Characteristics

When to use: When you are bullish on volatility but are unsure of market direction.

A long straddle is an excellent strategy to use when you think the market is going to move but don't know which way. A long straddle is like placing an each-way bet on price action: you make money if the market goes up or down.

But, the market must move enough in either direction to cover the cost of buying both options.

Buying straddles is best when implied volatility is low or you expect the market to make a substantial move before the expiration date - for example, before an earnings announcement.

Long Straddle Greeks

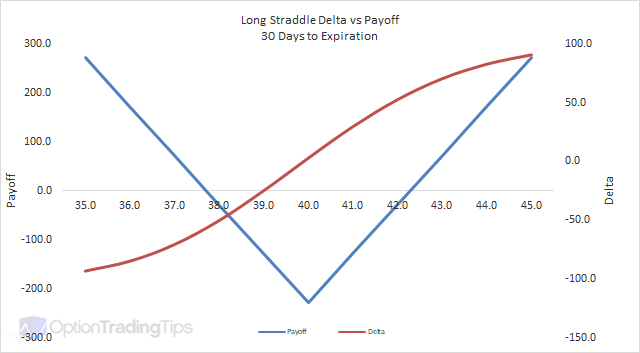

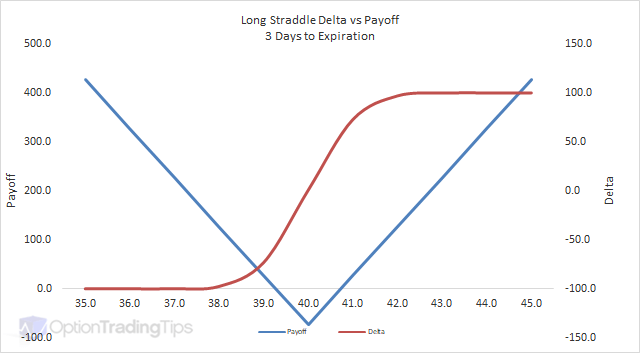

Delta

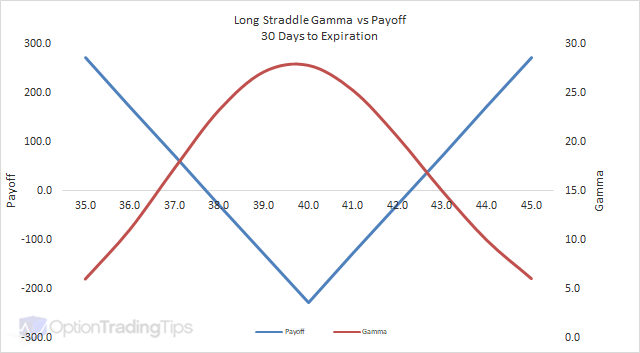

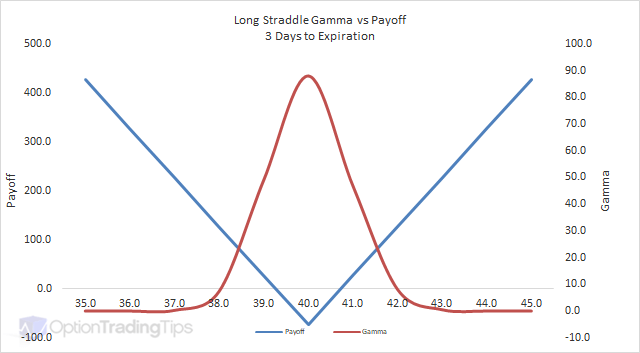

Gamma

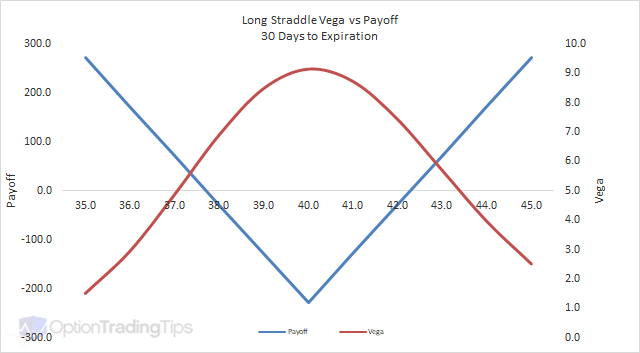

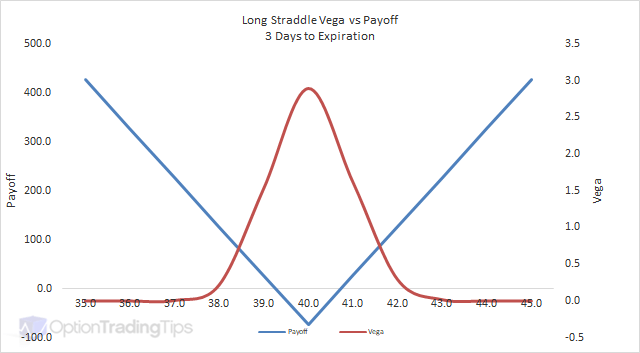

Vega

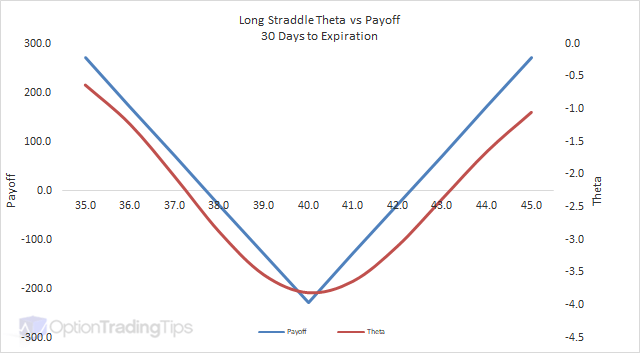

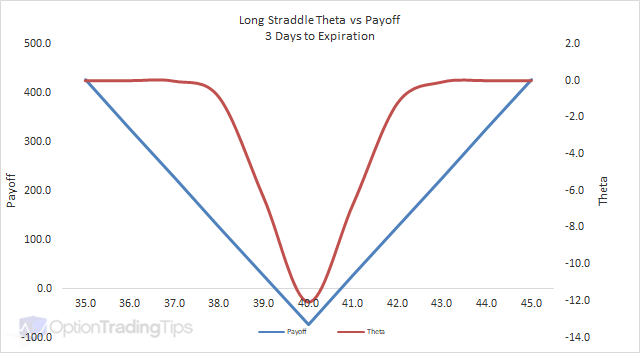

Theta

Pete DJune 27th, 2016 at 10:22pm

That is so funny! I have long call in ANF!

So far you're trade is winning. I should have close it on Thursday, the Brexit Day. It was mistake to wait for more profits after the results were in.

Good luck to you too.

PeterJune 24th, 2016 at 8:09am

No worries, happy to hear about others experiences...it helps my understanding too!

No, I think I will take some losses today. I have long calls and long puts across 10 stocks, a covered call (VIAV) and short stock/long put (ANF). I'm worried about the covered call as I will take losses as the market sells off without any protection.

I have a long $7 July call in RBS that I bought for 0.30, which was trading at 0.84 yesterday. Pre-market shows RBS already down 24% to 5.71...so that call will probably go to zero today.

Hopefully the long puts I have make massive gains...but I don't think any of the stocks will sink as much as RBS. Too bad I guess....good thing that my positions are small so it's not too depressing!

Good luck to you too!

Pete DJune 24th, 2016 at 1:02am

Hi Peter,

Thanks for your input, I appreciate it.

I was between rock and the hard place, in regards to these Straddle trades. It appeared, prior to the Market opening, that I'd make some profit in the last two examples, but the option prices were lower when the Market opened. So, at the open I already looked at the loses. Not to big, though, but as the trading was progressing and stocks moved lower and lower, the losses piled up. Bad luck.

I'm glad that from the trading point of view I did something right, even though I had losses.

