Option Portfolio

Market Close January 19, 2017

P&L up $3

| Symbol | Position | Price | Close | P&L |

|---|---|---|---|---|

| GLW Short Iron Condor | ||||

| GLW Feb17'17 $25 Call | -3 | 0.48 | 0.47 | 3 |

| GLW Feb17'17 $26 Call | 3 | 0.2 | 0.16 | -12 |

| GLW Feb17'17 $23 Put | -3 | 0.23 | 0.26 | -9 |

| GLW Feb17'17 $22 Put | 3 | 0.13 | 0.2 | 21 |

| Total | -1.14 | -1.11 | 3 | |

| Grand Total | 3 |

How to Adjust a Losing Iron Condor?

January 25th, 2017

Looks like my pre-earnings Iron Condor strategy was indeed a bad idea. GLW released their earnings before the market opened Tuesday 24th January to the surprise of analysts.

Core EPS turned out to be $0.50 on a predicted $0.44. The stock opened strong and rallied higher throughout the day to close the session up 5.7% to $26.18.

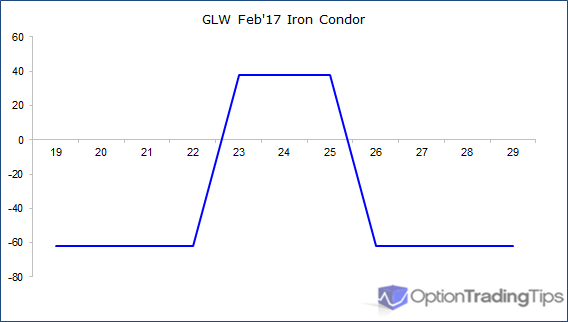

The stock is now outside the upper breakeven point of $25.38 and if it continues I will realise my max loss of $186 ($62 per contract).

What Options do I have to Adjust?

I have a few alternatives to consider as to how to manage this trade at this point:

- Do nothing and hope that the market pulls back from now until expiration

- Sell a higher strike put spread

- Sell a higher strike put spread in the next expiration

- Reverse the existing short call spread into a long call spread

- Close the short call and leave the long call to run

- Double down with another Iron Condor

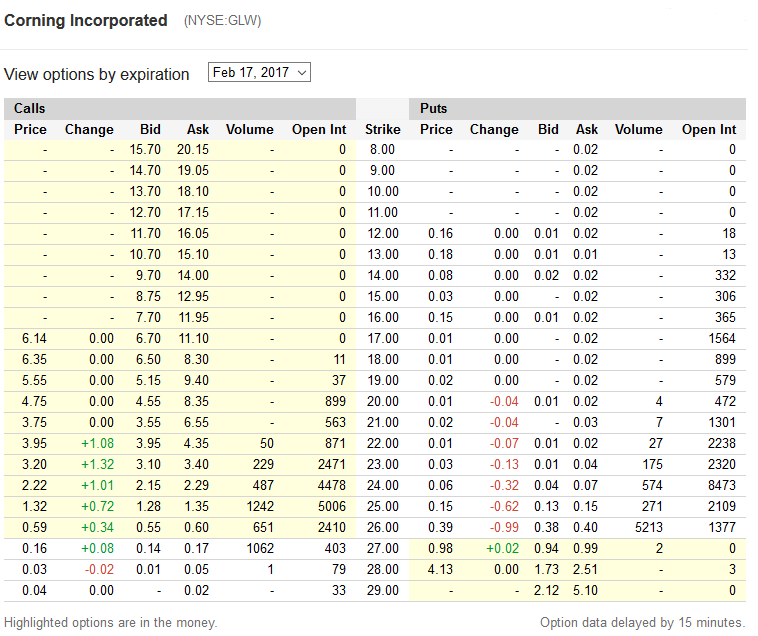

In considering the above, I looked at the option prices at the close for the Feb 17th options:

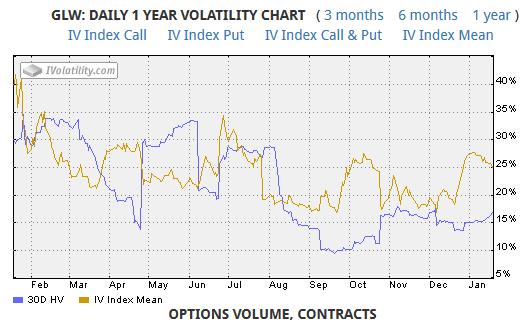

Since the pop in stock price due to earnings, the uncertainty has since been remove and can be seen in much lower option prices. Implied volatility has dropped to 18% so 2, 3 and 6 don’t look like bringing in much premium. Plus, putting on another Iron Condor in March would mean having to put it with narrow strikes in order to make it worthwhile but also means a lower chance of the stock staying between the bands.

