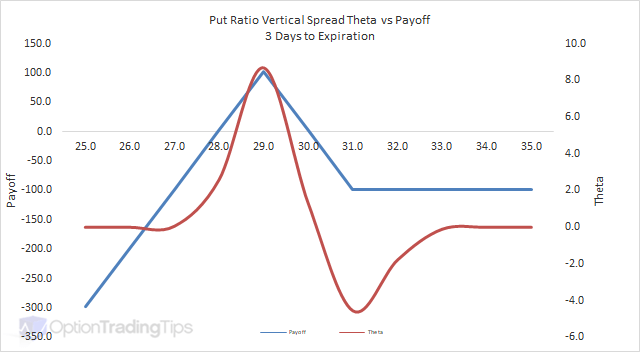

The Max Loss uncapped on the downside and limited to the net premium paid on the upside.

The Max Gain is limited to the difference between the two strikes less the net premium paid.

PeterMarch 26th, 2014 at 3:30am

It will likely be a debit spread - especially if the payoff graph looks like the one on this page. It does depend, however, on the premiums of the option prices when establishing the trade.

GCMarch 22nd, 2014 at 7:16pm

I think a put ratio spread should be a credit spread, isn't that so?

jayMarch 8th, 2014 at 8:58am

i m unable to diffrentiate between the components of PUT RATIO VERTICAL SPREAD AND BACK SPREAD. As the payouts are different, the strategies are diff. Pls elaborate a bit more.

thanx

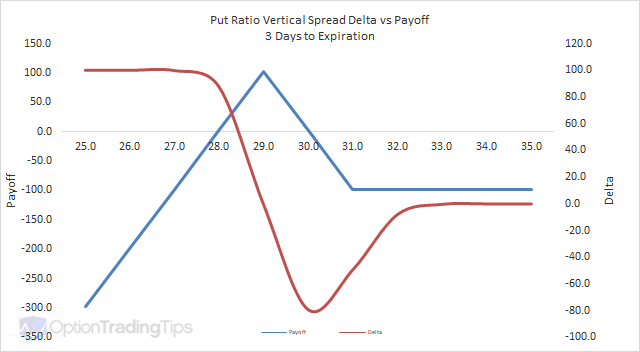

AUMKARAugust 3rd, 2010 at 1:29pm

This one is the strategy, one can use for the one or two days.

Add a Comment