I hope you have some protection in the market. It's looking ugly and maybe it's just the start.

I'm going to have some limited losses, but some trades are hedging the down move, so I hope some $$ will be recovered, if not all.

Thanks again and good luck!

Pete

PeterJune 22nd, 2016 at 7:47pm

Hi Pete,

A1. The amount of decay isn't linear. It's magnitude will be determined by the option's moneyness, time to expiry and implied volatility. I.e. an option that is out of the money, that is close to expiration and has high implied volatility will have the most decay. If you buy an option with these characteristics, you will need the stock to move by a lot in order for the option to be profitable in the short term.

What can happen, as you've described, is that the stock moves in your direction but the movement isn't quite enough to overcome the effect of time decay. You can read more about this here;

Time Decay

Option Theta

A2. Mmm, yeah this is a tricky one and hard to say without all of the information. Of course, in hindsight, you could say that you should have exited the position at a profit but it isn't always an easy decision. Once the position moves in your favour, you might be optimistic that it could continue higher, especially after a favourable earnings announcement, but as you've seen the stock has pulled back afterwards.

I guess you also need to consider what's acceptable in terms of profit and risk. When the position was immediately profitable, that might have been a good win for you and maybe you could have take it. But on the other hand it seems that you had more appetite for gains and were willing to risk those gains for further gains. This is what the game is all about.

I have been struggling with this myself the past week. I had a bunch of positions, a few of those were immediately profitable but I decided to hold onto them until expiration, expecting those to continue to gain. However, all of the June 17 options I had outstanding turned out to be losses. From now on, I will be more considerate with those that experience large gains early and will probably look to close those out, especially if they have doubled or more in profits.

A3. Yes, I would have done the same in this case. With the options expiring that day you are likely to experience a lot of decay as the day nears the close. Plus, you wouldn't want to leave it expire as one of the legs will be in the money, which means you will be exercised either take delivery of a long position or a short position.

Let me know if these answers make sense or not and if you have any other questions, let me know.

PeterJune 22nd, 2016 at 7:22am

Hi Pete,

Apologies, I've been traveling the past two weeks so have not had a chance to reply. I will review and come back to you shortly on this.

Pete DJune 17th, 2016 at 8:09pm

Hi,

I have a questions about managing and exiting Long Straddle trades.

Recently I traded a few of them and even though it looked like I should make a profit it was actually a loss.

Here are the examples.

1. LULU, Jun10 expiry. Straddle (4 contracts) was established ATM on June 3rd. Earnings report was scheduled for June 8th before the market.

On June 7th I sold and purchased Straddle again, to be ATM again.

Q1. Was this a good idea?

I thought it was, but after the report was out LULU didn't move much, about 3%. So, I closed the Straddle with the loss. If I left the original Straddle I would still lose but it would be much less.

2. GBT, Jun17 expiry. Straddle (2 contracts) was established ATM on June 9th. GBT drug trial announcement was scheduled for June 10th early in the morning.

After the announcement, in pre-market hours, the stock shot up 30% and by the market was open it dropped to +25%. Then it continued to go lower and lower, with one short small bounce during the first hour of trading, and then continued to go lower and lower.

Q2. Was I suppose to close the Straddle right at the open of the market, seeing that it never made higher than the opening gap in pre-market hours and starting with the red candle right away? Or I was to wait a bit for dust to settle, as I did?

3. SWHC, Jun17 expiry. Straddle (8 contracts) was established ATM on June 15th. Earnings report was scheduled for June 16th after market hours.

After the report SWHC was up 7-8% and it held in the after hours trading on June 16th. This morning it continued to go higher in the pre-market trading and reached about +10%. However, it started to drift lower and lower right at the opening of the market. When it dropped below the mark of yesterday's gap up, during the first half hour of trading, I closed the Straddle.

Q3. Was I suppose to wait to reach this mark or it was better to close it right at the open because the price was moving lower from the pre-market high, during the pre-market trading?

I'd appreciate and value your feedback.