Also to consider is the sentiment since the report, which was very favorable for the future outlook of the stock. I would say that I am now bullish on the stock.

Pre-market activity also shows a strong open with the stock having traded $26.30 with an hour before the open. So what I’m going to do is go with #5 above; close out the short $25 call and leave the $26 long call open. The $25 calls closed at $1.32 but with the pre-market looking to open higher, I’m not sure what price to go with. Perhaps yesterday’s offer price of $1.35?

Iron Condor Pre-Earnings

January 19th, 2017

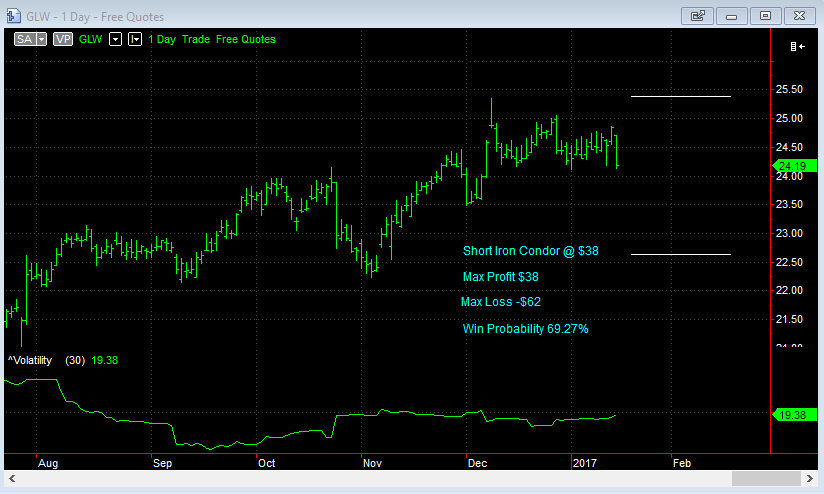

It's not always a good idea to take on short volatility strategies pre-earnings, but take a look at this Iron Condor setup for GLW.

| B/S | Strike | C/P | Price |

|---|---|---|---|

| Sell | $25 | Call | 0.48 |

| Buy | $26 | Call | 0.20 |

| Sell | $23 | Put | 0.23 |

| Buy | $22 | Put | 0.13 |

| Total Credit | $38 | ||

The stock has earnings out January 24th and the options expire February 17th. The implied volatility suggests there is some uncertainty leading into the announcement; IV is relatively high at 25% compared to historical vol of 15%.

Max profit on this is $38 per contract, which is the net credit received at the time of trade. Max loss is $62. At the current volatility level, there is a 69.27% chance of success with this trade.

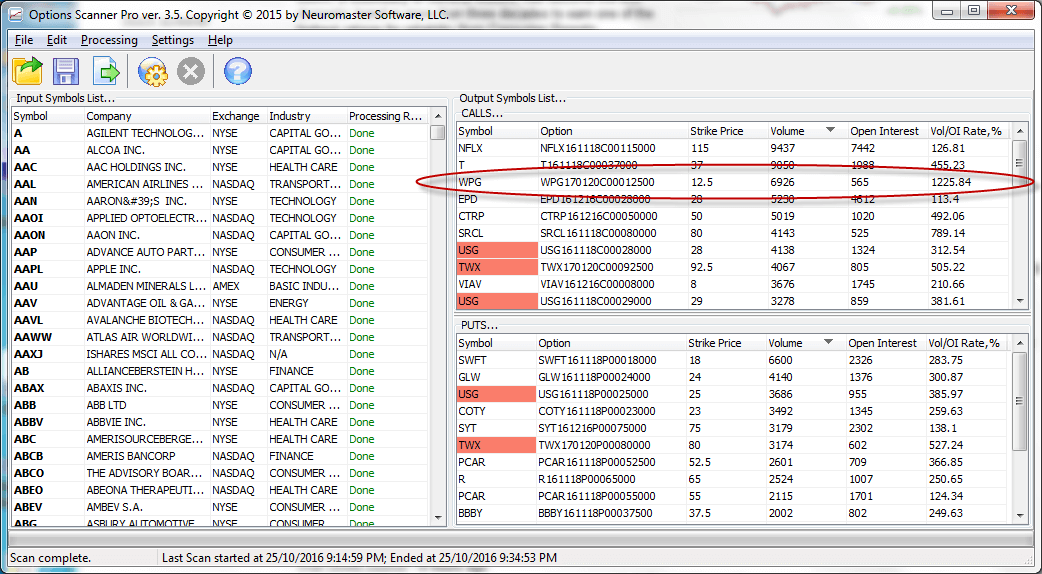

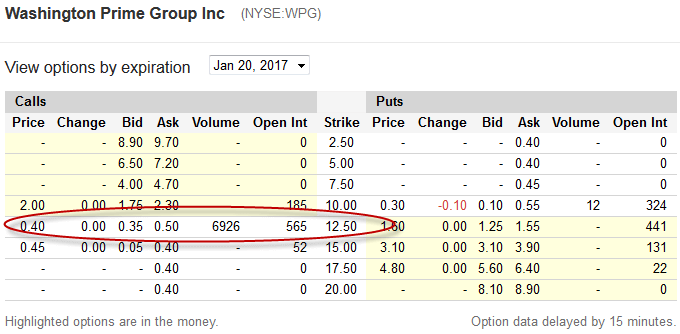

Long 5 $12.50 Call Options

Trade Start: 25th October

Description.

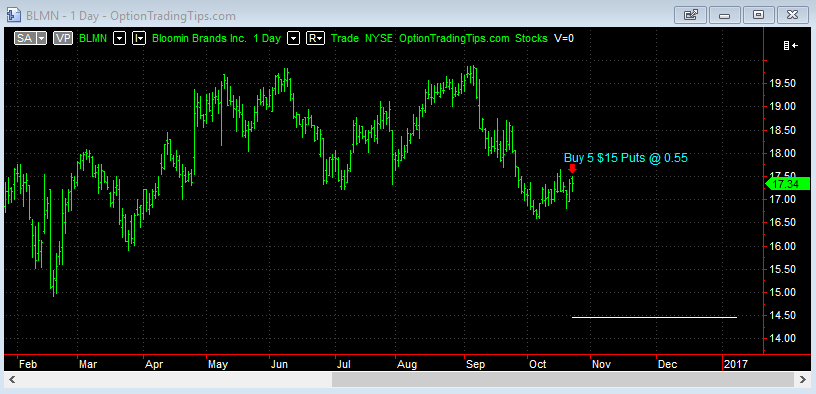

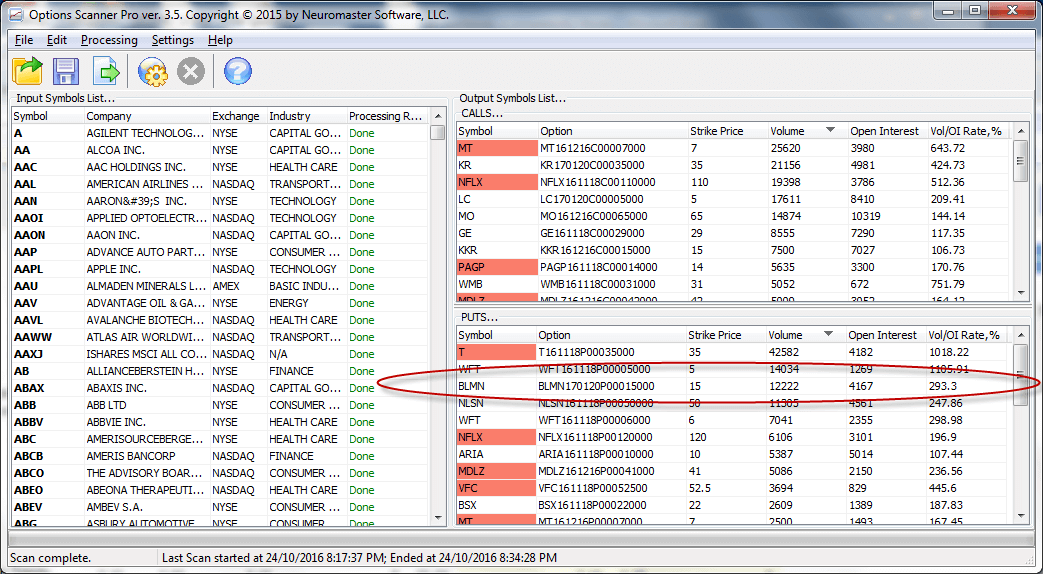

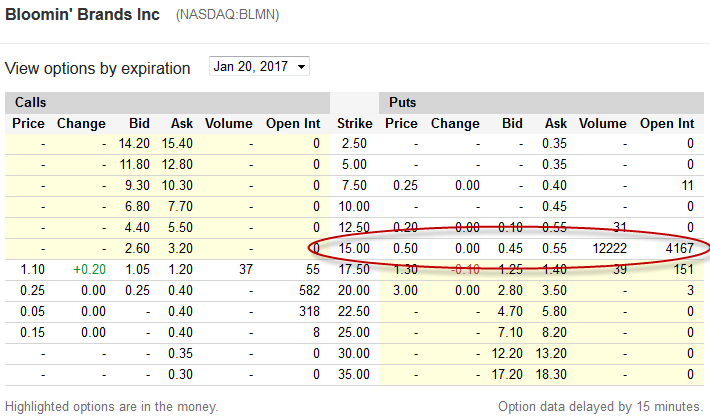

Long 5 $15 Put Options

Trade Start: 24th October, 2016

Only 0.55 for these puts when they are 3 months out. The chart doesn't make it look like a good trade but there's plenty of time in this one. Earnings are out October 28th.