Thanks,

Pete

PeterNovember 13th, 2014 at 3:43pm

Hi Anantha,

If the straddle is using ATM strikes, then the premiums should be close - they probably won't be the same as the forward price of the stock may be slightly higher than the actual strikes used, but the premiums should still be close.

But, straddles don't have to be ATM; you're free to choose whatever strike suits your ideas. Most are ATM though...

Anantha RamanNovember 13th, 2014 at 4:44am

In long straddle is it important that the premium of call and put should be same?

Anantha RamanNovember 13th, 2014 at 4:43am

Naga,

your strategy is called long strangle.

PeterAugust 25th, 2014 at 4:23am

Hi Jaycelle,

The total cost of a long straddle is 0.042.

The Breakeven points are 1.058 and 1.142

For a long straddle with the underlying trading at $0.90;

- The call option expires worthless

- The put option is worth 0.20

- Your profit is 0.158 (0.20 - 0.042)

With the underlying trading at $1.05;

- The call option expires worthless

- The put option is worth 0.05

- Your profit is 0.008 (0.05 - 0.042)

With the underlying trading at $1.50;

- The call option is worth 0.40

- The put option expires worthless

- Your profit is 0.358 (0.40 - 0.042)

With the underlying trading at $2.00;

- The call option is worth 0.90

- The put option expires worthless

- Your profit is 0.858 (0.90 - 0.042)

Let me know if anything is unlcear.

JaycelleAugust 24th, 2014 at 4:28am

Hi Peter,

A long euro straddle, a call option on euros with an exercise price of $1.10 has a premium of $ 0.025 per unit. A put option has a premium of $0.017 per unit. The euro values at option expiration are $0.90, $1.05, $1.50, $2.00.

a) What is the net profit per unit for each possible future spot rate?

b) The break-even points of the long and short straddle?

Thanks.

PeterJuly 15th, 2014 at 7:24pm

Hi David,

Even though the strikes are reversed, the strategy is still called a Strangle.

Are you sure about the market prices? It would seem as if you cannot lose with those prices. What stock is it?

DavidJuly 15th, 2014 at 11:05am

Consider a stock currently trading at a price of $122. You enter into a strategy to buy a call option with an exercise price of $85 selling for $11 and a put option with an exercise price of $122 selling for $9. Both the calls and put expire in three months.

What kind of a strategy is this and why? Can someone help please

PeterJuly 3rd, 2013 at 5:11am

Hi Paul,

For long straddle's you just add and subtrace the total premium from the strike price. For example;

Strike: $25.00

Call Price: $5.00

Put Price: $4.50

Total premium paid is $9.50. So your breakeven points are $15.50 and $34.50.

PaulJuly 2nd, 2013 at 8:18am

Peter -

If I'm implementing a long straddle position, how do I model break-even?

PeterFebruary 21st, 2013 at 2:30am

Hi Chetan,

Sure, you can use mine here ;-)

Option Trading Workbook

It uses Black and Scholes - so for European options but serves as a good framework for understand strategies and payoffs for all option markets.

ChetanFebruary 20th, 2013 at 11:19pm

Peter, can u suggest an excel Spread sheet which can be used for Indian stocks for analyzing options and statergies., Thanks in advance.

PeterApril 22nd, 2012 at 7:43pm

Hi G,

Does the OptionsXpress tool allow for paper trading? If so, that would be a great place to start. Just put aside some time to implement some of the strategies and see how they go in real.

Once you're comfortable with the ideas then you can start with small amounts of money to gain some confidence in trading options.

GApril 22nd, 2012 at 12:56pm

Hello,

I'm very new to the options trading side and am using the virtual tool of OptionXpress to learn. Yet while I get the "general" gist of a call versus a put - call: betting that a stock will go up; put: betting that a stock will go down; I'm still trying to wrap my mind around the stuff beyond that like a covered call or protective put, etc. I read the definitions and can comprehend it but I'm trying to understand it and how it applies, etc.

Any recommendations?