2016 Closed Position Summary

| Trade | Open | Close | Days | P&L | Total |

|---|---|---|---|---|---|

| COH Iron Condor | 25-Jan-16 | 5-Feb-16 | 11 | 31.4 | 31.4 |

| COH Adj Call Spread | 3-Feb-16 | 5-Feb-16 | 2 | 55.5 | 86.9 |

| CAT Short Call Spread | 28-Jan-16 | 12-Feb-16 | 15 | -22.5 | 64.4 |

| COH Assignment | 8-Feb-16 | 12-Feb-16 | 4 | 74.6 | 139 |

| FCX Iron Butterfly | 28-Jan-16 | 18-Feb-16 | 21 | 35 | 174 |

| FSLR Iron Condor | 23-Feb-16 | 26-Feb-16 | 3 | -26.2 | 147.8 |

| TGT Short Call Spread | 23-Feb-16 | 26-Feb-16 | 3 | -66.6 | 81.2 |

| EPD Put Bear Spread | 29-Feb-16 | 18-Mar-16 | 18 | -40 | 41.2 |

| SPY Iron Condor | 2-Mar-16 | 4-Mar-16 | 2 | -22 | 19.2 |

| RCL Put Spread | 24-Mar-16 | 15-Apr-16 | 22 | -143.5 | -124.3 |

| MU Straddle | 30-Mar-16 | 1-Apr-16 | 2 | -50.6 | -174.9 |

| RIG Put Spread | 30-Mar-16 | 15-Apr-16 | 16 | -56.7 | -231.6 |

| VZ Long Call | 30-Mar-16 | 15-Apr-16 | 16 | -101.6 | -333.2 |

| JWN Long Put | 30-Mar-16 | 15-Apr-16 | 16 | 364.2 | 31 |

| C Straddle | 31-Mar-16 | 15-Apr-16 | 15 | 221.8 | 252.8 |

| EMC Long Put | 13-Apr-16 | 20-May-16 | 37 | -160 | 92.8 |

| ETE Long Call | 19-Apr-16 | 20-May-16 | 31 | 168 | 260.8 |

| MRO Long Call | 19-Apr-16 | 20-May-16 | 31 | -75 | 185.8 |

| KEY Long Call | 20-Apr-16 | 20-May-16 | 30 | 6 | 191.8 |

| MS Long Put | 20-Apr-16 | 20-May-16 | 30 | -100 | 91.8 |

| VALE Long Put | 21-Apr-16 | 20-May-16 | 29 | 360 | 451.8 |

| JNPR Long Put | 21-Apr-16 | 20-May-16 | 29 | -62 | 389.8 |

| KMI Long Call | 28-Apr-16 | 20-May-16 | 22 | -100 | 289.8 |

| IPHI Long Call | 29-Apr-16 | 20-May-16 | 21 | -55 | 234.8 |

| NG Long Call | 29-Apr-16 | 20-May-16 | 21 | -80 | 154.8 |

| MRO Short Call | 29-Apr-16 | 20-May-16 | 21 | 55 | 209.8 |

| CTL Long Put | 2-May-16 | 20-May-16 | 18 | 212 | 421.8 |

| HIMX Long Call | 9-May-16 | 13-May-16 | 4 | -55 | 366.8 |

| ETE Short Call | 10-May-16 | 20-May-16 | 10 | 55 | 421.8 |

| VIAV Long Call | 24-May-16 | 17-Jun-16 | 24 | -100 | 321.8 |

| CYH Long Strangle | 25-May-16 | 17-Jun-16 | 23 | -110 | 211.8 |

| HBI Long Strangle | 31-May-16 | 17-Jun-16 | 17 | -115 | 96.8 |

| ANF Long Put | 31-May-16 | 17-Jun-16 | 17 | -90 | 6.8 |

| RF Long Call | 1-Jun-16 | 17-Jun-16 | 16 | -80 | -73.2 |

| WLL Long Put | 8-Jun-16 | 24-Jun-16 | 16 | 300 | 226.8 |

| ANF Covered Put | 17-Jun-16 | 24-Jun-16 | 7 | 60 | 286.8 |

| ATVI Put Spread | 2-Jun-16 | 15-Jul-16 | 43 | -126 | 160.8 |

| CY Long Call | 2-Jun-16 | 15-Jul-16 | 43 | -42 | 118.8 |

| GOGO Long Put | 6-Jun-16 | 15-Jul-16 | 39 | -124 | -5.2 |

| VLO Long Put | 6-Jun-16 | 15-Jul-16 | 39 | -100 | -105.2 |

| RBS Long Call | 8-Jun-16 | 15-Jul-16 | 37 | -120 | -225.2 |

| PBI Long Call | 9-Jun-16 | 15-Jul-16 | 36 | -100 | -325.2 |

| GGAL Long Call | 9-Jun-16 | 15-Jul-16 | 36 | 60 | -265.2 |

| MT Long Call | 9-Jun-16 | 15-Jul-16 | 36 | -110 | -375.2 |

| PLD Long Call | 9-Jun-16 | 15-Jul-16 | 36 | 90 | -285.2 |

| VIAV Covered Call | 22-Jun-16 | 22-Jul-16 | 30 | 258 | -27.2 |

| BID Long Call | 11-Jul-16 | 9-Aug-16 | 29 | 1950 | 1922.8 |

| NLY Long Put | 8-Jul-16 | 19-Aug-16 | 42 | -90 | 1832.8 |

| LGF Long Put | 8-Jul-16 | 19-Aug-16 | 42 | -145 | 1687.8 |

| CMCSA Long Call | 11-Jul-16 | 19-Aug-16 | 39 | -100 | 1587.8 |

| D Long Put | 26-Jul-16 | 19-Aug-16 | 24 | -135 | 1452.8 |

| PEG Long Put | 27-Jul-16 | 19-Aug-16 | 23 | 140 | 1592.8 |

| KR Long Call | 27-Jul-16 | 19-Aug-16 | 23 | -150 | 1442.8 |

| DB Long Put | 11-Aug-16 | 16-Sep-16 | 36 | -150 | 1292.8 |

| LOW Long Put | 11-Aug-16 | 16-Sep-16 | 36 | 1050 | 2342.8 |

| FIT Long Call | 11-Aug-16 | 16-Sep-16 | 36 | -126 | 2216.8 |

| GT Long Call | 18-Aug-16 | 16-Sep-16 | 29 | 450 | 2666.8 |

| NUAN Long Put | 18-Aug-16 | 16-Sep-16 | 29 | -140 | 2526.8 |

| GFI Long Call | 13-Sep-16 | 21-Oct-16 | 38 | -170 | 2356.8 |

| EGO Long Call | 14-Sep-16 | 21-Oct-16 | 37 | -200 | 2156.8 |

| CCL Long Put | 19-Sep-16 | 21-Oct-16 | 32 | -120 | 2036.8 |

| BAC Long Butterfly | 27-Sep-16 | 21-Oct-16 | 24 | 105 | 2022.8 |

| DDD Long Put | 20-Sep-16 | 27-Oct-16 | 37 | -49 | 1987.8 |

| JCP Long Call Spread | 23-Sep-16 | 27-Oct-16 | 34 | -47 | 1940.8 |

| CNP Long Call | 26-Sep-16 | 27-Oct-16 | 31 | -150 | 1790.8 |

2015 Closed Position Summary

| Trade | Open | Close | Days | P&L | Total |

|---|---|---|---|---|---|

| BBY Short Put | 6-Jan-15 | 17-Jan-15 | 11 | 69 | 69 |

| F Long Call | 9-Jan-15 | 30-Jan-15 | 21 | -20 | 49 |

| AVP Calendar | 14-Jan-15 | 27-Feb-15 | 44 | -23 | 26 |

| AVP Put Spread | 14-Jan-15 | 27-Feb-15 | 44 | -32 | -6 |

| COH Short Condor | 15-Jan-15 | 30-Jan-15 | 15 | 81 | 75 |

| GRPN Buy-Write | 23-Jan-15 | 13-Feb-15 | 21 | -36 | 39 |

| WTW Short Put | 23-Jan-15 | 2-Mar-15 | 38 | -560 | -521 |

| CRUS Double Calendar | 26-Jan-15 | 30-Jan-15 | 4 | -1 | -522 |

| SPY Short Condor | 12-Feb-15 | 20-Feb-15 | 8 | -66.4 | -588.4 |

| MX Double Calendar | 13-Feb-15 | 20-Mar-15 | 35 | -71.6 | -660 |

| JCP Double Calendar | 25-Feb-15 | 13-Mar-15 | 16 | -3 | -663 |

| KYTH Short Butterfly | 25-Feb-15 | 20-Mar-15 | 23 | -100 | -763 |

| TASR Short Condor | 25-Feb-15 | 20-Mar-15 | 23 | 35 | -728 |

| BBRY Long Butterfly | 24-Mar-15 | 2-Apr-15 | 9 | -84 | -812 |

| BTU Long Put Spread | 12-Jun-15 | 3-Jul-15 | 21 | 117.5 | -694.5 |

| MU Long Put Spread | 17-Jun-15 | 3-Jul-15 | 16 | 71.4 | -623.1 |

| RAD Short Call Spread | 19-Jun-15 | 3-Jul-15 | 14 | 92 | -531.1 |

PeterJune 10th, 2014 at 1:01am

Hi Kan,

One suggestion could be to sell the same amount of puts that you are long on a lower strike than what you have already bought. You will then be long a put spread (or bear put spread). The sold put will bring in some premium for you, however, your gains should the market fall, will now be capped at the difference between the two strikes less the net premium - rather than capped at the stock price going to zero.

This won't turn things around but will stem the bleeding a little and keep you in a position.

Alternatively, if you feel strongly about your view on the market and think it is still going to sell off, you could always roll your put to a strike closer to ATM. Or, reverse it go a long call ;-)

kanJune 8th, 2014 at 8:55am

Hey:)

I trade in the Indian Market .. I have been buying puts in the expectation of the markets to fall but scene is completely different and the markets are just touching new highs.. is there any way i could hedge them and minimize my losses ??

thanks in advance :)

AnonymousApril 7th, 2014 at 12:44am

Hi Peter Sir,

I use indian market for trading.I am new in option (Intra day) trading..Please tell me how to use the option trading calculator (Intra day trading) and how i get the information about "how much call/put it gives today?" means how much points market gives call or put.