PeterNovember 13th, 2011 at 6:33pm

Hi Josh,

Increasing time has the effect of higher option prices. So a straddle with a longer maturity will mean it is more expensive and hence wider breakeven points. Conversely, a shorter time frame will make the straddle cheaper and closer breakeven points.

Typically, the effect of time decay begins to decrease fastest when the options are < 30 days to expiry.

joshuaNovember 11th, 2011 at 5:19pm

in your graph you have time +60. how does a longer or shorter expiration affect the straddle. when does time decay begin to show significant loses if the underlying has not moved?

PeterNovember 9th, 2011 at 6:39pm

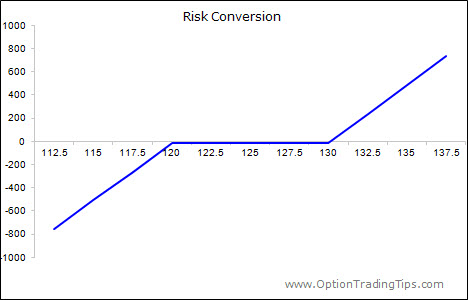

This strategy is call a Risk Conversion.

Click to enlarge:

To answer your questions;

a) Risk Conversion

b) Unlimited

c) $130.10 d) This strategy is very bullish, so not suited to markets that trade sideways alot. If you're view of the market is neutral you might sell straddles or strangles.

PareshNovember 7th, 2011 at 8:42am

120 strike put @ 3.85 and 130 strike call @ 2.80

PeterNovember 7th, 2011 at 4:28am

Calls or puts?

PareshNovember 6th, 2011 at 5:42am

Hi

I am short on Sterlite Industries 120 strike price @ 3.85 and at the same time long at 130 strike price @ 2.8. Current Market Price of Sterilite is 123/-

a) What is this strategy called?

b) What will be by max gain / loss?

c) What will be my break even?

d) Is this the correct strategy in current market scenario where market is up on one day and down on next day?

PeterJuly 26th, 2011 at 8:03pm

No, you would need to buy the OTM put options for it to be a strangle. Buying the calls and selling the puts resembles a synthetic - but with different strike prices it has the same profile as a long collar.

rezaJuly 26th, 2011 at 7:21pm

Hi,

can you tell me if I bought calls OTM of XYZ stock and then sold OTM of XYZ put options, is this called strangle and when would you make such trade strategy?

PeterJuly 18th, 2011 at 4:28pm

That's called buying a strangle.

NagaJuly 18th, 2011 at 11:42am

Hello...

Please tell me what is this strategy called???

Ex.. buying 5400 put one lot, buying 5600 call one lot in nifty (present rate of nifty future is 5500)

PeterMay 3rd, 2011 at 5:46pm

Hi Manish,

First - by its definition a Straddle must have the same strike for call and put. ATM is the best selection because it gives the position the greatest chance of success as the underlying can move either way to profit.

Second - a Strangle that uses ITM options is called a Long/Short Guts. You can use ITM calls and puts for sure...the premiums will be higher though and so will your break-even points.

Manish MeenaMay 3rd, 2011 at 1:32am

Hey peter,

First of all thanks for these awesome site on options. :)

I have a query regarding strangle v/s straddle.

In Long/short strangle you have suggested OTM call and put. while for long/short straddle you have suggested ATM call and put. What is the rational behind this.

If I create a strangle with ITM call and ITM put what would be the chances I get good return compare to OTM call and OTM put.

Thanks in advance

PeterMarch 17th, 2011 at 4:39pm

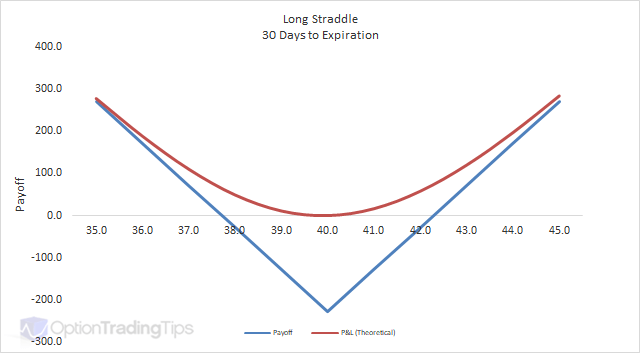

The magenta line shows what the theoretical P&L of the strategy is with 60 days left until the options expire.