If you have another strategy then please tell me..

Thank you,

Anu (India).

PeterMarch 27th, 2014 at 5:41am

Hi Anu,

Not sure what you mean by CE/PE - but you can either use my option spreadsheet or an online option calculator to simulate various option greek and pricing values.

I would also recommend paper trading for a while to get a feel for trading options before risking your real money. Log your trades and your reasons for taking them so you're comfortable before you jump in.

What markets are you going to trade - Indian, US etc?

AnuMarch 27th, 2014 at 2:12am

Hi peter Sir.

I am Indian. I started option trading now a days.I am very interested in trading.Is there any trick for what will happen today means what it give(CE/PE).

Also tell your own tricks for start up.

Thank you.

PeterSeptember 2nd, 2013 at 6:17am

Great! Glad I could help!

RathaSeptember 1st, 2013 at 9:46pm

Hi, Peter

I would like to inform you that i can solve and calculate the option position related to matrix method.

Thank you so much for guiding me and tell the way to do it.

Best Wishes

PeterAugust 29th, 2013 at 11:51pm

Hi Ratha,

I see! Yes, you can download my option pricing spreadsheet, which has the option pricing code unlocked in the VBA editor. Alternatively, you can read the formula and how it is composed on the black scholes page.

Let me know if there's anything else that is unclear.

RathaAugust 28th, 2013 at 1:28am

Hi Peter

Thanks, this is a result that i would like to know. But i still wonder how to calculate call price simulation as in the table of Online Option Calculator. Because i want to know clearly the formula. I have tried to find it for three days but can not solve it.

I hope you can help me. This is a first time which i have studied about the capital charge of equity option position. On the other hand, no one has taught me about how to calculate it, only on self studied via google search. Thus, I want you to guide me.

Best Wished

PeterAugust 28th, 2013 at 12:33am

Hi Ratha,

I see - you want to see a risk matrix displaying both price changes and volatility changes.

You can use the online option calculator for this. Enter the option parameters in the section on the left and hit calculate. Then scroll down to the bottom of the page where you'll see the simulation table.

Does this help?

RathaAugust 27th, 2013 at 9:14pm

Hi Peter

Many thanks for your replying to me quickly.

But what i would like to do in this case is that i don't understand how to calculate general market risk of equity option risk under scenario approach in market risk as in example linked : http://www.bnm.gov.my/guidelines/01_banking/01_capital_adequacy/gl_05_Capital_adequacy_framework_RWA.pdf

in page 298 described about General Risk to Scenario Approach in b) and c) which shows the result -15.57, -9.21, -0.92.....how to calculate it?

Best Wishes

PeterAugust 26th, 2013 at 6:15pm

Hi Ratha,

You're welcome to put together your own using my options pricing spreadsheet as a base - or you can use an online version of the option calculator.

RathaAugust 25th, 2013 at 11:52pm

Hi sir

I would like to all of you to explain me how to calculate the matrix in call or put option. price interval 8%, volatility 15%, market value $19.09, strike price $20, risk-free rate 5%, residual maturity 0.36 year, annual dividend rate 0%.

Thanks for your respond.

PeterAugust 1st, 2013 at 6:40pm

Hi Greg, Which spreadsheet are you having troubles with: the pricing or the volatility spreadsheet? Have you seen the support page?

Greg August 1st, 2013 at 1:53pm

I tried using the workbook spreadsheet but not sure if I am using it correctly. Are there direction or phone # I can call for help???

PeterFebruary 4th, 2013 at 4:11pm

Hi Vidur,

Long straddles are good strategy when you expect a large move in the underlying, however, the movement needed for the strategy to be profitable depends on the length of time until the expiration of the options and the total price of the straddle.

For example, the straddle may be priced so high that the stock may need to move 4% just to break even. Alternatively, if the implied volatility is low a 2 to 3% move may just result in a decent profit.

vidur gupta February 4th, 2013 at 9:49am

first of all thanks for the insights .. really appreciate it !!

Is long strangle a good strategy to be played when you expect 2-3% move in stock ??

OptionsbearJanuary 19th, 2013 at 3:20pm

Hello what do you know about Second order greeks vanna, vomma?

ArunDecember 25th, 2012 at 3:42am

Very Nice....

PeterAugust 29th, 2012 at 10:53pm

Mmm - you're right. The data comes from Yahoo and they seem to be behind on the latest data for India. I'm not sure when NSE data is updated to Yahoo - hopefully before the market opens!

KumarAugust 29th, 2012 at 10:23pm

thanks for your prompt response.

a query on Historical Vol Calc spreadsheet.

when I press GETDATA latest Nifty data is getting updated in the spreadhsheet.

Last row shows date of 28th Aug only

29th Aug Nifty closing prices is NOT Getting automatically picked up.

am I missing anything here

thanks

PeterAugust 29th, 2012 at 7:58pm

Hi Kumar,

Yes, IV (implied volatility) is only for derivatives (e.g. options). The historical volatility spreadsheet calculates the historical volatility.

Historical volatility = past volatility

Implied volatility = future estimate volatility

PeterAugust 29th, 2012 at 7:15pm

Hi Mojalefa,

Are you after an online course? If so, check out the Members Area here for video courses on learning options.

KumarAugust 29th, 2012 at 5:20am

Thanks for the Historical value spreadsheet It was useful.

a query

I thought IV can be only for different strike price of an underlying index / stock, then how come I see IV for underlying index / stock itself.

thanks

Mojalefa MokotediAugust 17th, 2012 at 5:55am

Hi Peter

I am interested in Financial Markets,could you please advise on which courses should be taken to understand currency options etc.

PeterJune 20th, 2012 at 1:18am

Hi James,

Sure, send me an email and I'll reply back with the file.

James June 15th, 2012 at 8:58am

Hi Peter,

I came across some of your previous work where you created a Historical Volatility spreadsheet.

The spreadsheet downloaded historical stock prices from the web and calculated the historical standard deviation for the range of values.

Would you be able to provide me with the VBA code?

Thanks in advance and great work

PeterApril 20th, 2012 at 12:30am

Hi Allan,

No worries about the replies - happy to help ;-)

Ok, I think there's some confusion between the market value of the position and the P&L.

So, you bought an option with a strike price of 440, which you paid 16,803. The current price of AAPL is 608.34.

You exercise the option. This means you buy the stock at a purchase price (strike price) of 440. Total cost to buy the stock = 44,000 (440 x 100).

BUT - you have also already "paid" 16,803 for the right to have this position (option premium). So the total "cost" of this position = 60,803.

So now you are long 100 shares of APPL worth 60,803.

The current market value of this position is 60,834 (608.34 x 100).

With the price of AAPL being 608.34 and you having a "long" position of 100 shares worth 60,803 means your profit if you sell the shares back is $31.

allanApril 19th, 2012 at 8:49pm

You have a lot of patience Peter-I can tell reading thru all the comments responding to questions. I dont want to beat a dead horse but I still dont have my arms around the value of my appl call if at expiration it has not increased in value. I think at expiration I will receive appl shares worth 608/share since 608 is a price greater than the 440 strike. If correct I will receive shares with a mkt value of 608x100=60,800 for a call that I paid 16,800 in prem (168x100) for a strike price of 440 (440x100=44,000) I think Im even-no out of pocket loss. I know Im wrong and I know it has something to do with extrinsic value but its still not clear to me how much $ I will lose on this trade:(

PeterApril 19th, 2012 at 6:30pm

Hi Allan,

I see where you're coming from: that the intrinsic value = the premium? Not always.

The price of an option that you see in the market will be made up of two types of value: intrinsic value and extrinsic value.