D.ThirupathiMarch 17th, 2011 at 11:26am

HI sir

I could not understand the Megenta line that P$L + 60 days. i want join with you pl.give me details . mail to [email removed]

PeterFebruary 23rd, 2011 at 3:48pm

Yes, you would want the straddle to be ATM. If you chose an ITM call and OTM put then the position would have a large long delta position, which means a strong upwards bias.

Straddles are generally viewed as market neutral i.e. you don't have ma directional view and wish to profit if the market moves in either direction. Hence ATM options are best.

BillFebruary 23rd, 2011 at 5:08am

Hi Peter,

Is the straddle works better with a strike price near or ATM? At the strike both Call and Put would be near or ATM, but if we choose the strike price to be deep ITM for the Call, it would be very much OTM for the Put which in turn would have very low delta. Thanks!

PeterNovember 26th, 2010 at 8:23pm

It depends on how much profit you are willing to take and your view of the market. If you've doubled your money but you think the stock can still go higher then you would hold onto the trade in the hope it will make you more - otherwise you would sell out of the option spread and cash in your profits.

MDNovember 25th, 2010 at 10:51pm

Hi Peter,

How can we decide the exit time in this strategy. At last date of options both values (call/put) are at lower point. Can you suggest any method to decide when to sell more profitable option.

Regards,

PeterNovember 10th, 2010 at 5:55am

Time affects both calls and puts in the same way - i.e. an increase in time increases the value of call and put options and vice versa for decreases in time to expiration. You might be confused between time to expiration and underlying price?

PhilipNovember 10th, 2010 at 4:46am

Thank you Peter. Clarifying further, in specific why does the put option value move in both ways with regards to the time to expiration while call option value will only increase as time to expiration is longer?

PeterNovember 10th, 2010 at 3:54am

Depends on the option. ATM options are very sensitive closer to expiration, however, deep OTM options will not move much at all when the stock price changes. But those same deep OTM options that have a longer expiration date will have more delta and hence change in value more than their closer to expiration counterparts.

PhilipNovember 10th, 2010 at 3:41am

It seems that profits for holding till expiration surpasses that for a shorter holding period when stock prices are very low or high. Shouldn't a shorter holding period have an advantage at all times since there is a time value to it?

PeterOctober 3rd, 2010 at 9:11pm

Up to you Haroon, which I guess depends on your expected profits from the trade and view of the market.

Haroon BashaOctober 3rd, 2010 at 6:20pm

Hello Sir,

What is the opportune time to exit from this strategy (Long Straddle)?

PeterSeptember 29th, 2010 at 6:11pm

I would guess that a straddle was named as such because the shape of a short straddle resembles the legs of a horse rider as they "straddle" a horse???

PhilSeptember 29th, 2010 at 2:39am

Hi,

does anyone know the origin of the terms straddle and strangle in this context. I'm confused because stangle suggests to me maybe a higher risk-return chance and straddle implies a gap between something (strike-prices) which is not the case.

I would appreciate your thoughts on the matter, I'm not a native speaker...

PeterAugust 30th, 2010 at 6:26pm

You can exit the position any time - provided there is enough liquidity of course.

jigneshAugust 30th, 2010 at 2:04pm

is this necesry to remain in this strategy till expiry? or one can exit before?

monu jnuJuly 18th, 2009 at 5:24am

i hope this strategie is always good for volitile market u can play in blind because u r making unlimited money with limited lose in any condition of market

SandeepDecember 9th, 2008 at 10:51am

Hi Jitin,

What are you looking for exactly?

JITINDecember 8th, 2008 at 2:53am

PLZ CAN ANY BODY TELL ME HOW TO THE SAME

[email protected]

9899418696

Add a Comment