For a call option, yes, you're right that the intrinsic value is the maximum between 0 and the stock minus the strike price. But there is also value in the expectation that the option could be worth a lot more by the expiration date - this is called extrinsic value (or time value).

If you did pay 168.03 for the option (that being the market price) then, yes, it is all intrinsic value. It's not worthless - it is worth 168.03, which is the price you paid for it. So, you've not made any profits yet. You've paid money to the option seller and in return received an asset worth 168.03.

If the value of this asset increases and you sell it for a higher price then you will receive money - the difference between what you have paid and received will be your profit.

allanApril 19th, 2012 at 10:40am

I sent a reply but dont see it listed but I did see this comment from u in answer to another comment-"At the expiration date, the option will be worth the intrinsic value, which will be the stock price minus the strike price.

In my example-my strike was 440 and at expiration the common price was flat at 608.34-so this is my understanding 608.34-440=168.34x100=$16,834 which is the amount of my prem cost-

My question is why is my option worthless-I dont understand? thx-

allanApril 19th, 2012 at 10:01am

I dont understand -doesnt my strike price of $440 vs common price at expiration of 608.34 have any value?

PeterApril 18th, 2012 at 10:58pm

Hi Allan,

If the option price is 168.03 then the premium you pay will be 16,803. You pay this at the time of the trade so it is essentially "lost" on the trade date.

You only make money if the value of the option increase in price from where it was purchased. So when you sell it the money received is more than what was paid out, which will be your profit.

Hope that makes sense.

allanApril 18th, 2012 at 9:56pm

I just stumbled on this site-great info about options. My question concerns the purchase of a deep in the money call option at a strike price below the price of the common. ie Share price of appl today is 608.34-I want to buy an appl call- strike price- 440-prem 168.03- total cost 608.03. On expiration if the appl share price is above my 440 strike price will I lose my premium?

PeterApril 9th, 2012 at 5:49pm

Hi Inderjit,

I recommend the example from Willow Solutions for this.

inderjitApril 6th, 2012 at 3:30pm

Hi Peter - I downloaded your stock volatility spreadsheet and wanted to have a look at the VBA but this is password protected. I work with databases and wanted to see how you can connect to a web server and extract the data. Would really appreciate if you can let me have a look at the code. Thanks for your site.

DharmendraFebruary 26th, 2012 at 11:55am

Hi Peter.

I trade futures in commodities. I want to learn options in Gold, Crude and S&P. Can you help me out for the same ?

Dharmendra Bhagat

Mobile :+971508980047

email : [email protected]

skype : tridentjewels

Twitter : dharamjee

benila anoopFebruary 21st, 2012 at 1:04am

hai peter,

i would like to start trading.. What should i do? Can you help me sir.

PeterAugust 28th, 2011 at 5:33pm

You mean you want to start trading the VIX?

Manish kumarAugust 28th, 2011 at 10:10am

Hi, I'm an option trader nifty index only I want to say thanks lot because I learn lot of thing from your option trading workbook, and now I want to improve my trading style at high and low VIX. How i improve myself advice me?

PeterJuly 16th, 2011 at 7:46am

Mmm...not sure about how exactly to calculate VAR, but here's a heavy PDF that explains it if you're interested - Value at Risk.

Is this what you were after or are you looking for a calculator?

danielJuly 15th, 2011 at 12:58pm

hi peter,

can you also tell us how to calculate the value at risk and the expected shortfall of options? Would really apreciate it. Thanks.

Daniel

EricJune 14th, 2011 at 7:52pm

Hi Peter,

This blog is amazing. Thank you so much. I just sent you a PM, so looking forward to talking with you soon.

Thanks!

PeterMarch 19th, 2011 at 6:57pm

Hi Jitendra, no, options will never be offered below their intrinsic value.

jitendraMarch 18th, 2011 at 8:33am

halo Peter,

I wanted to clear some doubts,,,,as a starter with options....

I have few questions

suppose current market price of X company is 5 euros and I purchase a call of 7 euros (2 euros is the premium) I have heard this ...but are the call ever available at discount).

PeterJanuary 23rd, 2011 at 3:19am

Hi there, I'm happy to hear some suggestions on what you'd like to see on the site. Maybe some tutorials on option trading software etc?

AnonymousJanuary 23rd, 2011 at 12:01am

I don't know what you call this but this is not option tutorials for me, more like an excerpt from some paper.

yogitaOctober 5th, 2010 at 1:21am

i want to know that how to analyse put call ratio. plz give me the writeup on theis topic.

Mahesh DDecember 11th, 2009 at 12:34am

Excellent analysis and the information provided is very helpful..

Thanks

Add a Comment